Market dynamics can be challenging

Current economic conditions have created a ‘perfect storm’ in petroleum economics. In this atmosphere, it’s crucial to utilize capital more efficiently.

Victor Koosh, Caesar Systems, Houston

While recent events drive volatility in the spot market price for hydrocarbons, global energy demand continues to grow and the cost of hydrocarbon recovery has doubled since 2002. Recent price volatility has challenged the exploration and production capital investment process, in turn straining the development planning and petroleum economics process of the past 20 years.

The combination of greater technical requirements, political/economic decisions with national oil company (NOC)/international oil company (IOC) partnerships, and market price uncertainty forms a decision continuum across the entire hydrocarbon value chain. Observations of the reservoir are interconnected and interdependent upon decisions involving drilling, facilities, transportation and economics.

Cost structures for upstream development have dramatically changed. Despite a dramatic fall-off in the price of oil since its high of about $147/bbl last July, the long-term trend reflects the greater technical challenges–and risk–of finding and developing hydrocarbons. While E&P capital investments have soared (from about $200 billion in 2002 to as much as $400 billion in 2008), there is valid concern that as much as 20% of these investments is being misdirected. Or, stated differently, capital is being used inefficiently.

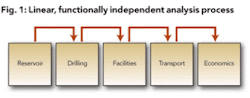

The essence of the problem is that investments in large projects are being evaluated with limited information in an analysis process that is itself a linear, functionally-disconnected process (see Fig. 1). Projects are being forced to fit the limits of the process and the tools, rather than the tools and processes enabling a thorough evaluation of the risk and opportunities presented within the scope of the project.

A greater number of appraisal wells can be drilled and other studies done to reduce uncertainty, but those are time consuming, expensive, and delay revenue from the asset. Producers attempt to achieve a balance between obtaining sufficient information for evaluation and moving projects forward as early as practical. Technical challenges exacerbate the risk and add complexity to the evaluation process. Deepwater projects, for example, usually mean a smaller number of higher-rate wells, which introduce greater variance or uncertainty in the project decision.

Gaps in the petroleum economic process

The challenge is not a problem with people, of course. The energy industry has highly skilled, knowledgeable people. It is a process and tools problem. Many companies employ a stage-gate process for project approval. Projects are evaluated using a combination of deterministic and probabilistic economics. Further, there is an emphasis on precision of output, sometimes at the expense of decision quality, i.e., missing opportunities and assessing risk.

Typically, the project management team has responsibility for guiding the project through the approval process. The subsurface team develops options using subsurface models, which are then used as inputs by surface teams. Once a technical model of the project is developed, the technical team provides a template of the project to the petroleum economist, who then casts the project into a financial model used to evaluate possible outcomes. Because of the linear nature, each discipline tends to focus on precision rather than accuracy. For the economist, this precision exhibits as pro forma financial statements of the project. This process is suboptimal as the team may lack visibility of key insights by being “over the fence” and because insufficient time is available for insight generation.

Still another problem inherent in this linear, “hand-off” approach is the disconnect between the subsurface, surface, and commercial teams. Accepting uncertainty in subsurface models is natural. However, at the surface, decisions must be made where the actual facilities are built using discrete equipment sizes, e.g., structures, vessels, compressors, pumps, pipe, etc. The type and capacity of fluid treatment required to process fluids is a major decision prior to actual production.

Collectively, these variables mean that obtaining an exact fit between the subsurface conditions and surface capabilities is inherently problematic, introducing greater risk and uncertainty in the model of the asset. While these technical and business challenges are certainly not new, this decade has witnessed a combination of dramatic changes exacerbating the problem and causing capital investment concerns.

In this process, petroleum economics is detached from subsurface and surface planning. The resulting linear, step-wise economic evaluation process does not simultaneously reflect the dependencies among inputs from all disciplines. Economic decisions are suboptimal when based on such limited models. The development planning model is more accurately represented as a non-linear, interdependent set of decisions and value inputs from multiple disciplines.

Typically, the conventional process – supported by complex spreadsheets – is managed as a set of independent decisions among technical disciplines. One of the greatest disadvantages of spreadsheets is they lack a business simulation capability. When planners try to create general purpose spreadsheet templates, they inevitably become overly complex, limiting the ability to troubleshoot calculations and to change the scope of the evaluation.

Fig. 2 illustrates the role of the integrated knowledge model of the asset; enabling a business-wide simulation of inputs from multiple disciplines involved in the planning and analysis of prospective oil and gas developments.

Various methods have been attempted to perform data integration among disparate software applications and spreadsheets. This level of data integration offers some tactical benefits but has not succeeded in providing development planners, petroleum economists and executive decision makers with an adequate understanding of the extent of risk, opportunities and value drivers. Executive decision makers are not provided with an integrated and clear understanding of decision trade-offs when evaluating competing projects alternatives, and when technical and human resources are constrained. Further, it has prevented insight that may lead to hybrid solutions that capture opportunities and eliminate or mitigate trade-offs.

Time, of course, may be the most significant limited resource in the petroleum economics process. With spreadsheets as the primary analytical tool, the time it takes to rerun project scenarios across several disciplines, based on varying assumptions, typically exceeds the time necessary for good decision making. The complexity of multiple, often interconnected, spreadsheets also increases the chance of error. This is an instance of the tools limiting the extent of risk assessment and opportunity evaluation that may be needed.

Recent price volatility exacerbates the problem. When decision makers (either at the project management level or at the executive level) do not have the integrated information available in time to adapt to changing conditions, value loss occurs.

The new role of petroleum economics: knowledge integration and business simulation

We propose a new approach. The planning and evaluation process should transition to one where technical teams and economists work together around a common business simulation model of the asset. Business simulation is enabled by a model of the asset that receives inputs and decisions from multiple disciplines. The requisite economic analysis (forecast) is then performed based on an integrated set of conditions and rules that include subsurface conditions, drilling, surface facilities, transportation, commercial, and financial assumptions.

“While E&P capital investments have soared (from about $200 billion in 2002 to as much as $400 billion in 2008), there is valid concern that as much as 20% of these investments is being misdirected. Or, stated differently, capital is being used inefficiently.”

Unlike data integration, knowledge integration incorporates the continuous learning of various disciplines into a common model. In this sense, knowledge models represent the decisions and information from each technical discipline. Knowledge integration allows synthesis of multiple knowledge models into a shared, standard model (petroleum economics forecast), which can reflect complex, significant dependencies among many uncertain variables. Using the shared model, a business-wide (project, region, or enterprise) simulation can then be performed quickly and repetitively as needed. The simulation can also incorporate and evaluate uncertainty if desirable.

Given capital investment projections for the coming years, much of it in higher-risk ventures (unconventional, Arctic, ultra-deepwater), the value of transitioning to the knowledge integration approach to petroleum economics could be worth billions or even trillions of dollars in value over the long term.

Implementing the shared asset simulation platform

Change management and education are fundamental to an integrated, shared knowledge model. The new work processes to be supported by a shared model of the asset may also require a cultural change in organizations. Adopting an on-boarding process supported by senior leadership is essential. Many organizations have built hundreds, perhaps thousands, of spreadsheet models; a carefully planned transition to the new business simulation platform is a key to success. Producers who have effectively made this transition, such as Shell Unconventional Oil, began with a limited pilot program to train key users and build confidence in the results of the model.

According to a recent article in the trade press, Shell evaluated options to replace its existing spreadsheet-based tools and work processes with a single, integrated platform. A platform was sought that reflects business rules, not hard-coded formulas, for greater flexibility in modeling and faster generation of a larger number of scenarios. The Shell team implemented the new technology to reproduce what numerous spreadsheets had done previously. Decision makers now enjoy greater visibility of project tradeoffs, value drivers and risk, while the cost of supporting decision models has been dramatically reduced.

Shell found that the pilot is best run in parallel with conventional tools and methods. The best candidate for the pilot is one that can be implemented in a few months on a limited scope, while still being relevant to the overall project. In addition to accurate outputs from the model, other metrics for success of the pilot should include:

- How easy is it for domain experts to become effective building new models?

- How efficiently can changes in the model be made?

- How does the model accommodate different forms of uncertainty?

- How quickly can new scenarios be run?

Once the pilot has proven successful, a champion of the new platform should be named to manage training and ongoing adoption of changes in work processes.

Advantages of the integrated business simulation platform

Knowledge integration that is enabled by a single business simulation platform offers the advantage of standardized business processes supported by knowledge capture, retention and transfer. This is especially important considering the next generation of E&P professionals. Creating such an integrated decision process provides better utilization of staff, a key consideration given the growing demand for the “next wave” of talent in the oil and gas industry.

As important as people and processes are, the integrated, shared asset model will accommodate the greater uncertainties in today’s more technically challenging oil and gas developments. This more agile planning and analysis business simulation platform will offer greater understanding early in the project life-cycle, leading to deeper insights about decisions to be made.

Conclusion

Faced with price volatility, greater technical challenges, increasing cost, and risk, reengineering the petroleum economics process is timely. The conventional process will be strained to respond to new economic realities. Evaluations derived under the limitations of conventional processes and tools are much more likely to miss opportunities and risk. Current processes and tools also constrain agility of decision-making in light of new information.

A knowledge-based petroleum economic process is required, supported by an integrative business simulation. The new process and tools can dynamically reflect inputs from all technical and commercial disciplines involved in project planning and analysis, up to and including petroleum economics. Producers that transition to this new process can expect a dramatic improvement in the efficient use of capital, derived from a deeper understanding of both project opportunities and risk.

About the Author

Victor Koosh, CEO of Houston-based Caesar Systems, has more than 20 years of global experience in the petroleum, high technology, professional development, and export industries. He joined Caesar Systems in 2001 from Wintershall AG, based in Kassel, Germany. His main interests lie in the integration, visualization, and communication of technical and commercial hypotheses for decision making and portfolio optimization in team environments. Born in the Ukraine, Koosh speaks numerous languages including Spanish, German, and Russian.