Algeria: Finding The Gas Oasis

THIS SPONSORED SUPPLEMENT WAS PRODUCED BY FOCUS REPORTS.

Project Director: Chiraz Bensemmane

Project Coordinator: Carla Verdera Mateu

Editor: Karim Meggaro

Publisher: Diana Viola

Thanks to Sonatrach for their support in putting together this report.

For exclusive interviews and more info, please log onto www.energyboardroom.com or contact us at [email protected]

Despite possessing some of the world's largest resources of oil and gas, Algeria wants more. "There is a need to considerably expand the nation's hydrocarbon reserves to meet long term demand, to diversify our energy resources and markets, and to finance the economic development of the country and accelerate industrialization," explains Youcef Yousfi, Algeria's former minister of energy. Indeed, estimates suggest Algeria's GDP will grow at a rate of around four percent over the next decade, with domestic gas consumption set to rise from an estimated 1.18 Tcf in 2013 to 1.72 Tcf in 2023. Dealing with this rise in domestic demand is becoming a priority for Algeria: as one of the world's leading gas exporters, through LNG tankers and pipelines to Europe, the country must add more annual production in order to meet the demand both at home and abroad. Something has to be done, and fortunately, the government is taking steps to address the challenges.

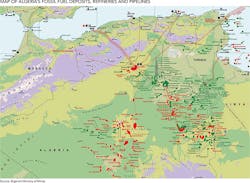

Increasing supply in a holistic manner starts with exploration, where Algeria still has plenty of potential: according to Sonatrach, Algeria's NOC, roughly two-thirds of the country remains either unexplored or underexplored. Although some of these resources are to be found in the north of the country and offshore, the majority are still in the south of the country, where Algeria's biggest fields are already producing. But there is still a lot of gas left in the tank: as of January 2014, Algeria had 159 Tcf of proven natural gas reserves, the tenth largest natural gas reserves in the world and the second largest in Africa behind Nigeria. Algeria's gross natural gas production was 6.4 Tcf in 2012, a four percent decline from the previous year.

However, Algeria's stakeholders play down this decline. "The supposed decline in production has been much exaggerated," says a representative of the Sonatrach management team. "A proper decline would be when you have lost 50 percent of your production capacity. In 2014, we produced five percent more than in 2013, so the gap is not so wide in real terms. Preconceived ideas of our hydrocarbons industry being in decline are simply not borne out by the facts. We have actually increased our reserve base by a full 10 percent from 2010 to 2014. Meanwhile, we have produced almost an additional 8 million tons of oil equivalent, which leads us to calculate that our ratio of discoveries to production is in excess of one."

It is Algeria's track record with gas that as early on as the 1960s established the country's reputation for innovation, with the first ever LNG cargoes setting sail from the country back in 1964. "We have a proven track record in commercialization having successfully marketed our natural gas in all sorts of areas from the US to Europe to Asia," explains Yousfi.

Despite gas being the main talking point for many in Algeria, the country also has significant oil production and potential - Algeria is a member of OPEC, and in April 2015 produced an average of 1.12 million b/d. Algeria's main oil reserves are located in a small number of large basins in the south of the country. The majority of proven oil reserves are in the Hassi Messaoud province, which contains about 71 percent of the country's 3P oil reserves, and contributed more than 40 percent of the country's total crude oil production in 2013, which averaged 1.2 million b/d.

It remains to be seen whether recent tax reforms and vast below-ground potential will help draw interest from multinational companies in Algeria's next licensing round, when weighted against the high level of state involvement, regulatory uncertainty and ongoing regional instability. To address some of this, new legislation was laid down in 2008 that created a new regulator Alnaft (Agence Nationale pour la Valorisation des Ressources en Hydrocarbures), tasked with running the bidding rounds for new blocks, once the domain of operator Sonatrach. "The hydrocarbon sector was organized in such a way that it was the national company Sonatrach that had a dual role as an investor and as the owner of field titles," explains Sid Ali Betata, Alnaft's president. "Alnaft launched its first licensing round in July 2008."

Algeria has now completed four of these block auctions under the new system. "The fourth bidding round was conducted against a backdrop of unsteady oil prices and as a result there were a confluence of factors that apparently generated investor cautiousness," explains Bjørn Kåre Viken, Statoil's senior vice president for North Africa and country manager for Statoil Algeria. "We can only hope that oil price will stabilize and that the next fifth bidding round will become even more interesting than the fourth."

NAVIGATING IN SONATRACH'S GRAVITY

Sonatrach dominates Algeria's hydrocarbon sector, owning roughly 80 percent of all hydrocarbons production and over 90 percent of the country's natural gas supply, as well as all refining and fuels distribution activities. By law, Sonatrach is afforded majority ownership of all oil and natural gas projects in Algeria. Sonatrach also has an extensive number of subsidiaries, which operate in a number of different areas across the value chain.

"As an NOC, we already have a good reputation internationally and the task will be to use those solid foundations as a launch pad to attain new heights," the company emphasizes. Sonatrach has launched an ambitious USD 90 billion investment plan to plug the gaps in its upstream and downstream capabilities: USD 50 billion has been earmarked for upstream exploration and development, with USD 10 billion set aside for investment in new refineries. "The bulk of this spending will actually take place over the first three years of the investment plan: USD 15.5 billion allocated for 2015, USD 22 billion for 2016 and USD 23 billion for 2017," the company explains. "A significant portion of these funds will also be channeled towards upstream development. With expenditure on exploration kept above USD 3 billion per year, our expectation is to drill an average of 125 exploration wells per year. This year, we are proud to say that we managed to cross that frontier for the first time in Sonatrach's history and we now enjoy the highest concentration of rigs ever: some 93 rigs in total shared between our exploration and development activities."

In order to complete this ambitious investment plan, Sonatrach will rely on its own capital, not borrowing a penny from international markets and only taking a small percentage of the total investment from foreign partners. "USD 11 billion of the overall USD 90 billion investment plan will be sourced from our international partners," explains a representative from the management. "The rest will come from both our own coffers and alternative domestic financing channels."

IOC involvement in Algeria is extensive, and although changes in the contracting system over the 2000s decreased investor appetite a little, there is still very strong support for the country from a wide range of players under the current contracting system. "Statoil doesn't see any problems with the 51/49 split," says Statoil's Viken. "We believe it's possible to make good business in the country under the administrative and legal frameworks in force and that's why we've been scaling up our activities. The Algerian state has the right to redistribute the wealth accrued from natural resource endowments in local business and we respect that approach. It is important to be reinvesting the proceeds of oil and gas growth back into the local communities."

Pertamina, Indonesia's NOC, is new in Algeria, having purchased the assets of ConocoPhillips in 2014. The move came as part of the NOC's recent drive to diversify its asset base outside of Indonesia, and was the company's first asset purchase in Africa or the Middle East. "It has been a huge learning experience for us in Algeria. There have been many obstacles during this first year that we've had to overcome," says Eko Rukmono, VP of operations for Pertamina and country manager for the company in Algeria. "With the support of Sonatrach we have learned a lot and we know much better how to go about projects such as this. Our projects in Indonesia and Algeria are not very similar so we've had to overcome this in order to be successful in Algeria. This year, we successfully passed the critical transition period of the first year, handing over from ConocoPhillips to Pertamina."

Adapting to local ways of doing business can also be a precursor to a shift in strategy. The demand for distribution transformers was growing and our prices were not competitive," explains Tarek El Gani, country managing director of ABB Algeria. "Therefore we decided to build a factory for producing distribution transformers to be competitive and provide fast delivery times. Besides this, the government is trying to reduce imports and reinforce their investment in industry. Algeria trends towards national tenders for products where local OEMs exist, such as DTR, to motivate foreign companies to invest in Algeria and support local companies. Before coming here, I was the general manager for the Gulf region for the low voltage products division, where we made significant growth. Having prior experience in corporate strategies for product sales go-to-market, I was moved here to see how to further develop the business in our product divisions."

RETHINKING EXPLORATION

A significant portion of Sonatrach's investment program will be allocated to exploration, but Algeria is not just throwing money at the challenge of reserve replacement: it is also thinking about how to create a whole new approach to exploration- rather than rushing to production, a more measured and considered approach to each basin should ensure greater total recovery rates. "Our approach is absolutely not about cosmetic investment merely for the sake of change," says Sontrach's management. "On the contrary, it's about fostering real value addition."

Alnaft will complement this exploration program by investing in the creation of complete extensive data sets for interested parties in upcoming bidding rounds. "We hope that the seismic database will be fully operational by the end of 2015 or in the first quarter of 2016, though the business applications are already functional," explains Alnaft's Betata. "We have the data, and a large amount of information is already in the system. We will simply continue with data transfer from Sonatrach. For this, there is scanning, control, and authorization work that needs to be done to turn this seismic data into a digital format that matches our databank."

The strategic shift comes as welcome news for some. "Algeria has long needed to optimize its exploration and production processes and must embrace tools that will enable the local industry to lower its costs," believes Statoil's Viken, who goes on to say that many other countries have faced the same challenges: "This is not an atypical situation. Exactly the same can be said for the oil industry's operations off Norway."

"We have transformed the manner in which we go about exploration," explains Sonatrach's management. "What used to be pure exploration now actually involves a production component because we have expanded our scope to act as pioneers for subsequent partnership contracts. Our thinking is that if it takes an extra two weeks to assemble more reliable data sets and construct a more complete picture of the formation, then we should do so because this enhances our internal E&P decision-making and creates a much more robust and reliable foundation that investors can commit to in the eventuality that the prospects are put up as blocks for bidding on by Alnaft during future licensing rounds."

Another aspect of making exploration attractive for partners is the right fiscal environment. "We possess 1.5 million km2 of sedimentary basins with abundant potential hydrocarbon reservoirs," says the former minister of energy. "Some are green-field sites while others have complex geologies without even counting the offshore opportunities. This is why it is essential to have an attractive tax regime especially suited to regions that are difficult to access and where there is a lack of processing or transport infrastructure." These changes in the legislation and tax system now give additional exploration time for companies, among other benefits, to incentivize exploration. For full details, see the box at the bottom on the facing page.

"Seismic activities account for up to 70 to 80 percent of Sonatrach's workload in the acquisition and seismic exploration area," explains Youcef Boukhalfa, CEO of Enageo, a Sonatrach subsidiary focused on seismic surveys and geophysics. "Everything depends on the trade-offs they decide upon. A study with high specifications may not necessarily produce large volumes every day, unless it is operated through high productivity methods, which we do use today but which are not yet fully implemented across our processes."

Today, Boukhalfa explains, Sonatrach needs the services of international seismic companies to complete its exploration goals, but Enageo's goal is one day to cover 100 percent of the NOC's exploration needs. But currently, the drive for exploration outweighs the need for self-sufficiency. "Foreign companies are present because of the fact that we cannot yet cover all the needs for seismic exploration, which must absolutely be done! It is the spearhead of the sector: without exploration and drilling, there is no oil or gas. Therefore, it should be developed as quickly and in the best way possible to meet demand: the country must cover every perimeter so as to renew its reserves, deal with domestic consumption and support the economy through exports." Still, the amount of work the NOC is providing to its subsidiary is significant, with planned work worth USD 2 billion in the pipeline.

This aim for self sufficiency is also part of Sonatrach's larger plans, as the company's management explains: "Sonatrach wants to lock an applied R&D arm, dedicated to value creation, onto the core of our business. We want to be able to deploy our own R&D personnel to the fields to analyze how operations can be optimized, to structure their thoughts and to offer cutting-edge solutions. This is not about jumping on the 'research bandwagon' and indulging in an area that is currently in vogue just for the sake of it; it's about spending money on specific research areas that we consider highly likely to add real tangible value. This obviously takes more time than if we simply outsourced the work but, at Sonatrach, we are adamant about doing things properly and are fully prepared to pay the price to learn."

This new focus on strategy also naturally extends to fields that are currently producing. Pertamina's offshore blocks are currently producing 23,000 b/d, but the company wants to raise this to 32,000 b/d over the next two years, thanks to the introduction of a new reservoir development plan (RDP). "For the time being, we will refer to the RDP 2005," says Rukmono of Pertamina. "Now however, we plan to revise the RDP, and we are working towards a new plan. Hopefully, once this RDP is approved, Pertamina can increase the production based on that."

Better identification of reservoir types in Algeria has helped Baker Hughes offer increasingly innovative solutions, as Salim Mouici, the company's country director, explains. "For each type of reservoir, whether it produces oil like Hassi Messaoud, or oil and gas like in the southeast, whether it has conventional porosity or permeability, or lower ones, we have to develop different approaches. This is precisely the reason why making an effort to identify the type of reservoir prior to anything else enables us to offer often innovative technical solutions."

Algeria might also have the third largest shale gas resources in the world, with technically recoverable reserves of 707 Tcf of gas and 5.7 billion barrels of oil, according to the IEA. Although approval for the exploitation of Algeria's shale reserves has tentatively been given, there are still no concrete development plans in place.

"Sonatrach's stance is that, if Algeria is blessed with such resources, it certainly shouldn't ignore them," reveals the company. "By 2018, we should have a much clearer picture of what it will take to make Algerian shale reserves a truly successful business and the sorts of technical services we will need to bring in to achieve the right level of scale and volume. One significant external factor will also be the price environment and whether we can achieve a fit that makes economic sense. We are, after all, talking about an entire ecosystem that would need to be put in place."

AN ENTREPRENEUR'S OBSTACLE COURSE

"Entrepreneurship in Algeria is often full of challenges, but there are no insurmountable obstacles," says Karim Cherfaoui, CEO of Divona, a local satellite communications company. "Today, it is getting easier to start a business in Algeria: procedures have eased, which has created the great level of inspiration that we have been feeling these past few months. Yet, even though the regulatory framework ensures wide latitude for initiative on paper, as entrepreneurs, we are still bound to provide the link between the various institutions, which wastes a lot of time and energy."

Cherfaoui gives the example of the difficulty that the Ministry of Energy and the Ministry of ICT have in communicating with one another as one specific challenge for Divona, which needs to work with both ministries regularly. But the big challenge as a local company starting to work in the oil and gas industry, is getting the required experience to compete for tenders as a new company. "To undertake a project, especially when the industry is quite structured as is the case with oil and gas, means that one must be able to create several sub trades before gaining a real foothold into the market." As it had previously been owned by Monaco Telecom, Divona had references in the sector, and was able to gain a foothold.

Today, Divona has the highest available authorization for projects in Algeria, allowing it to work for state enterprises such as Sonatrach, following its first work with the NOC in 2007. The company generates 70 percent of its turnover from the oil and gas sector; it has around 50 employees, two thirds of which are deployed on field operations.

RedMed-Group, another locally-born service provider to the oil and gas industry, took a different tack to market entry, targeting private players first. "In 1998, when I took up my duties with the family group, there were very few service providers operating in the country, which is to say none at all," explains Mohammed Fechkeur, CEO of RedMed. "Large corporations such as multinationals and associates of Sonatrach that operated over large areas in southern Algeria expressed a need in terms of accommodation, catering, in short all of the logistics needed for their back bases. Therefore RedMed-Group was able to step in and provide the necessary facilities while ensuring the safety of camps and base camps."

DELIVERING GAS PROMISES

Algeria's gas supply is being pulled in two directions: rising domestic demand places an ever-increasing burden on a production level that also must deliver a significant amount of gas for export, via both pipeline and LNG. Algeria became the world's first LNG producer in 1964 when the Arzew LNG facility came online. In 2013, Algeria was the world's seventh largest exporter of LNG, exporting about 5 percent of the world's total exports. In 2012, Algeria exported more than 1.7 Tcf gas: around 1.2 Tcf of this was via pipeline, with the remainder being transported by LNG tankers. After Russia, Algeria is Europe's largest natural gas supplier, supplying Italy with 22 percent of its annual gas supply and Spain with 41.7 percent of its annual supply.

"Algeria's geographical location, at the heart of a global market, allows us to trade with the USA but also Europe," says Smain Larbi Ghomri, CEO of Hyproc, the Sonatrach subsidiary charged with operating its LNG tanker fleet. "Qatar might take a larger share of the Asian market, but we have the best location to do business with Europe and the US. We still need to be competitive when it comes to production costs and transportation, but also we need to master deadlines and make sure to keep customers happy with our service."

"Our goal is to be a part of Algeria's success, and for gas exports to be successful we need to have a logistics chain in place that adds value to the product," continues Ghomri. "Many of our customers must meet national needs along with local energy needs: Hyproc tries to be as efficient as possible in order to answer all our customers' demands before the deadline that they set, without any intermediary. We try to be competitive by cutting the transportation margin as much as possible, to allow Algerian LNG and LPG to reach the market at competitive rates. We are able to do this by not having intermediaries between our company and the customers."

But as well as reaching export markets, gas also has to drive internal growth for Algeria. Natural gas accounts for 98 percent of current power generation in the country, and electricity coverage reaches 99 percent of the population. And as the country's middle class swells, and industrial output increases, more gas is needed.

Algeria's public power utility, Sonelgaz, is pursuing a large-scale investment program to almost double electricity generation capacity in the next three to four years. The company has already made notable strides, as capacity increased by about a third from 2011 to 2013. "In 2015 these efforts will begin to bear fruit: we should have good coverage and satisfy future demand as a result of the work we have done," hopes Abdelaali Badache, executive committee chairman of Creg, Algeria's gas regulator.

Why has demand risen so quickly? "The economic recovery of the country, due to satisfactory state income, housing, transport, and socio-economic infrastructure, led to a huge growth of energy demand, which could not be delayed at the risk of popular reaction," explains Badache. "This evolution of demand, and therefore changes in regulation and production, correspond to the development of the Algerian population. As a regulator, we must make sure that demand is satisfied across the whole country."

By 2030-2040, forecasts predict total demand of around 3.53 Tcf, 1.41 to 1.59 Tcf of which will go to power generation. This leaves about 2.12 Tcf for export," explains Noureddine Boutarfa, CEO of Sonelgaz.

In 2010, a decision was taken to make Sonelgaz realize production plants by itself. "We have medium and long-term development plans to achieve, which we adjust annually," explains Boutarfa. "What changed with this decision in 2010 is that now, instead of planning to take shares in power plant projects, we realize them through our own subsidiaries. This allowed us to gain visibility. Indeed, we need to remain the master of our development plans, so as to control equipment volumes and make the best choice with regards to technology and business opportunities."

But the big question remains, as Boutarfa of Sonelgaz puts it: "Will there be enough gas 30 years from now?" Perhaps, is the answer that comes from Sonatrach. Gas export demand may actually drop in the years to come. "My personal analysis is that there is now much more competition from cheap coal which is finding its way onto European markets as a direct result of the shale revolution in the US," says Sonatrach. "Coal has thus taken a share of a market traditionally reserved for gas and this explains why Sonatrach's gas exports to Europe have diminished over the past years."

No one would dispute the fact that the road ahead for the Algerian oil and gas industry will be difficult, but the metrics show that the potential for restoring the country's former greatness is there: with current oil production of 1.12 million b/d, 159 Tcf of proven natural gas reserves, gross natural gas production of 6.4 Tcf, and shale resources as yet untapped, there certainly is a lot for Algeria to be positive about.

Incentivizing Exploration

- Increased time for exploration: possibility of a renewal for a maximum of two years

- Introduction of a right of preference: preferential right is granted to the company that is carrying out exploration works on a perimeter set for competitive bidding, provided it lines up forthwith with the best offering, and provided that the bidding runs for the area concerned.

- Possibility to recover exploration expenditure: exploration expenditures previously approved by Alnaft and incurred by a person on a given perimeter will be considered research investment in case the company concludes a hydrocarbon exploration and production contract over the said perimeter.

- A two-year extension of the exploration period can be granted by Alnaft to allow completion of the delineation program on a discovery made before the end of the exploration period