Global LNG market outlook

INVESTMENT SWINGS TO NORTH AMERICA

MARK ADEOSUN, DOUGLAS-WESTWOOD, FAVERSHAM, UK

IN RECENT YEARS, the demand for LNG has been driven by the need to bring conventional gas reserves to market. LNG demand is a function of increasing natural gas consumption, driven by economic growth and fuel switching. Furthermore, the decline in local production in some key consumer nations has increased regional demand for LNG, as this is seen as the alternative source for gas supply. Consequently, LNG will be fundamental for future gas supply in many countries.

However, there have been concerns over the economic viability of many LNG projects due to sustained low commodity prices caused by the oversupply in the global LNG market. This is as a result of the weakening of demand from major market such as Japan and South Korea and the increase in global export capacity driven primarily by large Australian LNG projects.

Furthermore, demand in Asia is forecast to be sluggish in the short term as a result of slower than expected economic growth in the region. All of this will result in LNG oversupply persisting beyond 2021 due to additional supply from North America.

Despite these near-term concerns, the long-term outlook for LNG is largely positive. LNG demand from other countries in Asia will ensure a demand-supply balance in the long term. The Chinese government's commitment to switching from coal to gas power generation to reduce greenhouse gas emissions is expected to continue, with the US and China agreeing to ratify the Paris climate deal. The European Parliament has also recently approved the ratification of the Paris deal, compelling EU member states to steer the global transition towards cleaner energy.

GLOBAL MARKET OVERVIEW

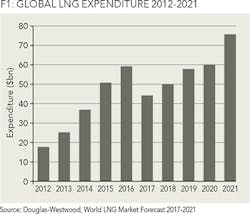

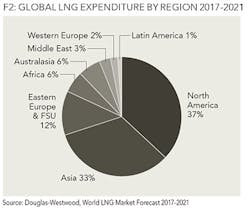

Despite near-term concerns, the need to meet rising domestic demand remains a compelling driver for the continued investment in capital-intensive LNG projects. Over the 2017-2021 period, Douglas-Westwood (DW) expects capital expenditure (CAPEX) on LNG facilities to increase by 50% compared to the 2012-2016 period, totalling US$284 billion. This increase in expenditure is predominantly due to large North American liquefaction projects currently under construction.

DW forecasts a regional shift in investment from Australasia to North America, with liquefaction projects currently under construction in Australasia expected to reach completion by the end of 2017. Proposed projects in Australia that were expected to trigger a second phase of investment in the country have either been delayed or cancelled due to current market conditions.

Forecast expenditure is one of fairly steady growth. However, 2017 and 2018 are expected to be weaker years in terms of spend, as a result of reduced project sanctioning in recent years. Expenditure is expected to experience an upswing in the latter years of the forecast period due to continued investment in North America and Russia, as well as an expected resurgence of the LNG carrier market.

Liquefaction projects will account for the largest proportion of total expenditure, reaching US$192 billion over the next five-year period - representing an increase of 42% compared with the 2012-2016 period. Import facilities will represent 14% of total expenditure, totaling $38 billion over the forecast period - a rise of 25% compared with the 2012-2016 period. Many of these projects will be built in Asia and Europe, as European countries seek to lessen their dependence on Russian gas. Other regions such as Africa and Latin America are expected to see a significant increase in the construction of import facilities.

The current vessel oversupply has limited the number of LNG carriers ordered in 2016. However, expenditure on LNG carriers will account for 19% of the global expenditure, reaching $54bn over the forecast period. DW forecasts over 150 additional units to be delivered outside the current orderbook - a total of US$33 billion will be required towards the end of the forecast period. The majority of these potential units are expected to be required to support additional export capacity to be installed in North America.

REGIONAL OVERVIEW

In recent years, the development of Australian coal bed methane (CBN) resources has attracted a lot of investment. However, investment in this sector is expected to slow down significantly, as many projects struggle to make economic sense in the face of rampant cost inflation, as well as the decline in oil prices, with most long-term LNG contracts being linked to oil prices.

North America is expected to become the dominant region for capital investment in LNG facilities over the 2017-2021 period. The region will account for 17% of global export capacity by the end of the forecast. Despite taking a conservative view on the viability of many projects, North America is still expected to take the majority of investment over the 2017-2021 period, with over 70% of its $105 billion forecast expenditure already committed. Major projects such as Head LNG, Cameron LNG, Corpus Christi, Dominion Cove Point, Sabine Pass and Freeport LNG will contribute to spend over the forecast.

Asia will maintain a fairly constant share of the market, with approximately 33% of forecast expenditure, totaling $94 billion - a 68% increase compared to the hindcast period. Much of the expenditure in Asia is attributed to the construction of LNG carriers, as all the LNG shipbuilding activity over the 2012-2016 period took place in Asia where the major shipyards are located.

This trend is forecast to continue with the exception of a handful of orders that might make it to Europe. One example: the Anthony Veder order with Neptun Werft for the construction of a new super 1A ice class LNG carrier, which is expected to be delivered before the end of 2017.

Over the 2012-2016 period, LNG construction activity in Africa was limited to liquefaction developments. However, over the forecast period, both liquefaction and import terminals will contribute to global LNG expenditure. Construction activity is expected to pick up by 2018, with the sanctioning of the Afungi LNG trains 1 and 2 in Mozambique. Furthermore, investment in Morocco's proposed import terminal near El Jadida will also support expenditure.

The Middle East is currently the largest LNG exporting region in the world, with six operational facilities that run on 25 trains. Iran is expected to be a major influence on expenditure in the region over the forecast period. With the lifting of USA, UN and EU nuclear-related sanctions, investment is expected to gradually stream back into the country, potentially re-starting Iranian LNG plans. Export capacity in the Middle East is expected to increase to 110.6 mmtpa by 2021. This will be driven by the construction of the Iran LNG terminal. However, due to large increases in capacity in Australia and the US, the Middle East's market share of just over 28% in 2016 will fall to 23% by 2021. Consequently, Australia is expected to overtake Qatar as the world's largest exporter by the end of 2017.

CONCLUSION

In the near term, a stormy ride is expected in the LNG industry, as the combination of low prices and LNG oversupply limit investment in capital-intensive liquefaction projects. However, the need to meet rising domestic demand remains a compelling driver for the continued investment in LNG projects. The long-term potential of the LNG industry is evident, as natural gas is expected to play an increasingly important role in meeting the world's energy demand, with countries seeking to diversify their energy supply.

Furthermore, seasonal gas demand will remain a key driver, particularly in Western Europe and Latin America, as LNG demand in these regions is often driven by prolonged winter seasons, while declining local gas production will also play a part.

With climate change having a far-reaching implication on the environment, LNG is seen as a key to redirecting the world towards lower carbon emission in the future.

ABOUT THE AUTHOR

Mark Adeosun is the author of "The World LNG Market Forecast 2017-2021," which examines trends in the LNG market by region and facility type, supported by analysis, insight, and industry consultation. Adeosun has a BSc degree in geology and a master's degree from the University of South Wales in geographic information systems (GIS).