Appalachian natural gas pipeline debottlenecking faces hurdles

Recent expansions to Appalachian-basin pipeline systems have improved the flow of natural gas and its components from the region to the US Gulf Coast for either export as LNG or use as petrochemical feedstock. Projects such as Shell’s Appalachian petrochemical complex undergoing final preparation in Monaca, Pa., will also help absorb regional supplies. But efforts to further debottleneck transportation to gas consumers in both the Mid-Atlantic and Northeast US remain stymied by environmental and landowner protests and associated legal challenges.

The US Energy Information Administration’s (EIA) Winter Fuels Outlook, published Oct. 8, 2019, noted that “in the case of very cold temperatures, Northeast electricity markets could see constrained natural gas supplies into the region causing electricity generation to be supplied by more expensive fuels, such as petroleum, which could contribute to higher wholesale electricity prices.” EIA noted that temperatures would be a key variable in determining prices and forecast that residential prices in the Northeast would be 6% lower than last winter, but it attributed the softening to relatively low prices globally for LNG, another supply source into the region.

In the meantime, production gains have combined with moderate year-to-date demand to depress regional spot prices as of mid-October to about half what they were for the same period in 2018, falling briefly below $1/MMbtu and averaging near $1.25/MMbtu on a Dominion South basis. The Dominion South pool comprises Dominion Energy’s system upstream of Valley Gate Junction near Pittsburgh, Pa., and includes pipeline in Pennsylvania, Ohio, Maryland, West Virginia, and Virginia.

Natural gas pipeline projects such as those detailed in this article have also become a political issue, with Democratic presidential contenders Sens. Elizabeth Warren (D-MA) and Bernie Sanders (I-VT) among those who have pledged to reject such projects if elected.

The projects are divided into major and minor. But even those of smaller physical scale are shown to be integral to increasing natural gas transmission capacity and improving system flexibility.

Major pipelines

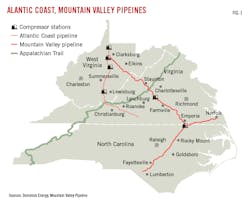

Dominion Energy’s 600-mile Atlantic Coast Pipeline (ACP) will carry 2 bcfd of natural gas from West Virginia through Virginia, with a lateral extending to Chesapeake, Va, and into eastern North Carolina, ending in Robeson County (Fig. 1). Two additional, shorter laterals will connect to two Dominion power plants in Brunswick and Greensville Counties, NC. ACP will use three compressor stations.

Dominion in June 2019 filed an appeal to the US Supreme Court of a Fourth Circuit Appeals Court decision stopping ACP from crossing the Appalachian Natural Scenic Trail. The appeals court had ruled that the US Forest Service lacked authority to authorize the crossing.

The Supreme Court said in October 2019 that it would hear the case and Dominion plans to resume partial construction before year-end. Early 2020 arguments would lead to an expected June 2020 ruling and, if favorable, a July 2020 restart of full construction.

In July 2019, however, the same appeals court ruled that the US Fish and Wildlife Service had not corrected deficiencies in an initial biological opinion (BiOp) and incidental take statement (ITS) for ACP when it issued new ones early in 2018. After three environmental organizations challenged the new findings, a panel of Fourth Circuit judges granted their petition on July 26 and vacated the BiOp and ITS. Five other permits once in place have also been cancelled.

Dominion nevertheless expects Atlantic Coast Pipeline to be fully in-service in early 2021.

The Mountain Valley Pipeline (MVP) is a natural gas pipeline spanning 303 miles from northwestern West Virginia to southern Virginia (Fig. 1). MVP is a joint venture of EQM Midstream Partners LP, NextEra Capital Holdings Inc., Con Edison Transmission Inc., WGL Midstream, and RGC Midstream LLC.

MVP will provide up to 2 bcfd of firm transmission capacity to markets in the Mid- and South Atlantic regions, extending from the Equitrans transmission system in Wetzel County, WV, to Transcontinental Gas Pipeline Co.’s (Transco) Zone 5 Compressor Station 165 in Pittsylvania County, Va. The line will use 42-in. OD pipe and require a 50-ft permanent easement (with 125 ft of temporary easement during construction). MVP will also require three compressor stations, one each in Wetzel, Braxton, and Fayette Counties, WV.

MVP construction began early-2018 and is about 90% complete. It voluntarily suspended construction on certain watersheds in August 2019 following lawsuits filed by environmental groups. The US Supreme Court in October 2019 upheld the project’s ability to quickly access private properties in the wake of approval, declining to hear a landowners’ appeal of a Fourth Circuit ruling granting such access. The US Federal Energy Regulatory Commission (FERC) in October 2019 ordered construction stopped while MVP’s impact on endangered species was evaluated.

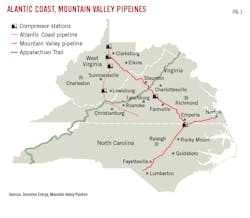

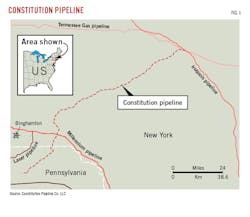

FERC approved Williams Co.’s 30-in. OD, 125-mile Constitution pipeline in December 2014. Constitution is designed to carry 650 MMcfd from the Marcellus shale to consumers throughout New York and neighboring regions (Fig. 2). On Apr. 22, 2016, the New York Department of Environmental Conservation (NYSDEC) denied Constitution’s water quality certification, halting work on the project.

FERC in late 2018 approved a 2-year extension for the project, giving Williams until December 2020 to get needed approvals. On Aug. 28, 2019, the commission found NYSDEC had waived its authority to issue the water quality certification required under Section 401 of the federal Clean Water Act by failing to act within the maximum statutory timeframe of 1 year. Constitution is now expected to enter service in 2021.

The 120-mile, primarily 36-in. OD PennEast pipeline (a joint venture of Enbridge, Southern Gas Co., South Jersey Industries, New Jersey Resources, and UGI) will carry natural gas from, Dallas, in northeastern Pennsylvania, to Transco’s pipeline interconnection near Pennington, NJ (Fig. 3). About one-third of the route is in New Jersey. FERC approved the project Jan. 19, 2018, and in December 2018 PennEast was granted authority to conduct field-level surveys on private property in both Pennsylvania and New Jersey.

In September 2019, however, the Third Circuit Court of Appeals issued a ruling preventing the project from condemning state-owned land in New Jersey as part of its eminent domain authority. The court noted that such condemnation would violate the 11th Amendment of the US Constitution, which grants states sovereign immunity from suits by private parties in federal court. PennEast responded by asking FERC to provide an authoritative interpretation of eminent domain under the US Natural Gas Act. Two New Jersey state legislators subsequently asked FERC to issue a stop-work order on the project.

In October, however, the New Jersey Department of Environmental Protection (NJDEP) denied PennEast’s application for a water quality certificate, saying the Third Circuit’s ruling had removed the project’s legal authority to perform activities on 49 properties along its route.

FERC approved National Fuel’s 24-in. OD Northern Access pipeline in 2017. NYSDEC, however, in August 2019 refused to grant a water quality certificate for the pipeline, its second such refusal on the project. A previous NYSDEC denial was vacated by the Second Circuit Court of Appeals in August 2018, the court maintaining that the DEC has not sufficiently explained its denial. NYSDEC was given permission to restart the process, however, with project supporters arguing in the meantime that the state commission no longer had authority due (like Constitution) to its not having ruled in a timely manner.

The 99-mile Northern Access would carry gas from McKean County in northwest Pennsylvania to a compressor station interconnect in Elma, NY, southeast of Buffalo. National Fuel expects to have it complete in 2022-23.

Smaller projects

TC Energy’s Buckeye Xpress project includes replacing about 64 miles of existing 20- and 24-in. OD pipeline in southern Ohio and northern Kentucky with 36-in. OD pipe. FERC released a favorable environmental assessment (EA) for the project in May 2019.

TransCanada expects to put the line in service late-2020, adding 275 MMcfd of incremental capacity to move gas to the US Gulf Coast.

The Adelphia Gateway project will convert the remaining 50 miles of an existing 18-in. OD 84-mile pipeline in near Philadelphia in southeastern Pennsylvania from fuel oil to natural gas, carrying 75 MMcfd. The northern 34 miles were converted in 1996.

The project also includes construction of two 16-in. OD laterals (Parkway, 0.3 miles; Tilghman, 4.4 miles) and two 5,625-hp compressor stations, one each in Marcus Hook and Bucks County, Pa.

FERC issued its EA on Adelphia Gateway in January 2019, finding no significant environmental impact. West Rockhill Township, Pa., appealed siting of the Bucks County compressor station, with the state Environmental Hearing Board rejecting the appeal in October 2019. The project is expected to enter service before end-2019.

Eastern Shore Natural Gas Co.’s (ESNG) Expansion Project consists of six pipeline loops totaling about 23 miles, a 17-mile 10-in. OD mainline extension, two new pressure control stations, and modifications to an existing compressor station, among other items.

The loops include 10-, 16-, and 24-in. OD segments in Pennsylvania, Maryland, and Delaware. The Seaford-Millsboro Connector mainline extension is in Sussex County, Del. An additional 3,750 hp is being installed at the existing Daleville compressor station in Chester County, Pa.

The project will add roughly 60 MMcfd of capacity from interconnections with Texas Eastern and Transco pipelines at Honey Brook and Parkesburg, Pa., respectively, to ESNG’s customers. The expansion was mechanically complete and passed a post-construction environmental inspection in September 2019.

Dominion Energy’s 1.5-bcfd Supply Header Project includes 37.5 miles of natural gas pipeline along existing pipeline rights of way, and modifications to existing compression in West Virginia and Pennsylvania. The Supply Header will transport natural gas from supply areas in Pennsylvania and West Virginia to Atlantic Coast Pipeline.

The new pipeline will include 3.9 miles of 30-in. OD pipeline in Westmoreland County, Pa., and 33.6 miles of 30-in. pipeline in Harrison, Doddridge, Tyler, and Wetzel Counties, WV. Modifications and upgrades will be made at Dominion Energy’s existing compressor stations in Westmoreland and Greene counties in Pennsylvania, and Marshall and Wetzel counties in West Virginia. These modifications will result in approximately 69,200 hp of additional compression.

Due to the modifications and additions to the existing Mockingbird Hill Compressor Station, the two existing compressor units at the Hastings Compressor Station will be replaced with one new unit with increased efficiency and lower emissions, which will be installed to maintain existing gathering operations.

Dominion expects the Supply Header to enter commercial service in late 2020.

Transco’s Northeast Supply Enhancement (NESE) project is a 26-in. OD pipeline that would transport gas from Pennsylvania through New Jersey, traveling underwater in the Raritan Bay and Lower New York Bay to about 3 miles offshore the Rockaway Peninsula in Queens Borough, NY. The 37-mile line will include 23.5 miles of subsea pipe.

NESE would connect to the existing Rockaway Delivery Lateral in Queens, providing 400 MMcfd of incremental capacity to National Grid to serve customers in Brooklyn, Queens, and Long Island.

Subsea installation would be a minimum of 4 ft below the sea floor, using a combination of jet trenching, clamshell dredging, and horizontal directional drilling (HDD).

A May 2019 NYSDEC denial of the project prompted National Grid to place a moratorium on new natural gas service in the area. A group of six Democratic state senators from Long Island in early October urged NYSDEC to expedite project approval.

NJDEP in September 2019 extended its permitting application deadline for NESE by 1 month to Oct. 25. New Jersey already denied permits regarding waterfront development, coastal land use, flood hazards, and freshwater wetlands once but allowed Williams, Transco’s parent company, to reapply. Williams requested the extension in the face of mounting environmental opposition to the project.

RH energytrans’s Risberg Pipeline will begin near Meadville, Pa. and extend northwest toward Ashtabula County, Ohio. The project will use 32 miles of existing pipeline and 28 miles of new-build line, 16 miles in Pennsylvania and 12 in Ohio. RH, an affiliate of EmKey Energy LLC, expects to complete Risberg mid fourth-quarter 2019.

Transco in August 2019 filed an application with FERC seeking authorization for its Leidy South project, which is proposed to connect natural gas production in the Marcellus and Utica shales in Pennsylvania with markets along the Atlantic seaboard by the 2021-22 winter heating season.

Leidy South will expand Transco’s firm transportation capacity by 582 MMcfd from the Leidy Hub and Zick interconnect to points downstream in Transco’s Zone 5 and Zone 6 markets. Seneca Resources Co. LLC, Cabot Oil & Gas Corp., and UGI Utilities executed binding, 15-year commitments for 100% of the project’s capacity.

The project will replace 6.3 miles of existing 24-in. OD Leidy Line A pipe with 36-in. OD pipe in Clinton County, Pa. and build 5.9 miles of new loop segments along the existing Transco pipeline corridor. It will also add horsepower at two existing compressor stations (12,000 hp in Wyoming County, Pa. and 35,871 hp in Columbia County, Pa.) and build two new greenfield compressor stations (46,930 hp in Luzerne County, Pa. and 31,871 hp in Schuylkill County, Pa.).

Leidy South also includes two lease arrangements: a capacity lease with National Fuel connecting Clermont, Pa., to the Leidy Hub; and a lease of Meade Pipeline Co.’s undivided ownership interest in the Central Penn Line from Zick to River Road.

National Fuel is building Line N to Monaca, a 4.5-mile lateral connecting National Fuel’s system to the Shell’s Appalachian petrochemical complex in Beaver County, Pa., about 30 miles northwest of Pittsburgh. Designed to produce ethylene and polyethylene (PE) from nearby ethane supplies, the complex will include an ethane cracker with an average ethylene production capacity of about 1.5 million tonnes/year and three PE units with a combined production of 1.6 million tpy. Two of the complex’s PE units will manufacture high-density PE pellets, while the third will produce linear low-density polyethylene pellets.

TC Energy’s 3.5-mile, 8-in. OD Eastern Panhandle Expansion Project will deliver 47.5 MMcfd of natural gas to Mountaineer Gas in Morgan County, WV. The expansion would move gas from an interconnect with an existing Columbia Gas Transmission line in extreme southern Pennsylvania across Maryland and into West Virginia. It, however, faces a sovereignty battle (similar to that in New Jersey involving PennEast) between the state of Maryland and its developers, who have received federal permission to proceed.

In January 2019 the Maryland Board of Public Works denied access to property, an HDD path under the Western Maryland Rail Trail, necessary to build the pipeline. HDD would also be used to cross beneath the Potomac River. TC Energy unit Columbia Gas Transmission filed suit in May 2019 seeking a preliminary injunction against the board’s ruling. The US District Court for Maryland dismissed the suit in August.

National Fuel subsidiary Empire Pipeline Inc. is expanding its system by 205 MMcfd via additional compression. The fully-subscribed Empire North project will add a 21,000-hp compressor station in Jackson Township, Tioga County, Pa., and a 32,000-hp compressor station in Farmington, Ontario County, NY. Empire will also increase the maximum allowable operating pressure of the pipeline to 1,490 psig from 1,290 psig.

FERC authorized Empire North in March 2019 and granted permission to begin construction in May. By August 2019 construction was underway at both compression sites and long-lead items ordered, in line with a second- or third-quarter 2020 in-service date.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.