The soaring cost of G&A and why CEOs should care

Steve Wright, SAIC, Houston

Significant increases in production costs and finding and development costs occurring around 2007-2008 have been well-documented. Less well-known is the extent to which General and Administrative (G&A) expense rose over that same timeframe.

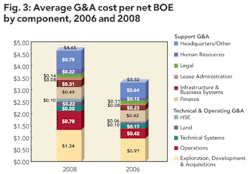

Benchmarking cost performance among North American upstream operators, SAIC found that average G&A cost per BOE rose from $3.32 in 2006 to $4.65 in 2008—a 40% increase. Using aggregate domestic oil and gas production as a guide, the increase of $1.33 in G&A cost per BOE translates to over $4 billion in lost profits in 2008 alone. To be competitive in the current environment, upstream companies must focus attention on this important cost element. In this article, I examine the sources of the recent increase in G&A costs and discuss why some companies are better than others at controlling those costs.

Understanding the components of G&A

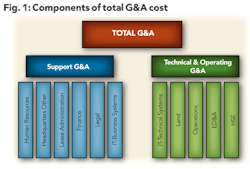

The SAIC G&A database contains cost, production, and other data from over seventy-five North American E&P companies from 1994-2008. In our conception, G&A includes all gross costs above first-level field supervision. We divide G&A into two components: Technical and Operating G&A and Support G&A, each of which should be managed differently from a strategic perspective (see Figure 1).

- Support G&A is a necessary expenditure to running the business. It includes finance/accounting, human resources, legal, lease administration, business systems, and headquarters/other.

- Technical and operating G&A includes core activities central to the success of a company in the competitive upstream marketplace—namely, exploration, development and acquisitions, operations, technical systems, health, safety, and environmental, and land. Technical and operating expenditures are often viewed as investments, in the sense that expenditures in those areas (e.g., technical systems) may result in efficiencies in other G&A areas.

What accounts for recent increases in G&A cost?

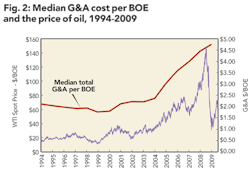

Figure 2, which displays median G&A cost per net BOE from 1994-2009, demonstrates that the increase in spend has been relatively recent. From 1994 until 2003, G&A spend remained relatively flat. Since 2003, median G&A cost has more than doubled. Although G&A costs have historically corresponded with the price of oil, there is some "stickiness" or lag in terms of its responsiveness to changing prices. At its current level, G&A simply cannot be overlooked by operations desiring to control costs.

What components of G&A account for the historically unprecedented recent increase? Figure 3 demonstrates that nearly three-quarters of the $1.33 average (mean) increase per BOE between 2006 and 2008 is a result of increases in just four areas: operations, exploration, development and acquisitions (ED&A), headquarters, and land. Of these, perhaps the most surprising is headquarters expense, which includes not only maintenance and rent for non-field facilities but executive staff salaries and bonuses as well. In general, however, most of the increase came from the technical and operating G&A areas, rather than the support G&A components.

Because G&A cost primarily consists of labor costs, it follows that labor costs must have increased since the early-to-mid 2000s. Using the Society of Petroleum Engineers (SPE) annual salary survey as a guide, there is indeed evidence that labor costs have increased significantly. The average base salary for US SPE members rose from $99,013 in 2002 to $140,588 in 2008, while total compensation for those members during the same timeframe rose from $122,516 to $204,444—a 67% increase. For a company with 2,000-2,500 G&A-related employees (comparable to a super major), the difference in total compensation amounts to over $160-200 million annually.

Controlling G&A costs

In an environment of increasing costs, it is fundamentally important to learn from those companies that have efficiently allocated their G&A resources. Top performers in G&A have a $1-3 per barrel advantage over their counterparts, which can have a significant impact on the bottom line—a difference of possibly hundreds of millions of dollars for super majors and super independents.

Although high commodity prices can often mask underlying fundamental weaknesses in G&A areas, that is no reason to avoid seeking improvement. Indeed, even though the strategic focus of upstream operations sometimes changes to other issues (e.g., supply management or growth) during times of high commodity prices, Figure 3 illustrates the importance of continuing to monitor and control G&A costs.

Characteristics of high performers from a G&A cost perspective include the following:

- Focused production portfolios. Companies that are spread in terms of geography or asset characteristics (oil/gas, conventional/unconventional, onshore/offshore, well productivity) are likely to have higher-than-average G&A spend. Those that are focused in both location and asset mix are likely to have lower G&A costs.

- Efficient management of (even low-performing) assets. Some independents in particular are efficient at managing their G&A spend even when their portfolio is laden with low-performing assets. Because each well must be maintained from some G&A perspective (e.g., accounting or legal), there is some fixed level of G&A spend implied. What this means is that companies with such portfolios must be better than their peers at managing their assets. For example, top performers pursue hydrocarbon accounting and production reporting solutions that can be leveraged across wells.

- High responsiveness to changing conditions. Top performers ensure that their G&A spend responds quickly to growth or decline in capital spend and wells drilled. They do not allow long lags between changes in their production or capital spend and corresponding changes in G&A spend.

- Targeted investment in information technology and information management. Increasing production costs and resource stretch have forced companies to focus not only on the deployment of personnel but also on the effective deployment of technology around virtualization, collaboration, and field integration.

- Continued attention to cost management even in the presence of high commodity prices. Top performing operations do not focus on cost management only when prices have declined. Rather, they build cost controls and monitoring into the way their business operates, with systems and processes geared toward realizing real cost savings.

The first step, and one necessary to undertake all of the above practices, is developing an understanding of your current performance in G&A cost management. The increasing G&A costs documented in this article provide ample support for an economic case behind such a G&A fact-finding exercise. OGFJ

About the author

Steve Wright is a principal consultant with SAIC, where he leads its annual G&A benchmarking study. He has over 25 years of experience in benchmarking and applied research. He holds a bachelor's degree from University of Texas at Dallas and a master's degree from The University of Rochester.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com