Multi-billion dollar assets changing hands as companies pursue diverse strategies

ANDREW DITTMAR, PLS INC., HOUSTON

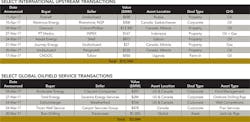

PLS INC. reports that following a first quarter dominated yet again by the Permian land grab, it didn't take long for a very different type of asset to grab headlines during the first month of Q2 when Conoco agreed to sell its prized San Juan Basin conventional gas assets to Hilcorp for $2.7 billion. The properties cover 1.3 million acres primarily in northern New Mexico with over 12,000 wells averaging 744 MMcfe/d during 2016. Privately held Hilcorp has largely eschewed unconventional assets following the successful sale of its Eagle Ford JV with KKR to Marathon for $3.5 billion in 2011. Instead, the company has focused on low-decline, conventional assets in Alaska, on the Gulf Coast, in Wyoming and in the Northeast to build a leading production profile among private companies including operating more gas production than any other private company.

For Conoco's part, the sale comes just a few weeks after a major divestment of Canadian assets to Cenovus for $13.3 billion. That deal, the largest in the upstream space since Shell's $83 billion buy of BG in April 2015, included Conoco's 50% interest in the Foster Creek Christina Lake oil sands project along with a substantial portfolio of producing assets in Western Canada's Deep Basin. The acquisition price paid by Cenovus of just over $50,000/daily boe for 265,000 boe/d net after royalties was right on point with CNRL's multi-billion-dollar oil sands deals with Shell and Marathon in early March.

While conventional gas assets in New Mexico and oil sands assets in Alberta may not seem to have much in common at first glance, they share a low-decline profile and long reserve life. Seeing large deals for assets with this profile indicates select buyers are actively on the hunt for cash flowing, stable properties that provide meaningful upside with rising prices over the long term - a contrarian investment style versus the unconventional land rush. A top-tier asset hitting the market that fits this profile is Resolute Energy's Aneth field CO2 property in Utah, which is being marketed in a joint effort by Petrie Partners and Barclays. That asset has net production of 6,000 boe/d with a mere 1% annual decline over the last three years. However, with a smaller universe of buyers than unconventional properties, striking the right deal for these assets can take time. For example, the market has been quiet on the status of Kinder Morgan's potential sale its CO2 business - the largest in North America with transportation of 1.3 Bcf/d of CO2 and production of 55,000 bbl/d.

For buyers seeking both a significant PDP component and unconventional development opportunities, the Eagle Ford has been a popular target during 2017. This includes a number of private equity-backed startups like Venado Oil & Gas, which recently made its second Eagle Ford buy this year and acquired its first operated position. The Austin-based company struck a deal to buy EXCO's position in Zavala, Frio, and Dimmit counties for $300 million. Like most Eagle Ford deals in recent months (at least outside of the limited Karnes Trough area), more than half of deal value is attributable to existing production, and the acreage was picked up at a fraction of Delaware or Midland Basin prices.

Back in the ever-popular Permian, Marathon doubled down on the New Mexico portion of the Delaware Basin with a $700 million acquisition from Black Mountain Oil & Gas. The company's second deal in southeast New Mexico (following its $1.1 billion entry via the BC Operating acquisition just a couple weeks prior) added substantial scale to its position, including more than 400 gross operated drilling locations. The deal was the most expensive yet of the large New Mexico acquisitions at nearly $35,000/acre, comparable to prices in the southern Delaware in Texas or the Midland Basin. Every major portion of the Midland or Delaware Basin now has a precedent transaction at more than $30,000/acre. It's been quite a run for the State of New Mexico, which has witnessed over $14 billion in deals (conventional and unconventional) since the landmark $2.4 billion EOG buy of Yates Petroleum. This activity in New Mexico bodes well for the state as the assets bought will continue to command significant future investments.

The next wave of Permian deal activity is likely to involve midstream assets as producers start to drill their shiny new properties. Blackstone is making a bet in that direction, paying fellow private equity firm EnCap $2.0 billion for EagleClaw Midstream Ventures. EagleClaw has 375 miles of gas gathering pipelines in the heart of the southern Delaware in Reeves, Ward, and Culberson counties. Current capacity is 320 MMcf/d with an additional 400 MMcf/d under construction. Navigator Energy Services (backed by First Reserve) is selling its oil gathering, storage, and transportation assets in the Midland Basin to NuStar Energy for $1.5 billion.

Like midstream operators, oilfield service companies are gearing up for an expansion of unconventional drilling. A key example is Schlumberger and Weatherford's creation of a new joint venture called OneStim with an expected enterprise value of $764 million that will have one of the broadest multi-stage completion portfolios along with one of the largest hydraulic fracturing fleets in the industry.