OPEC’s influence on oil prices

How macroeconomics and geopolitics are driving the price of oil

Jason Reimbold

The Theseus Group

Market anxiety about the global recession hit commodity prices hard in fourth quarter 2008 and drove the price of crude down to a four year low of $40.81 (at the time of publishing). While US consumers welcomed lower fuel prices, the free fall of crude has hit OPEC interests hard. In response, the cartel made cuts in production, but even this action has yet to significantly impact the price of crude. Has OPEC lost its influence over oil prices?

OPEC has been long revered for their immense oil reserves and their ability to manipulate the price of oil through the adjustment of production quotas among member countries. The cartel demonstrated the extent of their influence when they flexed their oil muscle with the Arab oil embargo in 1974. However, the world economy was starting to exhibit signs of recession at that time as well, and not long after the embargo, oil prices began a downward trend ultimately decreasing by more that 60% in from November 1985 to March 1986. It is unnerving to recognize that the market has experienced a drop in oil prices of nearly the same magnitude since July of 2008. Nevertheless, OPEC still attempts to support pricing with cuts in production.

The OPEC cut of 1.5 MMbd in October 2008 was unable to counter the falling price of crude, and at the time of publishing, the market had not adjusted for expected December cuts. OPEC members produce approximately 40% of the world’s supply of oil, and only an extraordinary cut, perhaps more than 4.5 MMbd, or approximately 12% of daily crude production would demand a reaction from the market. However, such a severe decrease in production is unlikely.

If crude prices were to spike in the midst of the current economic climate, the impact of the recession on oil prices would be heightened, and demand for oil would likely continue on a downward trend ultimately driving oil to the $30 to $40 dollar range—perhaps even lower.

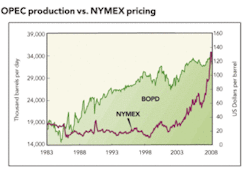

It is true that OPEC announcements can have an impact on daily trading, but the cartel’s production does not appear to have a meaningful impact on oil prices over the long-term. One would expect that as OPEC increases or decreases supply the price of oil would decline or rise respectively. However, a regression analysis of OPEC production and oil prices does not indicate the presence of such a relationship, and with the exception of anomalous events such as the embargo of 1974, the inverse relationship between OPEC production and the price of oil is very weak (see table).

Even after adjusting for lag time in the market by a factor of one, two, and three months, the results were still inconclusive further suggesting there is no meaningful relationship between OPEC’s production and the price of crude.

Given this data, we can reasonably assume that much of OPEC’s influence on oil prices is perceived and not actual. Remember, this isn’t to say the cartel has no influence, but rather that under typical market conditions the magnitude of their influence is not statistically significant over the long-term.

The nations of OPEC, especially Saudi Arabia, stand to gain much more through cooperative business practices with the international community than by attempted market manipulation. As the data suggests, only immense production cuts would have a meaningful impact on oil prices, but in this economic climate, a spike in oil prices would almost certainly lead to wide-spread demand destruction which would be detrimental to the price of crude over the long term. The interdependence that exists between OPEC and the consuming nations makes it unlikely that we will see significant cuts in production. OGFJ

About the Author

Jason Reimbold founded www.GlobalOilWatch.com, an energy research portal for industry analysts and investors. In 2007, he co–authored The Braking Point: America’s Energy Dreams and Global Economic Realities (www.thebrakingpoint.com) with Mark A. Stansberry.