Multiple stacked plays in Anadarko Basin

Ingenuity helping Oklahoma shift from pure natural gas plays towards liquids

IPAA, Washington, DC

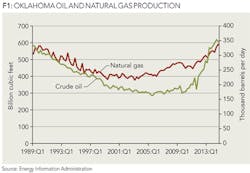

The pioneering of Anadarko Basin's several Woodford shale plays in Oklahoma have helped turn around that state's oil and natural gas production over the past decade, reversing a severe slump that began in 1985 for oil and the 1990s for natural gas.

More recently, the Cana Woodford play and extensions such as the SCOOP, also known as the South Cana Woodford, and the STACK, have highlighted the shift in interest away from pure natural gas plays, especially in Oklahoma, toward those with more liquids potential. A key feature of these Anadarko Basin plays is their multiple, stacked geologic horizons compared with some other major plays across the US, highlighting the added importance of managing efficiency and costs.

Other plays in Oklahoma such as the Granite Wash, straddling the border with Texas, and the Mississippian Lime, extending down from Kansas into Oklahoma, have also contributed to the state's dramatic turnaround. Shale activity has boosted the state's natural gas output by nearly 38% between 2003 and 2013, to 2.14 trillion cubic feet annually, according to US Energy Information Administration (EIA) data.

One fourth of Oklahoma's natural gas production now comes from shale formations. The state's output of natural gas liquids also rose over that period, from 74.7 billion cubic feet equivalent in 2003 to 140.3 billion cubic feet equivalent in 2012. Oklahoma's crude oil production jumped 25% in 2013 from 2012, and this year's first-half production, averaging over 350,000 barrels per day, was more than double the 2005 level, according to the EIA.

GEOLOGY AND RECENT ACTIVITY

The Woodford shale is a world-class source rock and covers a vast territory spreading over several geologic basins in Oklahoma and beyond, including the Arkoma Basin (eastern Oklahoma and extending into Arkansas), Ardmore and Marietta Basins (southern central Oklahoma), and Anadarko Basin (western Oklahoma and beyond). The Arkoma Basin is also home to the Fayetteville play on the Arkansas side of the basin, while the Anadarko Basin also includes the Granite Wash play.

In the early 2000s, attention on the Woodford shale was focused on natural gas in the Arkoma Basin, extending the experience gained with the Barnett natural gas play in Texas. However, there was increasing attention on the Anadarko Basin beginning in 2007, when the use of hydraulic fracturing and horizontal drilling began to demonstrate the region's stronger natural gas yields and richer natural gas liquids content.

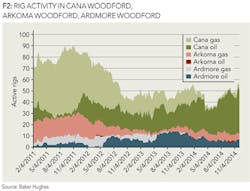

Although the Anadarko's wells are deeper and thus more costly to drill (9,000 - 12,000 feet in the STACK and 10,000 - 14,000 in the SCOOP compared with 6,000-8,000 in the Arkoma), the higher natural gas yields, increased oil cuts and relative value of its liquids content made it a viable play. The Cana, SCOOP, STACK, and Springer plays of the Anadarko Basin together now see more rig activity than the other two basins combined, according to Baker Hughes rig counts.

The Anadarko Basin's many formations make for a particularly thick accumulation of sedimentary rock, 40,000 feet worth at its thickest interval in the south. Within that extensive column, the Woodford shale dates to the end of the Devonian period, roughly 350 million years ago, when much of Oklahoma was covered by a shallow sea. Organic material trapped in the sediments eventually transformed into oil and natural gas trapped in sedimentary rock, including the combination of relatively impermeable shale and siltstone that make up the several hundred feet in thickness of the Woodford shale.

The US Geological Survey estimated in 2010 that the Anadarko Woodford plays (oil and natural gas combined) held approximately 18 trillion cubic feet of undiscovered, technically recoverable natural gas, 393 million barrels of oil, and 251 million barrels of natural gas liquids.

The Cana Woodford play is named for Canadian County, located in the center of the state. Devon Energy and Cimarex Energy both played a notable role in the early chapters of the Cana Woodford play. STACK extends the traditional Cana field to the northeast, where liquids yields are higher.

Although the first horizontal well was drilled in 2007, vertical wells from several conventional reservoirs were producing oil and gas as early as the 1930s in the Cana Woodford area. Horizontal drilling in the Cana Woodford/STACK is relatively deep, and thus more costly than for some other major plays. Currently, most wells fall into the 9,000 to 12,000 foot range, deeper than wells in, for example, the relatively shallow Fayetteville natural gas play with wells 1,500 to 7,000 feet deep, or the Barnett and the Marcellus, typically in the 5,000- to 10,000-foot category.

With its relatively costly wells, the Cana Woodford/STACK is a clear example of how the higher relative value of liquids versus natural gas in current markets has driven the focus of operators from natural gas to liquids over the past three years. In 2011, nine out of 10 rigs were drilling for natural gas, according to Baker Hughes data. So far in 2014, the shift towards liquids has transformed the natural gas share to just 15%. As with the Eagle Ford and Utica plays, liquids content varies by location. The STACK tends toward greater liquids content toward the northeast, where liquids content of 30 to 40 percent would not be uncommon.

One offshoot of the play, announced in 2012, is variously called SCOOP (for South Central Oklahoma Oil Province) or South Cana Woodford. As the name implies, this play has extended activity further south in the state. However, the area is hardly new to the industry, experiencing its first production more than 100 years ago with the Sho-Vel-Tum field - a field that has produced hundreds of millions of barrels since then. However, the main targets of the SCOOP play lie deeper, at perhaps 10,000 to 14,000 feet. The play's high liquids content is held to be especially attractive, with yields of 30%, 30% NGLs, and 40% natural gas reportedly a representative result. Lower initial decline rates have been another positive feature of many SCOOP wells, based on recent operator data.

The "STACK" is another recent extension of the Cana Woodford. Announced in the fall of 2013 by Newfield Exploration Company, the STACK play has expanded Woodford activity towards the northeast. As the name implies, this is a stacked play, with a major target being the upper Meramec formation. The Meramec's source rock, the Woodford shale, lies close below it, separated by the thin Osage. These formations, along with the Hunton below the Woodford, comprise additional targets of the "STACK." Hydraulic fracturing comes into play because the Meramec is relatively impermeable without natural or man-made fracturing. Drilling targets range from 9,000 to 12,000 feet. Representative outcomes in the "STACK" are reported to be around 50%, 25% NGLs, and 25% natural gas.

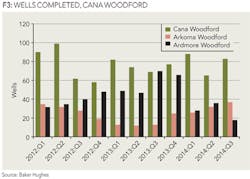

For the Cana and its offshoots, as in any play, the management of costs and efficiencies always plays an important role. According to data from Baker Hughes, operators were drilling about 1.5 wells per rig in the first quarter of 2012. But with experience and attention to efficiency, they have been averaging 2.5 wells per rig more recently. Thus, despite a decline in the rig count, the number of wells drilled in the third quarter of 2014 was above 80, compared with an average of 77 per quarter in all of 2012.

PERSPECTIVES

The Cana Woodford and related plays may be deeper and more costly than some other major US plays, but by targeting high liquids content wells, optimizing drilling efficiency, using better proppant recipes, and applying experience and skillful reservoir analysis, operators have maintained the play as a viable contributor to Oklahoma's turnaround in crude oil production.

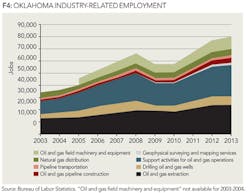

According to a recent IHS study, unconventional oil and natural gas activity contributed 65,325 direct and indirect jobs in the state in 2012, and is projected to grow to 149,617 in 2020 and 225,387 by 2035. Interestingly, this is in a state hosting a particularly diverse mix of operators, with the top 20 producers in the state accounting for just 43% of oil production and 66% of natural gas production.

The activities of these diverse participants in the Woodford, along with other plays in the state, have helped Oklahoma reverse its long-term decline in crude oil and natural gas production, achieving in 2013 its highest crude oil output in 25 years and its highest natural gas production in 22 years.

The IPAA thanks to Paul Korus, Bruce Stallsworth, Cindy Hassler, William Schneider, Marcus Krembs, Todd Moehlenbrook, Kristin Hincke, Paul Blanchard, Steve Trammel, and Bob Fryklund for reviewing this piece.