Will the Bakken boom go bust?

North Dakota shale players feeling the squeeze from weak oil prices and safety regulations

Bridget Hunsucker, Genscape, Houston

Hillary Stevenson, Genscape, Louisville, Ky

Declining US oil prices and new environmental and rail-car safety regulations are expected to dampen North Dakota Bakken Shale production in 2015, while narrow crude-by-rail arbitrage margins may limit spot market destinations for the crude that has become less economic for some refiners.

The Bakken shale oil boom in North Dakota produced over 1.1million barrels of oil per day by the end of 2014, according to the North Dakota Department of Mineral Resources. But by September 2015, Bakken rig counts are expected to decline to an all-time low of 81, down from a high of 181 in September 2014 due in part to weaker global crude prices, according to Genscape. In late January 2015, the Bakken rig count stood at 154. In addition, rig counts nationwide are poised to decrease by more than 600 to 735 by September 2015.

Spot Bakken prices at North Dakota crude-by-rail terminals decreased nearly $56/bbl to $36.10/bbl between January 2014 and January 2015. Bakken crude prices declined alongside major weakness in the global crude complex in 2014.

Following OPEC's November 2014 meeting, crude prices fell to less than $50/bbl and set new six-year lows for both WTI and Brent. Citing the threat of US shale oil as a justification, OPEC decided to maintain output levels to retain market share. In turn, supply and demand economics pulled down the price of crude, which may push some US shale oil plays underwater in the long term. The most recent International Energy Agency estimates show that shale producers will break even at $42/bbl.

Break-even costs for operational rigs in North Dakota are near $15/bbl, and tax exemptions may be enacted if crude costs continue to remain depressed in order to incentivize capital investment, the North Dakota Department of Mineral Resources said in December 2014.

North Dakota has two tiers of tax incentives. One is for new horizontal wells completed in a month following a month where the average price of West Texas Intermediate falls below $57.50/bbl. The second, broader tier tax incentive would take effect if the average price of WTI remains at or below $55.09/bbl for five consecutive months and applies to all wells for the first 24 months in production. Should both of these price thresholds be met, North Dakota could face tax revenue losses near $100 million a month.

NORTH DAKOTA RAIL, PIPELINE FACE OFF

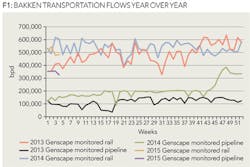

Like Bakken prices, North Dakota crude-by-rail loading volumes have also declined, as the benchmark price spread between Brent and WTI crudes, a leading indicator of US crude-by-rail volumes, narrowed. The spread tightened over $8/bbl from January 2014 to January 2015 to $3.73/bbl with January average rail loadings at 506,000 bpd, 55,000 bpd lower than average rail loading volumes in January 2014, according to Genscape.

Rail volumes have decreased in part with an increase in relatively cheaper pipeline takeaway capacity options from the state, including Tallgrass' 230,000 bpd Guernsey, Wyo.-to-Cushing, Okla., Pony Express pipeline, which began operations in October 2014, according to Tallgrass.

When Hiland Partners' 50,000 bpd Double H pipeline is operational, even more Bakken barrels are likely to shift from rail to pipeline. Double H is expected to start operations in Q1 2015. Recently, Hiland Partners and its assets-including Double H-were acquired by Kinder Morgan. The deal closed in mid-February.

Continental Resources, a large Bakken producer, which in 2014 railed 70% to 80% of its North Dakota crude, was planning to "get off the train as soon as possible," Stephen Bradley, vice president of oil marketing said during a 2014 presentation. In preparation, the company planned to grow its pipeline "connected barrels" by 5% a year until all production is connected, he said.

However, total rail and pipeline takeaway capacity from North Dakota already exceeds Bakken production, which may result in the cancelation of some planned pipeline projects, sources said. In mid-December 2014, Enterprise Products Partners announced plans to shelve its 340,000 bpd North Dakota-to-Cushing Bakken pipeline, citing that they had too few committed shippers. Other pipeline projects, including Energy Transfer Partners' 450,000 bpd North Dakota-to-Illinois pipeline and Enbridge's 225,000 bpd Sandpiper pipeline, remain slated for completion in 2017.

CHANGING CRUDE-BY-RAIL OPTIONS

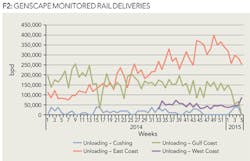

Crude-by-rail emerged in 2008 as a way to send growing supplies of relatively cheap, light sweet Bakken crude to destination markets ahead of available pipeline capacity. At that time, crude-by-rail arbitrage economics were favorable for many shippers, and investors quickly built crude-by-rail loading infrastructure to catch up with production. Bakken was first railed to the US Gulf Coast, but as production increased from the nearby Permian Basin and Eagle Ford shale plays, additional Bakken barrels were routed to the US East Coast. There, infrastructure was quickly developed to receive unit trains of Bakken and other crudes. US West Coast refiners are also seeking railed Bakken barrels, but are facing environmental permitting delays for unloading facilities.

In recent months, changes in crude-by-rail volumes unloaded at destination markets were observed as the Brent-WTI spread narrowed and pipeline transportation options increased. For example, crude-by-rail shipments to EOG's Stroud, Okla., terminal resumed in January 2015 for the first time in two months, while stocks increased at Cushing because of WTI's step contango price structure. Barrels delivered to Stroud are moved to Cushing, the basis for NYMEX light sweet oil contract, namely WTI, via EOG's 90,000 bpd Hawthorn pipeline.

EOG Resources was an early participant in the Bakken boom, sending its first rail shipment to Stroud in late 2009 from its Stanley, ND, loading terminal. EOG began constructing the loading facilities in Stanley, the facilities in Stroud, and the Hawthorn Pipeline in the second quarter of 2009. The frequency of rail movements into the terminal often shows the value of moving Bakken crude to Cushing versus coastal markets.

At the beginning of 2015, the cheapest destination for Bakken crude sent on rail was to Stroud, according to Genscape. US West Coast destinations were the next inexpensive over US Gulf Coast destinations, while East Coast destinations boasted the most expensive rail-delivered Bakken price at that time.

Spot rail movements declined greatly in the past year to the Gulf Coast, namely the hub at St. James, La., as a flood of regional light sweet and relatively cheap crude competed with Bakken imports. In addition, at the start of 2015, North Dakota Bakken crude-by-rail spot movements into the East Coast slowed because of narrow arbitrage and attractive imported crude prices.

"With Brent trading very close to WTI, Cushing seems like the best market for Bakken crude now." RBN Energy analyst Sandy Fielden said in January. "It would be better to send it there by pipeline than rail, but if you have a bunch of rail-cars and a terminal, then I guess it makes sense."

Cowen and Company senior analyst Sam Margolin agreed, saying that the "increased contango is making Cushing more attractive these days." It's possible that Bakken production field prices are at "material discounts to most hubs including Cushing and Clearbrook, (Minn.)," Margolin added.

Crude may have also been railed to the Cushing market to blend with other grades, a trader said, adding that Cushing is as "good a market as any" for current rail economics, with rail costs to Oklahoma cheaper than to coastal markets. With Bakken's crude quality similar to WTI, some barrels may be blended into domestic sweet crude to deliver against the NYMEX light sweet crude futures contract.

Given the steep WTI contango, rail transportation cost advantages and blending capability, railing Bakken shipments to Cushing have been economically appealing, and the US Midcontinent or PADD 2 is the "home of the Bakken crude" Citgo general manager of crude supply Jorge Toledo said in a recent presentation.

RAIL SAFETY REGULATIONS TO INCREASE

Increasing safety and environmental regulations, including new rail-car standards, North Dakota mandates to reduce gas flaring, and North Dakota light-ends removal regulations have combined to put pressure on North Dakota crude oil producers.

The light-ends removal regulations will require all crude produced in North Dakota to have a vapor pressure of no more than 13.7 pounds per square inch by April 1. This will require producers to build infrastructure to remove natural gas liquids from Bakken Crude oil before shipment.

"Under the order, all Bakken crude oil produced in North Dakota will be conditioned with no exceptions," the North Dakota Industrial Commission said in a statement.

Opinions on the cost of this additional processing varies, some sources believe it could add as much as $1-2/bbl to the price of Bakken crude. However, the North Dakota Department of Mineral Resources estimates the capital cost of the oil conditioning regulation to be near $20 million, equating to $.10/bbl, North Dakota Minerals Department Director Lynn Helms said in a monthly North Dakota production call in December 2014. Either way, a small sum could be a high price to pay in the current crude-by-rail economic environment.

Crude-by-rail producers and other shippers could face costs associated with new US rail-car regulations. The US Department of Transportation in 2014 proposed three different tank car designs for the new DOT-117 specification as of January 2015. DOT-111 tank-cars could be phased out or require costly modifications to comply with the new standards.

The cost of rail-car modifications are estimated to be between $26,000 and $34,000 per car, according to the Pipeline and Hazardous Materials Safety Administration. Market participants are anticipating new rail-car regulations to be handed down in the first quarter.

About the authors

Bridget Hunsucker, senior editor at Genscape, is based in Houston. Hillary Stevenson, supply chain network manager for Genscape, is based in Louisville, Ky.