Fixed asset management excellence

HOW OIL AND GAS COMPANIES CAN UNLOCK HIDDEN VALUE

DEVIN HALL, MITCHELL LUCKETT, CHAD PODRAZA, AND STEVE WRIGHT, PWC, HOUSTON

THE OIL AND GAS BUSINESS is not only asset-intensive; it's also transaction-intensive. Acquisitions and dispositions are routine occurrences. Together, these two realities underscore the importance of managing a portfolio of fixed assets in an aligned and thoughtful manner.

In an ideal world, companies would track the records for refineries, processing plants, pipelines, well equipment and other such assets through a single, end-to-end process that informs strategic capital planning, operations reporting, financial accounting, and taxes. In practice, however, most oil and gas companies are unable to manage their fixed asset records in such a seamless and strategic fashion. Indeed, the industry has generally lagged other asset-intensive industries in the way it manages assets throughout their lifecycle.

This inability stems in large part from the lack of adequate end-to-end recordkeeping solutions. Standard enterprise resource planning (ERP) systems are rarely able to accommodate the industry's unique accounting practices. The result: unrealized cost savings, overstated taxable earnings, and significantly greater financial reporting and compliance risks.

PwC's recent Oil & Gas Fixed Asset Management Benchmarking Study explored the challenges leaders face in fixed asset recordkeeping, through extensive surveys of and in-depth interviews with oil and gas executives from 19 companies. Based on our findings, this article describes obstacles the industry faces in fixed asset recordkeeping, highlighting the capability gaps that many companies overlook. Drawing from actual client experience, we present actionable steps companies can take to enhance their fixed asset management capabilities. Through these steps, they can strengthen the business value of those assets, while reducing risks and missed opportunities elsewhere in their business.

THE CHALLENGES OF FIXED ASSET MANAGEMENT

The ultimate goal of any fixed asset management (FAM) team is to provide accurate, timely, and actionable data for financial, management, and tax reporting-as cost-effectively as possible. Achieving this goal requires the input of a wide range of stakeholders throughout the organization, as well as a deep understanding of accounting and tax reporting.

The breadth of knowledge that FAM requires invariably leads to shared ownership of the overall process, which our survey reveals as a critical issue. The vast majority of respondents struggle with the same underlying difficulties, each of which contributes to another fundamental difficulty for oil and gas companies: applying and maintaining two very different treatments-one for Accounting, one for Tax-to the same set of fixed asset records.

Among the challenges this situation presents:

Companies are stymied by organizational silos.

Although tax and accounting departments ultimately answer to the CFO, they report directly to different units, according to our study. Fully 100% of fixed asset accounting groups operated under Finance and Accounting, as do 71% of project accounting groups. In contrast, only 22% of tax accounting groups report to Finance and Accounting on fixed asset matters, with the remainder reporting directly to the tax department. Organizations striving for comprehensive, timely, and accurate fixed asset records are hard-pressed to do so when the groups involved work separately and collaborate only for reconciliation purposes, often months after the fact.

The conventional view that FAM is not a strategic practice ("It's just about compliance").

Oil and gas companies do not see fixed asset management as a strategic link between Tax and Accounting. Nearly two-thirds of survey respondents agreed with the statement "Our main job is to meet compliance requirements." Maximizing the value from investments in fixed assets is generally not viewed as one of FAM's purposes.

A reliance on manual processes and systems.

One-third of study participants said they use offline databases or spreadsheets "to a great extent" in fixed asset management. Another 50% use spreadsheets or offline databases to "a lesser extent." Not surprisingly, the use of spreadsheets is associated with an increase in reporting time: respondents said it took more than 4,000 person-hours per year, on average, just to produce internal and external fixed asset related reports. That amount is equal to the annual working hours of more than two full-time equivalent employees.

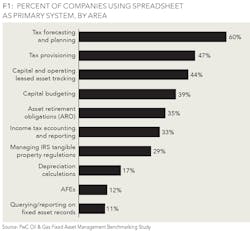

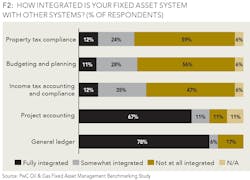

The use of spreadsheets as the primary management system was especially common within tax and capital project-related functions; 60% of companies, for example, rely on them for tax forecasting and planning (see Figure 1). Manual processes, of course, reflect a lack of systems integration, particularly between GAAP and Tax depreciation systems. Fifty-nine percent of respondents said their FAM systems were "not at all integrated" with property tax systems; 56% said the same lack of integration was true with budgeting and planning systems; and 47% noted that this was the case with their income tax systems (See Figure 2). Reconciling differences between GAAP and Tax is often tedious. Moreover, it's not entirely clear which area is responsible for reconciliation.

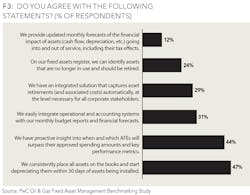

The lack of regular, structured, and transparent communications.

In most organizations, the accounting and tax functions generally don't talk to each other, other than to reconcile asset data. Collaboration is rare, except to meet compliance reporting requirements. Communications on asset impairments, asset status changes, retirements, and disposals are often haphazard, and conducted via e-mail. We also found that few study participants were able to learn the status of assets and their financial impact in a timely manner. Only 24% reported that their fixed-assets register indicates which assets are no longer in use (and should therefore be retired), and only half as many provide monthly forecasts of the impacts of assets going into and out of service (see Figure 3). Thus, senior executives, who rely on FAM data for decision-making, cannot obtain an accurate status update or forecast of fixed asset positions in a timely manner.

The special challenges of certain industry segments.

Although our study revealed many different approaches to FAM, we also found a striking similarity in the challenges certain industry segments face. These include complicated and ever-changing compliance responsibilities for Accounting and Tax purposes. Two additional factors that complicate tax reporting for partnerships are K-1 filings and the possibility of technical terminations. We also found that poor operational recordkeeping will generally have a direct impact on fixed asset recordkeeping, particularly in the upstream segment. Only 20% of project accounting systems in upstream companies are integrated with the fixed asset record systems, compared to 75% for the midstream and downstream segments.

THE RISKS

Because asset recordkeeping is spread throughout the organization, the risks of poor asset management can be far greater than stakeholders realize. Ultimately, accounting and finance leaders should consider both the short-term and long-term risks created by fragmented fixed asset data and communication flows.

We have identified four significant such risks:

Lost opportunities in tax optimization and planning.

The ability to capture tax-ready data from the GAAP accounting and operations systems is critically important, particularly during the earliest stages of the asset life cycle. Companies that lack this capability may be missing out on tax benefits, both one-time and annually recurring. For example, companies that track asset records at a lower level might be inadvertently accelerating tax depreciation deductions. Furthermore, teams with access to granular data can perform beneficial tax analytics, such as tax repair and "what-if" scenario planning, and have ample evidence to substantiate their findings. Those findings can lead to millions of dollars in savings.

Errors in financial and tax reporting.

The more manual the reporting processes, the greater the odds of entry- and calculation errors. In addition, the earlier in the process that manual intervention is required (say, in the project accounting phase), the greater the risk of reporting error. When a company erroneously calculates asset values or current-period depreciation, gains, or losses, it risks misrepresenting its tax position-potentially by hundreds of millions of dollars. These errors also increase the risk that a company's deferred tax accounts are misstated for financial purposes. Such an outcome could indicate a lack of proper controls and a potential material weakness in the financial statements. Further, companies that lack a physical asset-tracking strategy could be carrying additional audit risk. They could also be over-reporting assets for property tax purposes, which can lead to millions in overpaid taxes.

The risks in IT, key personnel, and insurance.

Most oil and gas companies face FAM risks of a more subtle nature-three in particular. Maintaining outdated or highly customized IT systems can stretch already limited technology resources and capabilities. Another less apparent risk is associated with long-term key FAM personnel who are often the sole repository of historical knowledge of long-lived fixed assets. The loss of such personnel at any stage of the FAM process could jeopardize reporting accuracy and timeliness in a significant way. Finally, insurance coverage based on inaccurate fixed asset data can put the business at risk of being over- or under-insured.

The new lease accounting standard.

The Financial Accounting Standards Board (FASB) recently issued an Accounting Standards Update on Topic 842 related to leases. This new guidance will substantially increase most companies' asset tracking obligations. The new standard eliminates the traditional concept of an operating lease. As a result, virtually all leases must now be included in the balance sheet, and one or more corresponding expense items must be recorded on the income statement. Although FASB's guidance will not affect how leases are treated for federal income tax purposes, it may require companies to record new, or adjust existing, book-tax differences and related deferred taxes. These implications should not be overlooked when establishing a comprehensive fixed asset strategy.

ENABLING FAM TO DELIVER VALUE TO THE BUSINESS

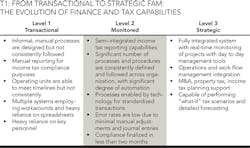

Sound fixed asset management should be more than a transactional process. By seeing FAM as a strategic activity, oil and gas companies can largely ensure that that it delivers value to the business-increasingly, an imperative in a volatile price environment (See Table 1).

How do successful companies accomplish this? Certainly, they employ FAM resources with a deep knowledge of fixed asset financial and tax rules. More than that, though, they empower those resources by recognizing the important role technology plays.

So what lessons can we take away from the successes?

Use technology that integrates data.

An organization's technology is probably the single most influential factor determining the efficiency and accuracy of asset record-tracking and asset-related financial and tax reporting. Companies that rely on an offline, non-integrated solution and perform after-the-fact tax record maintenance are doomed to perpetually struggle with depreciation, regulatory compliance, and accurate and timely financial reporting. Their tax and accounting treatments will likely differ, sometimes significantly-even before capitalization for self-constructed assets starts. Technologies that can integrate project and planning data, however, provide visibility into an asset from its earliest stages. For that reason, they are the most successful at satisfying the goals of efficiency and accuracy, as well as in mitigating risks. They also minimize the need for intervention by accounting personnel.

Get the right technology.

When assessing any new technology solution, executives must consider how it would redistribute the risks (and responsibilities) between Accounting and IT. A highly customized system or integrated bolt-on solution that captures project-level data might well help Accounting improve asset tracking, but it could also shift the burden for system maintenance and risk to the IT group. Software as a service (SaaS) and remotely hosted solutions can alleviate some of this burden, but they cannot completely offset the added risk. Some companies outsource their fixed asset record maintenance and tax compliance work, but relying on a third party for calculations and reporting introduces other disadvantages, including potentially slower reporting times and reduced visibility into their fixed asset positions. Successful companies understand the need to support their FAM resources with technology solutions that integrate the financial aspects of planning and managing projects, acquiring and creating assets, maintaining asset records, and retiring assets.

Evaluate processes and internal alignment.

Leading organizations are realizing the many benefits of forging partnership among their FAM-related accounting, tax, and operations functions. To identify the barriers to partnership within your organization, start by evaluating your process model. Pinpoint the particular challenges and information gaps your organization faces. Ask yourself:

- Do your FAM capabilities allow for capital management throughout the asset lifecycle?

- Do your processes effectively support the business's profit, risk, and operational objectives?

- Are you operating as one organization with multiple partnerships that interact effectively-or as insular teams with handoff challenges?

Systems notwithstanding, the most successful companies are those that closely align the tax and accounting treatment of their assets. They do so, in large part, by establishing procedures for regular, structured communications between the two areas throughout the year.

Above all, achieving FAM excellence starts with recognizing the value of a strategic and integrated approach. Such an approach enables companies to maximize opportunities, bolster planning and forecasting, and improve accuracy, thereby minimizing reporting and compliance errors and reducing rework. These benefits apply regardless of the economic environment. But when commodity prices rebound, an oil and gas company that follows this approach can be way ahead of the game in its ability to readily access asset data and scale up. In other words, it can be equipped with potentially game-changing insight and agility.

ABOUT THE AUTHORS

Devin Hall is a tax partner and a leader in the Tax Projects Delivery Group at PwC. He has 20 years of experience performing tax services for companies in the upstream, midstream, and downstream sectors of the oil and gas industry. His experience in encompasses cost segregation studies, repairs and maintenance reviews, and deferred tax reconciliations.

Mitchell Luckett is a senior associate in PwC's Finance Effectiveness practice. Previously, he worked in the firm's Private Company Tax Services group. He has helped guide numerous fixed asset management system implementations involving testing, training, and process redesign.

Chad Podraza is a director in PwC's Energy Finance practice. He has more than 15 years of experience in finance transformation initiatives. For oil and gas clients and others, he has led projects to implement processes and enabling technologies for fixed asset tracking and tax compliance.

Steve Wright leads the Oil and Gas Benchmarking practice at PwC. He has more than 25 years of experience in benchmarking and applied research. He has developed and led oil and gas industry studies on cost management, operations, upstream land management, supply chain, finance, and human resources.