India: The Silent Revolution Pt.1

Project Directors: Karim Meggaro & Henrique Bezerra Project Coordinator: Federica Torgneur Project Assistant: Andrey Muntyan Prepared in collaboration with Petrofed

India's economic growth is widely praised, and with a GDP of $4.046 trillion USD in 2010 and a GDP growth rate of 8.3% last year, it is clear why the country is making the headlines in the most positive of lights. In his latest visit to India, U.S. President Barack Obama stated that "India is not simply emerging: India has already emerged." However, before it can complete its transformation into one of the world's superpowers, India must address two big issues that are hampering its development. These are its infrastructure and energy challenges.

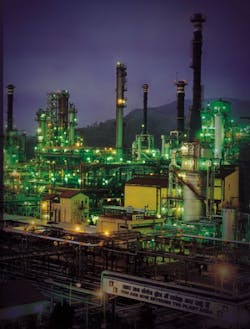

Despite the fact that stories of India's booming economy and emergence on the world stage shout from newsstands across the world on a daily basis, very little time is dedicated to discussing the industry that is needed to fuel this growth. However, India has taken important steps to address its energy imbalance. Indeed, it has been remarked that the transformation that has taken place in the Indian oil and gas industry over the last two decades has been a silent revolution, and today India stands as one of the most influential and important oil and gas markets in the world – and more importantly, it has reached this position without the rest of the world noticing. Focus Reports has spent some time on the Indian subcontinent in order to uncover the factors that have caused this revolution, and discover where the Indian oil and gas industry is now headed.

"The transformations in the Indian oil and gas industry represent a silent revolution," says S Sundareshan, outgoing secretary of the ministry of petroleum & natural gas, "because, besides allowing India to grow and improve the lives of hundreds of millions, it goes largely unnoticed. For instance, India's refining capacity jumped from 68 million tons to 185 million tons in only ten years. It is likely to increase to 240 million tons before 2012." Today, India has excess refining capacity, and as a result the country currently exports about 40 million tons per annum. When capacity is further bolstered, India will be in a position to export more than 80 million tons per annum.

However, India is the world's fourth largest oil consumer after the United States, China, and Japan, consuming around 3 million bbl/d in 2010 while producing only about 900 thousand bbl/d, making energy security one of India's major bottlenecks for its future growth.

As a response to this, Indian policymakers have gradually liberalized India's oil and gas industry over the last 15 years in an effort to boost the country's 5.6 billion barrels of proven oil reserves (as of January 2011), the second-largest reserves in the Asia-Pacific region after China. Its main policy tool has been the New Exploration licensing Policy (NELP), which aims to provide a level playing field for all players active in E&P. Under the NELP regime, organized in rounds and starting with NELP I in 1999, 87 oil and gas discoveries have already been made in 26 exploration blocks, not counting this year's bidding round.

The latest NELP round, NELP IX, closed in March 2011, and offered 34 exploration blocks in 10 sedimentary basins covering an area of 88,807km2. The blocks comprised 19 onshore blocks, 8 deep-water blocks and 7 shallow water blocks. 19 of these blocks were being offered for the first time to interested parties. At the close of the bidding cycle, 33 of these blocks had bids placed on them, with 10 new companies entering the Indian E&P sector for the first time, 2 foreign and 8 Indian.

Sunil K Srivastava, the director general of Directorate General of Hydrocarbons (DGH), India's upstream regulatory authority, believes the country's sound governance and stable rules have been the main ingredients in its efforts to attract more private investment to its oil and gas industry: "Reliance Industries' KG-D6 discovery took only six years to go from discovery to production; its success was not only a product of the competence of the operators but also the government's fast-tracked decisions, approvals, governance and policies. Thanks to India's sound policies, investors both domestic and international have increased their stakes in India's E&P industry."

As a result, since April 2009 India has added 2.1 billion cubic feet of natural gas production per day to its existing 2.65 billion with the start of production on the Krishna Godavari (KG) basin and specifically the KG-D6 block, the biggest natural gas discovery in the world for the year 2002.

Even so, India is aware that it is far from achieving self-sufficiency in the oil and gas sector. As a result, it has applied pragmatic policies to boost national production and import capacity; internationalize its companies and secure assets and markets overseas; and become a prominent international refining hub by importing crude oil from its Middle-Eastern neighbors and exporting refined products to new markets.

The silent raise their voices

On reflection, what many may regard as a fairly quiet player on the oil and gas map seems to have an awful lot to shout about. Admittedly, the vast nature of the market, the history of state influence in India, and the need for subsidies in order to make fuel affordable to India's rural poor make the downstream a fairly unattractive option for private companies as it stands at the moment. But as BP has shown recently, there are attractive options in the country for multinationals willing to take a bet on India's untapped reserves, and less of a bet on the country's massive refining capacity. On top of this, the private sector players have gone through a period of change and emerged on the other side as profitable, energized and creative businesses, diversifying and evolving to overcome new challenges and build themselves a market for the future. The private sector cannot be forgotten in this equation. Having established a formidable presence in their home market, companies across the value chain are now looking abroad to find the next frontier. As India's pioneering spirit develops and matures, the world will see a tiger awake – one that can beat competitors on price, and still bring an excellent level of quality to bear. Traveling to India, it is hard to describe the country as silent, but now it is time for the country to roar.

Changing faces, evolving undertakingsIn recent months, India has not only changed the top three figures at the ministry of petroleum and natural gas (minister, minister of state and secretary), but also, due to the stipulation that the chairmen and managing directors (CMDs) of state-owned companies must retire at sixty, the heads of ONGC, IOCL, HPCL and BPCL have all been replaced. ONGC still does not have a permanent CMD due to the complex process by which these leaders must be nominated, approved, checked and then appointed. Whether this situation will affect the industry in the months and years to come will remain to be seen; it has the potential to either set the country back by removing those with the most influence and experience in the industry, or bring bright new figures to these positions with the ideas and creativity to help the industry realise its full potential.

We asked the new chairmen of several of India's PSUs what it is that makes their company unique, given the shifting and diversification of the state-controlled industry. This is how they replied…

AK Hazarika, ONGC

ONGC has an important role to play in India's energy development. Today, ONGC contributes about 70% of domestic oil production for of the country. In gas, Reliance Industries has taken a large share of the market after the commencement of production from KG-D6, but still ONGC and ONGC's share of its joint ventures accounts for almost 50% of India's domestic gas production. OVL is also contributing around 20% of India's total oil production. In India's oil and gas industry, ONGC's role will always remain important.

AK Purwaha, Engineers India Ltd.

Engineers India is unique in its partnering relationship with all of its esteemed clients, whether public or private sector. This has developed well since the company began. Initially, the company's only interactions were with the Indian public sector, as these were the only companies involved in the oil and gas industry in the country. Today, we have seen that the market has been liberalized and the world has entered India, and EIL has learnt to deal with its new clients just as well as it did with its old ones, who are still very valued clients. Our recall value and return business rate are proof that we have managed these relationships very well, even in this brand new industrial and economic environment that we are facing today. As the years progress, we hope that the confidence our clients have in us will continue to be our greatest strength.

RK Singh, Bharat Petroleum

The question of whether BPCL continues to remain downstream or diversifies and looks at other opportunities has been debated at length. Any company, whether it is a PSU or a private sector business, wants to grow and have access to more opportunities. BPCL also wants to grow and diversify its business activities, but not at the cost of the core activities. Therefore we have created strategic business units, so that each remains focused on their core activities.

S Roy Choudhury, Hindustan Petroleum

Hindustan Petroleum is the amalgamation of Esso and Caltex. As a result, we have a very rich cultural blend of Esso and Caltex mixed with our experience in the public sector. Putting all this together, I think HPCL got a very clear defined strategy to service the people of the country at the same time maintain its growth. Whatever we do, we should always remember that we are a commercial organisation. We must generate profit in order to grow, and we will ensure that we achieve this growth hand in hand with India.

India, in need of a little NELP

For a long time the Indian oil and gas industry was dominated by its top state-owned players: the so-called ‘public sector undertakings' or PSUs. Once funded by the government, these companies are now self-sufficient, although due to fuel subsidies imposed by the government, they rely on regular compensation in order to keep themselves profitable. As a result, many of these companies, headed by new management, are now looking to diversify their businesses and make them independently sustainable, whilst continuing to play the role for which they were established; ensuring that India has access to the energy it needs.

Outside India, these companies are not particularly well known, but on the subcontinent, these companies are the public face of India's fight for energy security. From ONGC, the major E&P player in India and the country's most profitable company, to GAIL, involved across the entire natural gas value chain including pipeline infrastructure and LNG terminals; OIL, mostly onshore oil E&P in the north west of the country but increasingly growing in other regions, both onshore and offshore; IOCL, focused mostly in the downstream sector owning around half of India's refineries; and HPCL and BPCL, two companies traditionally focused in downstream and marketing activities, bringing finished products to consumers; and finally EIL, the engineering consultancy created specifically to solve the challenges that would be faced by India's fledgling oil and gas industry.

In the 1990s, the liberalization of the industry and the introduction of the NELP started to change this state-dominated environment. Companies such as Cairn and Reliance Industries have become prominent private players in the upstream and downstream sectors – Reliance Industries recently completed the world's largest refinery complex at Jamnagar, with a combined production capacity of more than 1,200,000 bpd. The development of private players, together with the fast modernization and development of India's state-owned companies, has contributed significantly to the creation of a complex and mighty service and equipment industry that is now crossing India's borders and conquering international markets.

However, this excitement about the potential of India does not yet seem to have spread to the world's major oil and gas players. The fact that only BP out of the global top ten is currently investing in India's upstream says a lot about the attractiveness of the Indian market for many large foreign companies.

Vikram Singh Mehta, chairman of Shell India, explains this lack of investment from the international majors: "If Shell takes the decision not to invest in Indian exploration, it is not a reflection of a purposeful strategic decision not to invest in India—it is simply a decision based on the relative geological attractiveness of the various opportunities that are available to Shell, at any particular point in time, throughout the world." Though this seems clear, Shell's decision years ago to sell its Northern Rajasthan assets to Cairn was later regretted when the massive Mangala oil field of 1 billion barrels of recoverable oil was found.

Indeed, as Rahul Dhir, managing director and chief executive office of Cairn India points out, "based on our success, it becomes hard for us to imagine the reasons why the world's majors have not invested in India." He believe that " people still don't understand India's full potential; about 80% of our sedimentary basins are not as well explored as elsewhere, so people have been very cautious about coming in. But on the upper side, the fiscal terms are very well understood; the licensing regime is very transparent; India has one of the fastest growing markets in the world; there is a very comprehensive downstream infrastructure with India being a net exporter of refined products; so there is no shortage of access to oil and gas, with the demand for gas being constrained only by supply bottlenecks. The government is very keen on overcoming these challenges by, for instance, giving open access to the pipelines. Therefore, it is a bit of a mystery to us to understand why some majors are not investing heavily in India's upstream sector."

For the full interview, log onto energy.focusreports.net

Why did the Jubilant Group choose to invest in a sector that is so technologically and capitally intensive, when it had so many other choices?

There is a silent revolution going on in the E&P industry in India. E&P markets opened up in India only in the 1990s, first through the pre-NELP programs, and then through the NELP. Even today, there is significant unexploited potential in this country. There are areas where we have not even done basic exploration activities. So, considering these facts, the group feels that there is great opportunity in this market. We know that the sector requires high technology, and considerable investment, but the group is prepared for that.

In many aspects, the E&P industry strongly resembles the pharmaceutical industry. In pharma, you have a very long process of drug discovery, which is akin to the exploration phase in oil and gas. Then, you have a process of drug testing—similar to the appraisal phase in O&G. Then, in both industries, you go into the production stage. In E&P, we work on 7 to 10 different exploration prospects/blocks and the success rate of 30-40% are likely to provide very good returns to shareholders. Both of these businesses require a lot of industrial expertise, a wealth of research, and a technologically focused mind frame.

The recent listing of Jubilant Energy on the AIM, raising $85 million USD, was the third largest IPO of the year on the AIM. What was your strategy to attract such high interest from the international investor community?

There were several reasons behind investor interest in our IPO. The first was the profile of India as a country, and the opportunities a company like ours has here. There are very few nations in the world, especially from an E&P perspective, that have sufficient in-house demand for everything you explore and produce in the country. That was a very strong selling point.

The second selling point was the significant under-exploitation of the Indian sedimentary basins. If you speak to the DGH, they will tell you that 70-75% of the Indian sedimentary basins are underexploited.

Another very strong theme that investors were interested in was that India is just emerging as an international E&P presence.

Jubilant is one of the very few E&P plays in the private sector in India. Yes, you have many government companies that are involved in E&P, but if you look into the private sector, you have Reliance and Cairn at the top, and then there is a huge vacuum of pure, independent E&P plays. Our objective was to show Jubilant, on the London market, as a model of such plays in India. A final aspect was Jubilant's reputation in India's capital market. Jubilant Group has always created significant shareholder value in this market. Our objective was to replicate the same model in the London market.

It seems, though, that the situation might be starting to change. Late February 2011 saw the largest foreign investment in India's energy sector to date, when BP announced that it would buy a 30% stake in Reliance Industries' assets, and form a strategic partnership together which would see a 50:50 joint venture created between the two for sourcing and marketing energy in India. Additionally, BP will take a 30% stake in Reliance's 23 oil and gas blocks, for which the company paid $7.2 billion USD plus a further $1.8 billion USD in the future through performance related payments. Deals like this will perhaps lead the way for greater involvement from the world's biggest oil and gas players.

As PMS Prasad, executive director of Reliance Industries (RIL) points out: "This deal marks a significant milestone in India's E&P history as it ushers in the participation of a global oil and gas major for the first time ever with a material stake in Indian oil and gas blocks. There are significant synergies between both the partners given BP's deepwater capabilities worldwide and RIL's demonstrated project execution capabilities. We believe it is a potent combination to find more the hydrocarbons to meet India's energy needs."

It is not just the majors that are looking at India with hesitation; India is also struggling to attract junior players to its NELP blocks, both domestic and international. Ajay Khandelwal, CEO of Jubilant Energy, a prominent junior player who has actively acquired assets in the NELP rounds seems optimistic, but asks for improvements. "With any market that undergoes a regulatory transformation, it takes time for everything to fall into its intended place. It cannot occur overnight… The whole idea and conception of the highly transparent mechanism of NELP is great, and very successful, but there are always limitations to any such mechanism. India has gone through multiple rounds of regulatory framework, and there has to be a transition where the market becomes even more investor-friendly, such as if the Open Acreage Licensing Policy (OALP) gets enacted. So, better times to come."

AK Arora, director general of PetroFed, India's main oil and gas association, agrees, "What would further boost new exploration intensity would be the implementation of the OALP, which requires the creation of a data repository now on its way. With the announcement of NELP IX the honorable minister of petroleum and natural gas gave a clear indication that the OALP would follow soon. It will probably be announced around 2012."

In the same way Ashu Sagar, secretary general of the Association of Oil & Gas Operators (AOGO), sees the need to increase the number of players, especially juniors in the Indian market, "India must have many more small E&P companies; the current number is not enough. It should be easy to get in; it should be easy to get out. There should be a completely open market where the increased number of players improves the quality of service and bring competitive prices. This is not a demand. It is a paradigm for a healthy industry."

One of the major hurdles standing in the way of the planned move to an open acreage policy is the lack of seismic survey work done in the country to date; without this data, it is hard for companies to assess attractive prospects for investment. Prem Vasistha, vice president of PGS India, explains the perspective from one of the world's largest seismic companies: "for some time, PGS has been working in India, thinking and discussing with the people that have been involved in policy regarding this transition. Until the government comes up with a policy where they put everything together to make speculative survey a viable option for the major seismic companies, OALP is not a feasible option."

Vasistha believes that in order to incentivize speculative survey in India, the government must work with the seismic companies and become stakeholders in the data that is needed in order to move exploration of the country forward. "Even a small concession of a financial contribution from the government will make a huge difference. I believe that the government should consider funding 25% to 30% up front for this work, so that good service companies would be encouraged to do the survey and recover the remaining cost from sales. This would have some very positive consequences. It would help the government with faster acquisition of data, encourage more mutual trust between seismic companies and the DGH, and also make the government, through the DGH, a joint partner in eventual data sales."

The government recognizes the need to consider new options, but is rightly proud of the success of the initial liberalization of the market through the NELP, as minister of state for petroleum & natural gas RPN Singh explains; "We will look at options of what we can do to address acreages, because we need to make this policy move at a much faster rate. Without doubt we can say that NELP has been a very successful initiative of the government, and to further kick-start exploration and production we will look at other proposals." He also addresses the need to collate the data on which an open acreage policy must be based: "We are working on a National Data Repository to be set up. As soon as that is ready, we will evaluate moving to an Open Acreage Licensing Policy."

An industry refined

Refining in India has come a long way since the country's first refinery, Digboi, opened in 1901. Technological leaps and aspirations towards global competitiveness mean that today, India is home to the world's largest refinery at Jamnagar on the country's west coast, operated by Reliance Industries and accounting for an incredible 2% of the world's refining capacity.

Quality has never been an issue for India's refineries. AK Arora of PetroFed points to the fact that it is not just the private sector players that have changed the industry; from as far back as the 1980s, India's state-owned refining companies were benchmarking themselves against global standards of refining. This is what has led India's refining quality to be so high today. "This benchmark exercise was a special challenge because it was done in a period when India was absolutely destitute of hard currency. Yet the PSUs spent valued resources on this, modernizing major refineries as well as those smaller and remote. We set our targets high – true, excellence is not always achievable, but you always have to aim in that direction." He concludes; "Indian refineries kept on improving quality and capacity at the lowest cost for decades. Now it is only natural that we are winning in international markets."

This drive by the PSUs to strive for international refining quality resonates with India's desire to increase self-sufficiency and take advantage of the relatively low cost of refinery building and operation in India, and today the government is pushing for an increase of annual refining capacity in the country to 240 million tons by 2012, both for the home and domestic markets.

Bharat Petroleum Corporation Ltd. (BPCL) is one such company paving the way to India's increased refining capacity. Today, the company's capacity stands at 30 million tons per annum, but in order to grow this capacity at the same rate as India's GDP, the company has initiated a plan involving brownfield expansions at its refinery in Kochi, and has recently begun crude processing new greenfield refinery at Bina, with a current capacity of 120,000 barrels per day, expandable to 240,000 barrels in the future.

Hindustan Petroleum Corporation Ltd. (HPCL) accounts for 10% of India's refining capacity, but with a petroleum product market share in the country of 20% and responsible for selling 40% of the nation's lube oil, the company is fighting a constant battle to refine enough crude to supply its customers. For this reason, a new refinery has been commissioned in Bathinda in partnership with Indian industrial giant Mittal.

Uhde - a global firstUhde, part of the ThyssenKrupp group, has been in India for over four decades, and the Indian subsidiary has worked on over 500 global contracts since that time. Dr. Benno Lueke, managing director of Uhde India, explains how the Indian subsidiary was responsible for taking Uhde's first steps into the oil and gas industry on a global level, at the time that the sector was just starting to liberalize in India: "after the refinery sector opened up, Uhde India was employed to provide engineering services to India's first public sector refinery at Mangalore. Previously in India, this work had only been given to Engineers India, as all of India's refineries were owned and operated by the public sector. The moment the refining sector opened up to the private sector Uhde India got involved. We started with the Mangalore refinery, and since that project we have worked on almost all the refineries in India. This is a competency that Uhde India developed on its own, and it has been instrumental in driving the business here."

It is the fact that Uhde India developed capabilities in the refining sector separate from the main Uhde group that makes it such a unique story. Today, the Indian subsidiary accounts for 20% of Uhde's global workforce, and following Uhde India's successes in the oil and gas sector, a new global business unit comprising the best of Uhde's oil and gas talent is being developed in order to take on projects around the world. "Combining forces," says Lueke, "we hope that we will be qualified for more projects in India, which will enhance our oil and gas business significantly." As well as offering EPCM and PMC services for various refining units, along with Uhde's refining technologies division, the company can also offer hydrogen plants, sulphur recovery units and aromatics extraction processes. It seems that for Uhde, India has been the first step along a long and fruitful journey into the hydrocarbon sector, and will play a continuing role in the years to come.

S Roy Choudhury became chairman and managing director of HPCL in August 2010, after 20 years with the company across the business, from marketing to sales, refinery, pipelines, operations and distribution. Today, Choudhury also serves HPCL as director of marketing. In his interview with Focus Reports, he explains the need to expand the company's refining capacity on a continuous basis: "even after you take into consideration this new refinery, HPCL will only be able to meet 56-57% of its requirement, because of the company's growth rate." Projecting sales figures of 40 million tons by 2015-16, the company has resolved to expand its refining operations in both Mumbai and Visakhapatnam. However, budget constraints mean that these upgrades in capacity have to happen gradually: "We are not going for the full capacity straight away because of the costs involved. Today we are walking on a tightrope economy, especially the public sectors. We have a lot of borrowings, and already HPCL's debt equity ratio is very tight. We concluded it would be better to start at 9 million tonnes, start to bring in revenue, and then go for another 9 million tons."

One of the companies that supported the most the development of the Indian downstream sector has been Engineers India (EIL). According to AK Purwaha, its chairman and managing director, "today, to EIL's credit, there are 20 of 24 refineries in country 9 of which were grassroots refineries built by us and another grass root refinery at Bathinda is close to completion. In this sense, Engineers India is unique, being probably the only company in the design engineering and project management consultancy segment who have more than 50 large refinery projects to its name."

Other PSUs, not traditionally involved in the refining sector, have seen the opportunities available in the sector for growth. Applying its expertise in the fertilizer sector to the refining industry, Projects & Development India's (PDIL) main growth driver today is project management for various refining units, working both in India and abroad.

There are not just opportunities for public sector players to take advantage of the silent revolution happening in the Indian refining sector. Engineering consultancies such as Enereff Engineers were quick to take advantage of the newly liberalized market, but of course had to overcome the traditional boundaries facing any new service provider in the oil and gas industry; building up a track record and gaining the confidence of clients, in this case, the PSUs who already had existing facilities in the country. Enereff's managing director, Lalit Shingal, explains that "once one of the refineries of IOCL had accepted us, there was less resistance with the second unit of the same company: acceptance was a little smoother, faster, better, as they had seen our work."

Shingal has noticed some major changes in the refining industry since he began his company at the time the liberalization of the sector was beginning to occur. As well as noting that today, Indian refineries are processing more heavy and sulphurous crude than ever before, he believes that the largest change has been in the scale of refineries being built and upgraded: "Today we talk of processing over 9 million tons per annum of crude in a single refinery. This has enabled refiners to install a lot of equipment that would otherwise have been non-viable economically." The complexity of equipment needed in such refineries provides plenty of opportunities for niche engineering consultancies such as Enereff, and today the company's main focus is working with Indian Oil at their new refinery at Paradip, providing heat exchangers in order to maximize the plant's efficiency.

Increasingly however, the PSUs that have been responsible for building up India's strength as a refiner are today looking to diversify their activities in order to continue their path to sustainable growth. RK Singh, newly appointed chairman and managing director of BPCL after a long period as director (refineries), spoke in detail to Focus Reports about his company's foray s into the E&P sphere, as well as its plans to move into gas marketing, city gas distribution, petrochemicals and power generation. He also summed up the need to diversify and remain profitable by saying "India is short of crude: we currently import 80% of our crude oil, and accordingly the government has placed a lot of emphasis on increasing crude production. That is how the NELP policy came into being. When India has such a demand for crude, it makes sense for companies like BPCL to enter the upstream sector. We took a risk, but we succeeded. As an organization, we have dreamt to grow and make more profit and diversify our portfolio and activities, and I am sure that BPCL now has a good future ahead."

Go forth and multiply

Another pillar of India's strategy to guarantee the supply of its fast-growing demand has been the acquisition of assets oversees. According to government figures, Indian oil and gas companies are already present in more than 21 countries and produce more than 8 million tons of oil and gas per annum outside of the country. Unquestionably, the company leading this charge to international markets for India is ONGC, who as a PSU is charged with the task of guaranteeing India's energy security for the years to come. Current chairman & managing director of ONGC AK Hazarika, also director (onshore), and charged with the task of leading the company while a permanent chairman is selected, explains the company's strategy in international markets: "Our focus is also on sourcing equity oil from outside India to meet the country's rising energy demands. That is why we created our subsidiary company, ONGC Videsh Ltd (OVL), whose sole purpose is to look for oil internationally. In this regard, another strategy, set by the company in 2002 is to source 20 million tons of oil equivalent per year into the country by 2020, through OVL.

"Today, OVL is a good growth vehicle for the company, and now has 34 properties in 15 countries. OVL has 9 producing assets where it has equity oil, and year on year the company is producing an increasing amount of equity oil. This year it has reached 9.4 million tons of oil equivalent, whereas last year, in 2009, it was 8.87 million tons." Through its flagship projects in Sudan, Venezuela, Brazil and Russia, ONGC hopes to secure energy for India, and also bring the Indian flag to large international projects, and promote the strengths of the Indian oil and gas industry abroad.

Oil India Ltd. (OIL) is another PSU now looking to internationalize its exploration and production activities. Chairman and managing director NM Borah had some interesting comments to make about the challenge of taking those first steps abroad: "one must be cautious and strategic when internationalizing. Three years back OIL had opportunities coming from everywhere, from Latin America to Africa. But we didn't have a structured way of thinking questions such as ‘given the choice, what part of the world would OIL like to go and why? Is it onshore or offshore? Gas, oil or both? If it's oil, what size?' The company didn't have good answers for these questions, so we realized that this was something we needed to figure out before further expanding abroad. This brainstorming might take some time, but it will put OIL on a better position to capitalize on good international opportunities that come along the way."

However, the acquisition of overseas oil and gas assets by Indian companies, though in fast expansion, is still shy when compared to its Chinese and Western counterparts. Outgoing secretary Sundareshan explains that "the Indian model of internationalization has been very different from others. If you look at Western countries, private companies carry all their investments. If you look at other players such as China, all their investments come from governmental funds, with the state's backing. In India, our state-owned companies have been internationalizing on their own, using self-generated resources. There is no national government contribution to this. But even without our explicit guidance, they have done a very good job guaranteeing India's future energy security. We hope that the private sector will add increasingly to this process, and help India's fast-growing economy to secure the future energy need."

The successful internationalization of Indian state-owned companies has followed the liberalization and modernization of the sector. But one issue still remains in the domestic market, and is arguably the main reason private companies are barely present in India's downstream sector: price controls for final consumers. The lack of profitability directly affects the international competitiveness of India's downstream companies and their capacity to acquire assets abroad and raise capital in financial markets.

Despite the challenges faced by oil and gas companies in the Indian market, one sector that has seen much growth and success over the years has been the service industry, and today, after many triumphs in the home market, these companies are now ready to expand internationally. "Once people see our credentials," says K Venkataramanan, president of operations at Larsen & Toubro, "the first question they ask is why are we not already present internationally? We tell them that we have been building our track record in India and now we believe that we have a sufficient number of references to internationalize. We have achieved that critical mass." This is something of an understatement from Larsen & Toubro, India's largest engineering and construction company, which on its 70th anniversary was hailed by India's political and industrial elite as ‘the company that built India'. Now, after conquering many diverse Indian sectors, from oil and gas to defense, the company is looking beyond its borders. As Venkataramanan says, "we have reached the point now where we would definitely like to become an international player, initially in the Gulf area, parts of Africa and South East Asian markets."

Currently, international projects account for 10% of Larsen & Toubro's business, but over the next five years, Venkataramanan hopes to increase this to at least 30%. With this in mind, the company is restructuring its international affiliates. In the Gulf, Larsen & Toubro has split its business into two clusters, one to service Oman and Qatar, and the other to cover Saudi Arabia, Bahrain and Kuwait. By recruiting local managers to lead the businesses, Venkataramanan hopes that their experience will help to drive the businesses. As well as this, the company has invested in a manufacturing complex at Sohar, Oman, where recently the largest structures ever made in the Gulf were completed and delivered: two 15,000 ton jackets for ONGC's Bombay High field. Additionally, the company has representatives in London, Houston, Singapore, Kuala Lumpur and Perth in order to drive more international business. Venkataramanan is optimistic about Larsen & Toubro's future in new countries, but is well aware of the challenges that lay ahead. "Larsen & Toubro is well regarded in the equipment space because that is where we are best known around the world. As a fully integrated EPC player, we are enlarging our circle of recognition. Companies might consider us for a $1 billion USD project, but we need to get into the consideration set right up to $2.5 billion USD, and for a wider range of services."

India's greatest natural resource

After Reliance's discovery in the KG basin back in 2002 and Cairn's discovery onshore in Rajasthan, two discoveries that have changed the shape of the upstream oil and gas industry in India, it might be tempting to believe that India could yet become one of the world's most important oil and gas investment destinations. However, there is one aspect in which India is already a world leader, and this is in the impressive human resource base on which the country is capitalizing. There are very few countries in the world where it would have been easy for Fernas to build a workforce of 1600 employees from scratch in two years; it now has plans to grow to a 5000-strong company by the end of 2011. The human resources are readily available in a country with a population of 1.2 billion; the biggest challenge is to make sure this rapid growth is completed sustainably.

Despite the successes of Indian education institutions in creating generations of engineers and scientists, there were some in the industry who believed that a dedicated institution for oil and gas-based studies was needed in India. Sanjay Kaul, the founder and president of the University of Petroleum & Energy Studies (UPES) explains his desire to found such an institution: "when I was in the oil and gas industry working for an oil company, I could walk into any hotel on any highway and find a hotel management graduate, whereas an industry that contributed almost 16-17% of India's GDP did not even have a university." He goes on to explain the short-term insights that contributed to his vision for an institution like UPES: "IT just boomed, and suddenly there were no software engineers, there were no hardware engineers. Innovation could only come from overseas. I thought to myself that if the same reforms come to the power sector and oil and gas sector, would this also happen? That you have got the reforms done, investment is pouring in, you have got a multiplier effect fuelled by the 9-10% growth rate, but no talent to fuel it."

Having had the initial idea for UPES in 1995, it was only in 2001 that Kaul felt the time was right to put his ideas into action. He believed that the only hurdle in the way of sectoral education was that there was no precedent. After successfully generating interest for the idea in the industry through round table events and forums, Kaul's dream became a reality, and the university became the first public private partnership (PPP) to be recognized by the University Grants Commission, an Indian statutory and regulatory body governing university education in the country.

SJ Chopra, the chancellor of UPES, explains his perception of the mission of the university today. "Our aim with UPES was to address the knowledge and skill gaps covering the entire gamut of the oil and gas industry: upstream, downstream and midstream components. Further, also for the management programs, our emphasis has been very specific to domains. This thinking is reflected in all our academic programs. Over the years we have made efforts to remain true to our stated vision of providing quality education and also engage effectively in training, research and consultancy in the core areas of energy, power and infrastructure. Our aim is to now address the growing needs of the entire spectrum of the energy sector with the idea of developing human talent that is tailor-made for the oil and gas industry."

The Indian Advantage

Many local service and manufacturing companies have made extremely good business out of the oil and gas sector despite international competition caused by liberalization and a transparent tendering process, because their home market allows them to focus on quality while keeping prices low. However, this advantage initially acts as a double-edged sword for companies, as the international reputation for products in a market like India are that quality suffers in order to keep costs low. However, as the cases below show, it is not only possible to keep high manufacturing standards in India, but also to overcome this issue of reputation and perception by international companies and clients.

One company that has capitalized on its Indian advantage is Jindal SAW, India's first and largest manufacturer of submerged arc welded (SAW) pipelines, with revenues of around $1.5 billion USD in 2010. According to Jindal SAW's managing director Sminu Jindal, "international markets already represent around 50% of Jindal SAW's revenues and we intend to continue expanding in fast-growing markets, especially through greenfield investments, and of course if any good acquisition opportunity comes along anywhere else we will take advantage of it."

For Jindal, the initial challenges related to the general perception that Indian products lack of quality were quickly overcome with high investments in quality and HSE standards. "This is a perception that we had to fight initially but eventually our products spoke for themselves. Jindal SAW's experience in the USA speaks volumes about how we managed to gain the confidence of our international customers. Our products faired exceptionally well and were in fact much above their prequalification criteria after which we didn't have to fight for recognition. Jindal SAW was the first of its kind to go not only for ISO 9000, but also 18000 and 14000."

Jindal SAW gained special recognition for its participation in Cairn Energy's Barmer Salaya pipe line (BSPL) project. The project involved the supply of longitudinal submerged arc welded (LSAW) line pipes for worlds' longest underground pre-insulated heat traced pipeline to transport waxy and heavy crude which otherwise solidifies at ambient temperature. "By undertaking this challenge and successfully completing the task," says Jindal, "Jindal SAW Ltd. proved its technical competence and execution capabilities to take on technologically challenging projects and accomplish their execution to meet the project's requirement. We were running on full capacity and to fulfill the requirement we had to set up new thermal insulation coating facility, new liquid epoxy coating facility, new hydrotesting facility for seamless tubes and sect tube welding facility involving complicated welding process – all from scratch. We did this and we also manufactured and supplied 590km of thermal insulated coated pipes all within 11 months – a record no one in the world had accomplished before."

Uma Shanker, chairman and managing director of Advance Valves, recalls the challenges faced by Indian manufacturing companies. In a concerted attempt to change the standard industry template, Advance Valves opted for an extremely transparent way of doing business that helped them win contracts with non-Indian companies. "We were encouraged knowing that you could be successful while disclosing the details of your technology—even as an Indian company. Sometime in the 1990s, the West started listening to Indian engineers. There was some resistance, but gradually they began to accept our capability."

Shanker believes that because of the high levels of quality permeating the local market today, there is now no distinction between international quality levels and Indian ones. "Indian buyers are as technologically demanding as global customers. The differences are vanishing more and more. Particularly with the global market—the supplier base, and the vendor base, and the engineering consulting base, are becoming more and more global; and the scale of operation in India is ever growing."

The fact that prominent Indian companies have been so conscious about the quality of their products and services and the safety of the environment and their employees has helped to break paradigms in international markets about how Indian companies are climbing the international value-added ladder while maintaining their cost-competitiveness.

Jindal Drilling, part of the D.P. Jindal Group, is another example of how Indian expertise has achieved international levels of quality. The company was incorporated in 1983 with a focus on providing quality offshore drilling and correlated services and today operates five jackup rigs and provides a wide spectrum of services such as offshore drilling, directional and horizontal drilling, mud logging, and manufacturing of seamless pipes.

Having built its business through working almost exclusively with ONGC in the Indian market, the company is now planning to spread its tentacles throughout the Indian market and beyond, as Raghav Jindal, newly appointed managing director of Jindal Drilling explains. "With the broadening of the Indian market, we will be looking at partnering with various new entrants. Jindal Drilling is bidding for tenders with some of the other already established companies in the market such as British Gas, Cairn and Reliance Industries and we recently did a drilling project for Cairn. Last but not least, Jindal Drilling will also target the international market and look into acquisitions abroad while participating in quality partnerships."

As part of its growing international recognition, Jindal Drilling recently received an award from Forbes Asia, rating the company as one of the top 200 companies on the continent that are under a billion in market capitalization. "That was a great achievement for the company. The ratings criteria are not specifically provided, but some of the noted areas are growth opportunities in the future, services, profit margins and turnover. There were only 37 companies selected from India, and just two or three from the oil & gas sector," says Jindal.

Gas is always greener

The 2002 discovery of KG-D6 natural gas reserves by Reliance has awakened India to the potential of natural gas in recent years. Today India is finally investing heavily in LNG terminals, gas pipelines, city gas distribution (CGD), compressed natural gas (CNG) and liquified petroleum gas (LPG), and many established Indian players are using such plays as a way to diversify their domestic business in the face of government subsidies on petroleum products.

The state-owned gas and infrastructure giant GAIL is involved in most of India's major infrastructure projects to increase its gas import capacity. According to GAIL's chairman and managing director BC Tripathi, the main "benefit GAIL has provided to India is in the development of its gas industry. When GAIL's first project started in 1984, India didn't have the necessary technology, consultants, or materials providers (such as pipes, compressors, and valves). Today India is one of the largest exporters of pipes in the world, having almost 25% share of the world pipes industry. The same happened in the construction industry: India had no contractors in 1984. When you look at the various equipment suppliers (such as gas turbines, compressors, wags), any item required in the industry is now produced in India and exported elsewhere". As a result, the "contribution that GAIL has provided to India over the last 25 years, apart from building the backbone infrastructure to the industry and supporting the energy supply, is the development of the Indian oil and gas value chain." The growth in GAIL's turnover has impacted directly on its investments, "In the last 25 years GAIL had an accumulated turnover of $5.5 billion USD, but we are going to achieve more than that in the next four years. The company currently has almost 4970 miles of pipelines and we are going to have 9320 miles by 2014/2015, almost doubling the available infrastructure."

Petronet LNG is an example of the emphasis placed by the government of India on increasing the country's energy supply through gas. The company constitutes an effort to bring together four major public sector undertakings (PSUs) to start a new business in LNG, a field where India had no real experience, technology, or expertise. "This was in 1998. The four companies – ONGC, IOCL, BPCL, and GAIL – came together, and to have access to the necessary technology, GDF SUEZ was taken as a strategic partner. The Asian Development Bank also provided international support. In this period Petronet LNG has done pretty well. The company has the biggest re-gasification plant in the world and we have been awarded the largest LNG sourcing contract," explains AK Balyan, CEO of Petronet.

Petronet set up India's first LNG receiving and regasification terminal at Dahej, Gujarat, and is in the process of building another terminal at Kochi, Kerala, both on India's west coast. While the Dahej terminal has a nominal capacity of 10 million tons per annum (MTPA) the Kochi terminal will have a capacity of 2.5 MTPA.

However, there are challenges to delivering the gas India so desperately needs. Balyan explains why. "Petronet LNG needs to have reasonably priced and affordable gas to make it available to a billion people and that is a challenge. The world gas scenario is very volatile and filled with uncertainties. So one thing we are working on is to have sustainable, long-term contracts at reasonable price levels, to be able to import and bridge the gap between demand and supply."

Vikram Singh Mehta from Shell complements Balyan's comments; "You cannot produce gas without infrastructure in place to support the market. That means power plants must be constructed, fertilizer plants must be constructed, and more. Demand is potentially huge, but you have to facilitate the demand." Even so, Shell and its partner Total have built the $700 million USD Hazira Terminal, which includes an LNG storage and regasification terminal with a fully functioning port. The industry hopes that current investments in infrastructure will facilitate the access of oil and natural gas to a largely unattended industry and population; LNG's current prices will help make it more competitive in a coal abundant, though extremely polluted, country.

If finding major buyers looks challenging, try delivering fuel directly to more than a billion people who are urbanizing at record speed, with a 300 million-strong middle class growing in size and purchasing power. This is what companies such as Indraprastha Gas Limited (IGL) are doing. Their main achievement, as its managing director Rajesh Vedvyas highlights, "has been to expand IGL's infrastructure so as to meet the ever growing demand. When I entered the scene there were long queues at Delhi's compressed natural gas (CNG) stations, so I took as my first task the expansion of the infrastructure at a rather fast pace to allow consumers to conveniently refill their vehicles. In a matter of two years IGL has built about 80 CNG stations from an initial base of 160, and another 40 are under construction. There is a huge jump in the infrastructure so as to make CNG refueling a pleasant experience for our consumers."

Thanks to the enforcement of incentive laws and the obligation for all public transport to run on CNG, the pollution levels in Delhi have diminished considerably, though there is still a long way to go. Vedvyas expects that in five years IGL will be at least four times bigger than today in terms of turnover. "Last year IGL had revenues of around $300 million USD, but our target for 2015 is to become a $1 billion USD company."

IGL is also growing quickly in PNG city gas distribution (CGD), though Delhi's wide acceptance of this clean alternative has not been a norm in India. "At the moment we have 40 Indian cities where CGD has been rolled out in the last five years, but in most of these cities, CGD business has not taken off in real terms. There are issues that need to be addressed before the PNGRB tries to implement CGD in 200 plus cities they are planning to. Even cities like Delhi and Mumbai still have unresolved issues. The PNGRB needs to act as a facilitator to resolve these problems first before expanding the CGD business on such a large scale. Unless they do that, it is doubtful that CGD business can be successfully launched in other cities." Again, the problem is not lack of demand, but how much large and small consumers are willing to pay and how much the government is willing to subsidize or enforce the use of cleaner fuels.

Fernas, a Turkish construction company, entered the Indian market explosively 2 years ago through the medium of oil and gas, winning pipeline contracts with GAIL, IOCL, and ONGC's Petro Additions Ltd. It is already looking to diversify its portfolio in India, firstly through power and road projects, but also through city gas distribution, an area where the company has experience as the owner and operator of city gas distribution in the Turkish city of Diyarbaker, where it supplies gas to more than 100,000 consumers.

As CEO of Fernas India Rohit Singhal explains, this would mark a shift in the strategy of Fernas in India so far: "City gas distribution is going to be another area where we may compete as an operator, rather than just as a constructor. The company outside India, especially in Turkey, has moved away from construction to asset ownership. We want to follow a similar strategy in India." It seems that despite the challenges of bringing gas to such an enormous market, including the logistical challenges of bringing gas to new cities and the legislative challenges still being faced regarding distribution rights for new cities, there are companies in India today willing to brave the challenges and seize the opportunities.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com