How ETRM systems best support the refinery model

Rana Basu, VP – Center of Expertise

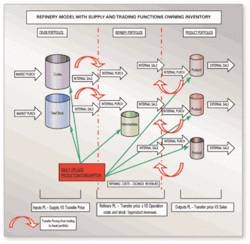

Recent market volatility has created a growing demand for ETRM systems to assume a more sophisticated role in managing the oil asset at the refinery level. To do this, the operational and performance indicators of the inputs (crude and feedstock supply), the refinery operation costs and leverage opportunities, and the outputs (marketing and trading of refined products) need to be captured and managed effectively. Doing this takes an accurate attribution of the P&L changes at all three stages of operation:

- Crude portfolios, where the P&L reflects supply versus transfer pricing to refinery

- Refinery portfolios, with the P&L reflecting transfer prices versus operation costs and stock / byproduct revenues

- Product portfolios, having the P&L shaped by transfer prices from refinery versus sales.

P&L results in all three portfolios are the product factors such as changes in the underlying commodity prices and yield mix, and the costs broken out into actionable groups like transportation, credit costs, processing costs, and fees. The ETRM provider’s challenge is to maintain the flexibility for modeling with the control needed for the actual transactions, and slicing the P&L in meaningful ways to accurately support decisions for trading / marketing, risk management, refining and accounting participants through the complete lifecycle of the asset transaction.

Optimizing the asset through juggling the possible yields (within engineering constraints) against the changing face of the market is as much an art as it is a science. Having the ETRM provide position details on market position and daily inventory position helps both the optimization of market opportunity and the effective hedging of the balance exposure and can make this a significantly smoother process. It therefore makes sense to connect the refinery / stock management system to the ETRM and make daily updates to the current day’s projected consumption of crudes and feedstocks and production of refined products. Furthermore, automating the upload of these daily quantities for both the current day’s forecast and prior day’s actuals significantly reduces the errors in final positions that lead to bad decisions.

Transferring the inputs at cost and adding in the cost of operations and transport to deduct from the final sales price does provide an accurate overall P&L picture. However, this model does not support analysis for performance tracking and improvement. Breaking out the performance into three groups – inputs, refinery operations, and outputs – allows comparative analysis of the individual pieces versus their own benchmarks. Inverting the model to rank crudes and feedstocks by the spread to their yields by asset scenario gives greater visibility to both the trading groups and the operations versus the crack spread and highlights favorable scenarios given current market conditions.

If the ETRM can take the next step of allowing flexibility in modeling the crack spread to more accurately represent current or possible market scenarios in the use of the asset, the information supports faster reaction to changes in market conditions An ETRM system that reflects the real costs and realistically manipulates the yields and inventory levels supports better decisions.

TradeCapture is a leading global provider of commodity trading and transaction management software systems. It is headquartered in Houston, TX and has sales, development and support centres strategically located around the world including Hyderabad, India, Rome, Italy and London, England. www.tradecapture.com

TradeCapture, Inc.

2500 CityWest Boulevard

Suite 745

Houston, TX 77042

Telephone: 1.713-339-5600

website: www.tradecapture.com