North American shale update

Per Magnus Nysveen, Rystad Energy

Since the previous quarter, the WTI oil price has dropped from approximately $97/bbl to $70/bbl. This change in price will influence the shale industry for the coming years and has resulted in lower activity within the oil plays for the short term.

Figure 1 shows the total liquids cost of supply curve for North American shale for 2015. The x-axis shows potential production and the y-axis shows breakeven prices expressed as WTI.

For 2015 ~5.6 million boe/d will come from wells which were drilled before or in 2014, meaning they will have a very low breakeven price. At a WTI oil price of 60 $/bbl, total liquids supply will be ~7 million boe/d. If the oil price ends up at 70 $/bbl, the total supply will reach 7.3 million boe/d.

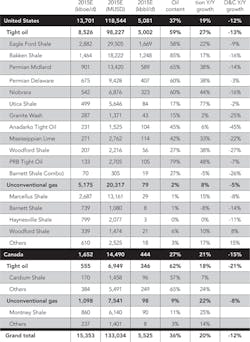

Table 1 shows the current production and spending level trends for 2014 and 2015 split by play. In 2014 the total supply from shale gas and tight oil plays is estimated at 11.4 million boe/d in the US, of which 3.9 million bbl/d is light oil. Canada contributes 1.3 million boe/d, with 0.3 million bbl/d of light oil.

Rystad Energy estimates that the total supply from North American shale production will increase by 2.5 million boe/d in 2015, where 1.15 million boe/d is light oil, 0.35 million boe/d NGL and 1.0 million boe/d gas.

To achieve this production growth, it is expected that the total drilling and completion costs (D&C) will be 133 billion in 2015. This is a decrease of 12% compared to 2014. Anadarko Tight oil, Granite Wash, Mississippian Lime and Barnett Combo are expected to be the plays most affected by lower oil prices.