The top 10 impairments in oil and gas

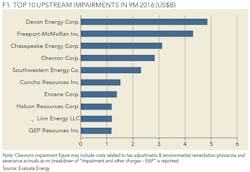

HERE ARE THE 10 LARGEST UPSTREAM IMPAIRMENTS THROUGH THE 3Q2016

MARK YOUNG, EVALUATE ENERGY, LONDON, CALGARY, AND HOUSTON

IMPAIRMENTS AND write-downs in the US oil and gas industry were brought right back into focus by ExxonMobil's admission in October 2016 that it might have to write-down the value of some of its exploration and production assets around the world.

ExxonMobil, in what would be a significant change in accounting policy, may soon officially concede that 3.6 billion barrels of oil-sand reserves in Canada and one billion barrels of other North American reserves are currently not profitable to produce, according to the New York Times. This would probably be the largest E&P impairment across the entire US industry in 2016, but ExxonMobil would by no means be alone in declaring asset write-downs.

Through the third quarter of 2016, looking at the most recent year-to-date nine monthly results for US-listed companies, Oklahoma City-based Devon Energy Corp. (NYSE:DVN) has recorded the largest single upstream impairment charge in its income statement at US$4.9 billion.

As for the three-month Q3 period alone, the largest upstream impairment was Chesapeake Energy Corp.'s (NYSE:CKE) $1.2 billion charge on oil and gas properties and other fixed assets, which represented around 38% of its total 2016 impairment charges of $3.1 billion. Chesapeake Energy is also headquartered in Oklahoma City.

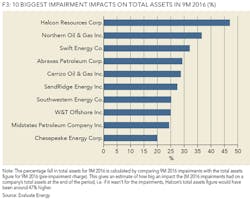

While it did not have the largest actual figure relating to impairments, the largest impact of 9M 2016 impairments was felt by Houston-based Halcón Resources Corp. (NYSE:HK). The company's $1.2 billion impairment charge over the nine-month period - either side of bankruptcy proceedings - made up the biggest proportion (47%) of pre-impairment total assets at period end across the entire US E&P space.

ABOUT THE AUTHOR

Mark Young ([email protected]) is a senior analyst at Evaluate Energy. Evaluate Energy has been offering information and analysis to the global oil and gas industry since 1988, including comprehensive oil and gas deal analytics covering upstream, midstream, and downstream companies.