Capital availability for E&Ps

TRADITIONAL LENDERS UNABLE TO EXTEND ADDITIONAL CREDIT; SOME MAY REDUCE THEIR CURRENT EXPOSURE

JOSH SHERMAN AND SEAN CLEMENTS, OPPORTUNE LLP, HOUSTON

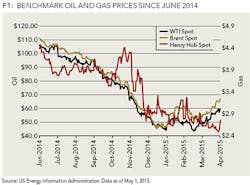

TO DATE, WTI has traded down as much as 60% from its 2014 peak, dipping below $50 for the first time in five and a half years. Natural gas has fallen in excess of 60% since its 2014 high and remained at sobering levels throughout the shoulder months (see Figure 1).

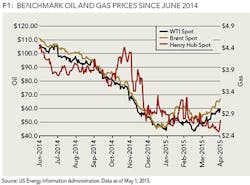

Current commodity market conditions are largely the result of supply-side dynamics deriving primarily from the enormous flow of production created by the North American shale boom, the recovery of drilling activity in the Gulf of Mexico, and the deliberate policy of OPEC and foreign competitors to protect their respective market share of production. The current supply glut was further fueled by tepid consumer demand, a strong dollar, and the most torrent capital markets the industry has ever seen.

One must look back to the early 1980s to find a supply glut that put as much pressure on oil prices as the current oversupply situation (see Figures 2 and 3). Though, the difference between the bust of the 1980s and the current situation is the evolution of the capital markets.

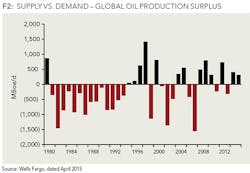

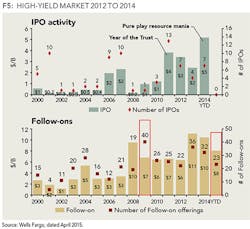

Since 2008, the Fed Funds Rate has not peaked above 0.25%, spurring the High-Yield market to explode from 2012 to 2014 (see Figure 4). IPOs raised approximately 150% more in the past four years than the previous 11 combined and the follow-on equity market produced two of the most prolific years in the past 15 (see Figure 5).

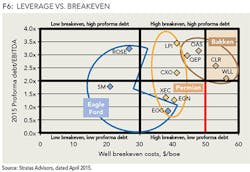

An abundance of capital and rising commodity prices over the last four years allowed oil and gas C-corporations and private companies to find and develop large amounts of acreage and allowed MLPs to make numerous acquisitions. Although this business environment produced frothy asset and equity returns, it also allowed the industry to venture into non-core assets, with less economic return, at peak acquisition prices and unprecedented levels of debt (see Figure 6).

CURRENT CAPITAL MARKETS ACTIVITY

Like other downturns, traditional borrowing base lenders are maneuvering carefully, finding themselves unable to extend additional credit to existing customers and thinking about how to reduce their current exposure. Although the E&P IPO markets are relatively closed for the time being, a wave of fresh capital is flooding the market from investors seeking to time the value trough.

A review of capital stacks across the E&P landscape, from senior secured RBLs to loosely structured unsecured bond indentures with permitted lien baskets big enough to drive a crude-carrying rail car through (the so-called "hookie dook"), highlights a myriad of both opportunities and pitfalls. Not all bets will pay out, but those companies otherwise on the verge of collapsing have several lifelines at their disposal (see Figure 7).

How this money will be deployed through operations is yet to be seen, but it offers costly hope and a potential source of much-needed near term liquidity for those unable to generate organic cash flow or to borrow from traditional sources.

THE PATH FORWARD: TRENDS AND EXPECTATIONS FOR CAPITAL DEPLOYMENT AND AVAILABILITY

Industry executives have let out a palpable exhale as we exit the spring borrowing base redetermination season - it was apparent that banks were actively addressing liquidity concerns head-on while remaining flexible and willing to stretch for their clients. Ultimately, banks settled on modest to no reductions in borrowing bases. However, in return for affirmation of borrowing bases, cracks in the RBL armor were highlighted by numerous amendments that included covenant holidays around going concerns, leverage tests, and asset coverage test.

Just as resounding as the spring exhale, is the apprehensive inhale of lenders and borrowers alike as they brace for the fall redetermination season. Absent any meaningful recovery in prices, RBLs that weathered the spring will begin facing challenges as October approaches:

E&P companies hedged between 45% and 60% in 2015 are exposed with only 15% to 30% coverage in 2016.

Photo by Anadarko.

Capital programs reduced in the name of liquidity preservation, while still forecasting to increase production for 90% of US producers in 2015, will begin to stress PDP production and the velocity at which PUDs are developed.

Lenders will no longer be able to stretch for borrowers who cannot demonstrate pro forma liquidity over the next year, who forecast ongoing covenant violations, and who are straining the senses of asset coverage.

For some, this will be the end of the road outside the costly and largely undesired context of a formal restructuring. For others, it will be a catalyst to tap the capital markets by terming out RBL facilities, capitalizing on the hookie-dook provisions in their indentures and taking the risk of additional leverage, debt-to-equity conversion, or simply raising new equity.

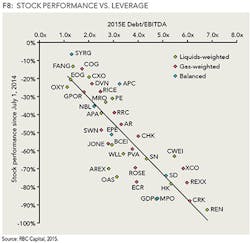

EQUITY: CONVERSION AND ISSUANCE

A simple and safe option for over-levered, cash-strapped companies may seem to be to issue new equity or the consensual, out-of-court conversion of debt to equity. New equity that replaces debt or the direct conversion of debt to equity eliminates the short-term interest drag on cash flow and shrinks the liabilities side of the balance sheet, freeing up capital to continue operations and drive value (see Figure 8).

Not all companies able to raise equity will use it to retire debt - some will deploy funds directly through the drill bit to prop up reserve values and generate organic cash flow.

However, equity is inherently more expensive and this approach dilutes existing owners (potentially to the point of it being unpalatable), raises imminent valuation issues, and absent the existence of legacy convertible debt instruments, is not guaranteed to be supported by existing creditors. That said, Halcon, Carrizo, Encana, and Concho, among others, have been able to raise equity in 2015. Those unable or unwilling to close equity transactions and in need of cash, however, will seek to divest assets or access debt markets to stay afloat and out of court.

ASSET MONETIZATION

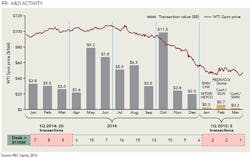

What remains to be seen in 2015 is how a stabilization in pricing will affect the volume of packages hitting the market and what impact of the flood of private capital flowing into the industry will have. As expected, 1Q15 transaction volume and value is lower as compared to 1Q14 (see Figure 9).

Though, with so many dollars coming into the A&D market, it may be reasonable to expect valuations to be bid up inconsistently with the underlying commodity price environment. A concern is that a feeding frenzy among the better-capitalized owners able to drill and develop assets could further stress the market by refueling oversupply and reinvigorating the downward pressure on commodity prices.

While an overheated A&D market remains a risk, private capital is poised to opportunistically develop undrilled core acreage through joint ventures. For example, an alternative to the outright sale of assets can be found in the DrillCo transaction between Linn Energy and GSO. This structure benefits Linn, GSO, and Linn's investors:

GSO gains an option in a working interest that can meet their return hurdle;

Linn continues to develop their portfolio without undue capital burden and mitigates operational risk; and

Investors up and down the capital structure garner the benefit of converting lower value PUD assets to higher value PDPs.

DEBT OPTIONS

On the creditor side, non-traditional first lien lenders, second lien and unsecured creditors are flocking to the space in search of yield and potential loan-to-own situations. Private capital lenders seeking first lien positions have the ability to lend more liberally against PUDs and non-producing assets than traditional RBL lenders in return for better economics, while still maintaining tolerable loan-to-reserve values. At the same time they can provide the liquidity to potentially monetize nonproducing assets through the drill bit, thus providing significant upside in terms of asset coverage versus return on invested capital. Moreover, this capital can be used to retire lower tier debt at a discount, improving both liquidity and overall credit quality.

Because traditional RBL lenders base their availability primarily on a haircut assessment of reserve value, there is an assumption of inherent value available below the first lien debt. Accordingly, we have seen a great deal of activity in the second lien market as parties appear to be positioning themselves as the potential fulcrum creditor in a restructuring or to play the upside value associated with a price rebound.

CONCLUSION

As always, the future of the industry rests in the hands of the unpredictable commodity markets and is captive to a precarious and ever-changing geopolitical environment. What remains clear, however, is that the survival of many oil and gas companies and their stakeholders will only occur upon a price return that is far higher than any forward curve currently suggests.

Well-capitalized financial and strategic buyers will consolidate assets and thin the herd of those unable to subsist in a protracted low-price environment, while others will fail or succeed based on their own ability to generate the liquidity necessary to weather the storm.

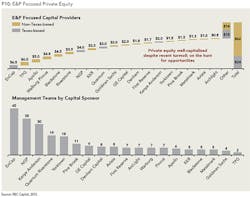

In any case, the upstream oil and gas industry is poised for renewed activity. Savvy and balanced commercial banks will hold their own but look to the same sources of private capital that flourished during the last bull market to soon ride high in the saddle again (see Figure 10).

ABOUT THE AUTHORS

Josh Sherman is the partner in charge of Opportune's complex financial reporting group. He has more than 16 years' experience providing clients across the energy spectrum with technical research, capital markets, and SEC reporting assistance. Sherman specializes in IPOs, variable interest entities, purchase price allocations, energy trading, and derivatives, stock-based compensation and oil and gas disclosures.

Sean Clements is a managing director in the Restructuring and Corporate Finance practices of Opportune. Sean has 15 years of experience across the entire energy spectrum and specializes in the restructuring of E&P and OFS companies, financial planning and analysis and damage calculations.