OGFJ100P company update

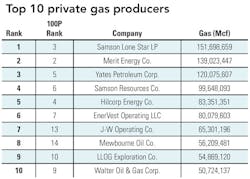

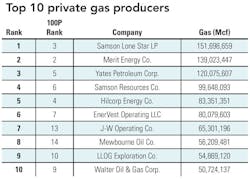

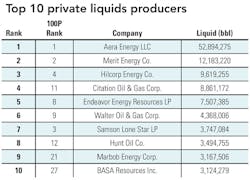

IHS Herold Inc., the independent research firm, has once again provided OGFJ with updated production data for our periodic ranking of US–based private E&P companies. The rankings provided by IHS are based on operated production only within the US. In this issue, the production data is year–to–date 2009.

There has been little movement in the Top 10 spaces since the last private company listing ran in January. Endeavor Energy Resources LP moved up two spots from No. 8 to No. 10, leapfrogging Walter Oil & Gas Corp. and LLOG Exploration Co. who now rest at the No. 9 and No. 10 spots, respectively.

While movement in the Top 10 was light, activity in the space continued.

Acquisitions

Unranked Charleston, WV–based Northeast Natural Energy LLC recently acquired 11,657 net acres in the core of the Marcellus Shale and associated shallow conventional oil and gas wells from Denver–based Nytis Exploration Co. and from Nytis Exploration of Pennsylvania. Northeast Natural Energy is a private company and financial terms were not disclosed. The acreage is located across Armstrong, Clearfield, and Westmoreland Counties, Pennsylvania.

Divestitures

On December 18, 2009, St. Mary Land & Exploration Co. closed the sale of all operated and non–operated properties in the Hanging Woman Basin coalbed methane project in Wyoming and Montana in a transaction with No. 26–ranked J.M. Huber Corp. While the purchase price was not disclosed, the total anticipated purchase price of this and other recent divestitures by St. Mary (minor asset packages of other non–strategic properties) are anticipated to reach $40 million.

Another private company looking to sell assets is The Woodlands, TX–based Branta LLC. The company is looking to sell interests in East Texas, the Gulf coasts of Texas and Louisiana, and the Rockies.

According to Madison Williams, unranked Branta LLC is soliciting offers from interested parties for a financing transaction or a sale or merger of all or part of the company. Branta LLC and subsidiaries have an interest in roughly 116,000 acres (65,000 net) in the Uinta Basin. Initial well results demonstrate over 3,500 feet of tight sands containing producible gas, over–pressure, and natural fracturing.

Branta also has a 28% to 40% working interest in a Green River oil development program as part of its Monument Butte northerly extension, with five wells producing approximately 1,600 b/d of oil and 1.8 MMcf/d of gas (gross).

Ratings

In January, Standard & Poor's Ratings Service lowered its issue–level rating on No. 39–ranked Antero Resources LLC's existing $375 million senior unsecured notes due 2017 to ‘B' from ‘B+' following the proposed $100 million add–on. Denver–based Antero plans to use the proceeds to repay outstanding borrowings under its credit facility.

Growth

From start–up companies to capital raises and joint ventures, the private company space has been active.

Start up

White Marlin E&P LLC has launched operations. The Houston–based oil and gas production company was founded by four principal investors and is led by Terrell J. Clark, president and CEO, and Jack C. Faubion, CFO. The company is working to build portfolio of offshore and onshore production and leasehold positions valued between $100M and $200M this year. In addition to conventional hydrocarbons, the company is looking at opportunities in the production of non–conventional gases.

Capital

Unranked, Dallas–based Broad Oak Energy Inc. recently received a $40M increase in its borrowing base. The company's bank group increased the borrowing base by 67%, to a total of $100M. JP Morgan leads the group which includes Bank of Texas, Union Bank, Societe General, Capital One and BNP Paribas.

Broad Oak's operations are centered on the Wolfberry play in the Midland Basin of West Texas, where it has drilled and completed 133 wells to date. The company plans to drill as many as 210 locations over its 60,000+ net acre lease position over the next 12 months running a minimum of five rigs.

Joint venture

Sources familiar with the situation anticipate No. 33–ranked Lewis Energy Group to enter into a JV with oil giant BP PLC. BP is looking to expand its US shale gas operations through a $160M deal with the San Antonio–based company. Lewis Petro Properties is active in the South Texas counties of Webb, LeSalle, and Dimmitt. Lewis Energy Group has been drilling in the Olmos Formation for over 25 years. BP is expected to acquire a 50% interest in 80,000 acres in the Eagle Ford Shale play at a price of $4,000 to $4,500 an acre.

Click here to download the pdf of the "2009 Year-to-date production ranked by BOE"

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com