The Horizontal San Andres

RELATIVELY NEW FOR INVESTORS, THE HZ SAN ANDRES COULD GENERATE VERY STRONG ECONOMICS AND IRRS

JOHN WHITE, ROTH CAPITAL PARTNERS, HOUSTON

ON MAY 9, Ring Energy (REI-Buy) announced plans to drill three horizontal (Hz) San Andres wells in Andrews County, Texas. We provide equity research coverage of Ring Energy and our rating is Buy with a $14.00 price target so we decided to dig a bit deeper into the Hz San Andres play on the Central Basin Platform of the greater Permian Basin.

Following REI's announcement, it became apparent to us that this play is relatively new for investors and analysts involved with publicly traded E&P companies. This play, we believe, has been "under the radar" for a couple of reasons. One, the play has been dominated by private E&P companies. Two, in our view, the play gets overshadowed by the much more intense industry activity in the nearby Midland Basin involving the Spraberry and Wolfcamp formations. As for other publicly traded companies in this play, the only other name we know of is Apache Corporation (APA-Not Covered), which we were told is not currently active in the play.

The Hz San Andres in Andrews County is distinct and different from the Hz San Andres development in and around the Platang field located in Yoakum and Cochran counties.

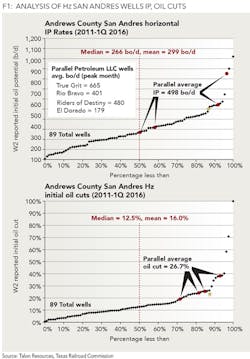

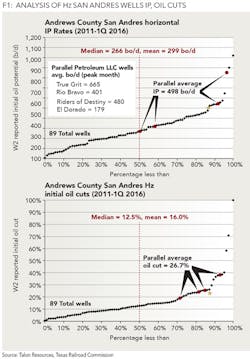

The Hz San Andres play is actually not that new, with over 130 Hz San Andres wells having been drilled from roughly 2009 to today. As mentioned, the play has largely been dominated by privately owned E&Ps, most of them staked by leading private equity firms. The most active private E&Ps in this play have been: Forge Energy, Pacesetter Energy, Parallel Petroleum, and Trey Resources. There are also numerous other smaller privately backed E&P companies involved in the Hz San Andres.

Three wells drilled by privately owned Parallel Petroleum, the Riders of Destiny 1H, the True Grit 1H, and the Rio Bravo 1H, recorded very strong results. In our opinion, Parallel employed improved completion techniques for these three wells that yielded very strong results. As such, we view these three wells as potential pivot points in furthering this play.

With regard to the current state of the upstream industry, for the healthy, larger companies, it appears we are entering the consolidation phase of the cycle. This observation is based on the recent increase in deal activity, to wit: 1) on 5/3/16, Synergy Resources Corporation (SYRG-Neutral) announced its agreement with Noble Energy (NBL-Not Covered) to acquire assets in the Wattenberg field for total consideration of approximately $505 million cash, 2) on 5/5/2016, Chesapeake Energy Corp. (CHK-Not Covered), said it was selling $470 million of assets in Oklahoma to Newfield Exploration Co. (NFX-Not Covered), and 3) on May 16, Range Resources Corp. (RRC-Not Covered) announced it had agreed to acquire Memorial Resource Development Corp. (MRD-Not Covered) in an all-stock deal valued at $4.4 billion. The RRC-MRD transaction represents a significant geographical diversification for RRC, as RRC's operations are focused in the Appalachian basin, while MRD's assets are concentrated in North Louisiana, primarily in the Terryville field in Lincoln Parish, Louisiana.

Given the improved transaction environment, we expect the Hz San Andres to be involved from perhaps several angles. Some of the private equity backed companies in the play may be ready to monetize by selling for cash to larger, publicly traded companies. If we get stronger signs of life starting to show in the public equity market, some of these private companies may IPO.

RING ENERGY'S PLANS

On May 16, we visited Ring Energy and sat down with Kelly Hoffman, CEO and a director and David Fowler, president and also a director. We are excited about REI's horizontal San Andres in its core acreage spread in Andrews County on the Central Basin platform. The San Andres in this area is a dolomite. REI has conducted a detailed study of encouraging horizontal drilling results offsetting its properties in the area. REI is targeting three horizontal San Andres wells to be drilled in late 3Q and 4Q 2016. These wells are planned for $2.0 million to $2.8 million completed well cost, depending on the lateral length and not including additional tank batteries for the initial wells, which will add about $350,000. REI estimates about 380,000 to 400,000 BOE estimated ultimate recovery with 90% oil and IPs ranging from 400 BOE per day to 600 BOE per day.

If these initial Hz San Andres wells work close to the figures cited, the Hz San Andres could be a real game changer for REI, in our opinion. Consider the possibility of three wells, with IPs ranging between 400 to 600 BOE per day, and compare that against REI's average production during 2015 of 2,051 BOE per day.

These wells are planned to be drilled to a vertical depth of about 5,000 feet and, depending on the lease provisions and Texas Railroad Commission regulations, with a one mile, one and one quarter mile or a one and one half mile lateral. The wells should be drilled in about 10 days with five to seven days to be completed. With this type of drilling and completion schedule, it is entirely possible, if all goes according to plan, for REI to drill upwards of 20 Hz San Andres wells in 2017. The 20-well figure was mentioned by Ring Chairman Lloyd T. Rochford on the recent 1Q 2016 earnings conference call, but was not offered as guidance. Then, in our view, you begin to grasp the potential of this play for REI.

HZ SAN ANDRES HISTORY

Following our meeting with REI, we then visited newly-formed Talon Resources, headed up by Don Tiffin, Brian McCurry, and Tom Hanna. We were fortunate to get this appointment as this team has been drilling Hz San Andres wells for several years and, as we understand, is credited with some of the best Hz San Andres wells in Andrews County. These gentlemen were previously with privately owned Parallel Petroleum where Tiffin was CEO, Hanna was CFO, and McCurry was VP of operations.

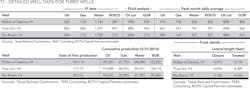

While at Parallel, this crew drilled the Riders of Destiny 1H, which IP'ed for 269 BO and 118 Mcf or 289 BOE per day (93% oil), the True Grit 1H, which IP'ed for 853 BO and 406 Mcf or 921 BOE per day (93% oil), and the Rio Bravo 1H, which IP'ed for 544 BO and 170 Mcf or 572 BOE per day (95% oil). These three wells are offset to the west of REI's proposed Hz San Andres pilot area. Detailed well data is shown in Table 1.

Continuing our investigation of this play, we were introduced to another of the early participants, Ted Mowers, formerly senior geologist at Parallel Petroleum and now an independent consulting geologist in Midland. Finally, just to touch all the bases, we visited with Larry Oldham, previously CEO of Parallel Petroleum, who is now an operating partner of a private equity firm. He is also manager of Oldham Properties Ltd., a family-owned entity, and is also involved in the acquisition of minerals and royalty interests in the Utica play through Gateway Royalty LLC.

We had an in-depth discussion with Mowers on the history of the play. E&P companies had sporadically drilled Hz San Andres wells going as far back as the 1990s, but it was about 2009 when the application of modern slick water hydraulic fracturing techniques started yielding impressive results. Mowers informed us that Pacesetter was the first innovator to employ modern hydraulic fracturing in the play, with Forge following close behind.

The team at Parallel Petroleum sat back and watched and observed the initial batches of wells drilled by Pacesetter and Forge to determine whether oil volumes would stabilize following high-rate completions. Mowers informed us their surveillance was facilitated due to the majority of early development by Pacesetter and Forge occurring on University Land leases. The term University Land refers to mineral rights that are owned by a branch of the State of Texas named University Lands, or UL. UL manages the surface and mineral interests of 2.1 million acres of land across 19 counties in West Texas for the benefit of the Permanent University Fund or PUF. The PUF is one of the largest university royalty endowments in the US and benefits more than 20 educational and health institutions across the University of Texas System and Texas A&M University System.

Mowers's geologic evaluation was aided by the UL's open data policy because operators are obligated to make data-such as well logs, drilling records, and completion reports-available to the public.

After concluding the geologic study and economic evaluation, Parallel then drilled what Mowers terms their "science well," the Parallel Petroleum Hall #A4 in which an extensive suite of open-hole logs was used to analyze the geologic, geochemical, and geophysical characteristics of the San Andres formation. In addition, Parallel ran two cross-well tomography seismic sections to evaluate the structure of the San Andres as well as to identify any faults or fractures along the horizontal wellbore path.

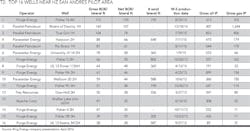

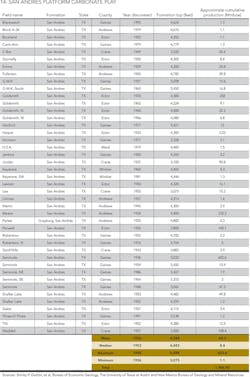

Ring has complied a study of the top 16 wells in the vicinity of its acreage and proposed a Hz San Andres pilot area, as shown in Table 2.

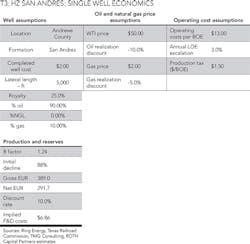

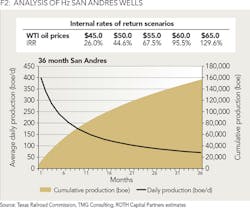

By our analysis, and employing the assumptions shown, these Hz San Andres wells could generate very strong economics and IRRs, as shown in Table 3 and Figure 2.

INDUCED FRACTURE ORIENTATION

Fractures induced by hydraulic fracture stimulation in the San Andres typically take on an east-west orientation due to natural stresses within the formation. This fact is supported by, among other things, microseismic monitoring, borehole break out, and open-hole logging of drilling induced fractures. As a result, Hz San Andres wells drilled in a north-south orientation have performed significantly better than those drilled in an east-west orientation due to their ability to generate a substantially higher number of induced fractures and thereby, more stimulated reservoir volume.

In our opinion, almost any oil and gas producer will tell you the best place to look for oil and gas is where it has already been found. As shown in Table 4, that is certainly true of the Central Basin Platform.

As described at length in the report titled "Play Analysis and Digital Portfolio of Major Oil Reservoirs in the Permian Basin" by Shirley P. Dutton, et al, at the Bureau of Economic Geology, the University of Texas at Austin and the New Mexico Bureau of Geology and Mineral Resources at the New Mexico Institute of Mining and Technology, oil and gas production in the Permian Basin occurs from reservoirs in Paleozoic strata, from Ordovician through Permian age. The Permian Basin is subdivided into: the Northwest Shelf, the Delaware Basin, the Central Basin Platform, the Midland Basin, the Ozona Arch, the Val Verde Basin, and the Eastern Shelf.

In the west, the basin is bounded by the Guadalupe, Sacramento, Sierra Blanca, and Capitan Mountains in New Mexico and the Diablo Plateau in Texas. To the north, the Permian Basin is bounded by the Sin Nombre Arch and the Roosevelt Uplift in Texas. The Matador Arch forms the northern boundary and separates the Midland Basin from the Palo Duro Basin. The southern boundary is the Marathon-Ouachita Fold Belt. The Eastern Shelf grades eastward onto the Concho Platform and Bend Arch.

ABOUT THE AUTHOR

John White is a senior research analyst in Roth Capital Partners' Houston office. Previously, he was a portfolio manager and analyst with Triple Double Advisors. Prior to that, he was an E&P equity analyst with Natixis Bleichroeder and Next Generation Equity Research. From 1996 to 2003 he served as an energy high yield fixed income analyst for BMO Capital and John S. Herold Inc. His experience also includes banking and credit analysis responsibilities with Scotia Capital. His industry background includes working in acquisitions and divestitures and exploration and production, primarily with BP. White received a BBA from the University of Oklahoma and an MBA from the University of St. Thomas (Houston). He serves on the OGFJ Editorial Advisory Board.

ROTH makes a market in shares of Ring Energy Inc. and Synergy Resources Corp. and as such, buys and sells from customers on a principal basis. Within the last twelve months, ROTH has managed or co-managed a public offering for Ring Energy Inc. Within the last twelve months, ROTH has received compensation for investment banking services from Ring Energy Inc.