Energy capital research

Rising CAPEX costs tighten economics in hot Permian Basin

Exploration and production (E&P) companies that successfully acquired Permian Basin acreage in the red-hot 'land-grab' market of 2016, are now faced with the challenge of maintaining premium valuations while meeting high-growth expectations in a rising cost environment, according to new research by IHS Markit.

"The Permian is the hottest basin going in 2017 due to its deep inventory of profitable locations under a lower oil-price scenario," said Sven Del Pozzo, CFA, director of energy company and transaction research at IHS Markit.

"This profitability has driven many companies to acquire acreage in the Permian land-grab, but now the pressure is on for these companies to create value to maintain premium valuations," Del Pozzo said. "Most of these acquisitions were almost entirely equity financed at notable premiums by companies that were highly regarded because they were already in the Permian, making seemingly expensive deals affordable without immediate dilution of shareholder value.

"After the group posted stellar shareholder returns in 2016, we believe differences in management, asset quality, company size and cost control - all have potential to cause stock performance to range more widely in 2017, especially as costs rise," Del Pozzo said.

Despite the continued economic attractiveness of the Permian Basin, rising service sector costs will raise per-well capex by more than 15% during 2017. Costs will continue to place upward pressure on break-evens averaging $5 per barrel in the Permian, according to Imre Kugler, senior consultant at IHS Markit.

"The economics for the Permian are still impressive at $41-per-barrel (weighted average) for a $55-per-barrel WTI price-projection, but costs are rising, mostly for service sector-related costs of drilling and completion, proppant, sand and a tightening rig market as utilization rates increase," Kugler said. "While Permian and Anadarko Basin plays remain in the money, so to speak, lofty acquisition values become more difficult to pay off when the plays require nearly $50-per-barrel WTI to produce a 10% internal rate of return."

Many companies are able to offset rising service-sector costs with increased productivity, particularly in the early life Permian plays, while more mature plays outside of the Permian have reached a plateau, with economics primarily altered by cost, Kugler said. Fortunately for operators outside of the Permian, the lack of infrastructure bottlenecks will place less cost pressure on the Bakken, Wattenberg and Eagle Ford plays.

"Oil price stabilization is creating greater confidence, and pumper calendars are filling up quickly," said Thomas Jacob, research consultant at IHS Markit. "In the Permian, in particular, we see significant expansion in drilling and completion activity. As a result, we at IHS Markit estimate the play will increase its proppant consumption from 20% of the US market in 2014, to 37% of the market in 2017."

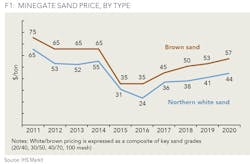

Additionally, Jacob said an increase in the number of wells fracked in 2017, and higher frack-sand-mass-per-well assumptions for fourth-quarter 2016 and beyond have led to an astounding 62% increase in North American frack-sand demand in 2017. "This year, mine-gate sand prices are expected to increase by roughly 50%," he said, "and in particular, fine-grade sand prices are increasing most significantly. The market share of fine-grade sand increased from 60% in 2014, to 80% in 2017."

Report: Task Force CALL for climate-related financial disclosures would mislead investors, distort markets

Recommendations by a Financial Stability Board (FSB) task force calling for separate requirements for disclosing climate-related financial risks could lead investors to misunderstand opportunities and risks, misprice assets and forego future returns, according to new analysis by IHS Markit.

The recommendations, released in draft form this past December by the FSB's Task Force for Climate-related Financial Disclosures (TCFD), suggest a framework for voluntary disclosures of climate-related financial risks in public financial filings. The recommendations apply to all entities with public debt or equity. The FSB is a body composed of financial regulators, central banks, finance ministries and international financial organizations. The FSB reports to the G20, the international forum comprised of 20 of the world's largest advanced and emerging economies. The FSB is expected to present the final TCFD recommendations to the G20 summit in Hamburg in July 2017.

The report says some elements of the TCFD framework could be helpful to investors in understanding how companies comprehend and manage potential risks related to climate change. However, the analysis concludes that several of the recommendations could obscure material information and create a false sense of certainty around the financial implications of climate-related risks.

"The TCFD proposal represents a radical departure from established financial reporting rules and goes against the basic principles of disclosure," said Antonia Bullard, IHS Markit vice president for energy-wide perspectives. "Singling out one type of risk for separate treatment would prevent financial markets from accurately assessing, comparing and pricing all risks and opportunities. That would undermine, not support, the goal of improving capital allocation decisions and market functioning." Among the problems that the IHS Markit report identifies:

Departure from the established concept of materiality in financial reporting

Disclosing information on climate-related risks as part of required public financial filings represents a radical departure from the established concept of materiality, the report finds. It could lead to unintended consequences, such as investors downgrading other risks that might have comparable financial impacts, but are not subject to specific disclosure frameworks.

Use of metrics that do not correlate with financial risk and opportunity

There is no evidence that the types of metrics referenced by the TCFD will allow investors to quantify climate-related financial risks, the report says. The impact of climate-related factors is more complex and multi-dimensional than typical financial drivers like commodity prices.

Metrics taken out of context do not allow for proper comparisons and could lead to inefficient investor choices. Carbon emissions do not correlate with climate-related financial risk in a straightforward manner. For example, operational emissions might decrease due to declining production rather than the result of improved emissions management, which could have a greater financial impact than climate-related risk, the report finds.

The TCFD also suggests a direct link between future earning capacity and emissions in a company's entire value chain (Scope 3 emissions). However, any link would be highly dependent on company specifics, such as the countries and sectors where its products are used and the pace of adoption of relevant climate-related policies.

"The Task Force acknowledged that further work is needed to define carbon-related assets and their potential financial impacts," Bullard concluded. "There is absolutely no consensus on the methodologies and metrics that could translate company-level climate-related metrics into measures of systemic risk."

In addition, the TCFD recommends the disclosure of "climate-related opportunities"-such as investments in low-carbon alternatives-in terms that imply that these opportunities will generate positive financial outcomes. No such guarantee can exist. In fact, some "clean energy" investments have high financial risk and some of the recommended disclosures could lead investors to misprice assets and increase their financial risk, the report says.

Misuse of scenarios analysis

The report finds that including financial implications of long-term scenario analysis in public filings as recommended in the TCFD draft would mislead investors about the certainty of those outcomes. This would distort markets, not enhance them.

Scenarios are not intended to serve as forecasts or generate financial projections. Any financial disclosures based on scenario analysis will be contingent upon a large number of assumptions about markets, technologies, prices, costs, company strategies and other variables, the report says.

Scenarios from different companies will use different assumptions and will vary depending on focus, approach and internal and external resources. Disclosing financial implications from scenarios created under different conditions cannot provide comparable information for pricing financial assets and risks, the report finds.

"IHS Markit has a long experience working with scenarios and regards them as a valuable tool," said Daniel Yergin, IHS Markit vice chairman and a co-author of the report. "But the use of scenarios as proposed by the TCFD conflates the hypothetical-using different plausible futures as an exercise to test strategic thinking-with detailed financial forecasts and projections. "This would create a false sense of certainty in the face of multiple possible outcomes."

Disclosure of confidential business information

The TCFD recommends that oil and gas companies disclose metrics such as "indicative costs of supply for current and future projects." Disclosures of such confidential information would undermine companies' competitive positions and harm existing shareholders, the report says.

In the oil and gas sector, disclosing information about project plans could reveal a company's development priorities and impair its position with host governments, project partners and service sector companies. In addition, absolute and relative costs shift constantly in response to market and technology changes. Companies also could face litigation if future costs do not align with the projected costs in the disclosures.

"The TCFD recommendations extend beyond the scope of investor needs and enter the realm of climate policy," Yergin concluded. "Climate policy is best designed and implemented by government agencies with the requisite mandates and expertise, not financial regulators."