Optimizing the refinery supply chain can increase margins, ensure survival

R. Chandrasekhar,EUS, Infosys Technologies Ltd., Bangalore, India

Over the past decade, there has been significant volatility in the margins and profitability of any petroleum refinery. Refiners operate in an environment where prices, costs, and markets are in a state of rapid fluctuations, particularly in today's tough economic scenario. External factors notwithstanding, the configuration of the refinery and how it operates is the single greatest influence on its profitability.

The greater the complexity of the refinery, the greater the chance of survival in these times. Unfortunately, not much can be done to modify refinery configuration, which requires a complete overhaul of the existing plant and machinery and also requires intensive capital.

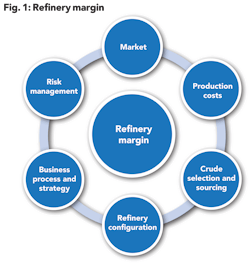

As is known, most (~ 90%) of the refinery working cost is spent towards procuring crude oil. Hence, effective management of the procurement supply chain, including foolproof scheduling, remains the key focus area for all refiners across the globe to achieve higher margins (see Fig. 1).

Scheduling is a daunting task for any refiner, owing to its complexity and wide-ranging implications, especially in an oil transaction, where the stakes are enormous and miniscule errors can make a significant dent in the margins.

Each refinery has its own configuration depending on logistics involved and the associated economics of related markets of feedstock and products. Based on the market supply-demand scenario, the refiner continuously optimizes the mix of product volumes produced with the aim of maximizing margins. This is primarily accomplished through optimal feedstock selection, varying the product cut-points, reactor severities, shuffling the inventory facilities, and re-routing intermediate product streams to alternative processing units, or alternative finished product blends.

In a competitive market, the refiner must be ready to capture any opportunity that may arise and thereby maximize the ultimate value by proactively responding to the situation by altering the internal parameters. The internal disturbances of the unit should at no point be allowed to alter and affect the external commitments of the company, which are binding and can impact the organization's credibility.

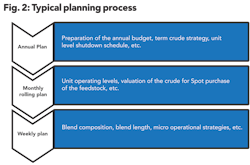

Before addressing the various issues involved in scheduling, let's look at the typical planning process in a complex refinery (see Fig. 2).

Most of the complex refiners employ tools based on linear programming models for optimization at the planning stage. The timelines for planning process differ depending on the business process of the organization and the related market conditions. In a typical integrated refinery, the rolling monthly plan starts around 90 days before the actual event based on the various factors predicted for the period. Hence, all the calculated results (based on predictions) must be construed as directional rather than as an inflexible course of action.

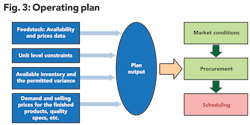

The operating plan as spelled out by the planning process is valid as long as the actual parameters remain the same as forecasted during the planning process. Ultimately, the operational decisions as suggested by the plan must be interpreted, keeping the underlying assumptions in mind (see Fig. 3).

As depicted in the Fig. 3 diagram, the actual procurement process depends on the current market conditions and the current scheduling requirements, but within the broad lines of the plan mandate. Once the crude oil purchase agreement is finalized, the onus shifts onto the scheduler to optimize the transaction and maximize the value through best possible processing within the available physical assets of the refinery.

Optimizing the oil purchase transaction differs from the value maximization, which has to be accomplished within the organization through a well-planned and executed scheduling process. The latter is the focus of this article.

A typical scheduler is expected to safely navigate through the following issues that may endanger the smooth operation of the refinery:

- Variation in feedstock quality

- Changes in the arrival schedules of the feedstock

- Plant and/or equipment failure or malfunction

- Weather disturbances

- Inventory surges resulted by disturbances in products lifting schedules.

Steady and homogenous feedstock (crude oil) is one of the most demanding aspects of any complex refiner for the obvious reason that the stability and efficiency of the downstream units of the refinery depends on the feed quality being produced by the crude distillation unit (and VDU). Generally the refinery columns operate in level control mode and it's highly unusual to have intermittent storages for receiving products from CDU/VDU. Therefore, it is imperative for the scheduler to coordinate and organize the overall refinery production environment through successful handling of the quality and quantity variables of finished products as well as feedstock being dispatched to both internal and external customers.

It is ideal for a process unit to run the unit with constant flow rate and uniform feed quality, but it may equally be impractical from a commercial sense to maintain the same throughput of the same quality. This requires deliberate forfeiture of opportunities in the volatile market scenario, which cannot be tolerated under a dwindling margin scenario.

Keeping in mind the quality and quantity issues and the unit level constraints (pump capacity, catalyst life cycles, pipeline constraints, tankage issues, etc.), the crude sequencing plan is worked out.

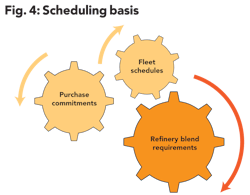

Having frozen the blend requirements of the refinery, the next step is to prepare an optimum sequence of the already procured crude oil. This is always subject to the availability of the time charter fleet schedules and the purchase commitments at the time of deal fixture.

Time charter fleet management

To protect the margins from the volatility of freight market, it is common practice to secure some fraction of the transportation requirement by entering into long-term chartering contracts, especially time chartering, in which the charter hire is paid for based on the number of days of charter. Since the charter hire is a sunk-in cost irrespective of the usage, the priority is to eliminate or minimize the idle time of the time chartered (TC) vessels. Depending on the current itinerary of the vessels, future schedules are projected and managed to achieve the maximum utilization of the fleet.

In most of the cases, the projected schedules of the owned fleet may not match with the refiner's cargo blend requirements and opting for a chartered vessel to cover the subject cargo may incur additional cost due to market volatilities. On real-time basis, an ideal scheduler has to function seamlessly with the fleet scheduler to minimize any variations in the projected schedules and to take timely corrective actions avoid unplanned shutdowns of the unit and unwanted quality variations of the products.

Co-loading requirements

To minimize the inventory costs and the freight cost and to provide the continuous supply of the blendable feedstock to the refinery, two or three grades of the crude oil are co-loaded from different terminals onto a single vessel. This inevitably reduces the freight cost by maximizing the average size of the vessel, but at the same time may pose many scheduling challenges. Multiple terminals would have multiple navigational restrictions and loading schedules and hence increases the complexity due to increased degrees of freedom with respect to the number of supply terminals, draft availability at multiple ports, suitability of the vessel at the multiple ports, cascading affects of weather disturbances, etc.

Supply constraints

The final crude arrival sequence at the refinery depends on the availability of the crude and the loading window at the particular loading terminal. A well-informed scheduler may track the production pattern of the supply terminals before nominating the loading details to the counter parties.

Depending on the confirmed loading schedules received from the suppliers and the projected fleet availability, the crude sequencing plan may have to be revised without compromising the blend requirements too much and thereby loss of value. These impacts need to be analyzed and agreed on prior to accepting the changes and keeping all the necessary people informed. Ultimately, scheduling is a dexterous balancing act of blend requirements, purchase/sale commitments, and freight optimization.

Any disturbance or slippages in the evacuation of the products can lead to significant disruption in the entire scheduling process of refinery (see Fig. 4). Adequate tankage facility for both the crude oil and refined products, at all stages of the refining process, significantly eases the scheduling constraints. But this is a costly option for the following reasons:

- Dead inventory

- Higher inventory carrying cost

- Price risk and associated hedging costs

- Increased capex (capital expenditure) requirement

On the other hand, having limited storage capacity increases the scheduling constraints and may result in lost opportunities, loss of optimization, and loss of profit and margin. Achieving the right balance, i.e. ensuring that the loss of margin due to tankage limitation does not exceed the incremental cost of the setting up extra tankage, is a critical managerial decision.

It becomes almost impossible to generate optimum schedules continually through manual systems, especially for plants that are resource constrained due to cost-cutting measures. It becomes absolutely necessary and is of tremendous value to have an automated scheduling application that can generate an optimum schedule in seconds compared to the few hours it may take a manual system to generate.

Timely decision making is extremely important to capitalize on opportunities that may arise in the market, like arbitrage, natural fluctuations, etc. In addition to ease and speed, these automated systems also make the entire process reliable by eliminating excessive dependence on a few individuals (see Fig. 5).

In spite of the enormous demand and importance, the availability of the integrated applications that can cater to the complete requirements of a refinery scheduler is limited.

The challenges are set out below:

- More focus on short-term planning and immediate requirements is needed for scenario and "what if" analysis. Many of the available tools in the market focus mainly on long-term planning.

- Proper sequencing is a requirement, and this extends to logistic planning as well. The integration of production constraints with logistical constraints and fleet management issues complicates the entire scenario.

- Most of the academic research in scheduling and operations research is focused towards batch processing.

- Traditionally, scheduling has been looked upon as production-oriented rather than as an integrated supply chain process.

- More advanced and robust process control systems must be in place to help take timely corrective action in crude distillation unit operating conditions for any change in the feedstock quality variations at the tank farm.

- Finally, speed of the application is still an issue with many of the available applications.

About the Author

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com