MAXIMIZING VALUE FOR GAS STORAGE

Who uses natural gas storage and what are the cost components? Calgary-based Ziff Energy consultants Bill Gwozd and Dana Bozbiciu provide insight into the costs (summer and winter) and offer up some ideas on how to improve gas storage operations.

W. P. (Bill) Gwozd, Dana Bozbiciu, Ziff Energy Group, Calgary

High natural gas prices, with volatility, and rising liquidity of gas markets have increased the intrinsic value of gas storage facilities to both active market participants and investors. Gas storage provides considerable value in terms of increased efficiency, greater reliability of service, and facilitates with market growth. Without gas storage, the natural gas industry would, for example, require additional capacity on the pipeline systems between the supply and market areas to meet winter demand.

Who uses gas storage

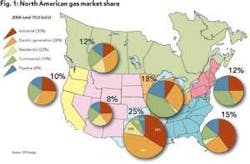

While gas storage may be used by gas producers, gas marketers, gas transporters, and end users, Ziff Energy believes that for 2006, 70% of the ultimate end use of gas storage is for gas and power utility type markets. The industrial sector comprises the remaining 30%. This is based on existing gas market share:

- 26% of gas demand is used as fuel by gas fired power generators;

- 22% of gas demand is consumed by the residential sector;

- 14% of gas demand is transported to the commercial sector; and

- 8% of gas is consumed by transportation companies for fuel.

Looking beyond 2006 to the middle of the next decade, Ziff Energy forecasts that the industrial gas demand needs will decline by 5% to 10% as a consequence of high natural gas prices, and the gas needs for the power sector will increase. Thus by then, the utility sector will be using more than 75% of gas storage.

Annual usage patterns for each sector vary. For example, the power sector may have daily gas storage withdrawal needs throughout the year, whereas the residential and commercial sectors typically rely on summer gas injections with winter gas withdrawals.

Location of gas storage requirements are generally adjacent to major populated regions with more than 70% of gas storage requirements in the eastern half of the continent. Figure 1 provides a snapshot of 70 bcf/d of North American gas markets by region and by sector that use gas storage. The size of the pie is directly proportional to the gas market needs.

null

Cost of gas storage - summer

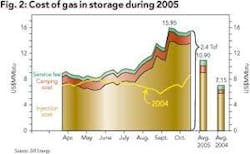

At times, there may be confusion as to the cost of gas in storage. Ziff Energy believes there are three1 separate costs that should be considered: the cost of gas to be injected; the carrying cost of gas injected from prior and current seasons; and the gas storage service fee paid to the operator/owner. Each cost component can be assessed separately - for example, for a gas utility, the combination of the three cost components can be averaged for a summer season to derive an expected cost for the forthcoming winter season withdrawal.

To illustrate, Ziff Energy analyzed average weekly gas prices for the summer of 2005. While gas injections may not be injected uniformly throughout the summer months, for this example we have assumed the cost of the gas injected to be a weekly average of the gas price of the 2005 summer.

Carrying cost refers to the cost attributable to finance the gas not used during the prior season. It also includes a cost for financing the cost of gas injected during the current summer season. The summation of the costs for the 2004 summer season, for North America, is estimated at US$7.15/MMbtu. Ziff Energy uses 6 months for the carry time (3.5 months summer, 2.5 months winter), and 7.5% for the time value of money. For this example, Ziff Energy used 1.3 tcf of carry over gas inventory, consistent with the March 31, 2005 values which results in a carrying cost of US$1.20/MMbtu.

Gas storage owners and operators rarely post or alert industry to the “gas storage service rental” fees, thus to estimate this variable, Ziff Energy assumed the last 10-year summer versus winter gas differential average as a proxy for the service fee, which is $0.65/MMbtu. The combination of these 3 values results in an average summer 2005 cost of gas in storage of US$10.90/MMbtu.

null

Cost of gas storage - winter

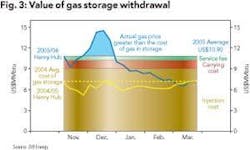

Withdrawal of gas stored may not be an automatic decision during the winter. One consideration may be to compare the cost of gas stored during the prior winter to the cost of alternate gas supply during the winter.

Using the example for the summer of 2005, the gas storage cost of US$10.90/MMBtu and the winter of 2005-2006 daily price of gas available at Henry Hub, it is quite apparent that Henry Hub prices were higher than $10.90 between late November, 2005 and late December, 2005. Consequently, gas storage withdrawals made financial sense during this period. Withdrawals during other periods of the winter may not be correct financially, but they may still have value if lower cost gas supply deliverability was not available from alternate sources at the time required.

With gas storage inventories on March 31, 2006 at 1.7 tcf (a record amount of carry over to the summer season), it may be a convenient explanation to simply justify the high gas storage inventory carry-over on warmer than normal weather across North America; however, an alternative explanation may be that less withdrawals were made because there were lower priced gas supply alternatives available. This happened during the previous year as well where the average cost of stored gas was greater than the daily winter Henry Hub outlook.

null

Areas to improve for gas storage

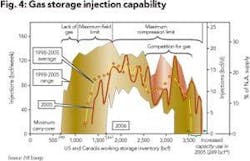

Ziff Energy has undertaken analysis to determine opportunities to improve gas storage operations. As a whole, gas storage fields utilize the maximum gas storage field injection capacity during the early summer gas injection cycle. However, gas injection capacity declines during the core summer due to limitations of gas compression.2 This creates an opportunity for installing additional gas compression for gas storage field injection.

Interestingly, the additional gas compression is not required to actually fill the gas storage field over the summer injection season. Rather it is needed to optimize the cost of gas injected. For example, if gas prices were lower on a specific summer day, the ability to inject more lower-priced gas would result in a reduced average cost of gas for the full summer. Thus, the savings in gas costs would be available to help financially underpin the economics for the new gas compression.

Figure 4 provides a summary of Ziff Energy’s analysis highlighting the need for additional gas compression opportunities for gas storage facilities. OGFJ

null

The authors

W. P. (Bill) Gwozd, P. Eng. [[email protected]] is vice president, gas services with Ziff Energy Group. He oversees the North American gas practice, focusing on long-term natural gas price outlooks, supply forecasts, pipelines, LNG, regulatory, storage developments, and market demand forecasts. Gwozd holds a chemical engineering degree from the University of Calgary, Alberta.

Dana Bozbiciu [[email protected]] is an intermediate analyst in the gas services group at Ziff Energy and provides analytical support to all gas service business units. She holds a degree in geologic and geophysical engineering from Babes-Bolyai University, Romania.

Ziff Energy Group, a global energy consultant and research firm, has been providing expertise and advice about natural gas to the energy industry since 1982. Ziff Energy’s comprehensive benchmarking studies have measured upstream performance for more than 100 exploration and production companies throughout the world.