Trump's America First Energy Plan

Reading between the lines

DENMON SIGLER AND ROCIO GUADALUPE MENDOZA, BAKER & MCKENZIE LLP, HOUSTON

WHILE LIMITED DETAILS surrounding Trump's America First Energy Plan are available at this time, a few themes are emerging, primarily a focus on increasing the production of fossil fuels and decreasing federal regulation. In particular, Trump's America First Energy Plan commits to:

- Eliminating "harmful and unnecessary policies" which would increase American wages by more than $30 billion over the next seven years, according to the administration.

- Embracing US shale and gas and taking advantage of "the estimated $50 trillion in untapped shale, oil, and natural gas reserves".

- Committing to clean coal technology, and to reviving America's coal industry.

- Eliminating US dependence on "the OPEC cartel and any nations hostile to our interests".

- Protecting our environment.

The positions articulated in Trump's America First Energy Plan, testimony provided by his nominees for EPA Administrator (Scott Pruitt) and Secretary of Energy (Rick Perry) in their respective confirmation hearings, and recent executive orders would suggest the Trump administration is focused on promoting cheaper and additional sources of power.

Revival, growth of certain energy sources

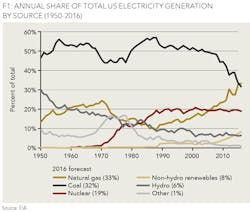

Coal consumption as a source of power generation has been on a steady decline since the late 1980s from approximately 57% of fuel source capacity to 32% (See Figure 1).

While increased regulation has certainly played a role in that decline, most experts agree that the increased production and decrease in price of natural gas driven by the shale boom have been the key factors in power producers shift to natural gas-powered facilities. This shift has resulted in an increased number of natural gas-powered projects slated for 2017 and 2018.

During his campaign and after, Trump expressed a commitment to reviving the coal industry. While his America First Energy Plan identifies a focus on clean coal technology, it is otherwise unclear what other specific actions the Trump administration would take to support the coal industry. But given that the implementation of clean coal technology will only add to the cost of using coal as a source fuel, it would be reasonable to expect some sort of subsidy or other incentive that would allow coal to be more competitive in the market. Increases in the price of natural gas could also make coal more cost-attractive and make it possible for coal to reclaim some lost market capacity.

Similarly, the market capacity of nuclear energy has flattened since the 1990s, hovering at just under 20%. Nuclear energy's growth limitations have been primarily caused by storage challenges and the health and safety concerns of the impact of even limited exposure to radiation. Rick Perry has already expressed interest in and support for nuclear fuel recycling technologies and small modular and advanced reactors. Scott Pruitt's stated goal of reexamining the science behind existing energy and environmental policies could also result in a review of the research underlying our understanding of the effects of low dose radiation. More concerted efforts along these lines could revitalize nuclear energy as well.

Deregulation and an uncertain environmental policy role

The Trump administration has also expressed a commitment to rolling back regulations, which, in its view, have been holding back economic growth and development by 75%, "maybe more". In this vein:

- Trump recently signed a "one in, two out" executive order, which requires executive departments or agencies to identify two existing regulations to be repealed whenever a new one is proposed and requires that the total cost of a new regulation be zero (with certain exceptions).

- Trump signed executive orders reviving the Keystone XL pipeline and Dakota Access pipeline, and a separate order to expedite environmental reviews of infrastructure projects, saying that the permit process will be streamlined.

- Trump and the US Congress overturned a coal-mining rule preventing coal mining debris from being dumped into nearby waters.

- Trump and the US Congress passed a resolution to reverse the Bureau of Land Management's methane venting and flaring rule.

While it is unclear how the regulatory changes described in the first two bullet points will be implemented, these actions will certainly stifle the ability of agencies, like the EPA, to issue additional regulations that might impact the energy industry.

Further, it is unclear how this push to curtail federal regulation, in particular environmental regulations, will be reconciled with Trump's America First Energy Plan mandate to be "responsible [stewards] of the environment" and maintain the "protect[ion] [of] clean air and clean water, conserv[ation] [of] our natural habitats, and preserv[ation] [of] our natural reserves and resources" as high priorities. In addition to its commitment to confirm the science underpinning existing environmental policies and regulations, the Trump administration specifically calls out the Climate Action Plan and the Clean Water Rule as regulations it intends to target for repeal. It remains unclear what the effect of any re-analyzing of scientific underpinning may be, whether the Climate Action Plan or the Clean Water Rule will be replaced or what additional laws, rules, and regulations the Trump administration will seek to repeal, enact, or implement. In any event, as environmental regulations are repealed or modified, we can anticipate continued (and perhaps more robust) protests by environmental groups against pipeline and other infrastructure development, and an increased focus by these groups on promoting and implementing state-level environmental regulations.

The future of renewables

Finally, noticeably absent from Trump's America First Energy Plan is any mention of renewable energy. The renewable energy industry has benefitted from favorable treatment from prior administrations, primarily in the form of tax credits that have made renewable energy projects economically feasible and competitive in the energy market. But the gradual decrease and ultimate expiration (by 2020 for wind and 2022 for solar) of the federal tax credits renewed in December 2015 and Trump's plan to cut corporate taxes will significantly alter the economics of financing renewable projects, ultimately making them them less attractive to investors and potentially decreasing their market share.

The plan's silence on this subject, and Trump's past commentary regarding the favorable treatment afforded to the renewable energy industry by the Obama administration, would suggest the new administration will not push for the increase or further extension of the credits. However, the Trump administration may have an interest in providing some support to renewable energy given the volume of jobs it has created in the last decade.

impact of recovery, economic realities of oil and gas market

Perhaps most unpredictable, and outside the Trump administration's control, is how the recovery of the oil and gas industry will impact other aspects of Trump's America First Energy Plan.

After almost three years in a slump, the oil and gas industry is showing signs of exiting the downturn. US E&P companies are becoming cash flow neutral after years of debt resulting from the high costs of shale exploration and production. The price of oil has recovered and, at press time, has steadied around $50/bbl. Banks appear to be open to engaging in reserve-based lending to E&P companies once again. According to Reuters, 34 companies have seen an increase in credit lines of 5%, on average, which is in sharp contrast to the limited credit opportunities available to industry players in the last couple of years. The Trump administration has also committed to taking certain actions designed to help the oil and gas industry specifically, including reinvigorating and facilitating exploration and production on federal lands, inland and offshore, and enacting executive orders that will facilitate the Keystone XL and the Dakota Access Pipeline projects moving forward.

Increased cash flow, combined with lower costs from decreased regulatory barriers, and more open access to federal lands, combined with increased infrastructure to bring product market through the completion of pipeline and storage projects will certainly lead to an increase oil and gas production. This increase in oil production could certainly decrease our imports of foreign oil, but it will eventually drive prices back down, once again making natural gas the more economic fuel source for electricity in direct competition with other energy sources.

Trump's America First Energy Plan is aspirationally focused on lowering the cost of energy for American consumers, creating American jobs and achieving and cementing the United States' energy independence. While the oil and gas and coal industries appear to be likely beneficiaries of these goals, it is unclear what the consequences of the implementation of Trump's America First Energy Plan will be given the interplay of a variety of market pressures surrounding the various fuel sources and the interplay of federal and state-level regulations. But one thing is clear, the shift toward a more balanced energy portfolio with an increased market share of renewable energy will likely cease.

ABOUT THE AUTHORS

Denmon Sigler is a partner at Baker McKenzie. Her practice includes domestic and international energy-related transactions and projects. She has over 17 years of experience advising clients on mergers, acquisitions, divestitures, joint ventures and project development.

Rocio Guadalupe Mendoza is an associate at Baker McKenzie. She advises clients domestic and international energy-related transactions and projects, including mergers, acquisitions, divestitures, joint ventures and project development.