The future of the OFS sector

Will change be incremental, or will there be a fundamental restructuring?

CHRIS ROSS, CHRIS CHAPIN, DAVID WOODS, AND HENRY XI,

THE UNIVERSITY OF HOUSTON CT BAUER COLLEGE OF BUSINESS, HOUSTON

BY WAY OF BACKGROUND, the collapse of oil prices from late 2014 through early 2016 undermined the economic rationale for development of new hydrocarbon resources by oil and gas companies. They concluded that future oil prices would be "lower for longer" and slashed their capital expenditures, thereby removing much of the revenues from oilfield equipment and service (OFS) companies.

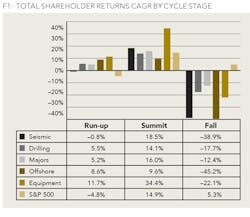

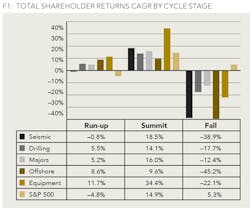

To add insult to injury, the oil companies negotiated down the prices they would pay for equipment and services, further reducing OFS revenues. OFS companies were obliged to cut their own costs and lay off tens of thousands of employees. Figure 1 highlights how difficult of a time the OFS industry has had during this recent downturn in oil prices.

In the aftermath of the price collapse, oil companies overturned the previous hierarchy of resource development opportunities. They successfully lowered the costs of developing oil shales by exploiting multiple stacked horizontal targets from a single drilling pad, drilling longer laterals and intensifying fracturing with increased horsepower injecting substantially greater quantities of fluids and proppants into the formations. Instead of being the highest cost resource, oil shales undercut the cost structures of most deepwater oil field and Canadian oil sands developments. Further, development of low cost natural gas shales led to an oversupplied US gas market and the construction of US LNG export facilities, compounding an already weak and oversupplied international LNG market and undermining traditional international pricing mechanisms.

The perception of "lower for longer" oil prices and the shift in the hierarchy of resource development economics has led to intense pressure to lower capital and operating costs and increase well productivity across all hydrocarbon resources. Overall, spending by oil companies is insufficient to support the number of OFS companies that compete in the 32 OFS segments tracked by Spears and Associates. Consolidation should be expected in the most fragmented segments. But there will also be growth opportunities for those companies that are able to develop equipment or services that contribute to lower overall costs and greater well productivity.

One opportunity that appears to have intriguing potential is to leverage big data analytics to improve decision quality in developing unconventional and conventional resources.

The opportunity to leverage big data analytics has been hinted at in announcements of recent major mergers and acquisitions:

1. Schlumberger Cameron, citing benefits from marrying Cameron's data from well-head equipment with Schlumberger's strong tradition of reservoir information.

2. Technip acquired FMC Technologies, potentially opening up opportunities to harmonize deep-water wellhead and platform design and construction.

3. The merger between GE Oil & Gas and Baker Hughes has promised to provide a framework for deploying GE equipment data collection and analysis to add value to Baker Hughes' suite of products and services.

4. Transocean has sold its fleet of jack-up drilling rigs to Norwegian Borr Drilling to become a "pure play" deepwater drilling company, focused on "utilizing decades of information, data and knowledge collected drilling offshore wells for customers across the globe."

The question is whether these transactions are being driven by the desire to buy distressed assets at a low point in the oil price cycle or do they represent the initial stages of a fundamental restructuring of the OFS sector?

OUR RESEARCH

A student team from the CT Bauer College of Business of the University of Houston was formed to address this question in three parts:

• Outline the digitization opportunity and assess which companies might be the beneficiaries

• Describe the OFS majors' recent and possible future strategies to grow enterprise value through M&A and participation in the digitization opportunity

• Assess the likelihood of a fundamental restructuring of the OFS industry

The team met with industry experts from oil and gas, oilfield services, financial analysis, and supply chain sectors, researched key companies' investor presentations and financial results and summarized their findings in this report.

THE DIGITIZATION OPPORTUNITY

Pursuit of a strategic technology enabled vision

The team concluded that there was substantial value to be unearthed in terms of better decisions and lower costs through deployment of sensors at all stages of the E&P chain to deliver a massive quantity of higher quality data that can be interrogated by AI-enhanced algorithms. The challenge will be to integrate unstructured data from multiple sources by enforcing common standards, or to create algorithms that can directly interrogate data captured in different forms. Both pathways appear to be under construction.

Drivers

The drivers for oil and gas companies are:

• To lower costs of high-cost resources, thereby improving near term returns on capital and expanding the economically attractive opportunity set for future investments

• To create more sophisticated decision support systems leveraging big data analytics to advance from descriptive to predictive and on to prescriptive analytics.

• To stimulate innovation and competition in the OFS sector by building win-win alliances with existing OFS companies and by encouraging new entrants that can disrupt inefficient practices.

• To maintain control and privacy of their data with the goal of leveraging the data to develop competitive advantage in superior reservoir understanding, thereby identifying and capturing new opportunities and safely developing them at lowest possible full-cycle cost.

Target areas for uncovering digitization's value

There are opportunities to lower costs and improve decision quality through big data analytics in the three main E&P stages: finding, developing, and producing oil and gas:

• Finding offers incremental advances leveraging the continuing expansion of computing power to build increasingly precise subsurface models and predict problems that might be encountered during the drilling process

• Developing further expands subsurface understanding by linking geophysical, geological and fluid dynamics data and testing of multiple options for development drilling, well design, surface equipment, gas processing and gathering systems. For deepwater, there is an opportunity to learn from the Light Tight Oil (LTO) experience in standardizing and automating to inform platform design, subsurface equipment and possible tie-backs to optimize safety, overall recovery, and net present value.

• Producing will benefit from better reservoir models that can continuously modify themselves to incorporate real-time production data, pressures, temperatures, flow rates and performance of individual fractures. These data can be fed back to continuously improve reservoir models and development plans, and crystallize future plans for deployment of Enhanced Oil Recovery (EOR) technologies. There is also an opportunity to modernize logistics using bar codes covering the delivery of materials, tubular goods, equipment, proppants, chemicals, and fluids to the well site and recycle or dispose of produced water.

Overall, all three of these stages can see great improvements in decision quality, efficiency and automation, as well as worker and environmental safety, through technology. The areas that should see the largest impacts are Development and Production. Field-development planning, reservoir modeling, production optimization, drilling and process-control automation, and reliability and preventative maintenance are all highly impactful areas for cost-control, efficiency, and productivity.

Data acquisition

GE has pioneered the use of sensors in its industrial products such as aircraft jet engines, analyzing the continuous flow of real time data to identify emerging weaknesses and to schedule maintenance actions. Following this lead, oilfield equipment manufacturers will all be incorporating sensors in their products to continuously examine rock properties before during and after fracking, measure flows within the reservoir of water and hydrocarbons and monitor pressure and temperatures as well as physical production of oil, water, and gases. Companies such as Siemens, ABB, and Honeywell are expanding their offerings of sensors and control systems.

Data architecture

Different data architectures are under development:

• Schlumberger is proposing its Petrel platform with embedded proprietary software packages. This is potentially threatening to large oil and gas companies, which may be reluctant to outsource a core competence: reservoir understanding.

• BHI-GE is proposing use of its Cloud-based Predix platform, appears prepared to host outside Apps and could accommodate new, dynamic models.

• Halliburton subsidiary Landmark's DecisionSpace® suite of cloud based products successfully attracted third party geoscience Apps and should be able to host third party software applications for big data analytics.

• New entrants with Cloud services incorporating high levels of data security are considering building their own platforms to serve the oil industry. Candidates could include Microsoft, IBM, Amazon, and other companies with big data analytics and Cloud services.

BIG THREE STRATEGIES

Schlumberger - recent strategy

Schlumberger (SLB) is the giant among the OFS companies with a February 1, 2017 Enterprise Value more than twice Halliburton's and five times BHI/GE's. SLB competes in 22 OFS segments, compared to 16 for BHI/GE and 10 for Halliburton and has a truly worldwide footprint. Through its integrated service offerings primarily with National Oil Companies, SLB has benefited from experimentation in compiling and interpreting data from all stages of the oil and gas E&P chain. SLB is keen to provide this expertise to all oil and gas companies and has made radical cultural, organizational, and process changes over the past decade with this in mind.

Schlumberger is a serial acquirer of companies that strengthen its competitiveness, allocating $1 billion of cash per year on average from 2012-2016 to acquisitions compared to an average of $100 million per year by Halliburton and half that by Baker Hughes. Schlumberger's recent acquisition of Cameron has served to reinforce its reputation as a technology-focused organization. From Schlumberger's press release on the merger: "The merger will create technology-driven growth by integrating Schlumberger reservoir and well technology with Cameron wellhead and surface equipment, flow control and processing technology, [resulting] in the industry's first complete drilling and production systems..."

Schlumberger - recent and possible future M&A

Schlumberger's acquisition of Cameron is being followed by other smaller transactions that reinforce its existing verticals such as Peak Well Systems (Peak), a leading specialist in the design and development of advanced downhole tools for flow control, well intervention and well integrity and Meta Downhole Limited, a UK-based engineering and service company that offers technology and expertise to provide downhole metal-to-metal isolation solutions in well integrity applications. In addition, SLB has formed One Stim, a joint venture with Weatherford to deliver completions products and services for the development of unconventional resource plays in the United States and Canada land markets.

This flurry of deals conveys an aggressive strategy to deepen its technology portfolio and strengthen its competitive position in multiple verticals.

There remain many other opportunities for SLB to strengthen its existing verticals: The Onshore Contract Drilling segment comprises hundreds of companies with very small market shares. Schlumberger participates in this segment but only has 4% market share (second smallest presence in any segment in which it competes). Schlumberger's market dominance in the OFS sector makes it the leading candidate to make focused acquisitions in this low Herfindahl market segment. The onshore contract drilling market is highly regionalized, due to the high cost of moving rigs and variations in the type of equipment that is required. Schlumberger might consider acquiring companies with a presence in regions it sees as high growth areas such as the Marcellus or Permian, and possibly for companies that will add to its presence in its current regions and decrease its competition.

Schlumberger - digitization strategy

Schlumberger's digitization strategy for the future will most likely build on its historical strategy of leveraging its close relationships with NOCs to advance its offerings in big data analytics, connecting geophysical, geological and production data sets to create field development insights. Schlumberger is able to offer to its worldwide customer base algorithms developed while providing services to NOCs and to further develop the algorithms through acquisition of small vendors with interesting new approaches.

The problem with this approach is that its Petrel platform is not yet cloud-based and is not designed to host third-party apps, limiting oil company options. Schlumberger will be a leader in this field in the near term, but may in the longer term experience intense competition in North America from cloud-based vendors hosting third-party apps.

Baker Hughes/GE - recent strategy

BHI/GE competes in 16 OFS segments and the business logic of the merger is to bring GE experience in manufacturing and in real time monitoring of equipment performance to the oil field, together with its cloud-based Predix platform. GE has been experimenting with leasing rather than selling equipment to operators, following the successful approach it has deployed for aircraft engines, but does not yet seem to have found a successful oilfield model. With a much broader portfolio of equipment and services, the company has a strong position from which to pioneer new business models. If it chooses to provide the Predix platform on an open source basis to entrepreneurs with big data analytical tools, it would be in a strong position to establish Predix as a preferred host, and then to acquire the most successful app offerings to form a portfolio.

The merger of Baker Hughes with GE Oil & Gas through a strategic partnership should make both companies stronger, more competitive, and bring additional value to both companies' shareholders through reduction of operational costs as well as by application of GE's data analytics platform to Baker Hughes' operations and services. The combination of these two companies puts together several complementary products and services, allowing them to better compete with rivals such as Schlumberger and Halliburton by offering new bundled service offerings.

BHI/GE - recent and possible future M&A

Beyond the merger, Baker Hughes and GE Oil & Gas have small market shares (below 10%) in several segments (Table 1). There are several small companies that are currently under financial stress in these segments that might make good takeover targets. Many of these companies are only in one segment, but there are several with a small presence in multiple complementary segments thereby strengthening BHI/GE's verticals in multiple complementary segments. For example, acquiring RPC Inc. (Coiled Tubing & Services and Downhole Drilling Tools) could increase BHI-GE's market power in two segments in which BHI/GE currently has a small presence, probably without attracting scrutiny from the US Department of Justice.

BHI/GE - digitization strategy

Baker Hughes should see significant benefits from upgrading their existing systems and infrastructure with GE's digital technologies. These benefits include faster and better decisions, better asset management, and increased productivity. Specifically, Baker Hughes will be able to boost its efficiency with the use of GE's Predix big data technology, bringing down its customers' cost per barrel, allow for faster cycle times, and increase its ROI.

From the GE website: "With operations in more than 120 countries, Baker Hughes, a GE Company, will draw from GE's digital technology expertise and Baker Hughes' capabilities in oilfield services, offering customers best-in-class physical and digital technology solutions for productivity."

BHI/GE faces a major challenge over the next few years to build a coherent portfolio of products and services that is complementary and realizes the potential of its Predix digitization platform.

Halliburton - recent strategy

The Halliburton-Baker merger would have provided an opportunity for Halliburton to capture substantial synergies, cementing its position as a cost-efficient competitor. However, it would have resulted in excessive concentration in several vertical segments. The US Department of Justice was most concerned about increased market power of the combined companies in several offshore segments and opposed the merger. Due to this DOJ opposition, compounded by an unfavorable change in industry conditions caused by the decline of oil prices, Halliburton was forced to terminate the merger agreement with Baker Hughes and pay a $3.5 billion termination fee. This has hurt Halliburton's ability to finance future M&A activity.

Halliburton - recent and possible future M&A

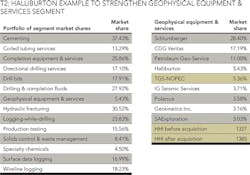

Compared to SLB, HAL has been relatively inactive in M&A since the failure of its BHI deal. However, Halliburton is constrained in its potential for organic growth within its current portfolio and will need to find a way to take advantage of low OFS valuations and increase its market share within those segments where it competes that have low-Herfindahl indices. For example, acquisitions within the geophysical equipment and services segment might complement Halliburton's Landmark software offerings. TGS-NOPEC, the fifth-largest player in the segment, owns a 5% market share. If combined with Halliburton, Halliburton's market share would double to 10% while the segment Herfindahl Index is only marginally increased (Table 2). TGS has an EV/EBITDA multiple of 5.74 compared with HAL EV/EBITDA of 25.69. An integration of TGS into the Halliburton web, if done properly and at the right price, could lead to a more powerful geosciences service offering by Halliburton and could be highly accretive.

Halliburton - digitization strategy

Halliburton's 2016 annual report states: "We are the execution company, with the best employees, technology, and service offerings to deliver on our value proposition - collaborating and engineering solutions to maximize asset value for our customers." The company is thoroughly grounded and is unlikely to stray far from its current product and service portfolio.

Yet it has taken some steps towards deploying big data analytics in the Middle East where "Halliburton Consulting and Project Management collaborated with the customer to identify the optimal plan. New well locations were optimized for drilling using Halliburton's patented Well Placement Optimization methodology. The coordinated plan was built with production assurance from Landmark's DecisionSpace™ Assisted History Matching, which uses reservoir data collected over time to create predictive models."

Halliburton's Landmark subsidiary has historically provided an open-source cloud-based platform that allows application integration and allows users to access third party applications. Halliburton has an opportunity to extend its Landmark platform into a distinctive cloud-based, big data analytics system combining geophysical, geological and production data to indicate ways to maximize hydrocarbon recovery and value.

LIKELIHOOD OF A FUNDAMENTAL RESTRUCTURING OF OFS SECTOR

After digesting its research, the team is persuaded that there is substantial value to be unearthed from increasing the quantity and quality of data and analyzing geophysical, geological, and production data sets. This would lead to understanding more fully the geometry and geology of oil-bearing rocks over time, their responsiveness to different drilling and completion approaches, and the likely results of those approaches in terms of early production rates, decline rates, and ultimate recovery of hydrocarbons. This enriched understanding should translate into dynamic development plans that optimize hydrocarbons recovery based on continuous monitoring of the reservoir. It should also result in higher returns on capital and higher intrinsic value for the companies that best implement the new algorithms.

However, the team remains skeptical on the value of synergies between large-scale equipment manufactured to provide real-time data and the big data analytics services that might provide valuable insights and improved decision-making in oil and gas field development. It seems to us that the benefits can be achieved through contractual means, specifying the data formats required from the equipment to enable data analytics to be performed. Even better would be industry standards adopted to allow multiple data bases to be interrogated by artificial intelligence-enhanced algorithms.

Moreover, there are risks in combining unlike companies. In previous research, UH Bauer teams observed differences in the drivers of shareholder value for the equipment manufacturing segment from those driving shareholder value of the major service companies and concluded that different business models and different capabilities are rewarded in the two sectors. Putting them together in a single organization may weaken both parties.

CONCLUSIONS

The team concluded that substantial value will be created from innovation and deployment of big data analytics in the oil field, but there does not seem to be a strong business case for a fundamental restructuring of the OFS sector. Indeed, consolidation of verticals to provide integrated services risks alienation of oil and gas company customers as threatening their fundamental value proposition of finding, developing and operating oil and gas fields based on their expert reservoir understanding. Less threatening and with more evident synergies is the acquisition by Technip of FMC Technologies, which mainly designs and engineers subsea and production systems.

However, there seems a strong likelihood of attrition in the number of companies in each segment. The three OFS majors are limited in their growth potential in their existing verticals, and they have opportunities to add new verticals or strengthen their few weak segments by acquisition at a time when valuation multiples are low. Also, cutbacks in capital spending have led to less work available in many sectors than the total capacity available, particularly in deepwater segments. A roll-up possibly funded by private equity of two to four companies in several segments would allow capacity to be removed to match available demand without leading to high Herfindahl indices. Overall, the team expects there to be significantly fewer public OFS companies in five years' time than today still competing in the same "vertical" segments.

A second conclusion addresses which companies will capture the value created by advances in big data analytics. Our view is:

• Innovators in data acquisition technologies should do well. Affordable sensors, chemical tracers, and controls to provide massive 4D data sets tracking reservoir properties and production metrics over time will provide the foundation for better field development plans and allow for increasing automation and cost reduction.

• Geophysical service companies with existing "spec" data sets will be able to transform existing 2D seismic libraries to approximate 3D images and sell useful, albeit low, resolution images. Improved geophones and improved processing will lead to higher resolution subsurface images.

• Oil companies will be able to upgrade their existing reservoir models to incorporate new relationships derived from big data analytics. New reservoir models will become more accurate more quickly through machine learning algorithms.

• Creators of successful new artificial intelligence enhanced data analytics algorithms will prosper. Many of these may be small "garage" companies with a single powerful idea and the capabilities to bring it to market. Others will be oil and OFS companies that nurture the new capabilities internally to become early adopters.

• The major OFS companies will compete with oil companies as predators seeking to acquire early successful software entrants and integrate their capabilities into their current models while being Darwinian in rethinking their product portfolios to align with the new technologies.

• The providers of platforms hosting massive data sets to enable "Cloud Computing" as well as basic analytic tools will be able to charge usage and service fees. These may include new oilfield entrants such as Microsoft, Amazon, and Google/Alphabet as well as existing OFS companies.

Big data analytics will form a new fiercely competitive ecosystem, driving down costs and increasing capabilities. This fierce competition will over time award most of the benefits to lease-holders who harness the resulting innovation most effectively to become the low-cost producer of what had previously been thought to be high-cost resources. Ultimately, competition among the oil and gas companies deploying big data analytics innovations will lead to lower oil and gas prices than would otherwise have occurred, so the true beneficiary will be the oil and gas consumer.

ABOUT THE AUTHORS

Chris Ross ([email protected]) is an executive professor of finance at the CT Bauer College of Business of the University of Houston. He has authored numerous articles on the oil and gas industry and is co-author of Terra Incognita: A Navigation Aid for Energy Leaders. He chairs the Oil and Gas Policy Subcommittee of the Greater Houston Partnership, and sits on the Program Committee of the Offshore Technology Conference. Ross began his career with BP in London. In 1973 he joined Arthur D. Little, and moved to Algeria where he managed a large project office assisting SONATRACH with commercial challenges in oil and LNG and advising on OPEC issues such as price coordination, price indexation, and production quotas. In 1978, he moved to the ADL headquarters in Cambridge, MA and on to Houston, where he opened the ADL office in 1982. From then until 2010 he led the Houston energy consulting practice which was acquired by Charles River Associates in 2002. As a consultant, Ross works with senior oil and gas executives to develop and implement value creating strategies.

Chris Chapin, David Woods, and Henry Xi are students at the CT Bauer College of Business of the University of Houston.