ONEOK to build new NGL pipeline and fractionator to serve Gulf Coast market

Tulsa-based ONEOK Partners LP said May 2 that it will invest between $910 million and $1.2 billion between now and late 2013 in order to:

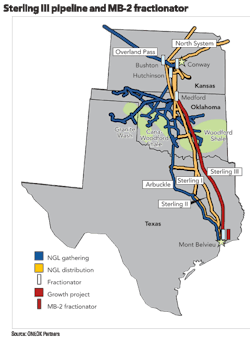

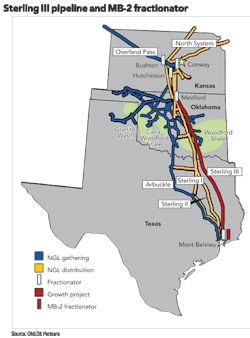

- Construct a new 570-plus-mile, 16-inch diameter natural gas liquids (NGL) pipeline, the Sterling III Pipeline, to transport either unfractionated NGLs or NGL purity products from the Mid-Continent region to the Texas Gulf Coast;

- Reconfigure its existing Sterling I and II NGL distribution pipelines to transport either unfractionated NGLs or NGL purity products; and

- Build a new 75,000 barrel-per-day (bpd) NGL fractionator, MB-2, at Mont Belvieu, Texas.

"These projects will accommodate the growing NGL supplies in the Mid-Continent and elsewhere and help alleviate the infrastructure constraints between the Mid-Continent and Gulf Coast markets, while meeting the requirements of natural gas processors and NGL customers," said Terry K. Spencer, ONEOK Partners COO.

Supply commitments, which are in various stages of negotiation for both the new pipeline and fractionator, will be anchored by NGL production from third-party processors. In aggregate, these projects are expected to generate EBITDA (earnings before interest, taxes, depreciation and amortization) multiples of five to seven times. The incremental fee-based earnings from these projects are expected to increase distributable cash flow and value to unitholders.

Constructing Sterling III, reconfiguring Sterling I and II

The new Sterling III Pipeline is estimated to cost between $610 million and $810 million and will have an initial capacity to transport 193,000 bpd of either unfractionated NGLs or NGL purity products from the partnership's NGL infrastructure at Medford, Okla., to its storage and fractionation facilities at Mont Belvieu, Tex. Once complete, it will double the partnership's current pipeline capacity between Medford and Mont Belvieu.

The investment also includes reconfiguring the existing Sterling I and II pipelines, which currently distribute NGL purity products between the Mid-Continent and Gulf Coast NGL market centers, to transport either unfractionated NGLs or NGL purity products.

"Building this new pipeline and reconfiguring our existing Sterling I and II pipelines give us the flexibility to transport and optimize the flow of unfractionated or purity NGLs through all three pipelines," Spencer said. "These pipeline projects, along with our previously announced Arbuckle Pipeline and Sterling I Pipeline expansions, further enhance our ability to transport NGLs - either unfractionated or purity products - to Gulf Coast markets."

The Sterling III Pipeline will complement the partnership's existing Sterling I and II pipelines, and when operational all three Sterling pipelines will be capable of transporting either unfractionated NGLs or purity NGL products. Construction is expected to begin in early 2013, following receipt of necessary permits and the acquisition of right of way. It is anticipated that a portion of the existing right of way on the Sterling I and II pipelines can be used. Completion is scheduled in late 2013. With additional pump stations, the Sterling III Pipeline's capacity can be expanded to 250,000 bpd.

"These projects will accommodate the growing NGL supplies in the Mid-Continent and elsewhere and help alleviate the infrastructure constraints between the Mid-Continent and Gulf Coast markets, while meeting the requirements of natural gas processors and NGL customers," —Terry K. Spencer, ONEOK Partners COO

The Sterling III Pipeline will traverse the NGL-rich Woodford Shale that is currently under development, as well as provide transportation capacity for NGL production from the growing Cana-Woodford Shale and Granite Wash, where it can gather unfractionated NGLs from the new natural gas processing plants that are being built as a result of increased drilling activity in these areas.

Constructing a new Mont Belvieu NGL fractionator

The new MB-2 fractionator will cost about $300 million to $390 million to construct and will supplement the partnership's 80%-owned 160,000-bpd MB-1 fractionator in Mont Belvieu. Its initial 75,000 bpd capacity can be expanded to 125,000 bpd to accommodate additional NGL volumes as they are added to the currently expanding Arbuckle Pipeline and the new Sterling III Pipeline and the Sterling I and II reconfiguration.

"The additional capacity from the new and reconfigured pipelines and the new fractionator at Mont Belvieu will enable us to better serve our petrochemical customers who are expanding their facilities or converting existing facilities to utilize price-advantaged NGL feedstocks," Spencer added.

The partnership recently submitted a permit application to build the 75,000-bpd fractionator to the Texas Commission on Environmental Quality. Following receipt of all necessary permits, construction of the fractionator is scheduled to begin in 2011 and is currently expected to be completed in mid-2013.

Other capital projects

In December 2010, the partnership announced plans to install additional pump stations on the Arbuckle Pipeline to increase its capacity to 240,000 bpd from 180,000 bpd by the first half of 2012. The Arbuckle Pipeline is a 440-mile NGL pipeline that extends from southern Oklahoma through the Barnett Shale of north Texas and on to the partnership's fractionation and storage facilities at Mont Belvieu on the Texas Gulf Coast.

ONEOK Partners previously announced approximately $1.8 billion to $2.1 billion in growth projects that include:

- Construction of more than 230 miles of NGL pipelines that will expand the partnership's existing Mid-Continent NGL gathering system in the Cana-Woodford and Granite Wash areas by connecting to three new third-party natural gas processing facilities being constructed, and to three existing third-party natural gas processing facilities that are being expanded. When completed, the projects are expected to add about 75,000 to 80,000 bpd of raw, unfractionated NGLs to the partnership's existing NGL gathering systems in the Mid-Continent and the Arbuckle Pipeline;

- Investments in the Woodford Shale in Oklahoma, with projects in both the natural gas gathering and processing and the natural gas liquids segments;

- Installation of seven additional pump stations along the existing Sterling I NGL product distribution pipeline, increasing its capacity by 15,000 bpd;

- Construction of three new natural gas processing plants, with a combined capacity of 300 MMcf/d, and related infrastructure in the Bakken Shale in the Williston Basin in North Dakota;

- Construction of a 525- to 615-mile NGL pipeline, the Bakken Pipeline, to transport unfractionated NGLs produced from the Bakken Shale in the Williston Basin to the Overland Pass Pipeline, a 760-mile NGL pipeline extending from southwestern Wyoming to Conway, Kan.;

- Related capacity expansions for ONEOK Partners' 50% interest in the Overland Pass Pipeline to transport the additional unfractionated NGL volumes from the new Bakken Pipeline; and

- Expansion of the partnership's fractionation capacity at Bushton, Kan., by 60,000 bpd to accommodate the additional NGL volumes from Overland Pass Pipeline.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com