Wolfcamp Delaware

An assessment of recent activity with a GIS approach

VERONIKA AKULINITSEVA AND ROMAN BOROS, RYSTAD ENERGY

DESPITE THE COLLAPSE in oil prices witnessed in the second half of 2014 and a persisting environment ever since, light tight oil production in the US has remained resilient and proved its commerciality, even in the sub-US$60/bbl environment. The average production of light oil exhibited a decline for the first time last year, reaching the bottom of 4.74 MMbbl/d in the third quarter of 2016, but production in the Permian Basin continued to show a growing trend. In 2017, the Permian Midland and Delaware are set to add approximately 500 thousand bbl/d of oil supply to the market. Operators in both shale plays have shifted their focus to developing their best acreage positions and optimizing completion techniques, which has led to continuous improvements in drilling efficiency and well performance.

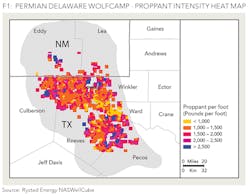

Since 2013, increasing completion intensity has become a major trend, as producers in the Permian aimed to boost well configuration through drilling longer laterals, increasing proppant loading, and experimenting with proppant composition and frac fluid type. In the Permian Delaware, proppant loading has doubled since 2014, surpassing the level of 2,000 pounds per foot on average in the first quarter of 2017.

Figure 1 shows a proppant intensity heat map for Delaware wells targeting Wolfcamp zones. The selection is based on 1,200 wells with at least one year of production data and full completion data disclosure. While proppant intensity is mostly distributed within the range of 1,000-2,000 pounds per foot, there seem to be operators experimenting with monster completions, pumping more than 2,500 pounds of proppant per foot. The tests are concentrated in the southeastern area of Reeves County; however, extreme levels of proppant loading are also observed in various sweet spots across other counties of the Delaware Basin.

Over recent years, higher proppant intensity led to the increase in well productivity, causing operators to continue to experiment with proppant loading in hopes of achieving even better well results while keeping well economics attractive enough amid depressed frac sand prices in 2015-2016.

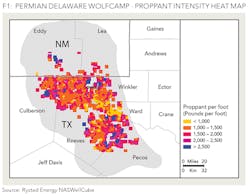

Figure 2 illustrates that further increases in proppant intensity do not necessarily result in significantly improved well productivity. The most impressive production results, with over 50 barrels per foot, are mostly seen in the areas where proppant loading has been in the range of 1,000-2,000 pounds per foot. Better overall results can be seen in the northern part of Reeves, as well as in Loving and Culberson counties. Eddy and Lea counties are also among areas with higher well productivity, despite significantly fewer wells drilled compared to the other core counties mentioned.

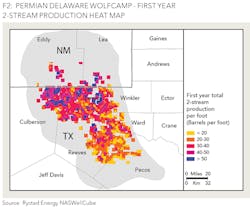

Looking at the wells drilled across the Permian Delaware, we observe another interesting trend - the dependence of the variability in the light oil content on the area targeted.

Figure 3 presents a split of all Wolfcamp wells in the selection by the first year Gas-to-Oil ratio (GOR), which is a ratio of gas production to combined crude and condensate output during the first year of production of the well. We observe that most wells drilled in Culberson County have a GOR of more than 9,000 cubic feet per barrel. Light oil content of the wells increases as we move to the northern part of Reeves and farther to Loving and Winkler counties. In general, the lowest GOR is more common for the southern and eastern parts of the formation. Thus, wells in the southern part of Reeves, for example, exhibit a GOR of less than 3,000 cubic feet per barrel compared to the northern part, where GOR is mostly within the 3,000 - 6,000 range.

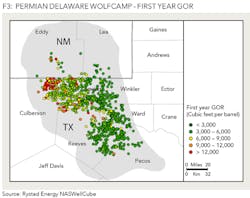

By experimenting with completion techniques to boost well productivity and targeting the best areas of the acreage, operators are striving to increase commerciality of the wells.

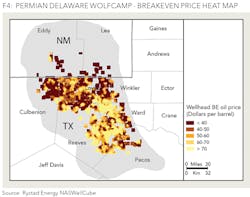

Figure 4 shows the distribution of wellhead breakeven oil prices across the Wolfcamp formation in the Permian Delaware for our selection of wells. We see that the wells in Culberson, parts of southern Reeves, and Loving counties in Texas, together with Eddy and Lea counties in New Mexico, demonstrate the highest commerciality in the shale play. The wells drilled in these areas, to a large extent, exhibit wellhead break even oil prices of under US$40/bbl. As we move to the lower part of the Wolfcamp formation, into southern Reeves, Ward, and Pecos counties, the breakeven price range significantly increases, with many wells holding wellhead breakeven oil prices of US$70/bbl and above.

ABOUT THE AUTHORS

Veronika Akulinitseva is a senior E&P analyst at Rystad Energy. She holds a MSc in economics and business administration from Norwegian School of Economics, Norway, and a BSc in Management from the University of Manchester, UK. Roman Boros has worked as a senior analyst in GIS development and as a project manager for Rystad's North American shale maps product. He holds a MSc in Geography and Cartography and a PhD in Cartography and Geoinformatics, both from Comenius University, Bratislava, Slovakia.