Water: Greatest challenge for shale gas. . . and the next investment opportunity

Leif André Skare, Energy Ventures, Houston

Dr. Vikram Rao, Energy Ventures, Research Triangle Park, North Carolina

There is no doubt that the so-called "Shale Gale" has taken hold in the US and is on the brink of spreading worldwide. Barnett, Marcellus, Haynesville, and Eagle Ford have become household terms for many, and in recent months, the industry has seen greater interest from overseas players in domestic shale fields and in Europe's shale resources.

Despite all the excitement around shale plays in the US and overseas, and the technological advances that have enabled the industry to produce this difficult resource, many challenges remain before even the known shale reserves can truly deliver on their potential. However, underneath these obstacles lies great opportunity for entrepreneurs, innovators and investors to play a key role in moving the industry forward to a more productive future.

Public & political challenges

The obstacles standing between shale's future as a long term resource and its current promise are all over the headlines. In the natural gas markets, available supply is growing much faster than demand. Bringing this situation into balance is largely a political battle where the level of encouragement and support for transitioning to natural gas as a base or bridge fuel must be decided. Environmental concerns around fracing and water disposal also need to be addressed, and the required regulation must be determined and made clear to industry participants.

It's a landscape filled with many questions and uncertainties, but one thing is certain: water stands to be the industry's biggest hurdle to productive, efficient, profitable and more environmentally friendly operations.

Shale is the most recent high-profile example of the public relations concerns, regulatory issues and general challenges the industry faces regarding water use and production. This is in large part because US shale operations have brought oil and gas exploration and production much closer to the general public than ever before, setting up shop in suburban neighborhoods and dense farming communities.

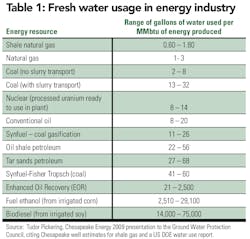

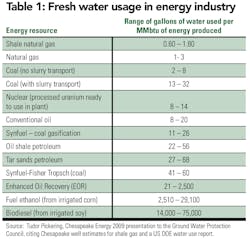

This amplified visibility has opened the door to increased scrutiny and led to widespread anxiety over fresh water use in operations and disposal of both flowback and produced water. Some of these concerns may themselves be exaggerated. The data shows that while fresh water use has become a popular public challenge for the industry, producing shale natural gas requires less water than many other options (see Table 1).

These concerns have driven home to regulators, the public, and some sectors of the industry that using fresh water resources to frac and treat shale wells and improve production in mature fields might not be in our best interests in the long term. As a result, in the US, New York has imposed a moratorium on activity in the portion of the Marcellus Shale within its borders until a study of the environmental effects of shale production is complete. Congress also introduced legislation to amend the Safe Water Drinking Act in the US and repeal the exemption previously made for hydraulic fracturing.

A bright spot for investing

Underneath what sounds like an awful lot of gloom and doom is, in fact, a tremendous opportunity to drive positive and widespread change through the industry. All of the factors mentioned above point to a critical need for the development and rapid adoption of technologies that will allow the industry to meet and exceed the current and expected regulations on water use in shale operations.

While oil and gas is an industry that is traditionally reticent to adopt new innovations, regulation and simple economics will mandate both development and implementation in the next few years. In short, the industry must find a way to economically meet changing water requirements or risk bottlenecking its most promising plays.

Many energy investors have been looking to shale plays and the technology to produce them as profitable investment areas in recent years, leading us to our current tipping point. As we look ahead, water related technologies will be the next industry hot spot for both innovation and investment.

Reduce, reuse and recover new resources

Within the large category of water use in shale plays, there are three key areas that are expected to show the most promise for technology development and investment. Those are, technologies that can reduce the amount of water required for a production operation from the start, technologies that make water injected into a play more fit for its purpose, and technologies that work to efficiently and safely treat flowback and produced water.

The first category examines the amount of water input into a shale operation. The challenge of reducing the demands fracing places on fresh water resources can be accomplished in two ways. One is to simply use less water per frac operation. The other is to use water that is not classified as fresh.

Several technologies currently in development aim to reduce the water input into a fracing operation. Incorporating nano-technology, Oxane Materials has created an ultra light ceramic proppant. Using Oxane's OxFrac, operators can transmit more proppant farther along a frac, with less water than required by other proppants.

Approaching the problem from another angle is digital rock physics lab Ingrain. Ingrain's imaging technology reveals physical properties and flow characteristics of reservoir rocks at the nanoscale. The result is better understanding of a reservoir, more strategic planning of fracing operations and hence, more efficient water management. Ingrain's technology also stands to inform the refracturing operations now becoming popular in shale plays by helping operations identify promising new production zones.

Fotech Solutions' Helios distributed acoustic monitoring system and Ziebel's Z-system, which allows for logging in highly deviated and horizontal wellbores, also provide operators with a more accurate and informed look at their reservoirs. The technologies were recently used together to analyze a tight gas well undergoing a multi-stage fracing job. As production was reviewed in real time, it was easily seen that just over half of the fracing stages were producing. This type of service can lead to cost savings for the operator by allowing them to produce gas with less fracing, and concomitantly less water. (See Figure 1.)

On the cutting edge of technology development are innovations that allow fracing operations to be conducted with saline water. A large amount of the existing investment and technology addressing water use challenges in shale operations has addressed desalination. However, a new target for investment and technology development is coming to the forefront. Many experts are now examining how to better use waters of convenience in shale production. That is, the closest available water resource fit for the purpose at hand - either economically or physically. For many operators the nearest resource is a saline aquifer.

Already, fracing operations can be conducted with saline water measuring 40,000 ppm (lakes and streams are generally under 1,000 ppm). Further innovation can be expected to double that number, making the use of saline aquifers, as well as recycled and treated flowback water a promising option.

Desalination will not fade away. Only about one third of water input into a fracing operation returns as flowback, so additional water supplies will always be necessary. Especially in light of the fact that the water associated with shale gas operations tends to be much more saline than average, up to 350,000 ppm in some cases. However, when these tracks of technology development are combined, they stand to cumulatively reduce overall water use of shale operations and decrease their pull on fresh water resources.

Conclusion

In conclusion, shale gas is a game changer and the most important development in petroleum production in decades. It has paved the way for North America to move from its position as a net importer of hydrocarbons to operating self sufficiently for a hundred years – and it is likely to have similar effects worldwide. But, the viability of this play is potentially compromised by water use and disposal issues. Consequently, innovative solutions to these comprise an excellent investment opportunity. OGFJ

About the authors

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com