Post-OPEC tightening, aggressive buying beyond the white hot Permian

ANDREW MASON DITTMAR, PLS INC., HOUSTON

AFTER TWO YEARS of belt tightening, companies across the energy space are loosening up and looking to take advantage of an increasingly brighter 2017. Even before OPEC delivered early holiday cheer in the form of a substantial output cut, oil prices were firming up from the effects of two years of drastic cuts to exploration and development budgets. The OPEC announcement and a historic agreement with non-OPEC producers just added a dose of confidence to an already strong deal market.

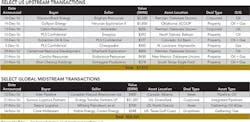

US onshore shale plays are perhaps best positioned to take advantage of rising prices and unsurprisingly continue to be extremely popular acquisition targets. The Delaware Basin, which has been the biggest story in upstream oil and gas for the last six months, continues to make headlines. Recently, two more private players that made early bets cashed out to established public companies. Brigham Resources, the creation of Bakken pioneer Bud Brigham, sold to Diamondback for $2.4 billion. In return for its investment, Diamondback added significant scale to its earlier southern Delaware entry by picking up 77,000 net acres primarily in Pecos County, Texas.

Diamondback was joined in the Delaware by fellow Permian veteran Callon Petroleum, which made its debut in the core southern Delaware by acquiring Ameredev for $650 million. That deal gives Callon a contiguous position in Ward County of just over 16,000 net acres. Centennial Resource Development, freshly public following its acquisition by a Riverstone-backed and Mark Papa-led acquisition company, is already making big moves by acquiring Silverback Exploration's Reeves County assets for $855 million. According to Papa, Centennial hadn't planned to strike such a big deal so quickly, but the opportunity to acquire 35,000 net acres of core Reeves County was simply too good to pass up.

While Permian acreage has consistently generated strong valuations through the down cycle, other plays are now seeing a ramp-up in the value of undrilled acreage. Within minutes of Diamondback announcing its Brigham deal, Gulfport Energy unveiled that it was entering the SCOOP play with a splash by acquiring just over 45,000 net acres from privately held Vitruvian Exploration II. The $1.85 billion deal was struck at a valuation of over $25,000 per acre-an all-time high for either the SCOOP or STACK. The only comparable deal in the plays in terms of size and acreage value is the acquisition of Felix Energy by Devon in December 2015. Devon shelled out a hefty $20,000 per acre in the $1.9 billion buyout and has managed to turn itself into an industry leader in the STACK play along with Continental and Newfield. Gulfport undoubtedly hopes to replicate that level of success in the SCOOP.

As a show of strength in the deal markets after the OPEC decision, buyers outside the white hot Permian are signaling an aggressive expansion to secure Tier 1 acreage in other large US onshore resource plays. Examples in the past month include a private company paying $28,000 per acre in a $292 million Bakken deal sold by Enerplus, Extraction Oil & Gas paying $10,000 per acre in a $177 million Niobrara deal sold by a private company, a private company paying $5,000 per acre in a $450 million Haynesville deal sold by Chesapeake, and an IPO by WildHorse Resource that values a combination of core Cotton Valley acreage in Louisiana and Eagle Ford acreage of $3,000 per acre.

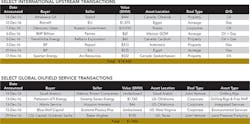

As upstream companies build out their asset bases, oilfield service companies are anticipating an uptick in drilling activity to pull them out of the worst slump in a generation. Perhaps no portion of the energy industry has been hit harder during the downturn, with drilling rig companies reeling from a one-two punch of slower activity coupled with demands for deep discounts. They now hope to make up ground on both counts. Patterson-UTI struck a deal to acquire Oklahoma-based Seventy Seven Energy for $1.76 billion in debt and equity. The deal adds high-spec drilling rigs and pressure pumping assets in active plays in West Texas and the Midcontinent.

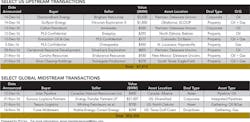

Midstream firms have been active consolidators. In what is set to be the largest energy deal of 2016 barring some spectacular last-minute fireworks, Sunoco agreed to acquire Energy Transfer Partners in a deal valued at $51 billion. The deal leads 2016 midstream transactions, slightly beating competitor Enbridge's acquisition of Spectra Energy for $45 billion announced in September. The merger and acquisition model in midstream of major corporate tie-ups differs from upstream activity, where buyers have focused on asset deals and the buyouts of privately held pure-plays.

In the largest upstream deal of 2016, and a major win for the Putin administration, Russia was able to raise $10.9 billion in funds and offload a 19.5% stake in national oil company Rosneft to Glencore and the Qatar Investment Authority. The deal leaves the Russian state with a bare majority in Rosneft, which had considered buying the shares itself from the state due to the lack of takers. The deal is also a big win for Glencore over arch rival Trafigura, which has close ties with the Russian firm. Glencore is ponying up $322 million of its own funds with the balance coming from Qatar and non-recourse debt. Meanwhile, Glencore secures an offtake agreement of 220,000 bbl/d for the next five years that positions the trader extremely well ahead of the expected continued rally in oil prices.