WoodMac: Argentina's Vaca Muerta shale play to double production by 2018

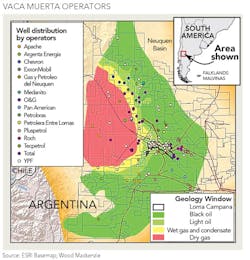

PRODUCTION FROM Latin America's premier shale play, the Vaca Muerta, is expected to double by 2018, said Wood Mackenzie following results of a development study. Argentina's massive play continues to be the most prospective tight oil play out-side of North America.

While a marked ramp-up can be expected by 2020, the study, released in mid-November, highlights that oil and gas output in 2016 should be moderate with year over year production at 10%.

Wood Mackenzie expects horizontal wells to become the development of choice as operators are increasingly able to target the most productive intervals of the Vaca Muerta.

"YPF and its JV partners continue to decrease drilling and completion costs aiming to move into ramp-up and development phases," noted Rio de Janeiro-based Horacio Cuenca, a research director for Latin America at Wood Mackenzie.

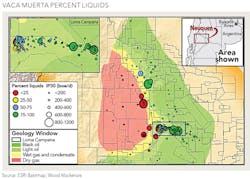

In the Loma Campana block, the current average horizontal IP30 rate is approximately 646 barrels of oil equivalent per day (boe/d), up from 443 boe/d in 2014. In comparison, the first one hundred wells in the Karnes Trough of the Eagle Ford Shale in Texas had an IP30 rate of 420 boe/d (the average rate today is more than double).

Said Cuenca, more joint venture deals will be necessary to fully develop the Vaca Muerta as YPF will need outside assistance to develop the 6.3 million acres it holds.

As companies prepare for full development, Wood Mackenzie estimated a total capex of US$1.2 billion in 2016, but cautioned that the heavy impact of unions on labor costs and political uncertainty remain the largest impediments to international investment.

The firm expects fewer wells to be brought online in 2016 than the estimated 200 brought online in 2015 as vertical wells are phased down. There were approximately 460 producing wells around the time of the study's release in mid-November.

Wood Mackenzie noted a total remaining NPV10 of US$9.7 billion for the Vaca Muerta, with the condensate window, including the Loma Campana block, driving value.