Understanding the impact of the Dodd-Frank Act

John L. Doran,

SunGard Global Services, Houston

The Dodd-Frank Wall Street Reform and Consumer Protection Act is a massive piece of legislation. The primary driver behind the new law is the economic crisis of 2008, when a handful of firms considered to be "too big to fail" came within inches of bankruptcy primarily due to their inability to post margin for their OTC derivative portfolios.

These firms were considered too well managed and diversified to ever have the risk of failure. The best practice for these ailing firms would have been to post collateral up-front with respect to their derivative portfolios. However, they were given a pass due to their AAA credit ratings.

Rather than punish specific companies and strengthen holes in existing regulatory controls, new laws with many new rules were created, impacting financial institutions and other firms that trade derivatives as part of their strategy. Among those "other firms" are energy companies, energy traders, and other industry participants.

The Dodd-Frank objective

The summarized objective of Dodd-Frank is stated as follows:

"To promote the financial stability of the United States by improving accountability and transparency in the financial system, to end 'too big to fail,' to protect the American taxpayer by ending bailouts, to protect consumers from abusive financial services practices, and for other purposes."

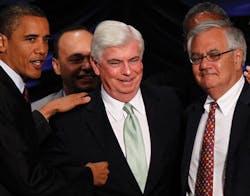

The 2,300 page bill was enacted into law on July 21, 2010. Now that it is law, what does the Dodd-Frank Act mean for energy companies?

The bill contains 16 titles that cover many different issues associated with financial reform. They include:

- Addressing Systemic Risk / Financial Stability

- Reforming the Federal Reserve

- Liquidation Authority

- Hedge Funds / Private Equity

- Credit Rating Agencies

- Executive Compensation / Corporate Governance

- Bank Regulation / Improvement

- Transparency / Accountability

- Consumer and Investor Protection

- Insurance Industry

- Mortgage Reform

- OTC Derivatives – Title VII

The last one, OTC Derivatives – Title VII, will have the greatest impact on energy companies.

Title VII OTC derivatives

The Title VII OTC derivatives section of the Act will have the biggest impact on energy trading organizations. The objective is to treat OTC derivatives like existing regulated future contracts. This means they will be executed on an exchange and be subject to clearing, reporting and control constraints. In order to achieve this, several new elements have been introduced by the Dodd-Frank Act.

- New Definitions: Market Participants (non-banks)

- Registration

- Execution / Clearing Requirements

- Capital and Margin Requirements

- Recordkeeping / Reporting Requirements

- Clearing Requirements

- New Business Conduct Standards

- Position Limits

Current rule mandates

There are currently 30 rule-writing teams that will be developing new regulations associated with the Dodd-Frank Act. While all but two of the 30 teams have proposed rules (the Volcker rule and portfolio margining procedures), many of these rules, which had original mandates of being complete before July of 2011, have extended comment periods and deadlines. These recent events indicate that implementation of year-end 2011, with rules phased in over time rather than all at once. The current status of the rules is available on the CFTC web site located at www.cftc.gov/LawRegulation/DoddFrankAct/index.htm.

On the CFTC web site, CFTC Chairman Gary Gensler stated, "The Wall Street reform bill will – for the first time – bring comprehensive regulation to the swaps marketplace. Swap dealers will be subject to robust oversight. Standardized derivatives will be required to trade on open platforms and be submitted for clearing to central counterparties. The Commission looks forward to implementing the Dodd-Frank bill to lower risk, promote transparency, and protect the American public."

The next sections will examine several Title VII elements as they relate to energy trading firms.

New definitions of market participants

A key issue for current market participants is the new categorizations by the CFTC/SEC rule writing team. If one is categorized as a Swap Dealer or a Major Swap Participant, then new capital, margin, reporting and regulatory reviews will be required. CFTC chairman Gensler estimates that there could be more than 200 entities that are classified as a "Swap Dealer." At this time, it is unclear how many entities will fall into the major swap participant category.

What characteristics have been used to define a Swap Dealer?

The CFTC believes that the distinguishing characteristics of a Swap Dealer are described as an entity that:

- Tends to accommodate demand for swaps from other parties

- Is generally available to enter into swaps to facilitate other parties' interest in entering into swaps

- Tends not to request that other parties propose the terms of swaps, but tends to enter into swaps on their own standard terms

- Tends to be able to arrange customized terms for swaps upon request, or to create new types of swaps at their own initiative

What characteristics have been used to define a Major Swap Participant?

The CFTC believes any one of the following characteristics apply to Major Swap Participants:

- An entity that maintains a "substantial position" in any of the major swap categories, excluding positions held for hedging or mitigating commercial risk and positions maintained by certain employee benefit plans for hedging or mitigating risk in the operation of the plan

- An entity whose outstanding swaps create substantial counterparty exposure that could have serious adverse effects on the financial stability of the United States banking system or financial markets

- Any financial entity that is highly leveraged relative to the amount of capital such entity holds, and that is not subject to capital requirements established by an appropriate Federal banking agency, and that maintains a substantial position in any of the major swap categories

What is the commission's definition of hedging or mitigating commercial risk?

The CFTC will examine facts and circumstances at the time a swap is entered into along with entity's overall hedging and risk mitigation strategies. These include swaps that:

- Qualify as bona fide hedging under CEA rules

- Qualify for hedging treatment under FASB 133

- Are economically appropriate to the reduction of risks in the conduct and management of commercial enterprise, where the risks arise in the ordinary course of business from:

- A potential change in value of (i) assets that a person owns, produces, manufactures, processes, or merchandises, (ii) liabilities that a person incurs, (iii) services that a person provides or purchases

- A potential change in value related to any of the foregoing arising from foreign exchange rate movements

- A fluctuation in interest, currency, or foreign exchange rate exposures arising from a person's assets or liabilities

New oversight for swap dealers and major swap participants

An entity characterized as a swap dealer or major swap participant will be subject to new CFTC oversight. Although the details behind these new rules are continuing to evolve, Table 1 describes the type of oversight market participants will be subject to for each type of activity.

Position limits for all swap categories

Most energy trading firms are familiar with position limits that have been established on regulated exchanges. The Dodd-Frank Act now plans to establish position limits for all categories of swaps.

As of June 2011, 28 core physical-delivery contracts and their "economically equivalents" derivatives have been targeted for position limits. Most of the position limits will focus on spot month during early implementation with future delivery periods to follow with additional specificity.

These limits will apply in aggregate across all markets in the same commodity. This will include all futures, options and economically equivalent swaps based on underlying physical commodities. This will be a significant challenge because there is limited visibility/oversight from the government maintaining list of economically equivalents at this time.

In fourth quarter 2010, the CFTC approved plans to establish a large trader reporting system for OTC swaps that requires clearing organizations and swap dealers to report positions of economically equivalent swaps on a daily basis.

Eventually, the swap data repositories will have this data, but the earliest that they will be up and running is toward the end of 2011. This creates a challenge for the CFTC to establish position limits without a complete picture of the market size and behavior. During an open meeting in October 2010, CFTC Commissioner Jill Sommers emphasized that "no position limit is appropriate if it is imposed without the benefit of receiving and fully analyzing complete data concerning the open interest in each market."

Assuming that this eventually gets sorted out, an organization must consider developing a master reference table to classify "like" products, and maintaining it as new products evolve. It also will have to be able to group these products across multiple markets. This will not only be challenging for entities trying to comply, but equally challenging for the CFTC to enforce.

Conclusion

The Dodd-Frank Act's substantial size and scope, and its overall objective, makes the law broad and over-reaching. Given the role of the 30 rule-making teams, regulators, and industry participants are only at the beginning of the process of establishing and implementing the actual rules.

Specifically, Title VII dealing with OTC Derivatives will have the biggest impact to energy trading firms. Those entities categorized as a swap dealer or major swap participant will face new capital, margin, reporting and regulatory review. Additionally, once fully implemented they will need to deal with newly imposed aggregated position limits.

One may question how much and how fast this all needs to be rolled out, as well as the potential adverse impacts this level of regulation may have on the markets. Centralized clearing reduces counterparty risk, but to the extent to which the related capital and margining requirements impact other areas of the business by reallocating these dollars is still unknown, as is the impact of a failed clearinghouse.

It is evident that regulatory reform is a moving target and will continue to be over the next year or two. Looking at the bright side, increased transparency into the swap market could be beneficial and usher in new opportunities.

Meanwhile, regulators are encouraging participation and comments from industry participants. It is strongly recommended that those firms affected by regulation stay involved in the evolution of the rules by voicing their issues and concerns to their representatives in Congress and in open meetings, as well as providing comments and letters to the CFTC. Networking with peer organizations is another helpful way to better understand how to prepare for this new legislation.

About the Author

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com