Shareholder value and lessons learned

MIDSTREAM AND DOWNSTREAM SECTORS

CHRIS ROSS AND VIKRAM ENJAM, UNIVERSITY OF HOUSTON CT BAUER COLLEGE OF BUSINESS, HOUSTON

EDITOR'S NOTE: This is the third and final article in a series of articles. Parts one and two covered the drivers of shareholder value in the upstream and oilfield equipment and services sectors of the oil and gas industry as the most recent cycle moved through its stages of "Run-up" from 2002-08 from 2008-2014 as the market left behind the "Long Grind" of the 1990s, through the "Summit" of sustained but volatile high prices, and onto the "Fall" from 2014 through mid-2016 (See Figure 1).

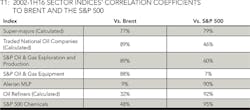

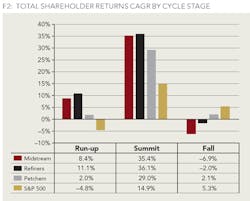

TSR FOR THE MIDSTREAM and downstream sectors, like the upstream sectors, are influenced by the oil price cycle: All segments beat the S&P 500 in the Run-up and at the Summit and all segments declined or underperformed in the Fall (Figure 2). However, the correlation coefficients with oil prices was lower than for the upstream and OFS sectors and the correlation with the S&P 500 index was higher (see Table 1).

The Midstream Alerian Index is not correlated with the price of Brent crude oil even though the sector's average TSR performance shows a similar pattern to the Refining and Chemical segments of outperforming the S&P 500 in the Run-up and Summit stages and underperformance in the fall. The fundamental drivers would appear to be:

- Prices for refined products and petrochemicals are set by international crude oil prices, which determine feedstock costs in most countries. In the United States, domestic prices for crude oil, natural gas liquids (NGLs), and natural gas were considerably lower than international crude oil prices during the Run-up and Summit stages, providing a competitive advantage to US plants.

- The relatively low US crude oil prices were in part due to inadequate infrastructure required to transport shale oil and gas from inland production locations during the Run-up and Summit cycle stages. Midstream companies seized opportunities to develop new infrastructure projects to remove bottlenecks and increase revenues.

- In the fall, the spreads between regional oil prices and between natural gas, NGL and crude oil prices collapsed, weakening the competitive advantage of the Refining and Petrochemicals segments over international plants and sharply reducing cash flow from natural gas processing plants not protected by fee-based contracts. These headwinds resulted in lower TSR performance.

MIDSTREAM

Our Midstream Segment TSR study focused on 14 Midstream Master Limited Partnerships (MLPs). The traditional model in this segment has been a General Partner (GP) that sets corporate strategy and provides management services, with limited partners investing through a subsidiary MLP. The Limited Partners benefit from favorable tax treatment for their distributions; the General Partner normally owns some limited partner units and in addition receives Incentive Distribution Rights (IDRs) as a reward for taking on greater risk and managing the MLP. Distributions to the limited partners are largely shielded from tax, but reduce the basis of the limited partner's initial investment. Therefore, sale of units incurs relatively high capital gains taxes and this may inhibit liquidity in the market for units.

MLPs offer investors with relatively high, tax advantage yields. During the Run-up and Summit cycle stages, they enjoyed strong tailwinds from declining bond interest rates. Investors not only received growing distributions per share, but also benefited from appreciation in the value of their units as investors eagerly sought out higher yield low risk securities.

The unusual structure contributed to TSR results that in the Run-up and Summit cycle stages were not correlated to revenue growth, reinvestment (Capex/Total Assets), nor to Returns on Capital (See Table 2).

Rather, TSR was correlated with higher beta and therefore with higher risk moderated by lower debt/ capital in the Run-up and Summit stages. In the fall stage, high TSR was correlated with Higher Dividend/ Share growth (or least reduction). This dislocation of TSR growth from the fundamental financial metrics of growth and return on capital is disturbing. Only in the fall cycle stage did ROC become a significant driver of TSR as well as Dividend/ Share growth.

Further, we found no consistent leaders in TSR throughout the cycle. The Summit cycle stage favored companies that increased gas processing capacity, often taking on commodity price risk through "percentage of proceeds" contracts rather than the more conservative fee-based contracts. These companies suffered major setbacks in the fall stage: for example, MarkWest was driven to sell out to Marathon Petroleum's MLP in July 2015; Targa MLP unit holders were bought out by the C-Corp GP, Targa Resources in February 2016. In recent years, several GPs have sold their IDRs to the corresponding MLPs, citing the high cost of capital associated with IDRs. Kinder Morgan went further and consolidated all its subsidiaries into the parent C-Corp company, KMI.

It seems that the recent wave of restructuring may continue, with IDRs no longer in favor. The result will be two separate populations of midstream companies: Companies favoring moderate growth, will remain as MLPs and will distribute most of their operating cash flow; growth oriented companies will adopt C-Corp status to more easily raise the capital needed for major projects; this trend could be further supported if corporate tax rates were reduced. We would expect that MPL TSR performance in the future will continue to track ROC, with revenue growth required to support predictable Dividend per Share growth. If crude oil prices continue to recover and natural gas prices remain low, companies with gas processing portfolios, hedged against short term commodity price volatility, will recover some ground lost during the fall stage.

PETROLEUM REFINING

US refiners benefited from tailwinds during the Run-up and Summit cycle stages:

- Rising oil prices always boost stated earnings and cash flow, as crude oil purchased at yesterday's price is refined and sold as finished products at tomorrow's higher prices.

- US oil demand grew by one million barrels/ day from 2002 to 2007, resulting in higher capacity utilization and strong refining margins.

- As the shale boom kicked in in 2010, domestic crude oil prices sold at considerable discounts compared to international prices. Companies with inland refineries had a competitive advantage over their coastal rivals.

- Coastal refiners themselves had an advantage over foreign refineries, and all US refineries enjoyed a further advantage in low natural gas prices giving them lower energy costs and cheaper hydrogen costs than foreign rivals. The US became a major exporter of refined products and coastal refineries achieved high utilization rates and high margins.

- Refiners also created value by dropping down their midstream assets into MLPs of which they were General Partners. This allowed them access to low cost capital and boosted the intrinsic value of future cash flows.

The fall stage led to declining prices and pressure on earnings and cash flow. However, on average refiners' TSR only declined 2% per year (See Figure 2) with the larger players (Valero, Phillips 66, and Tesoro) continuing to grow shareholder value.

TSR of the Refiner segment is not driven by growth: neither revenue growth nor reinvestment (except Capex/ Total Assets in the Run-up) are correlated with TSR (Table 2). However, there was a strong correlation between TSR and ROC in all cycle stages. Investors appear to value high ROC, low beta, low debt and increasing dividends/ share. HollyFrontier, with refineries in the mid-Continent and Rocky Mountain regions, had access to heavily discounted crude oil, excelled in the Run-up by distributing much of their rising cash flow to shareholders through rising dividends/ share. Tesoro fared best in the Fall as it reaped the benefits of its acquisition of BP's Carson refinery and associated infrastructure. Western Refining fared worst: Tesoro acquired Western Refining for $4.1 billion in November 2016, further strengthening its portfolio of inland refineries.

PETROCHEMICALS

US petrochemicals companies were buffeted by price changes during the cycle stages:

- Strong economic growth increased demand for petrochemicals during the Run-up stage but high natural gas prices and increasing NGL prices raised costs compared to international rivals and resulted in low average TSR, albeit higher than the S&P 500.

- Falling natural gas and NGL prices after 2008 through the Summit stage provided US plants with a competitive advantage over foreign plants relying on oil-based feedstocks and energy and increased TSR above the S&P 500.

- Collapse of oil prices during the fall cycle stage resulted in shrinkage of their competitive advantage and depressed TSR below the S&P 500.

In the Run-up cycle stage, TSR was driven by growth in revenues and reinvestment in the business (Capex/ Total Assets), with an emphasis on ROC, low debt and low beta enabling consistent growth in dividends per share (See Table 3). In the Summit stage, the drivers of high TSR were capital discipline and high ROC to support dividend growth and acceptance of high beta. In the fall cycle stage, there was little correlation between TSR and ROC metrics, acceptance of negative revenue growth due to lower feedstock and energy costs and high beta.

We believe that falling oil prices exposed the heterogeneity of the petrochemical companies studied: TSR of companies like Westlake, with high exposure to commodity olefin and vinyl plastics, expanded and contracted with the cycle, while industrial gas companies Air Liquide and Air Products were relatively insulated from the cycle.

The petrochemicals segment growth has fallen back towards GDP growth rate. Parts of the industry are restructuring, with several companies seeking to reduce exposure to commodity products in favor of specialty products, and others to strengthen existing portfolio elements through acquisitions:

- Air Liquide acquired Airgas in September 2016 for $13.5 billion to strengthen its position in US industrial gases.

- Olin acquired Dow Chemicals' Chlor-alkali business in October 2015 for $5.4 billion, forming a joint venture with Dow with superior market strength in this segment.

Westlake acquired Axiall Corporation in June 2016 for $3.8 billion, strengthening its Chlor-alkali and vinyl derivatives businesses.

SUMMARY

Based on the analysis summarized in this article and the two previous articles, we have reached some cautious conclusions on the likely drivers of shareholder value over the next decade. These are grounded in a view of the future oil price cycle portrayed in our first article, which should be hedged with uncertainty.

For the upstream sector, we found that the drivers of TSR changed as sectors passed through the stages of the cycle. The key enablers for the upstream oil and gas sector during the Run-up was early recognition that oil prices had passed a point of inflection, requiring a change in strategy from the long grind of the 1990s; the Summit required continued high reinvestment, capital discipline resulting in high returns on capital and low debt laying a strong foundation for the Fall, which favored high returns on capital and sustaining reinvestment, even if that led to higher debt.

For the oilfield equipment and services sector, we found significant changes in business models adopted by the OFS sector during the cycle: in the seismic segment, TGS delivered best TSR after the Run-up by successfully adopting an "asset light" model that allowed more flexible adaptation to the changing business cycle, with the focus on its seismic library, processing and visualization rather than on the equipment required to acquire the seismic data.

The offshore drilling and offshore construction segments, under pressure from activist shareholders, increased debt leverage and lowered required returns on capital. By contrast, major OFS companies through the cycle created highest TSR by investing cautiously in capital projects relative to their peers, growing slowly, sustaining high ROC, low beta and low debt, while growing dividends per share.

Looking ahead, the industry is currently in a grind mode, like that endured from 1986-2001 (See box in Figure 1 of our first article, OGFJ, January 2017). The duration of the grind this time is uncertain and depends greatly on how scalable are existing shale oil plays and whether the US business model can be replicated internationally.

Mark Twain noted that "history doesn't repeat itself, but it does rhyme." We believe The most likely scenario is that the business environment will remain hostile through the early 2020s: occasional surges in prices will be extinguished by premature investment in new production. The most likely scenario is that the business environment will remain hostile through the early 2020s: occasional surges in prices will be extinguished by premature investment in new production. However, the duration of the next Grind stage seems more likely to be five years rather than 15 years. The likely recipe for shareholder value creation in the upstream and OFS sectors will look like the 1990s playbooks and like the success factors identified for the Fall stage of the current cycle:

- Returns on capital will be the primary driver of shareholder value: harnessing new technology and embedding it in streamlined workflows is a key enabler.

- High ROC will generate sufficient cash to satisfy secondary drivers: sustaining dividends and healthy reinvestment in organic growth without increasing debt ratio.

- There will be an active M&A market as well as a steady stream of bankruptcies. Companies with strong balance sheets should be able to acquire assets, products and services at lower than the cost of developing them.

Leaders will need to be vigilant in "looking around corners" for convincing evidence of a point of inflection that signals a return to a new Run-up in prices, starting a new cycle that will require a shift towards more aggressive growth, with reduced emphasis on dividends and debt. However, there will be false dawns and leaders should be wary of expanding too soon, losing capital discipline and running up debt that is not sustainable through market dips.

In the downstream sectors, we expect that the Midstream MLPs will eradicate IDRs and the growth-oriented higher risk companies will move from MLP to C-Corp structures. This transition would gain pace if tax rates on corporate income were lowered to international norms.

Successful MLPs will demonstrate capital discipline and settle for moderate capital spending to provide growth in revenues and distributions. There will be consolidation as companies with strong balance sheets merge with weaker companies presenting synergy capture opportunities.

ROC will be the primary driver of TSR. Refiners also will focus on ROC, with growth in their midstream MLPs and from incremental capital improvements allowing some dividend growth. Consolidation and specialization will continue in the Petrochemicals companies and TSR will be driven by revenue growth from value accretive acquisitions, organic growth from capital investment projects in US plants leveraging advantaged low oil and gas prices, high ROC, conservative debt, and dividend per share growth.

ABOUT THE AUTHORS

Chris Ross ([email protected]) is an executive professor of finance at the CT Bauer College of Business at the University of Houston. He has authored numerous articles on the oil and gas industry and is co-author of Terra Incognita: A Navigation Aid for Energy Leaders. He chairs the Oil and Gas Policy Subcommittee of the Greater Houston Partnership, and sits on the Program Committee of the Offshore Technology Conference. Ross began his career with BP in London. In 1973 he joined Arthur D. Little, and moved to Algeria where he managed a large project office assisting SONATRACH with commercial challenges in oil and LNG and advising on OPEC issues such as price coordination, price indexation, and production quotas. In 1978, he moved to the ADL headquarters in Cambridge, MA and on to Houston, where he opened the ADL office in 1982. From then until 2010 he led the Houston energy consulting practice which was acquired by Charles River Associates in 2002. As a consultant, Ross works with senior oil and gas executives to develop and implement value creating strategies.

Vikram Enjam ([email protected]) is an MBA candidate with a focus on energy at the University of Houston's CT Bauer College of Business. He has more than eight years' experience in the LNG industry. He holds master of engineering and bachelor of technology degrees in mechanical engineering from Lamar University (Texas) and JNT University (India), respectively.