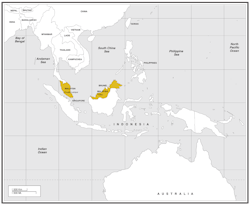

Malaysia goes deeper and further afield

This sponsored supplement was produced by Focus Reports. Project Director: Anne-Lyse Raoul. Project Coordinator: Léa Boubon. For exclusive interviews and more info, please log onto energy.focusreports.net or write to [email protected]

When Malaysia´s Prime Minister Najib Tun Razak unveiled its highly anticipated New Economic Model (NEM) in March 2010, he re-emphasized the importance of the oil & gas industry for Malaysia. "In oil and gas, we have one of our nation's most visible and valued champions in PETRONAS. It has built a strong brand internationally, and I believe now we must also help drive growth here in Malaysia with even greater support for local suppliers as it grows. Beyond the core oil and gas sector, however, Malaysia's international energy expertise can help companies in this industry and beyond expand internationally by sharing its know-how, partnering on international bids and offering support on a truly global scale. The strength of having a well-developed pool of local talent and companies which are able to compete globally gives us a lead advantage."

Since the establishment of its National Oil Company (NOC), PETRONAS, under the Petroleum Development Act in 1974, the hydrocarbon industry has been crucial for the country, contributing much to the nation's wealth. Over thirty years later, Malaysia still exports more oil and gas than it consumes, although this trend might change as Malaysians become richer and use more energy. Oil and gas have been and will continue to be at heart of the Malaysian economy, generating 41% of the country's revenue and being among the country's top-10 foreign exchange (forex) earners.

As of January 2009, Malaysia had proven oil and gas reserves of 20.18 billion barrels of oil equivalent. The country is also the largest LNG exporter in the world, and has built international giants such as MISC, Sime Darby, Scomi or KNM. PETRONAS alone employs some 40,000 people.

Malaysia has reached a defining moment in its development path and its oil and gas industry wants to continue be at the forefront of the country´s economy by going deeper under water, reaching further internationally, and capitalizing on past successes to develop a strong base of service providers.

The industry is well aware of PETRONAS's lead under the direction of Tan Sri Hassan Marican, and how the former President and CEO pushed the company beyond its own comfort zone. Replacing Marican at the head of PETRONAS, Shamsul Azhar Abbas is now determined to bring some change, starting by focusing the industry's effort on the domestic market and prospects in deep waters to replace depleting reserves. Rozali Ahmad, President of the Association of Malaysian Oil & Gas engineering consultants (MOGEC) highlighted that the NOC´s impetus would help to develop the local capabilities: "Malaysian companies have already developed expertise in shallow water, so the place where new competitive edge can be developed in the new ten years is definitely deepwater."

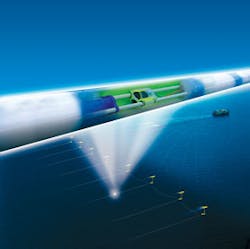

Shifting from shallow waters to deeper waters will require intensive technology transfer and international companies´ support, especially for seismic acquisition. As K.T. Tong, Country Manager for CGGVeritas Malaysia noted "now with the technological focus mostly on deepwater, this presents different types of challenges such as high temperature, high pressure, and changes in drilling technology. CGGVeritas has advanced technology in terms of being able to record and image these deeper targets with specific data acquisition and processing & imaging techniques."

The future of Malaysia lies in deeper waters, but not just in Malaysia, as many Malaysian service providers have shown they can stand on their own feet internationally. For Sofyian Yahya, President of the Malaysian oil & gas service council (MOGSC), "PETRONAS has created a healthy environment for Malaysian business to grow and establish their capabilities and experience in the Oil & Gas industry. Malaysian businesses on their part have risen to the challenge, and from purely representing foreign companies in the beginning, to developing joint ventures with foreign partners, and now we see many Malaysian companies with their own capabilities and experience which they can even export other Oil & Gas regions around the world."

Location, location, location!

Only one year after being hard hit by one of the deepest economic slowdowns since World War Two, Asia is now considered to be spearheading the global recovery. While the US and Europe have typically guided the recovery of the past three world recessions, for the first time Asia is leading the way. With 61% of the executives in the region being optimistic about their revenue growth in Asia-Pacific (APAC), according to IDC (International Data Corporation) researches, the oil and gas sector would not be outdone and has well recognized the potential that APAC represents. And they have reasons to be optimistic: in 2009, 35% of the global discoveries were made in the region, creating therefore prospects for strong exploration and production (E&P) investments to be done in this area. For most executives within the industry, the reason for Malaysia's success lies in its strategic location at the center of Asia Pacific, and a hub for all activities from Russia´s Sakhalin to the Middle East. As far as oil transportation is concerned, the importance of Malaysia is even more blatant: Roughly one-third of oil shipments transported by boat pass through the Strait of Malacca, making it one of the two most important oil shipping lanes in the world.

Oil and gas companies used to choose Singapore to head their activities within Asia-Pacific, as it was considered the most developed and stable nation in the region. As Ziyad Elias, who founded one of the most promising Exploration and Production geosolution and engineering groups in Malaysia — Orogenic - explained, companies soon realized the advantages of setting up camp in Malaysia too. "Malaysia is a business friendly country with energy resources on site, compared to Singapore which has the technology but no resources. Indonesia has the resources but its business environment is not as promising as in Malaysia."

In the same way the founder and CEO of IEV Group, Christopher Do, believes Malaysia is the best place to do business in the region. After his beginnings in Australia, he soon decided to come sell his inventions here and established its subsidiary IEV Energy in Malaysia. "Malaysia is a very good industrial regional corporate hub, especially in the oil & gas industry. There are many advantages in being here: the industry is here, the lifestyle is easy to adapt to, the cost of living is very low compared to Singapore or Sydney." Expatriates living in Kuala Lumpur tend to agree with Do, praising the city's multi-cultural diversity, and the relatively well developed infrastructure compared to, for instance, Indonesia´s capital Jakarta with its interminable traffic jams. Another selling point is the relatively cheap and cheery regional flights which allow for easy traveling - as well as weekend breaks- to discover the entire region.

In view of these virtues, many foreign companies such as Aker Solutions, Technip, Cameron, or AECOM have moved their regional headquarters to Malaysia. For Baker Hughes and its Director of Marketing for the Asia Pacific region Brian C. Wiesner, it was clear that after the reorganization of the company into geo-markets, Malaysia had to play an important role in the company's strategy: "In Malaysia, Baker Hughes has recognized the importance of the country as a strategic location to service its customers, such as PETRONAS. Malaysia is exploiting resources, while neighboring Singapore does not have any oil or gas. We view Malaysia as a valuable regional service center which expands our customer base, enables more immediate attention to our customers' needs, and reduces overall costs."

Local solutions for ambitious plans

Creating its Research and Technology division in 2006, PETRONAS made innovation a priority for the country, focusing especially on deep water technologies, but also developing its capabilities in terms of Enhanced Oil Recovery (EOR).

The Malaysian market current trends have created a suitable playground to implement the PGS' newest technologies, and its Country Manager Jesemee Zainal Rashid explained: "On the seismic front we match the country's ambitions to go deeper thanks to our unique streamers." PGS´ technology - the GeoStreamer - is a unique development that will make it possible to record deeper data, with a greater bandwidth, and beneath carbonates. As emphasized by Guillaume Cambois, President for the APAC region in PGS, "with technology like GeoStreamer, we can create better imaging of the reservoir, and through better images help the industry develop much more efficiently."

For Keith Collins from Petrofac, this development is a great sign of Malaysia's determination to develop its own solutions instead of importing foreign expertise. "There is - but should be more - development of new technology by Malaysian companies rather than the application of technology developed outside of Malaysia. The Malaysian service industry sees itself as an agency type of business instead of a true innovator in the world oil & gas business; but they have the potential to transform." Petrofac however has a unique approach to the Malaysian market. As an international provider of facilities solutions to oil & gas production, the company has chosen Malaysia - and the Cendor Field - as the location of one of its four energy development offices around the world. "The opportunity that we seized was to choose technically challenging and marginal projects, using the capabilities of a wider company, a service providers approach rather than a conventional approach, and take a risk with the investment."

Today many operators as well as service providers have established strong partnerships with the NOC, welcoming contractors — who are called "secondees" here — in their offices to ensure technology transfer. Total, a late entrant in the market, signed a production sharing contract (PSC) with PETRONAS in 2008 based on its technological expertise. For Vincent Dutel, General Manager of Total Malaysia "the added value of bringing in partners is to acquire new technology, find new concepts and new exploration plays. One example is the deep plays with high pressure and high temperature especially in the Malay Basin, below the existing producing fields. PETRONAS was interested in our experience as a possibility to find new resources, so we had direct negotiations with them."

In addition, Malaysia has developed a handful of flagship service companies, among them Sime Darby, Kencana, Scomi, KNM, MMC or Dialog, which are today exporting their own technology, the ultimate example of Malaysian service provider being MISC. MISC has evolved from its creation as purely a shipping line in 1968 to a fully integrated maritime, heavy engineering and logistics services provider, particularly in energy transportation. It is today one of the top five shipping companies in the world by market capitalization and the largest owner and operator of LNG fleet in the world. But its management does not want to stop there and is looking at becoming a midstream player, offering LNG technology solutions for new offshore applications. Technology will become a key area and a pillar for the transformation of the company's portfolio.

The Norwegian experience

One country in particular is benefitting from Malaysia's ambitions to transform into a deepwater hub: Norway. It is widely acknowledged that the strongest link uniting the two countries is technology. The number of Norwegian companies in Malaysia has doubled over the past three years, standing today at 61, of which 40% are directly involved in the oil and gas sector. According to Øyvind Bjørkhaug, Chairman of Malaysia-Norway Business Council (MNBC), "more and more Norwegian companies will settle in Malaysia thanks to these deepwater developments, but also because it is where growth is available and Malaysia as a frontrunner in deepwater for Asia, will become a hub and a centre of expertise in this field". Both nations have seen their oil and gas industry grow in the early 1970s. While Malaysia mostly gathered knowledge in shallow waters, Norway had to develop cutting edge expertise in deep waters and harsh environments. Tuan Hai Ewe, the most Norwegian of all the Malaysians involved within the oil & gas industry, now Country Manager of Innovation Norway in Malaysia and local advisor for INTSOK notes that, "Deepwater is an area where the two countries can cooperate. Norway and Malaysia started their oil and gas industry at about the same time, but Norway has gone a bit further in the development of deepwater and can lead the way for Malaysia."

Safety first. "If operational results and safety ever come into conflict, we all have a responsibility to choose safety first. Talisman will always support that choice." With the tragedy of the Gulf of Mexico´s Deepwater Horizon fatal explosion making everyday newspaper headlines, the words of John A. Manzoni, President & CEO of Talisman seem ever more pertinent. Talisman, the Canadian independent E&P company, entered Malaysia in 2001, taking over Lundin's assets. Since then the company has established a strong presence in the region, putting a strong accent on contributing to the country's development while ensuring the safety of its operations. As Dato Wee, Vice President of Talisman Malaysia, put it "In the relatively short presence in Malaysia, Talisman feels it has added value to Malaysia's and PETRONAS's goal in the development of its oil and gas resources. Talisman has successfully applied its capabilities in its Production Sharing Contracts (PSCs) assets effectively, safely and efficiently both technically and in Cost, Time and Resources." In an industry where people's lives are at stake, Talisman decided in 2009 to add safety to its core value, making of it a priority to the group. That is why when Dato Wee explained his ambitions for Talisman's growth in the region, he stressed one imperative: "It will have to be done safely! " After this interview, Dato Wee left his position as Vice President of Talisman Malaysia and was appointed Executive Vice President for Exploration and Production in PETRONAS. |

DNV, Roxar, Wilhelmsen, Jotun, SPT, and EMGS have recognized the strategic importance of Malaysia. However the Grenland Group — a leading engineering, procurement and construction (EPC) company — has made a difference by choosing Malaysia to establish its first international office and a strategic location for its 3D modeling activities. "From the first moment, our aim was to market 3D laser scanning and modeling and to establish relationships with PETRONAS. From 2010 onwards, we will focus on the local market to promote this technology. By having a subsidiary of Grenland Group in Malaysia, 100% of the group's 3D modeling will be done here, in Kuala Lumpur. Therefore the Malaysian office is crucial for Grenland's activities as no modeling activities will be feasible without us from now on," highlighted Mohd Rozlan Mohamed Ali, general manager of the Grenland Group in Malaysia.

Anticipating rewarding prospects in Malaysia´s deep waters, Aker solutions, a flagship Norwegian service provider, has chosen to heavily invest in Malaysia and benefit from what the country offers to strengthen its global capabilities. Dave Hutchinson, President of Aker Solutions APAC explained "Our Port Klang facility is unique in the world. It is a true one-stop shop that offers Aker's clients the understanding and knowledge that all their products are getting done under one roof. The facility was not built purely for Malaysia or Asia Pacific, but it was built with the world in mind. When we decided to invest $100 million in Port Klang we envisioned serving the global industry." Aker is not alone in recognizing the role of Malaysia as a global deepwater hub. Other players such as FMC, Cameron or Technip are also demonstrating their trust in the country's potential by heavily investing in subsea facilities.

From blue collar to white collar workforce

For decades, Malaysia was associated with the textile and electronic goods industries, manufacturing fueled by a blue collar local workforce. Today, as the country transforms into a knowledge-based economy, its human resources are mutating at the same rate. As Omar bin Khalid, managing director of Tanjung Offshore, believes Malaysians will achieve this easily. "One thing I strongly believe is that God gave us a brain and the opportunities to use it. It is then up to us to take the opportunities and develop them into something fruitful."

It seems, however, that even though Malaysia is able to attract foreign companies and expatriates, the country has so far failed to retain its own workers. The Deputy Foreign Minister A. Kohilan Pillay said that between March 2008 and August 2009, a total of 304,358 Malaysians had left the country, which for a population of 27 million amounts to what economists call a "brain drain" or a "talent crunch". Sam Haggag, Country Manager of Manpower, believes there are two main reasons why Malaysians are so in demand internationally: "Malaysia has certain skills set that are sought after overseas, in particular the Middle East, largely due to its rich history in the oil & gas industry. Malaysians have also proven to be among the most able to adapt to the culture in the Middle East."

International standards: Bridging the gap Transforming Malaysia into a high income nation by 2020 requires a leap in information and communication technology (ICT) in all fields, starting with its applications on the oil and gas industry. By inaugurating Cyberjaya in 1997, Tun Dr. Mahatir aspired to create the Silicon Valley of Malaysia, but today companies want to go beyond information technology (IT), and use Malaysia's excellence in services to build a hub for information management (IM). Using the status of Multimedia Super Corridor (MSC), companies such as AVEVA, ALCIM or IBM are pushing to change the perception of the general public from "software" providers to a consultancy based type of business. Since setting up operations in Malaysia over a decade ago, AVEVA has been a proponent of Integrated Operations (IO) within the Oil & Gas industry. According to Rozita Mohd Nor, Vice President APAC for AVEVA, "Ten years ago EPC contractors did not have any engineering design tools to deliver their engineering deliverables. By having AVEVA's system they are now able to compete on the international market. They have accurate deliverables and can work with giants such as Shell, Exxon etc". Internationally, the company is involved in FIATECH to accelerate the development and adoption of standardized and universal IO technologies and systems. ALCIM is also involved in this initiative and wants to educate the industry on the need to adopt international standards and on the opportunity to transform the country into a center of excellence for IM. Toralf Müller, CEO of ALCIM highlighted that "as member of the international POSC Caesar Association (PCA) and the US based FIATECH, both ALCIM and PETRONAS are promoting together the implementation of Data and Interoperability Standards like ISO 15926. PCA recognized the efforts of ALCIM and PETRONAS to bring the awareness of information inter-operability to Asia and asked ALCIM and PETRONAS to host the yearly PCA conference in Kuala Lumpur." Exploiting this collective push, IBM and its Managing Director Ramanathan Sathiamutty have also managed to move away from the image of a purely IT company. Under the umbrella of the "Smarter Planet" program, the company is looking at building a reputation as a solution based business, and becoming the right advisor to the government on how to implement international standards in a Malaysian context. |

The challenge of finding enough skilled workers is a concern for the entire industry, starting with the Malaysian Gas Association (MGA), and its President Datuk Abdul Rahim Hashim. The association, which is now heading the International Gas Union (IGU), has set "Building Strategic Human Resources" and "Nurturing the Future Generation" initiatives among its top priorities. These two programs aim at reducing the gap between experienced and young engineers, as well as attracting the younger generations to the industry. "When looking at the demographics profile of the industry, with the average age of around 50 years old, and lesser new graduates entering the industry, the industry has to undertake big changes in order to address issues relating to sustainable supply of human capital. We will also engage children so as to create awareness and interest in the oil and gas sector in general."

EPC companies that require a high amount of qualified engineers but work on a project basis and therefore cannot always guarantee a stable flow of work are especially affected by this trend. Dr. Ragunath Bharath, managing director Innovative Fluid Process, a Malaysian multi-discipline, integrated oil & gas engineering company, has had to devise a different approach to counter the situation. "We changed our strategy and tried to attract young Malaysian engineers to come and work for us, even people who do not have an oil & gas background but willing to learn. What we try to do is to expose our engineers to many works by securing as many different jobs as possible so that they feel challenged and can learn new things every time."

Embarking on the Offshore Support Vessels (OSVs) market

According to a report from Pareto Securities Asia, Malaysian yards accounted for less than 1% of the global fleet built during the nineties. This percentage increased to approximately 6% for the period 2000-2009, thus propelling Malaysia as an OSV shipbuilding hub. Among all the domestic yards, Nam Cheong is the most "international company", present in the Singapore, Papua New Guinea, Australia and the Middle East markets. For Datuk Tiong Su Kouk, executive chairman of Nam Cheong, "We have looked at different water depth for our vessels to operate in, and want to be the most efficient producer for each of the type of vessel that we produce. Today the world is our oyster!" Given the high price competitiveness of the region compared to Europe, and its proven track record supporting the country's deepwater ambitions, the company's growth is unlikely to stop there. In addition to expanding its operations internationally, Nam Cheong is determined to diversify its activities up and down the oil & gas service value chain, to become and integrated offshore company. Datuk Tiong Su Kouk believes that "With Nam Cheong, hopefully we can go up and downstream, to reduce the impact the cycles and variations that our business implies and enter the parts of the value chain that will bring us more stability in terms of revenues." But Nam Cheong's primary goal is not just to grow its own revenues, it is to build the country's talents and ensure a healthy competition within the market. The group established a number of "firsts" in Malaysia: participating in Kikeh, the country's first deepwater project, building the first high-tech Safety Standby Vessel for Sarawak Shell Berhad, or being the first shipbuilding company to manufacture the first dynamic positioning 2 (DP2) vessel in Malaysia. In its executive chairman's words "I want my company to grow together with the country, and embody the slogan it was built on: "Malaysia Boleh!", which in plain English can be translated as "Malaysia Can Do It!"

To answer the industry's human resources challenge, PETRONAS has always pushed for a "malaysianisation" of all companies working within the Malaysian borders. International companies are following suit with a constant training process to make sure that, once expats are gone, Malaysia will be able to integrate new skills and stand on its own. Graham McClelland was for long the only expatriate within Bukit Fraser Thermal, and even though he nearly feels Malaysian today, passing his experience in heat transfer technology to local employees. "We believe in training and have transferred a lot of knowledge to the young staff joining us; it has been developed to such an extent that today our local staff are conducting the training in terms of design works. I consider today some of my employees as good as anyone I know in the West working in the same field. As they have grown comfortable with their technologies, they become able to pass it on to their countrymen."

However as Steve Abbis emphasized, every expat is the result of a localization policy in its own country. "We are products of the Cameron localization philosophy of doing business. We both would not have jobs if Cameron had not invested in the UK or France back in the 50's. In the coming years you will see Malaysians taking the role of expats in new locations."

Islamic Finance hub or the "values" of money in Malaysia

With conventional finance recovering from losses and declining investors confidence, the world is looking for opportunities and warily eyeing the fast-growing Islamic Finance sector. Islamic banking is indeed one of the world's fastest-growing economic sectors, formed by more than 300 institutions in over 75 countries. The largest hubs for Islamic finance are located in the Middle East and South East Asia, with Malaysia being considered as the frontrunner for the past 20 years. However competition is rising with a growing interest from Europe, Hong Kong and Singapore.

In a nutshell, Islamic finance is an activity consistent with the principles of Islamic law (Sharia), prohibiting the payment or acceptance of interest fees for the lending and accepting of money respectively, for specific terms, as well as investing in businesses that provide goods or services considered contrary to its principles.

The oil and gas industry has already demonstrated a strong interest in the matter, with several projects backed by Islamic finance, such as Dubai Dolphin Natural Gas Pipeline, Kuwait Equate Petrochemicals Company, Saudi Basic Industries Corp, and Shell Malaysia. Most recently PETRONAS issued a five--year US$1.5 billion Sukuk Al-Ijarah (Islamic bonds), the single largest US dollar issuance by an Asian entity outside Japan in 2009 as well as the largest international US dollar Sukuk since the US$1.5 billion Dubai Ports issue in 2007.

After enjoying an exceptional career of more than 35 years in the oil and gas industry, Tan Sri Megat Zaharuddin was appointed Chairman of Maybank. Thanks to this dual expertise he clearly saw that oil and gas assets were suitable for many types of Islamic financing, and that investors interested in a competitive alternative to the conventional market place would find a wide array of products and services to answer their needs. "There are several types of Islamic finance structures and applicability to oil and gas deals namely ljarah (financial lease), Musharakah, Mudarabah, Murabahah (cost plus sale), Istisna'a (commission to manufacturer contract) and Sukuk.," he says.

"In the context of the oil and gas industry — he goes on - an ljarah could be an ideal mechanism for leveraged lease financing of large pieces of oilfield equipment, notably deepwater platforms or drill ships provided that the value of such oilfield equipment should be equal to or represent a material percentage of the offering amount.

Musharakah or Mudarabah could also be used to finance upstream activities. Investors or financial institutions would provide a portion (Musharaka) or all (Mudarabah) of the capital, and the oil and gas operator would operate the oil and gas properties and provide the necessary expertise. The arrangement could be documented in a joint venture agreement, or the parties could form a limited liability company, providing for dividends to be shared in a set proportion predetermined by the parties at the outset. The successful development of the oil and gas project could provide significant upside for the investors. Given the flexibility of these types of Islamic Finance arrangements, Musharakah and Mudarabah could be used widely at all levels of the energy industry for operations of various sizes and levels of complexity."

For Dato Yusli Mohd Yussof, CEO of Bursa Malaysia, the country in general has developed all the requirements to become an Islamic financial hub, and is now looking at strengthening its position within this market. "We are leveraging on this existing infrastructure to introduce facilitative framework, products and services to accommodate issuers' and investors' demands. We are also widening our reach to other markets in support of the MIFC's initiative in facilitating Malaysia's aim as an Islamic financial hub. In addition, we are on a quest to position Bursa Malaysia as a global platform for issuers worldwide to issue Islamic papers to raise funds."

CONCLUSION

Malaysia´s oil and gas industry is setting its sights on going deeper and further afield to ensure that its current position as Asia´s only next oil exporter and the world´s largest LNG exporter is guaranteed in the years to come. The industry is focused is deep water drilling, enhanced recovery, and international expansion to battle oil depletion. After proving that "impossible is nothing" by creating its NOC, the Malaysian oil & gas industry believes it is destined to become against all odds the fourth deepwater hub in the world after Houston, Rio de Janeiro and Europe.

"The problems of this world cannot possibly be solved by skeptics or cynics whose horizons are limited by the obvious realities. We need men who can dream of things that never were." &mdashL J. F. Kennedy

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com