There will be blood

FALL 2015 OIL & GAS CAPITAL MARKETS OUTLOOK

HANWEN CHANG, NEXEN, HOUSTON

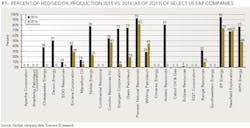

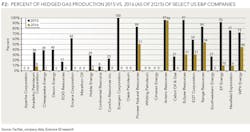

WITH A PARTICULARLY GENEROUS equity market and a fairly benign credit redetermination cycle, many E&P companies were bailed out by investors and banks in the first half of 2015. There has been over $23 billion of equity issued by US and Canadian publicly-listed E&P companies since the OPEC meeting at the end of November 2014, an estimated $20 billion of asset sales, and billions more of debt and private equity capital that has been injected into the system. However, as the over-supply situation continues with no sign of imminent improvement, and oil prices continually testing lower territories, the second half of 2015 is expected to look very different. The upcoming fall borrowing base redeterminations could be punitive, mostly driven by:

However, there are some factors that may potentially offset lower price deck and diminishing hedges:

Another factor to consider is how banks will respond to the additional regulatory pressure on reserve-based lending during this cyclical trough. The Office of the Comptroller of the Currency (OCC)'s National Risk Committee recently put oil and gas lending near the top of the list as an industry which poses a threat to US banks, given the unpredictable swings in oil prices. The director of commercial credit for the OCC said in an interview, "We are beginning to see some deterioration in the credit quality of oil and gas loans to borrowers that used high volumes of debt to finance their growth over the past several years."

Moreover, it's highly likely that the Fed will raise interest rates in 2015 or early 2016. Although the Fed has been very clear that the pace will be very slow, an increase in interest rates means even less capital flowing into oil and gas equity markets and more financial burden for companies.

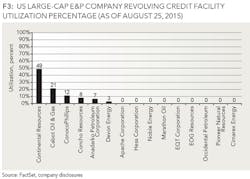

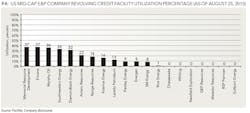

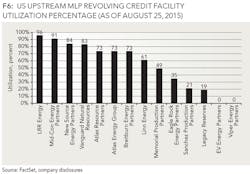

REVOLVER DRAWDOWN: UPSTREAM MLPS TAKE THE LEAD

Due to the wave of equity and debt financing in the first half of 2015, revolving credit facilities for large-cap and mid-cap E&Ps are relatively clean. Small-cap E&Ps and upstream MLPs are most vulnerable to borrowing base reduction. On average, upstream MLPs remain about 60% drawn on credit facilities at the end of the second quarter of 2015.

LOWER OIL, MORE EQUITY?

To pay off the cap between the current and new borrowing base and fund 2016 drilling programs, companies face two options: selling assets or issuing equity. Since non-core or unproved assets do not contribute to the borrowing base and do not impact EBITDA much, it makes sense for operators to divest non-core or unproved acreage. Although there is a large amount of private equity capital waiting to be deployed, PE buyers appear to be looking for high quality assets. It is unlikely that non-core or unproved acreage will receive high bids from multiple players. Financing could also come in the form of Joint Ventures, Joint Developments, farm-outs, and outright working interest sales. But in many cases, the most valuable assets are the higher quality producing properties, and divesting those impacts EBITDA, which in turn impacts leverage ratios. Therefore, issuing more equity seems like a logical option.

On Aug. 5th, RSP Permian announced an offering of $157.5 million equity and $200 million senior notes. One week later, Diamondback Energy announced an offering of $175 million equity. These two companies issued equity in the spring. Notably, Diamondback Energy has tapped the capital market three times in 2015. This indicates that the capital markets are still open to high quality companies. Since companies access capital markets when they are open, we will see more equity issuance from high quality names in the next two months. However, public equity and debt financing windows seem largely closed to companies with assets in marginal plays or acreage in marginal areas of core plays-companies in true need of capital injection.

SHRINK TO SURVIVE, HOPEFULLY

Goodrich Petroleum recently announced the sale of its proved reserves and associated leasehold in the Eagle Ford for $118 million. The company will use the proceeds to pay down its revolver balance. Goodrich's $150 million revolver will be reduced for this sale along with lower marked to market value for remaining PDP's from Tuscaloosa Marine Shale and Haynesville shale in its October redetermination. Goodrich is expected to not need any revolver liquidity until 2Q16, buying the company some time for a commodity turnaround. Penn Virginia announced in early August that it had retained Jefferies to "evaluate strategic alternatives" for its assets in the Eagle Ford. The news came just days after the company ruled out raising cash by issuing debt.

Most operators view selling core assets (especially proved reserves) as a last resort as doing so would require them to forego all upside potential of such assets, including a recovery in commodity prices and future development. However, with capital raising off the table, cost-cutting mostly done, and non-held by production (HBP) acreage dropping in value every day due to lease expirations, companies have little recourse except to sell core assets, basically cutting themselves in order to live.

With the potential for Iranian barrels to pressure prices even further, there appears to be general agreement between buyers and sellers that prices will be lower for a longer time, which may help A&D deals get done. Thus, the borrowing base redeterminations this fall will be the catalyst for A&D deal flow. More A&D activities are expected in the latter part of 2015, increasing in 2016.

MERGER OF EQUALS AND JVS

During the EnerCom Oil & Gas conference in August, the CEO of Approach Resources, J. Ross Craft, said that the company is searching for like-minded operators who may be interested in an all-stock merger, which would provide synergies from potential SG&A reductions as well as efficiencies of scale on the combined entity. This indicates that, in the current environment, as companies focus on capital productivity/efficiency, there may be a rise in mergers of two roughly similar sized E&Ps, or zero premium M&A deals, as scale provides the opportunity to cut costs and boost efficiencies.

There may also be an increase in joint ventures, as it will become a preferred route of securing additional capital in a low price environment. Compared to asset sales, the JV structure benefits the seller by allowing for increased production and cash flow while still retaining some upside from assets. The bid-ask spread is more manageable for JV structures as they can take various forms, which helps deals get done. Chesapeake Energy CEO Doug Lawler mentioned in the company's latest earning call that the company is currently reviewing opportunities in multiple operating areas to create additional value through strategic asset sales, joint venture agreements, and participation, or farm-out agreements.

On August 25th, GEP Haynesville LLC announced a definitive agreement to acquire Haynesville Shale assets for $850 million from Encana Corp. GEP Haynesville LLC is a joint venture of GeoSouthern Energy and GSO Capital Partners, a credit-focused investment group of Blackstone. This deal could be a model for upcoming joint venture deals between E&P companies and private equity companies. A few years ago, joint ventures were mostly funded by national oil companies and international majors, which were trying to enter into and gain knowledge about US shale plays. This time around, savvy private equity investors are most likely to be on the other side of the trade.

ALTERNATIVE FINANCERS PICKING UP BUSINESS

Some private equity firms provide lending at a higher cost of capital than a bank would charge with a similar focus on securing the loan with an asset. These firms tend to provide capital to smaller E&Ps and cede working interests to the operator until a certain return hurdle rate is met. This is basically equivalent to debt providers lowering effective rates or extending payback periods, similar to the covenant relaxation that many public companies receive. These higher-cost lenders have recently seen a pick-up in business. As a borrowing base reduction is expected in the fall and equity and debt financing window closed, more small E&P companies will be pushed to work with these lenders.

On July 6th, Legacy Reserves LP (LGCY), an upstream master limited partnership, announced an agreement with TPG Special Situations Partners (TSSP) to fund horizontal development of LGCY's acreage in the Permian Basin. TSSP will fund 95% of the development expenses and receive an undivided 87.5% interest in LGCY's working interest in the acreage until a 1.0x ROI is achieved, then a 63% interest until a 15% IRR is achieved. TSSP has initially committed $150 million to fund the first tranche of the program, and has the right to participate in future opportunities (LGCY estimates $700 million of total opportunities).

On July 28th, Lonestar Resources announced a Joint Development Agreement with a private investment firm, IOG Capital. The latter will loan Lonestar up to $100 million for its Eagle Ford drilling program. Wells to be drilled need to meet return criteria of both IOG and Lonestar. IOG will contribute 90% of the up-front well cost. After a specified return is achieved, IOG's working interest will decrease to 10% from 90%.

Lonestar's CEO Frank D. Bracken III commented, "… this agreement will allow Lonestar to more aggressively pursue additional farm-in opportunities without materially augmenting our capital budget. Farm-ins have been a principal source of leasehold and reserve growth for Lonestar in 2015, and we see that trend continuing."

On August 10th, Magnum Hunter Resources entered into a non-binding letter of intent with a private equity fund to develop unproved Utica and Marcellus acreage. The agreement covers a total of 28,500 net acres, but will initially target 9,500 net acres within the leasehold with the fund committing up to $430 million. The fund will own a 100% working interest in the farm-out until it achieves either a 12% IRR or 1.2 times multiple on invested capital. Once the hurdle rate is met, 90% of the working interest would revert back to Magnum Hunter.

These types of deals may become effective ways to grow reserves for companies having liquidity issues. On a large scale, the deals would also be an ideal fit for companies like Chesapeake Energy, which owns a large inventory of unproved acreage with high potential in the emerging Meramec play (mostly HBP). These deals would increase reserves in non-core areas and the borrowing base for an E&P without raising the capital budget. Anticipate similar deals going forward in a variety of structures.

CONCLUSION

The borrowing base redeterminations this fall will be the catalyst for M&A deal flow. More companies are expected to become distressed and more A&D activity is expected in the latter part of 2015, increasing in 2016. More small E&P companies will turn to private equity for financing deals. There may also be a rise in mergers of similar-sized small E&Ps and Joint Ventures between E&Ps and private equity firms.

ABOUT THE AUTHOR

Hanwen Chang is a corporate development associate at Nexen. He holds a bachelor's degree from Northeastern University and a master's degree from Texas A&M University. Hanwen is a CFA charter holder and a member of the CFA Institute and CFA Society of Houston.

This article represents the views of the author. Any opinions expressed do not necessarily reflect the views of Nexen or any third party.

INVESTOR BAILOUT NOT LIKELY

October is the time that many banks and other lenders will renew the lines of credit they previously extended to oil and gas producers when crude prices were higher and the companies had more financial protection in the form of hedges that are expiring soon. As a result, some industry watchers are predicting a "blood bath" this fall in which producers will get clobbered.

During credit redeterminations last April, crude prices were on a brief upswing and investors began buying oil stocks in hopes of purchasing them near the bottom in anticipation of a quick recovery. Alas, prices cratered again in the second quarter and market conditions don't look favorable for a quick recovery - at least not until 2017, according to most industry forecasts.

Current stock prices for North American producers are at or near their 52-week lows, and many large investors see no reason to commit to upstream companies when it is not clear whether prices will continue to fall and exactly how long it will take the industry to recover.

Investment guru Warren Buffett, the so-called "Oracle of Omaha," is usually ahead of the curve. With energy prices falling rapidly cratering in the fourth quarter of 2014, his Berkshire Hathaway firm sold its huge stake in Exxon Mobil Corporation, which was estimated at more than $3.7 billion. This was the firm's largest oil holding. Most Warren-watchers don't believe Berkshire Hathaway lost any money on the transaction, and the firm may have come out ahead.

Buffett has twice made major investments in the petroleum industry, only to change direction a short time later. He made a $7 billion bet on ConocoPhillips in 2008 when oil prices were near their peak, then changed his mind, as indicated in this letter to shareholders:

I bought a large amount of ConocoPhillips stock when oil and gas prices were near their peak. I in no way anticipated the dramatic fall in energy prices that occurred in the last half of the year. I still believe the odds are good that oil sells far higher in the future than the current $40-$50 price. But so far I have been dead wrong. Even if prices should rise, moreover, the terrible timing of my purchase has cost Berkshire several billion dollars.

The global surplus of oil is bigger than ever, which prompted Goldman Sachs to say that the glut could drive crude prices down to $20 a barrel. "We now believe the market requires non-OPEC production to shift from our prior expectation of modest growth to large declines in 2016," said Goldman, noting that uncertainty about production and prices has greatly increased.

As the industry gets closer scrutiny by their lenders this fall, analysts expect far more borrowing base cuts, which can put them in a difficult position as they struggle to at least maintain the status quo. And this time, the industry is less likely to have white knights like Buffett come to its rescue.