Chasing the Midstream Man

Midstream activity across major US basins

JUSTIN CARLSON, EAST DALEY, DENVER

RUN RUN AS FAST AS YOU CAN, you'll never catch him he's the Midstream Man, or so goes the old nursery rhyme. Following the midstream markets over the last few years has certainly felt that way. Prior to 2015, when oil prices were above $100/bbl, the task at hand was keeping up with all the proposed expansions. With the crash of oil prices to $50/bbl at the beginning of 2015 and the collapse to $30/bbl at the beginning of 2016, asset declines and counterparty risk became the more meaningful measurement. Now that WTI has risen back above $50/bbl and rig counts in the US from October to February climbed by around 180, determining where the market is growing versus declining and what that means for midstream operators is essential to understanding MLP investment opportunities. This is especially true for midstream companies that are diversified across multiple basins or have vertically integrated upside. Now more than ever, as the markets seem to have stabilized, is the time to prepare for the point when markets shift again and determine whether we will once again be tracking expansions or counterparty risk.

From February 2016 to February 2017, WTI prices have climbed 75%. The result has been a substantial response in rig counts, which are up more than 260 rigs in the same period. The Permian has seen the most substantial rig additions, up 94 rigs (42%) in just the last five months. Other basins have also responded. The Anadarko is up 28 rigs (23%), the Eagle Ford is up 30 rigs (53%) and even the ArkLaTex (including the Haynesville) is up 14 rigs (35%). In each one of these basins, understanding which midstream operators are realizing the greatest benefits from those rigs, as well as the financial impact to the company as a whole, is vital to understanding upside and downside risk. If the basin is not growing, are there enough rigs on the system to at least keep volumes flat? Or are there minimum volume commitments (MVCs) in place which will guarantee returns for a period of time? To answer these key questions, let's look at a large integrated company like Energy Transfer (ETP). ETP not only has gathering and processing (G&P) assets in several basins, but also has vertically integrated infrastructure which leverages those volumes downstream.

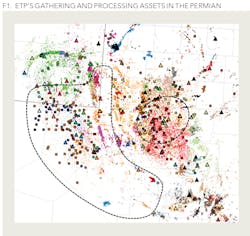

ETP's G&P assets in the Permian are some of the most important in their portfolio (See Figure 1). While the Eagle Ford is the largest contributor to company adjusted EBITDA at 8% for 2017, the Permian is quickly gaining ground, increasing to 6% in 2017 from 4% in 2016. The key component of that increase has been the position of the company's systems in the high-growth areas of the Delaware and Midland Basins. Figure 1 shows every natural gas processing plant (triangles), rig (squares) and well (dots) in the Permian basin. Rigs and wells are color-coded to match the operator of the midstream G&P system that they supply. The circled areas highlight ETP's current Delaware and Midland system footprints. The allocation of rigs over time shows that as of October 2016, 20% of all rigs drilling in the basin were operating on an ETP gas processing system. Further, the company captured one out of every five rigs added to the basin since October, maintaining their dominance as the largest gas gathering and processer in the play. As a result of this growth, ETP has already completed the 200 MMcf/d Panther Plant in the Midland Basin and announced plans to construct the Arrowhead Plant, to be completed 3Q 2017. Based on the current forward curve, there will be enough rig activity and production growth for the company to add at least two additional plants by the end of 2019.

On the other side of Texas, in the Eagle Ford, ETP has realized some equally significant results. In October, the number of rigs operating on the company's Eagle Ford system was around 11 rigs. Rigs operating on that system doubled to 22 rigs in February. The additional rigs is the difference between the system staying relatively flat to potentially realizing enough growth to justify another plant by end of 2019.

The importance of the growth in both the Eagle Ford and Permian is not limited to the midstream segment. While every rig on their system means more molecules of gas flowing through their processing and gathering assets, it also translates into more natural gas liquids (NGLs) flowing on ETP's NGL Pipelines to the company's fractionation complex in Mont Belvieu, TX. Based on rig levels in both basins at the end of 2016, there was enough production growth to anticipate adding a fifth fractionator, which was subsequently announced prior to the 4Q earnings call. Figure 2 shows the companies fractionation capacity versus the volumes flowing on Lone Star and Justice NGL Pipelines from the Permian and Eagle Ford into Mont Belvieu. Since the end of last year, based on continued increases in rig activity through February, the company will have enough volumes to announce a sixth fractionator.

While ETP is growing in the Permian and Eagle Ford, as well as in the Marcellus, the company does have some offsetting declines in other areas of the country. Its position and rig allocation in the Anadarko and Barnett regions is not as strong. However, these areas make up less the 2% of the total company's 2017 portfolio.

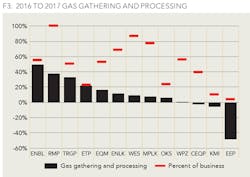

In total, ETP's Midstream Segment, mostly comprised its gathering and processing assets, is expected to grow 22% in 2017. This might be expected given the rebound in commodity prices. However, breaking down each company by asset provides a unique comparison across similar asset types and commodities. Figure 3 illustrates the estimated 2016 to 2017 growth of natural gas G&P assets as well as the percentage of the company's business that this segment represents. The graph shows that ETP's 22% growth is important as natural gas G&P makes up 23% of the company's overall portfolio in 2017 (excluding the impact on downstream assets). On either end of the spectrum are Enable (ENBL), which is expected to realize 50% growth in the G&P business, which represents 55% of its portfolio versus Enbridge Energy Partners (EEP), which is expected to decline 48%, but only makes up 4% of its total business. MPLX is slated to grow 8% in 2017, however a large portion of its position is in the Marcellus, which is currently constrained by natural gas takeaway capacity that is just beginning to be relieved toward the end of the year.

Chasing the midstream man often feels like an exercise in futility. Not all midstream assets and companies are homogenous, which makes them both challenging and interesting. Now is the time to prepare for the next market shift by understanding the risk factors that these companies are exposed to and the magnitude of that exposure. Now is the time to be discerning, so that when the Midstream Man starts to move again, it is apparent and quantifiable which direction he is going.

ABOUT THE AUTHOR

Justin Carlson serves as vice president and managing director or research at East Daley Capital Advisors. Carlson has over 10 years of experience in data analysis, energy information, and consulting across the energy sector. Prior to launching East Daley, Carlson was a senior manager at Platts, a division of McGraw Hill Financial, which acquired Bentek Energy, where he was senior member of the leadership team.