CEO trends in oil and gas

AN IN-DEPTH STUDY OF US AND INTERNATIONAL PUBLIC COMPANIES

CHRIS REINSVOLD, ADVISOR AND CONSULTANT, HOUSTON

TO GAIN A BETTER UNDERSTANDING of leadership trends in the global energy sector, the author studied the experience, education, and backgrounds of 281 CEOs from the largest publicly traded US and international oil and gas companies.

- This in-depth study of oil and gas industry leaders resulted in several noteworthy findings, including the following:

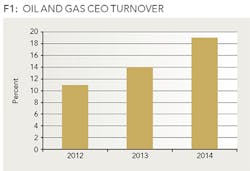

- Oil and gas CEO turnover increased significantly in 2014, continuing an upward trend of the last few years.

- The median tenure for oil and gas CEOs remained almost unchanged at 4.6 years.

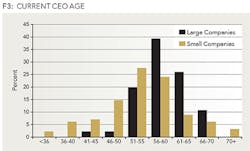

- The media age of large-cap (greater than $10 billion in market capitalization) oil and gas CEOs was 58, while the median age of smaller-company CEOs was 55.

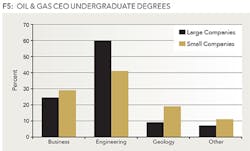

- Technical degrees (primarily engineering and geology) outrank business degrees in the education of oil and gas CEOs.

- The majority of all CEOs were promoted from within their current companies, while a significant number of CEOs from the smaller companies were recruited from CEO positions at other companies.

- Considering the roles of CEO versus chairman of the board, in the US there was an increase in the number of CEOs that held both roles in 2014 compared to 2013. However, outside the US the opposite trend occurred: more companies split these roles in 2014 compared to 2013.

CEO TURNOVER

In 2014, there was a large increase in the number of leadership changes in the petroleum sector: 19% in 2014 compared with only 14% in 2013 and 11% in 2012 (Figure 1).

Leadership changes occurred at several prominent companies such as BG, Statoil, ENI, Noble Energy, and Total. However, a greater percentage of smaller companies changed their CEOs than the larger companies-20% and 13%, respectively. For comparison, a study by The Conference Board showed that the companies in the S&P 500 averaged an annual turnover rate of 11% from 2000 to 2013.

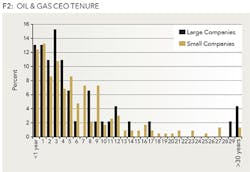

CEO TENURE

According to our study, the typical oil and gas company CEO has been in his/her current role for 4.5 years. Overall, there was a wide variance in tenure (Figure 2), with about half of the CEOs having served for less than five years and 9% for greater than 15 years. The median tenure for large company CEOs was 3.7 years and for small company CEOs it was 4.7 years.

CEO AGE

More than half (53%) of the oil & gas CEOs in our study were between the ages of 51 and 60, a drop from 58% for the same age range in 2013 (Figure 3). The median age was 58 for CEOs from the larger companies and 55 for the smaller-company CEOs. Considering the age at which they started their current role, we see that half of the large company CEOs started by age 53. However, smaller companies tended to hire younger CEOs, as evident by a median starting age of 47 years (Figure 4).

CEO EDUCATION - UNDERGRADUATE DEGREES

In general, the oil and gas CEOs in our study held three broad types of undergraduate degrees: business degrees (including business, accounting, finance, and economics), engineering degrees (including petroleum engineering, mechanical, electrical, civil, etc.) and earth sciences degrees (collectively described here as geology.) Figure 5 shows the distribution of CEOs by undergraduate degree, segmented by large-company CEOs and small-company CEOs.

Engineering degrees were the most common undergraduate education for larger company CEOs at 60% of the group. In smaller companies, the CEOs have a much more diverse background with geology and business majors playing a significant role in addition to engineering (41%).

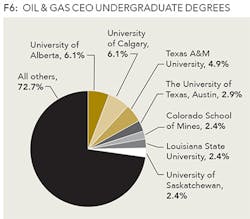

UNIVERSITIES ATTENDED

As a group, these CEOs earned their undergraduate degrees from a broad mix of public and private universities. However, seven public universities were the most commonly attended schools, accounting for 27% of the CEOs (Figure 6).

The top seven schools for the 2014 study are the same seven schools from the 2013 study. However, there are several rank changes within the top seven, including a tie for the number one spot between the University of Calgary and the University of Alberta.

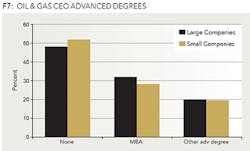

MBAS AND OTHER ADVANCED DEGREES

Many of the CEOs earned an advanced degree in addition to their undergraduate degree. For the entire group, just under half (48%) earned a graduate degree. Among CEOs from larger companies, 52% had an advanced degree compared with 47% of smaller-company CEOs (Figure 7.)

The MBA was still the favored advanced degree with 29% of the CEOs having earned one. Also, the combination of a technical undergraduate degree (engineering, geology, or other science degree) plus an MBA was held by 19% of the CEOs.

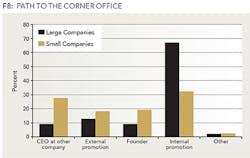

LAST STOP BEFORE THE CORNER OFFICE

These oil and gas CEOs took a variety of paths to their current leadership positions. This study examined their roles just prior to becoming the CEO at their current companies.

In general, the positions held just before the CEO role can be categorized as follows:

- CEO at another company - Occasionally, a CEO moved from the CEO position at one company to the CEO role at another company.

- External promotion - This describes a person who moved from a position at one company (senior level, but not CEO) to the CEO role at another company.

- Internal promotion - This is when a person is promoted from one position to the CEO role at the same company.

- Founder - A number of CEOs founded or co-founded their companies.

- Other - This most common scenario in this miscellaneous category is when a board member assumes the CEO role after the departure of the previous leader.

There were significant differences between the career paths of CEOs at larger and smaller companies (Figure 8).

Sometimes CEOs were recruited from another company where they already held the CEO title. This happens more often with smaller companies (28%) than larger ones (9%). In larger companies with broader internal talent pools for future leaders, the majority (about 67%) of the CEOs were promoted from within. However, in smaller companies, only 32% of the CEOs were promoted from within. External promotions (being promoted to CEO from a lower-level position at another company) were more common at smaller companies than larger companies, 18% and 13%, respectively.

Finally, some of the CEOs were also founders or co-founders of their respective companies. This was more common with smaller companies (19%) than larger companies (9%). Most of these 2014 percentages are similar to those from the 2013 report, with the exception of the number of large company CEOs that were CEOs at another company. In 2013, 15% of the large company CEOs were recruited from CEO roles at other companies, while this fell to 9% in 2014.

SPLIT GOVERNANCE

In oil and gas, as in other industries, there has been increasing debate as to whether the chairman and the CEO positions should be held by two separate individuals. While the CEO's primary responsibility is to manage the business, the chairman's role is to provide management oversight through the board of directors, and like all directors, represent the interests of the shareholders.

Proponents of a split-governance model argue that separating the two roles strengthens the board's independence and oversight function. Opponents of the split-governance model say that splitting the role creates inefficiencies and undermines the CEO's authority.

About 28% of the CEOs in this study held the combined CEO-chairman role. In the US, 52% of the CEOs served the dual CEO-chairman role, while only 17% of Canadian CEOs did. Outside the US and Canada, only 12% of oil and gas CEOs held both the CEO and the chairman title (Figure 9).

Compared to 2013, more US CEOs held the dual role, while the dual CEO-chairman role is becoming less common outside the United States.

ABOUT THE AUTHOR

Chris Reinsvold ([email protected]) is a strategic advisor and consultant to boards, executive leaders, and management teams. Over his career, he has worked in a variety of positions in the energy industry, both in the US and abroad, from roustabout at an oil company to CEO of a management consulting firm. For much of the past 13 years, he has helped companies develop and execute a wide variety of strategic initiatives.

ABOUT THE STUDY

This study includes US and international public companies that met the following criteria:

- Independent and traded (i.e., not private-equity-backed, privately held, or a national oil company)

- Fully integrated oil and gas companies (the majors) and exploration and production (E&P) companies

- Not a division of another company

- Not a pure-play refining, midstream, or chemical company, nor an oilfield equipment and service provider

- Market capitalization of more than $50 million

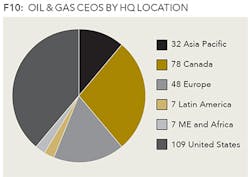

Based on the above criteria, the CEOs of 281 companies were studied, representing a broad selection of US and international oil and gas leaders. These CEOs lead companies that vary significantly in size and location. Larger company CEOs, (companies with greater than $10 billion in market capitalization) account for 46 of these CEOs, while smaller company CEOs make up the remaining 235. About two-thirds of the CEOs lead companies that are headquartered in North America with the rest coming from many other regions (Figure 10).

The information included in this profile was compiled from publicly available sources such as company websites, press releases, and financial reports. Not all data was available for every CEO. The CEOs included in this report are those that were in place as of Jan. 1, 2015.