Permian crude production growth requires natural gas pipelines

Permian crude oil production will reach a 6-month high of 6.19 million b/d in June 2024, according to the US Energy Information Administration, with new-well production/rig hitting 1,400 b/d, a level not seen since late 2021. Production from these new wells was expected to outpace an expected drop in legacy production, leading to the new high. Meanwhile, Enverus Intelligence Research Inc. forecasts that undrilled Permian well inventory could add roughly 2 million b/d of incremental output by 2030.

Along with this crude, however, comes large amounts of associated gas. Some of this gets consumed locally. Some it gets shipped to the Gulf Coast for conversion to LNG or petrochemicals, or combustion to generate electricity. Some of it gets sent by pipeline to the western US and Mexico to meet similar fates.

But the more that gets produced, the more that needs to get shipped. And the more constrained transportation out of the region becomes, the weaker prices get. You can’t sell what you can’t get to market, no matter how low a price you put on it. And eventually producers will be forced to reduce crude production, even though there’s good money to be made there. That’s where new or expanded pipelines come in.

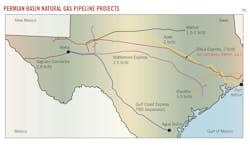

WhiteWater Midstream LLC, MPLX LP, and Devon Energy Corp. expect to begin service on their 2.5-bcfd Matterhorn Express natural gas pipeline third-quarter 2024. The 580-mile, 42-in. OD pipeline will ship gas from the Waha hub to the Katy area near Houston.

Whitewater’s proposed 193-mile Blackfin pipeline will extend from Colorado County, Tex., on the edge of Eagle Ford shale, to Jasper County in East Texas, north of Beaumont and Port Arthur near the Louisiana border. The project, which was approved by the Railroad Commission of Texas (RRC) in March 2023, would effectively serve as a 3.5-bcfd Matterhorn extension and increase overall delivery optionality out of Katy. Whitewater expects to begin construction third-quarter 2024 with a targeted in-service date of fourth-quarter 2025.

Capacity on Energy Transfer Partners LP’s 1.5-2 bcfd Warrior pipeline is 25% subscribed. The project would build about 260 miles of greenfield pipeline between Midland basin and Dallas-Fort Worth, using loops and already operating infrastructure for the rest of the journey to the Louisiana Gulf Coast.

During Energy Transfer’s first-quarter 2024 earnings call, co-chief executive officer and chief financial officer Tom Long said that the industry had “a strong interest in another pipeline probably by mid- to late 2026. We are very optimistic that we will be the next pipeline to come out of West Texas.” He went on to say that late third- or early fourth-quarter 2024 final investment decision would be needed to hit a hypothetical end-2026 Warrior in-service date.

The RRC in March of last year also approved Targa Resources Corp.’s 562-mile Apex pipeline, this project delivering gas directly from Midland County to Jefferson County, Tex., near Sabine Pass and south of Blackfin’s planned endpoint. The 42-in. OD pipeline would carry roughly 2 bcfd by 2026. During its most recent quarterly earnings call, however, Targa indicated that while it continues to develop Apex it is also studying other shipment options: “at the end of the day, Targa has one priority and that’s to make sure that the gas gets out of the basin.”

The US Federal Energy Regulatory Commission (FERC) earlier this year granted ONEOK Inc. a Presidential Permit to build and operate the Saguaro Connector natural gas pipeline border crossing into Mexico from Hudspeth County, Tex. The proposed 2.8-bcfd Saguaro Connector would use 155 miles of 48-in. pipe to transport Permian basin gas carried by ONEOK’s existing 777-MMcfd WesTex intrastate pipeline and other sources to Mexico by 2026. A pipeline on the Mexican side of the border will carry the gas to the west coast for liquefaction and export.

KMI is considering a further expansion of its 500-mile, 2-bcfd Gulf Coast Express pipeline, with estimated in-service of 2027-28. The company completed a 570-MMcfd expansion of the system in December 2023. Gulf Coast Express runs from the Permian to Agua Dulce hub, north of Corpus Christi, Tex.

Moss Lake Partners LP is next into the greenfield breach, planning to start work on its 2-bcfd DeLa Express pipeline in June 2026 to meet a July 2028 in-service target. The company in April 2024 requested FERC approval to begin the pre-filing review process for the project. The 42-in. OD, 690-mile pipeline would supply gas from the Texas Permian basin directly to Calcasieu Parish, La., supplying markets ranging from Port Arthur, Tex., to Cameron Parish, La., including LNG plants, fractionators, and Moss Lake’s NGL export project, Hackberry NGL.

Crude

Enbridge Inc. launched an open season in May 2024 for as much as 120,000 b/d of expanded capacity on its 900,000 b/d Gray Oak crude oil pipeline between Reeves County, Tex., and destinations in Corpus Christi-Ingleside and Sweeny-Freeport, all in southeast Texas. The open season will end June 28, 2024.

Enbridge will also add 2.5 million bbl of capacity at its 17.5-million bbl Enbridge Ingleside Energy Center (EIEC) by end 2025. As part of the expansions, the company will buy two marine docks and land adjacent to EIEC from Flint Hills Resources LLC.

NGL

Targa is building its 400,000-b/d Daytona NGL pipeline to move liquids from the Permian basin to a North Texas interconnect with its 550,000-b/d Grand Prix NGL pipeline and continued transport to Mont Belvieu, Tex. The pipeline will be expandable to 600,000 b/d via the addition of pumps and the company said in its first-quarter 2024 earnings call that it was on track to begin operations fourth-quarter 2024.

ONEOK is fully looping its West Texas NGL pipeline, which will more than double the company’s Permian NGL transport capacity to 740,000 b/d. Looping will include a connection to ONEOK’s 500,000-b/d Arbuckle II pipeline, running between Oklahoma gathering systems and Mont Belvieu. The company expects work to be complete during first-quarter 2025.

Based on internal projections for steadily increasing NGL production growth in the Permian, as well as rising NGL production from the Rocky Mountains and San Juan basin, Enterprise Products Partners LP plans to build and wholly own the new 550-mile Bahia NGL pipeline to transport as much as 600,000 b/d of NGLs originating from Delaware and Midland basins to the company’s fractionation complex in Mont Belvieu.

To consist of a 24-in. OD segment from the Delaware basin that will connect to a 30-in. segment running from Midland basin to Chambers County, Bahia NGL would begin service first-half 2025, according to the operator. It will be expandable to as much as 1 million b/d with additional pumps.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.