P. 4 ~ Continued - How Haynesville shale will lift Louisiana's gas production profile

View Article as Single page

Production model

The expected production from future undiscovered fields is a function of the number of new discoveries made during the year and the average production expected to be achieved per discovery.

Production arises from discoveries made during the year that start producing, as well as fields that previously came online. For each year the process repeats, with previous year discoveries contributing to production along with new discoveries.

Average production profiles for oil and gas fields are from a sample set that includes 59 gas and 45 oil fields in North Louisiana and 72 gas and 39 oil fields in South Louisiana. The standard deviation envelope indicates profile variability, and because of the diversity of field production, the envelopes are large and only a fraction (in this case one-fourth) of the standard deviation is presented. Standard deviation is maximum at peak production and declines with age as production declines.

The contribution of undiscovered conventional fields to total production is expected to be negligible relative to current producing fields, and we estimate the range of production potential at 1.9% to 2.4% of total production in their peak year.

As the largest oil and gas fields in Louisiana diminish in productivity, there is little prospect that the loss of their capacity will be offset by new conventional discoveries. New conventional oil and gas field discoveries have not kept up with the depletion of these fields and historical trends are believed to be a reliable guide to the future.

Undiscovered unconventional fields module

Haynesville shale

The Haynesville shale covers about 9,000 sq miles across East Texas and Northwest Louisiana, and its contribution to future gas production in the state is expected to be large and significant, but how large and how significant is unknown and speculative.

Haynesville is in the early stages of development and is subject to evolving environmental, technical, regulatory, and market uncertainty. Complex geological and petrophysical systems with heterogeneities occur at all scales.

Unconventional reservoirs are characterized by more significant capital expenditures relative to conventional development and profit windows that are more sensitive to operating conditions. Concerns over water requirements have led to stricter environmental reviews and regulatory changes that may impact growth trends in the short run but are unlikely to have significant long-term impacts because the issues appear manageable. The US economic recovery and demand for gas will also play an important role in the pace of shale gas development in Louisiana and in other states.

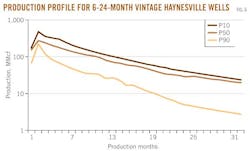

Type curves

The average monthly production profile P50 for Haynesville wells of 6-24 month vintage through December 2010 is depicted in Fig. 6. The data set consists of 683 single-well LUWs; multiple-well LUWs are excluded because of normalization requirements.

In addition to the average production profile, we also present P10 and P90 curves. P10 represents the production profile of the well where 10% of the category wells exceed its cumulative production at the beginning of 6 months; P90 represents the well where 90% of the category wells exceed its 6-month cumulative production. Prolific wells produce more and longer; less prolific wells produce less and are plugged earlier.

Scenario description

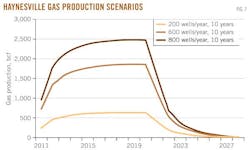

For unknown uncertainties, the best way to forecast future production is to present scenarios that illustrate the range of production potential.

From 2008 through 2010, 66 wells (2008), 349 wells (2009), and 601 wells (2010) were drilled and completed in the Haynesville (in 2011, 374 wells have been drilled through September). We use historic data to bound future outcomes and assume that future activity will range between 200 to 600 to 800 wells/year.

We adopt three drilling scenarios and apply the P50 type curve to determine the potential impact of shale gas output to state production.

We assume future wells will follow P50 type curves, a constant level of drilling activity for each of the next 10 years, and no pipeline infrastructure constraints in the region that would curtail or limit production. Market prices are assumed to remain above $4/Mcf to avoid significant curtailment and reduction of drilling activity. A price floor between $4 and $5/Mcf will continue to support drilling activity in the region because a portion of wells remain profitable.