Offshore vs. shale

Which will prevail in the long-term?

Per Magnus Nysveen and Leslie Wei, Rystad Energy

As a response to lower oil prices, E&P companies have guided considerable cuts in their 2015 investment budgets. Preliminary budgets indicate a ~20% drop in global E&P investments this year, with shale declining the most.

Does this mean offshore is more competitive than shale, and how have these sources performed historically?

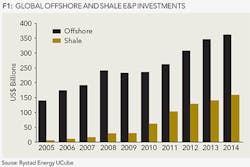

Observing historical trends, Figure 1 shows global investments for offshore and shale oil and gas. During the past decade, offshore investments have increased from ~ US$150 billion in 2005 to ~ US$360 billion in 2014. The growth in offshore investments is a combination of higher activity and higher unit costs (i.e., rig rates). Also over the last 10 years, shale activity accelerated as horizontal hydraulic fracturing became proven and economical. As a result, investments increased from almost zero to ~ US$160 billion in 2014.

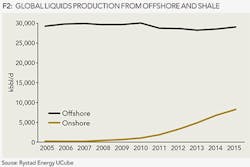

Figure 2 shows the change in production resulting from investments. While incurring increasingly more costs throughout the period, offshore production remained largely unchanged at 27 MMboe/d. Shale production, on the other hand, showed robust growth, increasing from less than 100 kboe/d in 2006, to an estimated ~7,500 kboe/d in 2015. The reactiveness of the production to the investments is largely a factor of the life cycle.

Offshore drilling has been prevalent since the 1960s and has a large accrual of declining legacy wells. Each year, operators must drill more wells just to offset the natural decline from historical wells. Shale is relatively immature, with significant activity levels starting in 2008. Therefore, operators are able to build up production with each new well drilled.

Looking into short-term investment budgets, 2015 E&P activity will be ~20% lower than 2014 levels. Shale-focused companies have reduced expenditures by ~30%, and non-shale counterparts have decreased their expenditures by 11%. This implies that shale-focused companies are more flexible to a short-term price collapse and are able to be more reactive in the budgeting.

Companies with exposure to both shale and offshore production (ConocoPhillips, Noble Energy, and Murphy Oil), have decreased their budgets for shale spending by ~50% in 2015, but only adjusted the offshore budget by ~10%. This reflects the flexibility of each segment. Operators can drop shale rigs more quickly than offshore rigs due to contract agreements and have fewer commitments when it comes to infrastructure.

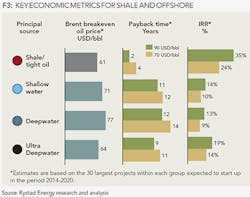

It is clear that operators are able and willing to decrease shale activity faster than offshore activity, but it is still important to review the economics of each source. Figure 3 looks at three economic performance benchmarks: break-even oil prices, payback time, and IRR. Shale and ultra-deepwater fields have the lowest break-even prices at US$61 and US$64, respectively. In terms of payback years, shale is much more attractive with four years before payback, assuming an oil price of US$70/bbl, compared to 11 years for ultra deepwater.

Over the last five years, shale has experienced extraordinary development, delivering much higher production growth than offshore. The flexibility of this source gives operators the option to reduce activity quickly when prices drop. In terms of economics, shale is still a very competitive source of production and will be the fastest to recover once oil prices increase.

About the authors

Per Magnus Nysveen is senior partner and head of analysis for Rystad Energy. He joined the company in 2004. He is responsible for valuation analysis of unconventional activities and is in charge of North American Shale Analysis. Nysveen has developed comprehensive models for production profile estimations and financial modeling for oil and gas fields. He has 20 years of experience within risk management and financial analysis, primarily from DNV. He holds an MSc degree from the Norwegian University of Science and Technology and an MBA from INSEAD in France.

Leslie Wei is an analyst at Rystad Energy. Her main responsibility is analysis of unconventional activities in North America. She holds an MA in economics from the UC Santa Barbara and a BA in economics from the Pennsylvania State University.