WTI Futures in 2017

THE MARKET WAS GLOOMY IN 2016, BUT OPEC CUTS PROVIDE SOME HOPE IN THE COMING YEAR

BRIAN L. MILNE, SCHNEIDER ELECTRIC, OMAHA, NEB.

AS DEMONSTRATED with Brexit, the Columbian peoples' rejection of a peace accord with FARC and the election of Donald Trump as the 45th President of the United States along with Republican majorities in both chambers of Congress, predicting outcomes is no easy task. With the exception of Republicans holding the House of Representatives, forecasters overwhelmingly predicted the opposite outcome to these stunning elections.

Yet price forecasting is a required endeavor for the oil industry, and oil futures are notoriously volatile. Fortunately, the market offers a variety of information that can be captured and studied, and adjustments and corrections can be made to most positions taken in oil futures. As we look into the 2017 horizon, a quick study of key drivers to the price action for West Texas Intermediate futures traded on the New York Mercantile Exchange in 2016 will provide counsel.

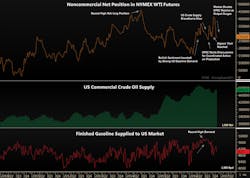

It was a gloomy market in early 2016, with WTI futures plunging to a $26.05 bbl multi-year low in February, as oversupply swamped futures values. Noncommercial traders held the fewest long positions, a bet prices would move higher, in more than 3-1/2 years. Yet, in less than four months, nearest delivered WTI futures would nearly double, topping $50 bbl in May even as global oversupply persisted.

A turnaround in the market's psychology, aided by historically strong early year gasoline demand was a key factor that rallied WTI futures from winter to late spring. A market follower can capture this data updated weekly by the Commodity Futures Trading Commission in their Commitment of Traders report that can be analyzed with DTN ProphetX software (see screenshots).

The market's psychology is reflected through the disposition of noncommercial traders who are speculating when buying a futures contract since they are not hedging a physical position in the underlying market. The accompanying chart highlights the frequent incongruities between sentiment and fundamentals, with noncommercial traders adding long WTI positions even though domestic commercial inventory continued to build.

Commercial crude inventory in the United States was drawn down in the second quarter from a late April peak well above 500 million bbl, according to data from the Energy Information Administration. Nonetheless, supply remained at stubbornly elevated levels despite record high implied gasoline demand in 2016 which peaked in June, said EIA. By mid-July, crude stockpiles were again growing, accelerating long liquidation that pressed nearest delivered WTI futures below $40 bbl in early August.

The summer's bearishness was also reflected in widening WTI calendar spreads that had narrowed by roughly 80% from the early first quarter to the end of the second quarter on expectations demand growth would overtake new supply and gradually whittle down bloated inventory as low market prices took their toll on production activity. Indeed, US crude production dropped to a 26-month low in ending June. However, domestic output edged higher, although sporadically, into the fourth quarter before making substantial gains in November, as WTI futures traded on either side of $50 bbl in October.

The contango widened in the summer with the production gains, illustrating bearishness driven by fundamental factors. However, market sentiment again changed in August, and abruptly, as talk by the Organization of the Petroleum Exporting Countries to reinstate a production quota previously jettisoned in 2014 prompted short covering after the mid-summer selloff.

For nearly four months, the market was enslaved by what action OPEC would take on production, last cutting their output eight years prior. The market had its qualms that OPEC would actually reach an accord to tighten their production, having failed to act on multiple occasions earlier in the year amid member combativeness, and again unwound long positions. However, a pledge reached in late September in Algiers ended the selloff, and rallied the WTI contract amid renewed bullish sentiment to a 15-month high in October.

While ending September with a pledge to reduce production, details on terms, including individual member quotas were to be determined ahead of OPEC's biannual summit in Vienna on November 30, sparking jockeying among the 14 members for terms that often fulfilled their self-interest. OPEC members pumped at a record production rate of 33.83 million bpd in October, according to the International Energy Agency, casting doubt that the producer group would reach an agreement.

The disharmony between word and action soured the market, again triggering long liquidation by noncommercial traders as market sentiment turned bearish, driving nearest delivered WTI futures to a multi-month low in mid-November.

As experienced in early August and late September, increasing bearish bets sets the market up for a short covering rally. WTI futures spiked more than 8.5% on November 30 in an initial reaction to an OPEC agreement to cut production by 1.2 million bpd beginning in January 2017. Market sentiment was again turning bullish.

As we peer into 2017, the OPEC agreement should provide price support for WTI futures. However, analysts note higher crude values will prompt increased production, notably by US shale oil producers, that diminishes the agreement's bullishness. That leads us to WTI's forward curve which remains under $60 bbl for the next several years, as the accompanying chart illustrates. Keep an eye on long-dated deliveries for clues on an evolving shift in sentiment, cutting through the market's noise with DTN ProphetX.

ABOUT THE AUTHOR

Brian Milne has been involved in energy for 20 years as a journalist, editor, and analyst covering all types of US energy markets. He is the editor of Schneider Electric's MarketWire - a real-time market and news service focused on US oil product markets and relevant news and analysis. Milne is frequently quoted in newspapers and trade journals, including the Wall Street Journal, Barron's, USA Today, and MarketWatch.