Investing in R&D

Oil executives should claim the full benefit of the research tax credit

Chris Bard, BDO USA, San Francisco, Calif.

Chai Hoang, BDO USA, New York, NY

How can oil and gas companies succeed in an industry where supply is limited, regulations and risks are high, commodity prices are dynamic, environmental impact is of great concern, and consumer pressure is prevalent? One way is through investing in research and development (R&D). Without investments in R&D activities, companies may become stagnant and fall behind their competitors, and the energy demand of the world's growing population may be left unfulfilled.

There have been major changes in technology related to finding, estimating, and producing oil and gas. In the future, as a result of upstream, midstream, and downstream sectors, technological advancements will likely continue. Companies are challenging the barriers of possibility, and many are making advances in the areas of subsea oil and gas technology, shale gas production, 4D seismic technology, and more.

With an emphasis already on development and innovation, executives should re-examine whether they are claiming the full benefit of the research tax credit. An additional benefit? The opportunity to generate cash from these same investments.

THE R&D TAX CREDIT IN BRIEF

Oil and gas companies attempting to develop or improve products, processes, or software to facilitate the exploration, extraction, production, transportation, and refinement of oil and gas are likely eligible for federal and state R&D tax credits (RTCs). These credits can equal up to 15% or more of qualified spending costs. With some large companies in this industry spending over $1 billion on R&D, these credits can be sizable.

Not only are large oil and gas companies eligible for these credits, but small- and mid-sized companies that provide services and materials to the industry may also be eligible. These dollar-for-dollar offsets against tax liability have enabled start-ups and mature businesses to increase their cash flow and earnings per share, reduce effective tax rate, hire employees, invest in new technologies, and finance other business objectives.

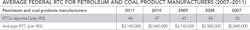

Even though the value of the credit is evident, industry experience and data indicate that oil and gas companies don't claim the credit to the extent they could. The US Internal Revenue Service reports that the average federal RTC for petroleum and coal product manufacturers from 2007 to 2011 (the latest data available) was almost $3 million each year. However, only 46 out of hundreds-if not thousands-of such companies reported the federal RTC in 2011 (See table below).

These IRS statistics grossly understate the opportunity for oil and gas companies. For the most part, such companies can claim RTCs for investments they've made over the past three to four years, and in some cases they can do so for investments they've made over the past 15 years.

CREDIT EXTENSION

On Dec. 23, 2014, the President signed a bill providing for a one-year retroactive extension of the R&D tax credit for expenses paid or incurred in 2014. As a result, executives can prepare for the credit extension while also considering whether they've taken full advantage of the credit in prior years, particularly in light of recent developments in the research credit area.

RECENT DEVELOPMENTS

The two methods of claiming the credit are the Regular Method and Alternative Simplified Credit (ASC) method. The Regular method is generally more burdensome and can sometimes require using financial information as far back as 1984. The ASC method, as its name suggests, is simplified and only involves spending for the current and past three years. Regulations released this year allow taxpayers to claim the ASC method on an amended return, where this previously wasn't permitted.

A US tax court case, Suder v. Commissioner, that was decided in October 2014 has several outcomes that are friendly to taxpayers. The court decision allowed allocating 75% of the CEO's time as qualified research activities. It was deemed as qualified because senior management's time was spent in strategy meetings coming up with new ideas, in follow-up meetings throughout the product development process, and reviewing and signing off on specifications, among other activities.

The ruling also found that expenses paid to law firms for patent research and prosecutions were also permitted. However, these expenses are often contested by tax examiners, and taxpayers can expect them to continue to be challenged.

Tax examiners also can challenge the substantiation of qualified activities, claiming that taxpayers have failed to provide a "nexus" between qualified expenses and the components on which employees performed qualified research. The tax court in Suder gave considerable weight to employees' testimony and representations in finding that qualified activities were performed.

Treasury Regulations released in 2014 provide further benefits to taxpayers. These regulations clarify that the ultimate disposition or depreciability of a supply is immaterial to whether its costs can be included as a deductible expense-a threshold question for the costs' credit-eligibility. Rather, the intent at the R&D stage determines whether the supply expenses qualify.

Jonathan Forman, managing director of BDO International's Global R&D Center of Excellence and principal of BDO USA LLP's R&D tax services practice, has already seen an increased number of claims based on the changes to the ASC and the regulations outlined above. However, he cautions oil and gas executives to properly document the intent of supply use for R&D, as he expects these expenses may still be challenged by tax examiners.

RETURN OF THE TEXAS STATE CREDIT

For oil and gas companies operating in Texas, there is even more good news. Texas reintroduced its state credit for 2014 that doesn't expire until 2026. This new legislation allows taxpayers performing qualified research in the state to claim either a franchise tax credit based on qualified research expenses or a sales and use tax exemption on certain depreciable tangible personal property directly used in qualified research. Companies can only elect one but can change the election from year-to-year to gain the best benefit for each period.

In Texas and throughout the rest of the country, the R&D tax credit is an excellent opportunity for oil and gas companies to capitalize on the investments in innovation they're already making. The benefits of the credit give executives the chance to add to their bottom line while advancing breakthrough technologies in the industry.

Material discussed is meant to provide general information and should not be acted on without professional advice tailored to your firm's individual needs.

About the authors

Chris Bard is national leader of R&D tax credit services at BDO USA. For more than 20 years, he has worked full time in the area of federal, state, and non-US R&D tax services. He has identified more than $2 billion in R&D benefits for companies in virtually every industry and supported over 90% of those benefits on exam or at appeals. He has designed and implemented procedures and technologies for large-, mid-, and small-cap companies to identify and document their R&D costs and activities in the most efficient and effective manner. Bard has a JD in taxation from Boalt Hall, University of California at Berkeley, and an MA from the University of Illinois. He received his BA from Georgetown University.

Chai Hoang is a senior associate with BDO's R&D tax services practice for the Northeast US region. She helps clients identify R&D opportunities across a variety of industries, including manufacturing, consumer products, financial services, technology, and software. Over the past two years, she has worked conducting research and development tax credit studies. Hoang obtained her JD/MBA from Hofstra University, and her BS in accounting and finance from Northeastern University. She is also an active member of the New Jersey State Bar Association.