As Permian buying slows, winners turn to asset sales for development capital

ANDREW M. DITTMAR, PLS INC., HOUSTON

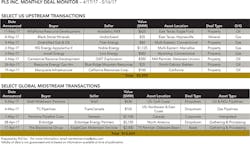

PLS Inc. reports that after a year of furious dealmaking, the pace of acquisitions in the prolific Permian Basin has finally slackened. Instead, recent deal activity has largely focused on companies with substantial Permian portfolios selling assets in other plays as they transition from Permian buying to Permian drilling.

Few companies bet bigger on the Permian during the height of the rush than Noble Energy, which spent $3.2 billion to acquire pure-play Clayton Williams and add 70,000 net acres in the core of Reeves and Ward counties. Shortly after closing that deal in late April, the company announced it was divesting its Marcellus upstream assets to Quantum Energy Partners-backed HG Energy II for $1.1 billion upfront plus a contingent payment. Noble had earlier primed itself for a Marcellus sale by divvying up a joint venture with Consol Energy. The portion sold to HG covered nearly 400,000 net acres in northern West Virginia and southern Pennsylvania with production of 415 MMfce/d and proved reserves of 1.5 Tcfe.

Anadarko Petroleum has also emerged a winner in the Delaware Basin boom but without having to spend big on acquisitions. The company holds a legacy position covering 235,000 net acres mostly in the core of Loving, Ward, and Reeves counties. The company estimates that the Wolfcamp A alone holds over 3.0 Bboe net resources from 6,000-plus drilling locations with EURs of 1.5 MMboe or more each. This position places Anadarko in the top-tier among Delaware Basin operators and has been elevated to a core asset along with the company's DJ Basin and cash-flowing deepwater Gulf of Mexico interests.

With the DJ and Delaware racing to the forefront in Anadarko's development plans, the company has been trimming other areas of its portfolio. Most recently, Anadarko sold its Eastern Eagle Ford assets to WildHorse Resource Development for $625 million. The assets covered 111,000 net acres primarily in Burleson County with production of 7,600 boe/d and 22.9 MMboe proved reserves. Anadarko received $3,350/acre net of PDP value, or just over $1,000/acre more than it received in the sale of its Western Eagle Ford assets to Sanchez Energy and Blackstone for $2.3 billion in January 2017. Combined, Anadarko generated nearly $3.0 billion in proceeds while exiting the Eagle Ford.

While Noble is retaining its Eagle Ford operations so far, it is remarkable how similar the portfolios of these two premier US independents have become despite their divergent histories and various sales/acquisitions over the years. Both have sold out of the Marcellus (Anadarko in December 2016 to Alta Resources for $1.2 billion) and are now focused on the Delaware and DJ Basins plus Deepwater Gulf of Mexico domestically. In their international portfolios, both companies have West Africa oil assets and long-term LNG development projects: Noble in the Eastern Mediterranean and Anadarko offshore Mozambique. It is a portfolio mix that appeals to even the largest supermajors, with Exxon recently making major investments in the oil-rich Delaware Basin combined with international LNG projects in Mozambique and Papua New Guinea.

Even if the pace of Delaware Basin dealmaking has slowed, deals there haven't entirely ground to a halt. Mark Papa-led Centennial Resource Development is venturing out of its core Reeves County position by acquiring northern Delaware assets in New Mexico from GMT Exploration for $350 million. The 12,000 acres in Lea County have 255 drilling locations with top-tier targets in the 3rd Bone Spring expected to generate IRRs of 65% or more, beating even Centennial's best legacy Reeves County benches.

Conventional gas assets have emerged as a surprising area of contrarian buying during Q2 after a Q1 notable for both its lack of conventional and gas deals. In addition to Hilcorp's blockbuster $2.7 billion bet on San Juan gas via its acquisition from ConocoPhillips in mid-April 2017, Jonah Energy recently spent $582 million to acquire Wyoming gas assets in the Jonah and Pinedale Anticline fields from Linn Energy. Jonah Energy has been scooping up conventional Wyoming gas assets since 2014 with backing from EIG and TPG Capital Partners. Jonah sees strong current PDP value in the assets combined with future horizontal development upside.

In midstream, companies continue to scoop up assets to support development while mostly sticking to premier unconventional plays. The Delaware Basin is an easy choice for example, with Blackstone paying $2.0 billion for EagleClaw Midstream Services. Noble followed up on its earlier upstream Marcellus exit by making a late-May deal to sell its associated midstream interests to another Quantum Energy portfolio company.

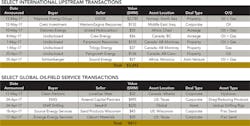

Internationally, the North Sea maintains a comfortable lead as the most popular investment area, particularly for private equity money. In the latest deal, Neptune Energy spent $2.7 billion to acquire upstream assets from Engie using funding from Carlyle and CVC Capital. Private equity has flooded into the North Sea as traditional large, European-based energy companies like Engie, BP, Shell, and OMV shed mature assets.