Israel's natural gas sector

Leviathan Natural Gas Field could revive a moribund industry

SHIRI SHAHAM AND SIMON WEINTRAUB, YIGAL ARNON & CO., TEL AVIV, ISRAEL

IN DECEMBER 2015, after a long period of deliberation, including extensive public debate and hearings, the Israeli government approved the Natural Gas Framework which resulted in a comprehensive regulatory solution for the Israeli natural gas industry. The regulatory uncertainty in Israel unfortunately did not dissipate with the approval of the Natural Gas Framework, as it was subsequently challenged before the Supreme Court of Israel. The court determined, by a majority opinion, which is considered a landmark in Israeli constitutional law, that the Natural Gas Framework was not properly adopted primarily on account of the legal status of the provisions known as the "stability clause" - i.e., provisions requiring the government to guarantee statutory and regulatory stability for 10 years.

On May 22, 2016, the Israeli government addressed the concerns of the court and amended the Natural Gas Framework with a more lenient stability clause. To date, this revised Natural Gas Framework has remained unchallenged and following its adoption in May 2016 has led to a rebirth of the local natural gas industry.

DEVELOPMENT OF LEVIATHAN

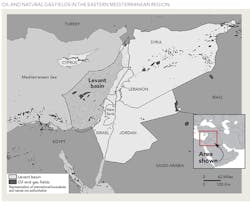

The main excitement today surrounds the Leviathan natural gas field which is located offshore in the Mediterranean Sea, 100 kilometers (62 miles) west of the northern port city of Haifa. This field was first discovered in December 2010, but its development was halted on account of the regulatory uncertainty that preceded the implementation of the Natural Gas Framework.

In June 2016 the Israeli Petroleum Commission approved the Development Plan for the development of this field based on an estimate that it is able to produce 17.6 trillion cubic feet (tcf) of gas. In December 2016, the partners in the Leviathan field, namely, Noble Energy, Delek Group, and Ratio Oil Exploration, approved the Development Plan with a target of reaching first gas by the end of 2019. The plan anticipates the production of 12 billion cubic meters of natural gas per year.

After a long wait, in February of 2017, the final investment decision (FID) was reached whereby the Leviathan partners approved the first phase of the Development Plan, representing the largest energy project in Israel's history amounting to a USD $3.75 billion investment. Concurrently with FID, each of the Leviathan partners entered into finance agreements to raise external financing, including the reported USD $1.75 billion financing to the Delek Group and the USD $400 million financing to Ratio Oil Exploration. These funds were raised by leading global banks and involved a broad syndication of leading domestic and foreign banks together with institutional investors.

GAS SALE AGREEMENTS

A number of new gas sale agreements have been reported since 2016, both in the Leviathan field and the Tamar field, which has been operational since April 2013. Notably in September 2016, the Tamar partners entered into a material amendment of its anchor agreement with the Israeli Electric Company regarding the option to increase the quantities that the IEC will require. The main goal behind this exercise and amendment of the option periods was to free up capacity and allow additional quantities to be supplied to other consumers in the Israeli market.

Another major development in this area was the signing of a gas supply agreement between the Leviathan partners and the National Electric Power Company of Jordan in September 2016, despite the fact that development of Leviathan is still at early stages. Pursuant to this agreement, the Leviathan partners undertook to supply approximately 45BCM to the State of Jordan. The agreement is still subject to the fulfillment of certain conditions and is slated to commence following commencement of first gas in the Leviathan field as well as post completion of the necessary transportation system between Israel and Jordan. This agreement is significant because it is the first major gas export agreement for Israel and has both important economic and geopolitical ramifications in the Middle East.

INVESTMENT OPPORTUNITIES

A crucial component of the Gas Framework Agreement is the provisions which dictate mandatory sales by Noble Energy and the Delek Group. Noble and Delek were required to sell their rights in the small Tanin and Karish fields and this sale was completed in 2016 to Energean Oil & Gas, a Greek energy company. Additionally by the end of 2021, the Delek Group is obligated to sell all its rights in the Tamar field and Noble Energy is required to sell at least 11% of its rights in the Tamar field.

In July 2016, Noble Energy sold 3.5% of its stake in the Tamar to the Israeli Harel Insurance Group and the Israeli Infrastructure Fund. Delek Group reported in April of 2017 that it intends to set up a special purpose company through which it will sell up to 10% of its rights in the Tamar field. According to the reported plan, the company will offer securities to the public, including debentures, and will be registered for trading on the TASE. It is also worth noting that in November 2016, the Israeli Ministry of National Infrastructure, Energy, and Water published a tender for oil and gas exploration in Israel's offshore exclusive economic zone. The tendered blocks are up to 400 square kilometers each and are located at least seven kilometers offshore.

CONCLUSIONS

It is still unclear at this stage which global energy companies will present bids under the new tender and the hope is that such new development and potential exploration together with the sale of existing gas fields will result in a new dawn for the expanding Israeli natural gas sector. One of the major and crucial challenges for Israel will be in defining a significant export market.

There is much discussion regarding a possible pipeline with Turkey and potential gas sales to Egypt, but to date only one export agreement has been signed (with Jordan) and a clear export path needs to be established before significant investment will occur in the industry. We are hopeful that the rebirth of the industry in 2017, including the development launch of Leviathan, will lead to significant transactions in 2018.

ABOUT THE AUTHORS

The authors are partners in the Israeli law firm Yigal Arnon & Co. and are the co-heads of the firm's oil and gas practice. Most recently they represented HSBC Bank and JP Morgan as Lead Mandated Arrangers in a $1.75 billion credit facility financing to the Delek Group as well HSBC Bank and BNP Paribas, as Lead Mandated Arrangers in a $400 million credit facility financing to Ratio Oil and Exploration. Both loans will be used for the development of the Leviathan field. In 2016 the authors represented the Harel Group and the Israeli Infrastructure Fund in its acquisition of a portion of the Tamar field.