Quantifying the impact of shale

LESLIE WEI, RYSTAD ENERGY

UNCONVENTIONAL PRODUCTION is controversial due to environmental concerns, including water safety and earthquake activity, but while shale exploration is sometimes regarded negatively, it is important to consider the positive impact the shale industry has had on the domestic and global economy.

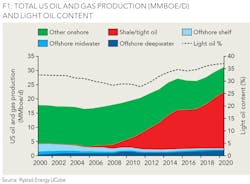

Oil and gas production in the United States can be broken down into two periods: pre and post shale. The timeline of each period is observable in Figure 1, which shows the oil and gas production in the United States split by the source of supply along with the light oil content. Before the "shale era," US production was decreasing, where the main contributor to production was conventional fields. During this period, the US relied heavily on oil imports and had to take measures to secure a consistent supply of oil. The introduction of shale completely changed the picture; oil production grew from five million barrels to nine million barrels per day, which has reduced the US trade deficit. Oil imports now contribute to just 1/3 of the trade deficit compared to 2/3 of the trade deficit before the shale revolution, thus further strengthening the solidity of the US economy.

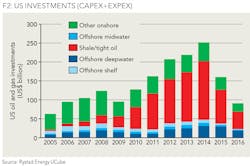

Shale also provides benefits to society through job creation and royalties and taxes paid to landowners and authorities. Figure 2 shows the historical investments (development and exploration) for both oil and gas fields in the US. Over the past five years, shale investments made up 50% of total US investment levels. During the same period, the number of jobs associated with oil and gas activities increased by approximately 300,000, according to the Bureau of Labor Statistics. In addition to job creation, companies pay royalty, production tax, and income tax to the landowners and government for each barrel of oil produced. Government and landowner income from shale peaked in 2014 at US$120 billion and dropped to about US$31 billion in 2015.

In terms of the global economy, shale plays an important role as the marginal producer, where it currently has 6% of the market share. Without shale, the call on OPEC would have gone from 33 million barrels to 38 million barrels in 2016, which indicates shale is a stabilizing factor for the oil price.

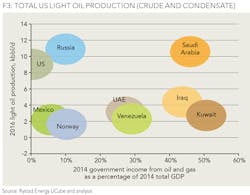

There are countries that benefit from each oil price scenario. A low oil price results in lower transportation costs and gasoline prices, which greatly benefit the developing countries, while a high oil price affects the government income for oil exporting countries. Figure 3 quantifies the effect of the oil price on the top oil producing countries, showing the 2016 oil production along with the oil and gas contribution to the total GDP. The OPEC countries, Saudi Arabia, Kuwait, and Iraq, are the most exposed to income from oil and gas, where the income makes up more than 40% of total GDP. These countries will benefit the most once the oil price recovers. Of the top three producers, Saudi Arabia, Russia, and the US, the US and Russian economies are less affected by oil price fluctuations since 1% and 10%, respectively, of the GDP are dependent on oil revenues.

The environmental impact will continue to present pushback for shale production in different societies. Nonetheless, the introduction of horizontal drilling and fracking has put the US back on the E&P map. With considerable growth in production over the last five years, the US has been able to move closer to energy independence and may be completely independent by 2020. The shale industry has also benefited other parts of the economy by creating 300,000 new jobs, which was important in the post-financial crisis period. In the global context, the introduction of shale has geopolitical influence by lowering the oil price and offering stable oil price to developing countries.

ABOUT THE AUTHOR

Leslie Wei is an analyst at Rystad Energy. Her main responsibility is analysis of unconventional activities in North America. She holds an MA in economics from the UC Santa Barbara and a BA in economics from the Pennsylvania State University.