UPSTREAM NEWS

US oil production has gained significant momentum - limited downside risk in the short-term

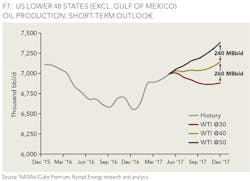

Looking at the recent evolution of oil production in the Lower 48 states (excl. Gulf of Mexico), Rystad Energy observes a continuous expansion, with a 430 MBbld growth from December 2016 to May 2017. Even though late-2016 production levels were adversely exposed to winter storms in several states, the growth from the average level in 4Q 2016 to May 2017 is still significant, around 340 MBbld. The majority of shale-dedicated operators were able to achieve oil production levels around the high-end of guidance in Q1 2017 or beat it on several occasions. Despite growing concerns about service cost inflation in the most active basins, completion activity is set for a steep expansion throughout the remainder of 2017. US Lower 48 oil production is set to expand by an additional 390 MBbld from May 2017 to December 2017 assuming a WTI price of 50 USD/bbl.

The recovery in rig counts has been outpacing the growth in completion activity since 2H 2016, resulting in a strong build-up of new high-quality inventory of drilled uncompleted wells (DUCs). Should the prices collapse to 40 or even 30 USD/bbl level, a major part of these DUCs can still be completed commercially given that drilling costs are sunk. Therefore, a drastic downward shift in the market conditions will not lead to a rapid collapse of the U.S. oil production. No more than 500 MBbld of December 2017 volumes are at risk in the 30 USD/bbl scenario.

"If the prices go down to 30 USD/bbl and we assume that operators behave rationally, we should observe relatively quick adjustment of activity, which will result in a temporary contraction of output with stabilization in 4Q at the level 100 MBbld lower than the current output as base production gets more mature," said Artem Abramov, vice president of analysis at Rystad Energy. "In reality, history tells us that many operators will rely on hedging gains or simply outspend more, so short-term evolution of supply in the 30 USD/bbl world might end up much closer to the rational 40 or even 50 USD/bbl scenarios."

IHS: US natural gas production falls again in April

Lower-48 US natural gas production averaged just 70.2 billion cubic feet per day (Bcf/d) during April 2017-the lowest level in two months-but higher than production levels at the start of the year, according to analysis from IHS Markit.

Texas, which in the past has been a leader in US natural gas production, along with the Gulf of Mexico, experienced sharp production declines in both March and April, IHS Markit said, recording the state's lowest production levels in nearly 10 years (since August 2007). Texas production dropped 0.1 Bcf/d in April after dropping 0.3 Bcf/d in March, averaging below 16 Bcf/d. Gulf of Mexico natural gas production averaged slightly more than 3 Bcf/d in April.

"While natural gas production averages for the Lower-48 were down in April by three percent compared to April 2016, the biggest surprise was the sharp declines in Texas and Gulf of Mexico production, which we've not seen since September 2008, when Hurricanes Gustav and Ike wreaked havoc on offshore platforms," said Jack Weixel, vice president for analytics at PointLogic Energy. (PointLogic is a business unit of IHS Markit, which tracks US production levels on a daily basis across 92 producing areas in the lower-48 states.). "Producers in the Gulf have recently shifted focus to deeper offshore drilling targeted at oil plays with lower associated gas production."

For 2017 to-date, Weixel said lower-48 gas production has averaged more than 70 Bcf/d, or 3.5% (2.4 Bcf/d) lower than the same period in 2016. April 2017 production was 0.2% (0.2 Bcf/d) below March 2017 levels, and nearly 3% (2.1 Bcf/d) lower than April 2016. Northeast production continues to inch higher-approaching 23 Bcf/d, which constitutes nearly 33% of total US lower-48 production. Key producing areas in the Southeast US have remained flat compared to levels recorded early this year.

"We see prices rising for natural gas, but the market is still sluggish in responding with new production, so the same dismal level of production persists for months on end," Weixel said. "The treadmill has gotten steeper to replace existing production which is in decline, particularly in shale producing areas. So the rig count is going up, but production is still catching up."

Production from Argentina's Vaca Muerta to reach 113 kboed by 2018

Production from the seven most advanced developments in the Vaca Muerta play (covering only 8% of play acreage), is expected to increase by 43% in 2017 to 77 kboed, and to double 2016 levels by 2018 to 113 kboed, according to a new Vaca Muerta Development Study by Wood Mackenzie.

"Our scenarios from the study demonstrate that production could peak between 0.7 and 1.25 mboe/d by 2031," said Elena Nikolova, Latin America Upstream Oil and Gas Research Analyst for Wood Mackenzie.

Since January 2017, new pilot and development agreements in the Vaca Muerta have been announced with increased frequency, demonstrating a significant uptick in interest in the play, especially in the gas window. Companies with gas acreage are exposed to the greatest upside by capitalizing on gas price incentives and attractive well performance. While still in the early days of development, Vaca Muerta well performance is already on par with some US shale plays that have thousands of producing wells.

Commitments since January 2017 total over US$3.5 billion, marking an inflection point in the play's ramp up. The largest announcement this year has been from Tecpetrol at Fortin de Piedra where US$2.3 billion has been committed to drill gas wells and build infrastructure. To fund play-wide development, Wood Mackenzie estimates that at least 15 times current annual capital levels are needed. Nikolova asserts that the government is taking steps to address several above ground concerns. The labor union and price agreements finalized earlier in the year have provided enough flexibility and pricing predictability to encourage operators to commit to new pilots.

In terms of drilling activity, the Vaca Muerta has transitioned to horizontal mode, according to the study. Nearly 100 wells were completed through October 2016 and 80% were horizontal. Wood Mackenzie expects future development to be through horizontal wells with laterals up to 2,500 meters. "Cost reductions are a key focus for operators and our type curves heavily reflect YPF's cost achievements," said Nikolova. "YPF has significantly brought down costs to US$8.2 million in Q4 2016. New entrants may be challenged to match YPF's cost structure, but logistics and proppant improvements can help bring costs down across the basin."

The study also examines how the Vaca Muerta can compete with the best US shale plays. Findings show that as Argentinian operators continue to move up the learning curve, strong well performance and lower costs can unlock scale comparable to that of US shale plays. "Vaca Muerta operators are still in the early stages of the learning curve. Production gains driven by drilling speed and completion intensity in the US will materialize in Argentina, as more and more operators enter the play," Nikolova concluded.

Hurricane details agenda for phased Lancaster project west of Shetland

Hurricane Energy has issued details of its planned Lancaster oil field early production system (EPS) west of Shetland in its latest results statement.

The aims are:

• To provide long-term production data to confirm the productivity and extent of the Lancaster fractured basement reservoir to optimize full-field development (FFD) planning and sanction

• Start development of the field's resources of the field in a phased manner, to enhance the understanding of the subsurface ahead of FFD

• Deliver an acceptable return on capital invested.

Last August the company appointed Bluewater to provide the FPSO Aoka Mizu for the EPS and TechnipFMC for front-end engineering and design (FEED) studies.

Bluewater's program is focused on repair and life extension of the FPSO, which has served elsewhere in the North Sea; a new mooring system and turret buoy; vessel and topsides upgrades.

TechnipFMC's FEED work concerns provision of the subsea, umbilical, riser, and flowlines and subsea production system elements with Petrofac Facilities Management working on the well completions.

The EPS concept is based on production from the existing Lancaster 6 horizontal well (205/21a-6) and horizontal side track well (205/21a-7Z) being completed and tied back to the turret-moored FPSO via individual flowlines.

The design, allowing for topsides metering of the individual wells, employs dual-pod electrical submersible pumps in each well to provide artificial lift with additional well data provided from downhole gauges.

The main tasks are the re-entry and completion of the two horizontal wells; procurement, fabrication, installation, and commissioning of subsea infrastructure comprising twin 6-in. flowlines, a power and control umbilical, risers and subsea manifold; procurement, fabrication and installation of a new turret buoy and mooring systems; and recommissioning of the Aoka Mizu.

Future oil export will be by shuttle tanker, with produced gas during the EPS phase used on the FPSO for either power generation and/or utilities, with surplus gas likely flared.

After the initial EPS period, Hurricane will assess the feasibility for tiebacks and future gas export as part of the FFD concept plans based on the long-term productivity testing of the initial two EPS wells.

Hurricane aims for first oil in 1H 2019 subject to engineering, procurement, and construction progress post FID in mid-2017. The latter remains subject to required funding being in place and the regulators' approval of the Lancaster EPS FDP and the environmental statement.