Unlocking the UK shale opportunity

MORE WORK IS REQUIRED TO UNDERSTAND THE POTENTIAL FROM SHALE DEVELOPMENT

ANDREA TEASDALE, EY, LONDON

With indigenous North Sea production in decline for over 10 years now - just a little under half of UK gas demand is being met by domestic supply. On a global scale, the UK's shale gas reserves are smaller than those in other parts of the world, but they still could play a pivotal role in reducing the country's dependence on imports. The UK has a clear need to secure its future energy mix and offset declining North Sea production. It must also reduce carbon emissions and ensure consumers have affordable energy. UK shale resources could pose a step in the right direction towards addressing those needs.

The true scale of the UK's shale resources is still unknown. In 2013, scientists from the British Geological Survey (BGS) estimated that the total gas in place in the Bowland shale in northern England is 1,329 trillion cubic feet (tcf) based on its central case. This assessment suggests that the Bowland shale could be the largest and most attractive onshore UK basin. However, the US Energy Information Administration (EIA) provides a more sober assessment of the UK's shale potential. The EIA estimates that the UK's technically recoverable shale gas resources total 26 tcf, equivalent to 10 years of supply at current rates of consumption. This compares with proved gas reserves of 8.6 tcf at the end of 2013, according to the BP Statistical Review of World Energy.

The amount of gas that is economically and technically recoverable will only be determined once exploration drilling begins. Estimates of shale gas resources are certain to be revised, upward and downward, over time as new information is gathered. Also, technology is not at a standstill. New technologies will be developed as the industry matures that will help lower the cost of shale extraction and improve the efficiency of development and production activities. Shale gas is unlikely to be the game changer that it has been in the US. It could, however, help diversify the supply base and partially fill the supply gap created by declining domestic output.

EVOLVING POLITICAL LANDSCAPE

The UK Government has been a strong advocate of shale gas development. "We're going all out for shale," Prime Minister David Cameron declared in January 2014. The Government has adopted diverse measures to encourage investment in onshore oil and gas, including shale gas. Fiscal incentives that reduce the tax rate on early profits have been introduced. An Office of Unconventional Gas and Oil has been established to coordinate the regulatory effort. Planning guidance has been issued that clarifies the interaction of the planning process with the environmental and safety consenting regimes. Additionally, procedures governing access rights for underground drilling have been simplified. The Government has also raised the prospect of establishing a sovereign wealth fund from the revenues generated by shale development.

Despite the broad government support offered to the industry, exploration activity has stalled. No shale gas wells have been spudded in the UK since 2011. This is largely due to the lengthy permitting process, particularly at the local level, that companies need to follow before exploration work can begin. Local opposition is one of the biggest challenges currently facing shale developers in the UK. Opposition has ranged from signatures on petitions to the barricading of sites. Negative public perceptions of shale, due to environmental concerns and messaging around the transportation of raw materials and equipment to sites, need to be addressed. The Government and shale operators have important roles to play in helping the public understand the risks and benefits of developing these resources.

The upcoming UK general election in May is creating some uncertainty over the future investment climate for shale developers. In January, MPs voted against introducing a moratorium on hydraulic fracturing. However, the Scottish Government announced the same month that it was imposing a moratorium on the granting of planning consents for all unconventional oil and gas developments, including hydraulic fracturing, until proper risk studies are undertaken and appropriate regulation introduced. Wales has since joined Scotland in moving against the use of hydraulic fracturing in unconventional gas extraction. The Welsh Assembly voted to ban the practice in Wales until 2021 to allow health and climate risks to be investigated more extensively.

A stable fiscal and regulatory regime is an important consideration for potential investors. Industry needs to work with the Government and other relevant authorities to ensure that proposed regulation is fit for purpose.

ATTRACTING INVESTMENT

Small to mid-size independent operators are the main players currently active in the UK onshore oil and gas sector. Typically, they do not have the balance sheet strength or financial flexibility of the majors. The high level of uncertainty around the UK's shale potential and pace of development makes it challenging for these smaller companies to access funds needed to train up crews and purchase equipment, some of which may require significant levels of investment.

To minimize investor risk, a number of operating models designed to increase the flexibility of those players are emerging. These include joint ventures or strategic partnerships between:

- Shale operators and suppliers

- Suppliers with complementary skills and service offerings that, by pooling their resources, are positioning themselves to compete against the larger international players

- UK-based international oilfield services and manufacturing companies to plug gaps in British industrial capability, particularly around rig manufacturing

The increased collaboration is likely to help drive down costs and improve the ability of projects to attract funding. The lower oil-price environment is creating negative investor sentiments around the resources sector, and the sharp correction in oil prices has made the economics of UK shale less viable. The oil price linkage in many LNG contracts means the price of LNG delivered to Asia is the lowest since the 2011 Fukushima nuclear accident. That presents a real challenge as gas prices in Europe and Asia have converged in recent months. The premium for LNG supplied to Japan over the spot price at the UK National Balancing Point (NBP) was US$7 per MMbtu in February 2014. By February of this year, the premium was zero. If this price dynamic continues, the economics of supplying spot LNG cargoes to Europe will become more attractive. UK shale gas will have to be competitive with existing energy sources, where investments in infrastructure have already been made.

BENEFITS OF SHALE DEVELOPMENT TO UK INDUSTRY

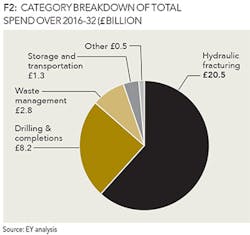

The US experience shows that the development of shale gas can help improve household energy affordability and security of supply and increase employment and investment that cascades into other sectors. Development of shale gas in the UK could create a sizeable investment opportunity for British business with the potential to create thousands of jobs. EY forecasts that to drill up to 4,000 horizontal wells over an 18-year time frame, the industry will need to spend in the region of £33 billion in supply chain activities. At its peak, this supply chain could be the source of about 64,000 jobs directly linked to shale gas exploration sites, indirectly linked to the supply chain or supporting services. However, the UK needs to work now to lay the foundation for the necessary infrastructure, supply chain standards and skills requirements before developers turn to more attractive investment opportunities overseas.

EVOLUTION OF SPEND FROM EXPLORATION TO DEVELOPMENT TO PRODUCTION

The UK has a long history of offshore and onshore oil and gas development, including proven hydraulic fracturing experience. The UK has been drilling wells onshore since 1919, and since that date, over 2,000 wells have been drilled, around 10% of which have required hydraulic fracturing.

The findings of EY's study, Getting ready for UK shale, reveal the following potential for UK industry from shale development:

Specialized equipment and skills for hydraulic fracturing totaling £17b.

This includes equipment such as pumps, trucks and blenders, which today are supplied to the industry by third parties and only partially from the UK. This sector provides a massive opportunity for UK-based oilfield service and manufacturing companies.

A £4.1b waste, storage and transportation requirement

More work is required by industry, government and regulators to understand what is possible with respect to localized and centralized services. In addition, investment will also be needed in order to bridge the gap as the industry grows.

A £2.3bn steel requirement in the UK

Over the next years, the industry will need approximately12,600 km of steel casing of specific diameter and quality, enough to go from Land's End to John O'Groats nine times. The report confirms the UK has the ability to produce this amount at the right quality, but further research and development is required to make it a reality.

The potential for a new £1.6b rig manufacturing industry

The industry will need up to 50 landward rigs at peak drilling activity and a number of workover rigs. Despite having the capability, UK fabricators are likely to need some initial support to bridge the gap between the current and the anticipated market requirement, so these rigs can be supplied from the UK in the right time frame.

A NEW MARKET FOR EXISTING UK BUSINESSES

The UK currently produces a number of the key components that will be vital for the UK shale industry, including cement, sand, drilling fluids and transportation. Despite no theoretical supply constraints, these companies will need to be kept informed of progress. The shale industry will need to work on ensuring standardized practices and common infrastructure are agreed upon and planned.

Over 64,000 semi-skilled and skilled jobs will be needed at peak activity levels. The UK has historically had a strong capability in highly skilled engineering and geosciences, but there is now evidence of an ageing workforce and skills gaps, driven by the downturn and lower investment during the years of low oil prices in the 1990s.The UK will need to standardize skills requirements in order to address shortages and to provide the right opportunities for existing qualified personnel. In November 2014, the UK Government announced plans to establish a National College for onshore oil and gas.

To prevent shale gas supply chain and skills constraints, the industry must work together with developers and government to:

- Define an investment case to develop required skills at pace

- Define common pad and hydraulic fracturing standards, setting detailed specifications for UK suppliers

- Encourage investment for UK-based capabilities in specialized areas like steel, rigs, hydraulic fracturing equipment as well as shared infrastructure for water treatment, waste disposal and gas processing

The current lack of a clear framework standardizing the approach toward shale gas exploration, as well as the lack of relevant skills, must be addressed to unlock further investment. A good launch pad needs to be established so companies are ready to push the green button and start exploring the UK's resources. Only then can the UK ensure that the billions of pounds currently spent on gas imports will be converted into revenues for local businesses and communities.

ABOUT THE AUTHOR

Andrea Teasdale is a Global Oil & Gas Strategic analyst with Ernst & Young LLP. She is based in London.

The views reflected in this article are the views of the author and do not necessarily reflect the views of the global EY organization or its member firms.