Canada shale

Challenges in the low commodity environment

SONA MLADA, RYSTAD ENERGY

CANADA IS the fifth largest producer of hydrocarbons in the world (after the United States, Russia, Saudi Arabia and Iran); 2016 average annual production is expected to be over 7 million barrels of oil equivalent per day (oil and gas combined). Almost 60% of this production is represented by light oil. In fact, Canada is the fourth largest light oil resource holder (after Russia, Saudi Arabia and the US), with over 130 billion barrels of remaining economical resources, almost 80% of which are represented by the oil sands. Shale production in Canada has become an important source since 2010. Due to the depth and geology structure, the shale formations in Canada are on average much more gas-prone than in the US. In 2016, nearly 80% of the shale production in Canada will be represented by rich gas (in the US this is ~65%). As Figure 1 indicates, conventional production in Canada has been in steady decline since 2007. Historically, oil sands were the fastest growing supply source. Growing supply from oil sands helped the country keep overall annual production flat - and if it were not for shale, production in Canada would not have experienced a growing trend in 2010-2014 (average growth of 4% p.a.). Here, an overview of the shale plays in Canada, explaining the challenges faced in the low commodity price environment.

Geology of Canadian shale

Western Canada is a treasure for Canada in terms of unconventional plays. Historically, the area of Western Alberta has been submerged during several geological ages. During the Devonian age, the sediments of Horn River Shale (Middle Devonian) and Duvernay Shale (Late Devonian) were deposited, followed by the Mississippian age, which contributed to the deposition of the Alberta Bakken Play (younger Banff and Exshaw formations are Mississippian age, underlying Big Valley is late Devonian). The two younger formations are Montney Play deposited in Middle Triassic and Cardium Play (Cretaceous). While Horn River and Duvernay are pure shale plays, Alberta Bakken is a mix of shale and tight sediments, Cardium is comprised primarily of sandstones and Montney is a hybrid of conventional formations, tight sands and black shale. The structure of the formations is especially complicated in the area of Foothills in the province of Alberta, where Duvernay, Montney and Cardium form a stacked potential, with Duvernay depth ranging from 3,000m to 4,500m; the depth of Montney ranges from 2,000m to 3,300m and Cardium from 1,000m to 2,500m. All three formations get deeper towards the Rocky Mountains on the border between Alberta and British Columbia (see Figure 2).

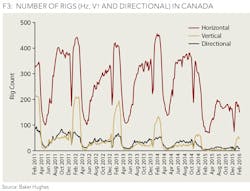

Recent development in horizontal rigs

Horizontal rigs in Canada experience a strong seasonality effect, as Figure 3 suggests. The number of rigs bottoms twice a year - in May (weather seasonality), when the soil gets muddy and it becomes more difficult to operate the rigs, and in December just before year-end. The number of horizontal rigs in Canada reached its peak in February 2014, when 451 rigs were running in the provinces of British Colombia and Alberta. After the commodity prices collapsed in late 2014, the February 2015 number reached just above 300 rigs (a 33% decrease Y-o-Y). As of now (February 2016), there are only ~180 horizontal rigs in Canada, representing a further decrease of 40% Y-o-Y.

Largest acquisitions in the Canadian shale

The M&A market in Canada cooled down in 2015 - the total value of all upstream deals in Canada amounted to only ~$10 billion last year. Of all the acquisitions in Canada since 2010, the five largest were partially or completely related to shale acreage and shale-focused companies. The three largest shale acquisitions in Canada occurred in 2012. The first one ,announced in June 2012, was the bid of Malaysian Petronas to acquire Progress Energy Resources for $5.3 billion, followed by a bid from CNOOC to acquire Nexen for $15.1 billion announced in July 2012. Both included vast acreage positions in Montney Shale and Horn River Shale. (Nexen held 300,000 acres in the shale gas area of northwestern British Columbia in the Liard Basin, Cordova Basin, and Horn River Basin and Progress Energy held 139,150 acres in the Montney Shale). Both bids were evaluated to determine whether they would be of net benefit to Canada. The third largest acquisition was ExxonMobil's purchase of Celtic Exploration for $3.15 billion, including 104,000 net acres in the Duvernay Shale and 545,000 acres in Montney Shale.

LNG in Canada and its future

The intent of operators in many of the aforementioned acquisitions was to invest in the buildout of LNG export terminals on the Western coast of British Columbia. Particularly in the years 2012 and 2013, when the LNG landed price oscillated around 12 $/kcf in the East Asian LNG spots, shipments of the liquefied gas from Canada seemed like a top-notch investment. At that time, the realized gas price in North America was on average four times lower compared to East Asian markets. Multiple operators applied for a facility permit from the BC Oil and Gas Commission, however, the first project in the province to receive the permit was Shell-operated LNG Canada. The joint venture partners in the facility are PetroChina, KoreaGas, and Mitsubishi. Shell operates ~300,000 net acres in the Montney Play, located primarily in the Groundbirch and Gundy areas. In addition, it holds over 350,000 acres in the Duvernay Shale. The LNG Canada Project, located at Kitimat, has an expected facility of 3.23 bcf/d. The project could cost nearly $40 billion, initially consisting of two trains, with a potential expansion to four trains in the future. Since LNG prices follow the oil prices, the LNG landed prices in East Asian markets have fallen to ~7 $/kcf. This is one of the main drivers for the joint venture to postpone its final investment decision to the end of 2016.

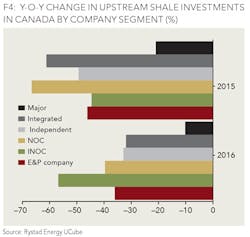

Investments in the Canadian shale

The upstream business in Canada was hit hard by the drop in commodity prices. In the country as a whole, investments fell by ~40% Y-o-Y in 2015 and are expected to fall by a further 30% Y-o-Y in the current year. The drop in shale investments is even more significant: ~45% in 2015 Y-o-Y and over 30% in the current year. However, shale investments are expected to recover faster in 2017 compared to other supply sources. The estimated increase of 2017 investment in shale is ~50% Y-o-Y. As Figure 4 shows, companies in Canada reduced shale investments across all company segments. In real terms, total investments dropped by almost $3.5 billion in the Montney Play in 2015 and ~$1.5 billion in the Cardium Play. Investments in the largest Canadian play, Montney, will drop by a further ~$1.5 billion in the current year.

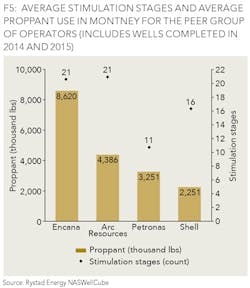

The largest shale play in Canada - Montney

Montney is the largest play in Canada, both in terms of production and investments. In 2015, on average, the play produced over 850 thousand barrels of oil equivalent per day, of which ~550 kboe/d were coming from the British Columbia part of the play. In British Columbia, the Montney production is primarily represented by rich gas - only ~5% of the total production consists of light oil. On the other hand, in Alberta, the operators tend to target liquid-rich Montney, causing the average light oil content to be slightly above 20%. The largest operators in the British Columbia part of the play are Encana, Petronas, Shell and Arc Resources (ordered by 2015 production). As Figure 5 suggests, Encana is the operator with the highest number of stimulation stages (21) and the highest volumes of proppant used (over 8,600 thousand lbs) for stimulating its Montney wells in British Columbia, on average. Consequently, Encana is the operator with highest average 30-day IP rates - for the wells completed in 2014 and 2015 the realized 30-day IP rate for the operator was 9 MMcfe/d, compared to 5.7 MMcf/d for Arc Resources, 3.6 MMcfe/d for Shell and 3.4 MMcfe/d for Petronas.

About 40% of the total well cost for the Montney wells is represented by drilling; the remaining 60% is completion cost. Over the last four years, the average well cost in the Montney Play has decreased by over 12% p.a. This is partially driven by the cost compression realized by the operators in 2015 and 2016, as well as increased pad drilling and improved well completions. In 2015, over 90% of all Montney wells in British Columbia were drilled using multiple wells pads.

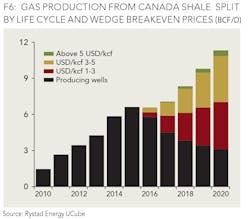

Conclusion

In 2015, total gas production from Canada Shale reached 6.6 bcf/d. In 2016, the production is expected to be flat Y-o-Y; however, only ~5.8 bcf/d is represented by wells that are currently producing (as of February 25, 2016). Figure 6 indicates the break-even price of production from wells that have been spudded and are awaiting completion. The gas production from Canadian shale has a potential to grow to above 11 bcf/d by 2020; however, almost 40% of this production is represented by wells with wedge breakeven prices above 3 $/kcf. The current Henry Hub price oscillates around 1.9 $/kcf and the current AECO prices around 1.2 $/kcf. Stronger gas prices will be crucial for the Canadian shale gas market to achieve a growth in the gas supply post 2017.

ABOUT THE AUTHOR

Sona Mlada is the lead Canada onshore and offshore activity Analyst at Rystad Energy. Her main responsibility is the analysis of upstream E&P activities in Canada, with a specific focus on shale asset modeling. She is the project manager for the North American Shale Report, published by Rystad Energy. Mlada is also responsible for analyzing the global discoveries and estimating the recoverable resources. She holds a degree from the University of Economics in Bratislava, Slovakia, including a graduate exchange program at Universidad de Granada, Spain.