Colorado's oil industry

Rapid recovery behind the scenes

Artem Abramov, Rystad Energy

While the market's attention within the US land oil industry has been recently attracted by the ongoing activity expansion in the Permian Basin, SCOOP, and STACK plays, there is one more major basin where oil output has been recovering even faster in relative terms. The Denver-Julesburg Basin, with the core activity in Weld County, Colorado, pushed total state oil production to a new all-time high level of 370-380 MBbld by late summer 2017. Colorado was the second most significant oil-producing state after New Mexico to renew the pre-downturn production record. An impressive growth rate of 30% was achieved in the period from February to August 2017, which alone suggests significant activity expansion in 2017.

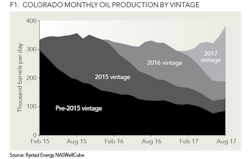

Figure 1 illustrates a breakdown of monthly Colorado oil production by vintage (i.e. the month when a well is turned-in-line and delivers first oil volumes). The pre-2015 vintage aggregates volumes coming from the wells that were producing as of December 2014. While this legacy vintage includes thousands of legacy conventional wells with very stable output, it is largely driven by pre-2015 horizontal Niobrara and Codell completions with steeper decline rates. Therefore, even in 2017, this legacy part declines by 22% during the first eight months of the year with some anomalies in May-June 2017 when Anadarko Petroleum shut down nearly 3,000 operated marginal wells following a fatal house explosion. The official data for July-August 2017 indicates that 360 of these wells came back online, pushing total legacy vintage production upwards.

When it comes to new activity in the DJ Basin, from 2015 to 2017, steep decline rates are clearly visible in Figure 1. New additions were fairly strong in selected months of 2016, but not enough to offset the base decline from historical vintages, and total state oil production was not able to grow. The situation changed drastically in 2017, as each month's vintage has been adding 30-38 MBbld of new volumes in the peak month since March 2017. Such strong and persistent production additions have not been seen since March 2015. As of August 2017, the 2017 vintage already accounts for 50% of the total state oil production.

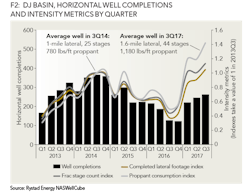

Figure 2 illustrates a significant expansion in the completion activity observed in 2017, however, the number of horizontal completions in Q3 2017 is 25%-30% below peak levels between Q2-Q4 2014. However, modern wells appear to be significantly more intensive, resulting in higher completed footage, frac stage count, proppant consumption in Q3 2017, as compared to levels observed three years ago. Operators such as Noble Energy, Extraction Oil & Gas, and Bill Barrett Corp. contribute to the average with even more intensive proppant loading per foot than the average for the basin in 2017, while the same companies, along with SRC Energy, also exhibit laterals above average.

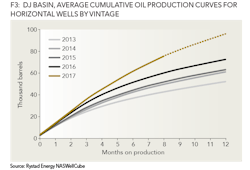

The shift towards more intensive completions, along with a high-grading of drilling locations, has naturally boosted well productivity in recent years. Looking only at the oil production stream, we observe that the first-year recovery per horizontal well increased from 52 MBbl in 2013 to 72 MBbl in 2016 (Figure 3). A significant improvement over 2016 levels has been observed so far in 2017, as an average horizontal completion tracks first-year oil recovery of 96 MBbl, a 35% improvement over the previous year.

Colorado's oil production has been recovering strongly since the early 2017. Dedicated operators treating the DJ Basin as a core play positions the state's production for a continuous expansion throughout 2018 if WTI prices stay above US$50/bbl. Despite severe service cost escalation in 2017, the latest breakeven prices in the core areas of the DJ Basin remain in a US$35-$45 /bbl range and major players are still able to absorb additional cost increases in 2018.

About the author

Artem Abramov is a vice president of analysis in Rystad Energy's shale well data research team, responsible for empirical analysis of well production profiles, completion techniques, and economic indicators. Abramov is the product manager for the NASWellCube, Rystad's NAM Shale well database. He is a co-author of the NASReport and a key contributor to the NAM Shale section of the OMT Report. He holds an MSc in Financial Economics from BI Norwegian Business School and a BSc in Applied Mathematics from the Novosibirsk State University, Russia.