Assessing the risk in capital-intensive opportunities

Richard Westney,

Westney Consulting Group, Houston

The increasing number and complexity of energy sector opportunities has made it more important than ever that investment decisions reflect a complete understanding of all the risks to economic value. Energy is a capital-intensive business, and the success of many opportunities is tied to the owner/operator's ability to create a new capital asset.

For example, the opportunity may be to participate in a newly-formed project company which intends to define, engineer, and construct a production facility and depends on project finance and other investors to fund the project. Or, it may be to invest in an established company with a portfolio of opportunities that require the development of capital assets.

Evaluating the attractiveness of these capital-intensive opportunities requires careful answers to questions such as:

- How much is the production facility likely to cost?

- What is the maximum cash impairment we are likely to experience before positive cash-flow?

- What is the likely time required to complete construction, commissioning and startup?

- How long is it likely to take to achieve full production?

- What is the likelihood we will have sufficient operating margin to service the project's debt obligations?

And above all:

- How likely are we to achieve our required return?

Operations Risks

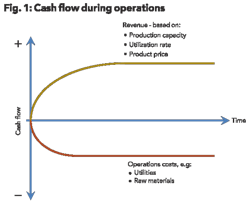

Some form of risk analysis is usually applied to develop answers to these and similar questions. In many cases, the focus is on Operations Risks. These risks create uncertainties around the base case assumptions as to the revenues and costs of the operating facility (see Fig. 1). The risk analysis will typically address potential variations from the base case assumptions for such variables as product price, production capacity, and utilities cost, in order to determine the level of risk to the Net Present Value (NPV) or similar metrics of economic value.

CapEx Risks

Capital-intensive opportunities also have significant CapEx Risks. These are the risks associated with the developer/operator's ability to define the project, achieve financial close, complete the engineering and construction within budget and on schedule, and start-up the facility. These CapEx risks are important. Large engineering and construction projects have had a long history of cost overruns and schedule delays, often resulting in major impacts on economic value as well as investor confidence.

The base case for a project is typically developed by internal and/or external engineering teams who define the scope, schedule, execution plan, and cost estimate. There is considerable experience to suggest the base case often grossly understates the cost and time required and reflects an overconfident assessment of risks.

Risks to the project's cost, time, and performance objectives are apt to be significant, and it can be difficult to fully transfer all these risks to contractors and suppliers. The evaluation of capital-intensive investment opportunities therefore requires the ability to assess the full range of CapEx risks and to integrate them with operations risks in order to have a complete understanding of the total economic risk exposure. Figure 2 illustrates the combined CapEx and Operations cash-flows that drive economic value.

Most of the variables associated with cost and revenue have a range of uncertainty as a result of CapEx and Operations Risks. Since the timing of costs and revenues is also uncertain, it is usually not self-evident how these uncertainties combine into the overall level of risk. The only place where the uncertainties in all the project variables come together is in profitability, which, for this purpose, is most easily measured by NPV.

The solution, then, for a capital-intensive opportunity, is to develop a probabilistic assessment of NPV which considers the combined impact of all risks. The decision-maker can use the results, together with consideration of risk appetite and other investment criteria, to evaluate the overall attractiveness of the opportunity.

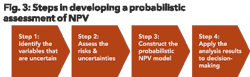

A probabilistic assessment of NPV is a four-step process illustrated by Fig. 3.

Step 1: Identifying the variables that are uncertain

Of course, every opportunity is different. The specific variables that are important, the extent to which they are uncertain, and how they vary with time must be understood. A choice must be made for each variable: whether to treat it as certain or uncertain. For example, if a firm fixed-price agreement is in place for the first five years of power supply, the model would treat the cost of power as fixed. If the product is a fungible commodity to be sold on the open market, it is likely that the model would be constructed to treat product price as uncertain. In most cases timing is treated as uncertain. Although this adds complexity to the model, it is an important part in ensuring the analysis yields meaningful results.

Step 2: Assess the risks and uncertainties

For those variables that are uncertain, the risks that drive uncertainty must be identified in order to determine that variable's range of uncertainty. For example:

- Risks to Revenue may include lower-than expected product price, reduced production capacity, or increased downtime.

- Risks to CapEx Costs may include cost overruns from scope changes, lower-than-expected contractor or supplier performance, or unexpected logistical difficulties.

- Risks to OpEx Costs may include production inefficiencies, higher cost of feedstock, and increases in utilities costs.

- Risks to Timing may include various causes of delays to the engineering, procurement, construction and startup of the project.

For each variable, the model will require a range of possible values, as well as the selection of a probability distribution that reflects the way that variable is likely to respond to the risks that affect it.

Step 3: Construct the probabilistic NPV Model

The probabilistic NPV Model will use Monte Carlo simulation to develop a probability distribution of all possible NPV outcomes. It must reflect both the uncertainties in the key NPV variables as well as the interdependencies among these variables. For example, the model may consider:

- The potential threats from strategic risks such as global market conditions.

- The correlation between commercial, financial, technical and execution risks.

- The cause and effect relationship between risks; for example, the risk of insufficient funding of front-end engineering can increase the risk of startup changes and operating issues.

- The "snowball effect" in which project risks over time combine and cascade in a way that drives a project to a tipping point beyond which failure is inevitable. For example a project that is poorly defined yet contracted with LSTK will inevitably experience cost overruns, delays, and even litigation.

- The importance of mapping all variables, and their risks/uncertainties, against time, which is itself an uncertain variable.

Step 4: Apply the analysis results to decision-making

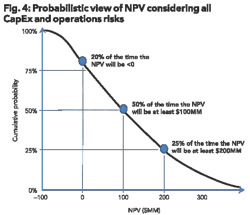

The results of the analysis usually provide insights into economic risk that are not readily apparent. Fig. 4 illustrates a typical presentation of the results. It shows a given opportunity's cumulative probability vs. NPV.

In this example, the decision-maker used these results to compare the opportunity's strategic fit with the portfolio, as well as its risk/reward profile with that of other alternative opportunities.

Summary

While energy sector opportunities abound, many are capital intensive and carry significant CapEx Risks. These risks, associated with the engineering, procurement, construction, and startup of a production facility, are often underestimated, with cost overruns and schedule delays common.

Investment decisions for capital intensive opportunities benefit from a comprehensive, probabilistic assessment of NPV that considers both CapEx and Operations Risks and their impact on NPV. OGFJ

About the author

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com