Singapore: Leadership in Pro-Active Thinking

This sponsored supplement was produced by Focus Reports. Project Director: Léa Boubon. Editorial Coordinator: Koen Liekens. Support: Anne-Lyse Raoul and James Waddell. For exclusive interviews and more info, please log onto www.energy.focusreports.net or write to [email protected]

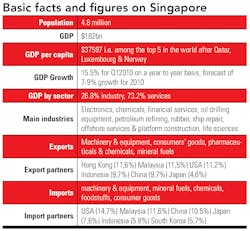

If you go downtown to the business district, the theatre district, you can see it is well kept...handsome buildings, lots of theatres, plays, musicals, arts, along well-kept streets. There is a certain civic pride and confidence and a thrust to a better tomorrow, and I think that is the way Singapore should be". Advocated by one of Singapore's most respected politicians, these words marked Singapore Prime Minister Lee Hsien Loong and his delegation's visit to Houston, USA, in July 2010. Given the 24 percent trade growth between Houston and Singapore in 2009, and Singapore's ambition to diversify its economy, it should come to no surprise that Lee aims to attract more foreign investment to the Lion City. What might be surprising is the fact that the island country of less than 275 square miles in surface is specifically looking to attract investors in the energy business, despite having zero natural reserves of oil and gas.

Lee Hsien Loong, Prime Minister of Singapore

Commenting on the investment potential in Singapore, chief executive Chong Lit Cheong of International Enterprise (IE) Singapore, the government's agency spearheading the development of Singapore's external economy, says that "the word arbitrage is sometimes used to describe Singapore's position, because it is central to the flow of values, money, information and people". Lawrence Wong, chief executive of the Energy Market Authority (EMA), the body that acts as energy industry regulator, systems operator and industry developer, agrees that Singapore is an attractive location for new investments in the energy space. "Singapore and EMA certainly welcome collaboration with the private sector because these are areas where the government does not have all the expertise and would welcome the competencies and capabilities of private companies", Wong finds.

Lawrence Wong,Chief Executive at EMA

The visit of Prime Minister Lee to Houston is only one example of Singapore's outward-looking and proactive policy. The remarkable extent of Singapore's proactiveness has allowed the nation to grow into its current hub status, servicing an integrated part of the oil and gas value chain. "Singapore has proven to the world that it has the infrastructure and technology as well as the management skill set to be able to help companies and businesses in this sector", comments Tan Poh Teck, deputy executive director of the global business division of the Singapore Business Federation (SBF).

Supplying the World's E&P Markets

If jack-up rigs would have a "made in" tag, it would immediately illustrate one of the key products that Singapore has been vigorously developing in-house. Following the latest statistics of its Ministry for Trade and Industry, Singapore holds a 70 percent manufacturing share of the world's jack-up rigs. With the addition of an equal share of the world's Floating Production, Storage and Offloading (FPSO) units being converted on its grounds, Singapore today has risen to become the world leader in this niche. The two local flagship companies bringing the majority of these contracts to the Republic are the well-established Sembcorp Industries Ltd and Keppel Corporation Limited. With heavily diversified operations, roughly 60 percent of Sembcorp's and 67.5 percent of Keppel's group turnovers were attributable to their respective marine divisions in 2009. Despite last year's global downturn, the two giants were able to draw on the construction boom of preceding years to perform well nonetheless. "As a result, Keppel successfully delivered 14 rigs, 14 specialized vessels and six major conversions and upgrades for various customers in 2009", says Choo Chiau Beng, CEO of Keppel Corporation.

Looking at how Singapore-based companies are able to export their expertise and gain market share on the international platform, most seem to have the ability to enter overseas markets quickly and efficiently. Ranked as the most globalised country by management consultant firm A.T. Kearney, Singapore's internationally-exposed companies are consequently more adaptable when operating abroad. "The society is more understanding of local cultures because of the differences in cultures around Singapore from Thailand to Malaysia, Vietnam and Taiwan", says Francis Wong, CEO of the USD 400 million Singapore EPIC contractor Swiber Holdings Limited. Exporting the groundbreaking expertise from leaders such as Sembcorp and Keppel, as well as smaller players such as Swiber, has been crucial in putting Singapore on the global oil and gas map, a progress that is set to continue.

S. Iswaran,Senior Minister of State for Trade & Industry, and Education

Moving Towards a Safety-Case Regime: the Right Equipment

Looking back at early 2010, the blowout on the Transocean / BP platform has become an adverse factor impacting the oil and gas industry worldwide. Concerns have been raised over the new and stricter safety standards that are to be imposed as the industry moves forward. However, as Singapore has grown into an engineering center renowned for its high standards, many of its oil and gas related businesses do not necessarily perceive this trend as a major threat. Quite the opposite, several of the Singapore-based players see the event as an opportunity to export their trusted brands. "Given that Prosafe is already positioned at the premium end of the offshore accommodation market, we know that we are well-placed to meet the high standards of the industry", proclaims Robin Laird, managing director of Singapore-based Prosafe Offshore, the leading owner and operator of semi-submersible accommodation and service rigs. David Ong, CEO of process automation and safety systems solutions provider Excel Marco, sees the implications of the unfortunate tragedy as a growth opportunity for his Singaporean company. "Such events increase the market size, causing demand to go up. As new regulations come along, capital investments need to take place accordingly", Ong concludes.

Chong Lit Cheong,CEO of IE Singapore

In view of these additional investments that may arise, many of the operators will be extra cautious when allocating their scarce resources. With shallow water oil reserves depleting and E&P companies increasingly moving into deepwater and harsher environments, cost management will become even more important. "Designing and constructing a drilling rig, you have to make certain critical decisions which involves accepting a number of compromises with respect to cost, weight, size, operational capabilities etc." comments Simen Skaare Eriksen, CEO of Frigstad Offshore, the international drilling contractor headquartered in Singapore. Expected to be delivered by late 2010, the prestigious Frigstad D90 design lays the groundwork for ultra deepwater semi-submersible drilling rigs with the ability to cover 95% of the world's deepwater areas. "One of the decisions that were taken in the design process was to focus on the worldwide deepwater market except Norway and the Barents Sea niche, because of its "ultra harsh environment" and special regulatory regime. This automatically takes away some essential cost-driving and capacity-hampering factors which would reduce the competitiveness of the rig when operating outside of these niche areas" Eriksen points out. Olivier Chapuis, co-founder and present director at rig designer firm Moonpool Consultants, concurs that contemporary rig design must focus on the following key principles: "easy to operate, easy to maintain, as simple as possible but with modern technology, comfortable and safe life on board, innovation but costs under control".

Choo Chiau Beng,CEO of Keppel Corporation Limited

Courtesy of Frigstad Offshore.

Moving away from projects to day-to-day operations, stricter regulations in the oil and gas industry will in fact benefit many of the Singapore-based maintenance firms, anticipating an increase in demand for additional work on some of the older equipment out there. Robert Dompeling, Group CEO of EPC and EPCm provider PEC Ltd., explains that while the company is also involved in project work, the maintenance business is the backbone providing revenue stability. Specialist in plant and terminal engineering, PEC sees most growth potential in projects and maintenance services that require more specialized expertise. "We are already working with all the key players in the industry, and have won numerous awards from clients and Singapore government bodies for our ability to plan in advance and maintain safety and quality control standards at all times", the CEO argues. Dompeling further points out that "Singapore companies have a competitive advantage in certain specialized areas when entering new markets, as they tend to have a deeper level of knowledge compared to many engineering companies outside Singapore". When asked about PEC's growth potential in Singapore's booming FPSO projects, Dompeling concludes that PEC sees opportunities in offshore work, as he is convinced its expertise is transferable. "After all, work done in a petrochemical plant on land is not so different from doing work on an offshore platform", Dompeling finds.

Wood Group Australia

Moving Towards a Safety-Case Regime: the Right People

Singapore's FPSO market has already attracted a plethora of well-integrated international players and today houses "some of the best shipyards in the world to perform FPSO conversion and integration work", comments recently appointed CEO of Global Process Systems (GPS) Ian Prescott. "With GPS' fabrication facility only a 40-minute ferry ride away in Batam, Indonesia, the company can do all the design in Singapore and have the fabrication done in Batam, before the finished products are brought back to the Singapore shipyards for implementation", explains the CEO of this Dubai-based provider of technology-based -design and build- process facilities for the upstream sector. Prescott further praises his company for adhering to outstanding safety standards which, he says, "is being achieved by profiling GPS as a local company. In terms of HSE performance, GPS is locally driven but only because the company has the confidence in these people and sees that they are at the right level to manage the business".

Robert Dompeling,Group CEO of PEC Ltd

If the industry will raise its standards following the Deepwater Horizon incident, more work for companies such as PEC and GPS will automatically follow. Having the right people in place will therefore become ever more important. However, some might wonder where to find this human capital. Following an influx of expatriates, there now seems to be a recurring trend to progressively rely on indigenous workforces to spread knowledge across the region. "Asia Pacific is an attractive place for engineering graduates...the role of the company is therefore to ensure that opportunities are given to young people across all its operations", comments regional director of Wood Group Production Facilities Asia Pacific, Bob Beavis. With an international track record of onshore and offshore oil & gas projects, the Aberdeen headquartered energy services provider offers a range of engineering, production support, maintenance management and industrial gas turbine overhaul & repair services worldwide. Today, the growth of the group is driven by Beavis' region, who describes it as "the growth engine for Wood Group, where the Group's ambitions are directly related to economic activity". "Asia Pacific is not opportunity constrained", Beavis adds. In Asia Pacific, the company interprets the group's strategy as "step out and step up". Explaining this dual strategy, Beavis clarifies that "Step out involves broadening the customer base and the services of the Group. Step up is increasing the intelligence and effectiveness of the group as well as pushing the range of capability to new areas". When asked about the short term plans of the company in his region, he envisions that "throughout the divisions in Wood Group there is opportunity for growth and the role of Singapore is therefore to help in this development".

Prosafe's Accommodation Rig, the Safe Caledonia

From Traditional Shipbuilding and Repair to A Centre of Maritime Expertise

What drove Singapore shipyards from repairing and building ships into oil rigs and converting specialized vessels, was the need to justify higher labor costs following a talent drain driven by Singapore's emerging electronics industry in the 1980s. At that time, both South Korea and China increased their shipbuilding and -repairing capacities. "These countries obviously faced lower labor costs, leading to Singapore losing market share", executive director David Chin of the Singapore Maritime Foundation (SMF) recalls. Constant innovation towards high-end solutions is what kept Singapore's maritime sector fundamental. Taking a closer look at Singapore's fleet shows a diversity of capital-intensive anchor handling tug supply (AHTS) vessels, offshore support vessels (OSVs), seismic survey vessels, platform supply vessels (PSVs), and ROV support vessels amongst many others, most of which are chartered to support the region's oil and gas industry.

Prosafe's Accommodation Rig, the Safe Caledonia

The Value of a Diversified Fleet

GBP 103.5 million (roughly USD 163.5 million) is the staggering amount John Giddens received in early 2010 to sell off Hallin Marine's diversified assets to Superior UK, most of which consists of purpose-designed vessels, ROVs and saturation diving systems. Exemplifying how Singapore's fleet has become so diverse, Giddens looks back at what drove him to set up the company in Singapore in 1998. "Fraser Diving [his previous employer] was a great company, but very single-product focused", he says. Hence, "at that time, I saw the opportunity to move into vessels, ROVs and diving", Giddens recalls. In the meantime, Hallin Marine has been a lead example of Singapore's high end innovative maritime solutions, launching a series of "cost-effective fit for purpose" vessels from its modern facilities in Loyang, located just six miles from Singapore's Changi International Airport. Looking ahead, Giddens is of the opinion that "innovation will come from how we use the combination of our assets: using vessels in an innovative way". As group chief executive, John Giddens will take Hallin Marine further into international waters, targeting markets such as Australia, West Africa and Brazil. The fact that Giddens himself is staying on board also illustrates that, contrary to assumptions, things have not changed for the group. "Now, we are simply innovating from a stronger position. Being part of a stronger parent company with good funding is important in the current climate" he concludes.

The propeller for the Royal Navy's new Queen Elizabeth class aircraft carrier measures almost seven metres in diameter and weighs 33 tonnes.

Naturally, key to a successful diversification strategy is the potential for cross-divisional expertise which is what made the Amsbach Group of Companies a success. "There is a relationship between the different activities Amsbach focuses on", explains the Group's President Peter Blumbach. "Even though the company is a shipowner, in order to meet our clients' needs we have to provide integrated turnkey solutions as well", he adds. This means that the company may, for example, be required to purchase parts and equipment, load a vessel, deliver the cargo and take care of the complete documentation. "At the end of the day", Blumbach concludes, "our main niche is to provide specialized services for the various sectors of the offshore oil and gas business" and in the meantime "the company will continue to work within its niche of specialized services and vessels in Singapore because of the convenience of the infrastructure and supporting services here".

John Giddens, Chief Executive Hallin Marine

David S. S. Chin,Executive Director of Singapore Maritime Foundation

Dealing with Equipment Oversupply

Held by Hong Kong quoted Swire Pacific Limited, Swire Pacific Offshore owns 73 vessels today and with 17 more under construction, this offshore marine operator is one more example of the range of vessels found in Singapore. From its inception in 1976, the company has learned valuable lessons from the several crises faced. "By having all the eggs in one basket which is attached to the exploration market, a vessel provider becomes very vulnerable. A little bit of diversification based on solid foundations works quite well", its managing director Brian Townsley argues. Today, we see the company active in a range of activities beyond the core business of providing marine services to the offshore industry, such as oil spill response services, offshore wind activities and salvage services. While continuous innovation and diversification remains essential for Singapore operators to stay competitive, many have raised concerns over the current oversupply of vessels on the market and some started looking in taking apt measures. "The offshore construction boom lead to many orders in 2007, attracting new entrants to the market and causing support vessel oversupply as a result", Townsley adds. He feels it is now important for established players "to try to push the entry barriers higher which can be facilitated by more regulatory standards, more capitalization and increasing difficulty for new entrants to obtain the commercial security to get involved in the industry". John Paterson, president of the prestigious manufacturer Rolls-Royce Marine, is of the same mindset when it comes to the current cycle, saying that "there is no doubt that the industry is approaching the end of the new build cycle and as we go forward and look into the future, clearly the demand for new vessels is coming down". Enthusiastic about the division's recent relocation of its headquarters to Singapore, Paterson is positive about the growth in the aftermarket to compensate for the decrease in demand.

John Paterson,President Rolls-Royce Marine

Location, Location, Location!

To support the upper end of the value chain, numerous seismic operators and surveyors have set up base in Singapore to serve the regional exploration markets. "The office in Singapore has been here for forty years and this has given the company insight and experience in the region", comments Rollin Delzer, Senior VP of Marine Acquisition for CGG Veritas Asia Pacific. His colleague, who directs SEA and Indonesia, Long Don Pham, is grateful for his stable Singaporean staff, describing them as "very intelligent, efficient and educated", qualities that are particularly important for the CGGVeritas' processing division in its Singapore regional headquarters. With the national oil companies (NOCs) taking larger shares of the industry year after year, Singapore's central location for Malaysia's PETRONAS, India's ONGC and Indonesia's Pertamina has been another key factor to attract seismic players to the Republic. "These NOCs are the future and in my opinion will ultimately have the lion's share of the industry", comments the VP for the Eastern Hemisphere of Houston headquartered geophysical services provider Geokinetics, Rick Dunlop.

Rollin Delzer,Senior VP Marine Acquisition, Asia Pacific Region, CGGVeritas

John Lim Kok Min,Chairman of Gas Supply Pte Ltd

U.S. headquartered international surveying and mapping company C&C Technologies already set up its offshore supply base on Singapore's territory in 2002, and consequently saw its branch growing by 50 to 100 percent annually ever since, says its regional managing director Rick Shannon. In doing so, "it is generally the big international companies that approach us while the local companies tend to work more closely with local suppliers". And even though Shannon needs to bring in his autonomous underwater vehicle (AUV) equipment from other parts of the world, the Asia Pacific region offers excellent potential for these products. Survey positioning and offshore construction support further make up a major part of the company's regional business. "Now is the time for C&C Technologies to develop a sustainable business in the Asia Pacific region; an exciting challenge", Shannon summarizes. Being able to offer the same quality of service will remain the key challenge for international companies operating in the region. "The bottom line and most important part of doing business in Asia is the quality of service you are able to provide, from the first meeting up to the project closeout", advocates Shannon.

Dato' Kho Hui Meng,President Vitol Asia

Centuries of Trade

Singapore's role as a logistical hub results from being regarded as a regional trading hub in the first place, located in the centre of international trade routes. Already in 1819, Sir Thomas Stamford Raffles described Singapore as "an excellent harbor and everything that can be desired for a British port" when landing on the banks of the Singapore river. Today this advantage manifests itself in the nation's distinction of the world's busiest port in terms of shipping tonnage handled. The fact that Singapore has additionally succeeded in oil trading is further proof of the government's exploitation of the port's ideal positioning, housing both local trading giants such as Hin Leong as well as international leaders like the Vitol Group.

Clyde Michael Bandy, Chairman & CEO of Chemoil

Originally founded in 1966 in Rotterdam, the Vitol Group is currently one of the largest independent energy traders in the world and has always found an ideal environment for trading in Singapore. Dato' Kho Hui Meng, president of Vitol Asia Pte Ltd, thinks that "for foreign investors it is interesting to look at Singapore as a place where one can feel the pulse of a booming trading industry. The pro-active government, English as an official language and the proximity to Asian growth markets are other crucial strengths of Singapore." Current world demand for oil lies around around 85,000 million bbl/day. Within this rather stable number of barrels, the smallest fluctuations in demand will determine whether the market will be stronger or weaker that day. "When it comes to the oil trading business, Asia is currently the growth area providing that last barrel defining the state of the market", Dato' adds. Present in Singapore since 1979, Vitol has experienced how the business has grown in this part of the world. But its Asia president is also cautious about the scarce pool of manpower the company can tap into in Singapore, of particular importance to a people-driven trading house like Vitol. "It is important to understand how people react under pressure, how they interact with their colleagues and how they carry out their trade […] This is the way in which Vitol and many other companies in its segment differentiate themselves from larger or more structured entities", Dato' points out. The people aspect is likely to be the hardest factor to manage in the trading business, because "it is not possible to train traders, but it is possible to train those who support trading, such as marketers, logistics specialists, finance experts and shipping professionals", he adds. Addressing this issue, Dato' praises public-private initiatives such as SMU's International Trading Track (ITT).

Ullswater at El NidoPhoto courtesy of Hallin Marine

Photo Courtesy of the Maritime Port Authority

Howard Pang, general manager of the independent oil storage operator Horizon Singapore Terminals concurs that Singapore is largely driven by the oil trading market. "With liquidity centered in Singapore, many new entrants are attracted to the market. And with Singapore being a premier global port, its status as the world's biggest bunkering hub remains unchallenged", he says. It is therefore not surprising to see some of the most innovative and leading operators from this niche market present in Singapore, from the world's leading tanker shipping companies such as Stena Bulk to well-established local bunker operators such as Hong Lam Marine. "There are many ports in the region that have the capability to challenge Singapore, but I do not see their government or their port authorities being as pro-active as Singapore in making their ports competitive for the next 50 years", states Clyde Michael Bandy, chairman and CEO of Chemoil. However, it needs to be said that these operators are restricted by the amount of space available in the small city-state. Waterfront land is scarce and most of the industrial land has already been used up. "The government is therefore also looking into other innovative solutions such as the caverns they are constructing right now as well as the possibility to operate with floating structures", Pang concludes.

Mr Lim Teck Cheng,CEO of Hong Lam Marine

Howard Pang,General Manager for Horizon Singapore Terminals Pte. Ltd.

Catching up on capacity Lacking natural resources has not prevented Singapore from importing raw materials and exporting them after a value-adding refining process, a system referred to as "entrepôt trade". With year on year excess demand of oil storage space in Singapore, a vast increase in capacity has taken place in the past decade. Taking advantage of the Singapore Model, a combination of economic planning with free-market thinking, the world's largest independent storage providers stayed ahead of the pack, entering Singapore's oil storage market at an early stage. What's more is that this potential was not foregone by smaller providers too, eager to grow from the excess demand. Reflecting the industry's confidence in Singapore as a critical supply chain hub for the region, Horizon Singapore Terminals joined the leading operators on Jurong Island since 2005. In the last five years, the company invested in a gradual but rapid three-phased growth, first adding 859,081cbm of capacity in Singapore in October 2006. Recognizing further growth potential in the two subsequent years, Horizon Singapore Terminals completed its other two expansion phases leading to a present capacity of over 1.24 million cubic meters, turning Singapore into the company's largest terminal outside the Middle East, representing one of the largest independent bulk liquid storage terminal facilities in the region as well as a key partner in Singapore's oil logistics infrastructure development. |

Cluster efficiency: Jurong Island

In Singapore, JTC Corporation (JTC) is the entity that develops the dynamic industrial landscape to make the nation the choice investment location. Commenting on the underground rock caverns (JRC) on Jurong island, JTC's CEO Manohar Khiatani explains that "the purpose is to provide enough capacity to store what Singapore needs in order to develop the chemical industry while addressing the issue of land scarcity". JTC's focus on creating a competitive cluster of chemical and petrochemical companies in Singapore further manifests itself in the success story of Jurong Island. In an industry where service turnaround time is critical, the proximity of the 94 chemical and petrochemical companies on Jurong Island is key to increasing efficiency. John Chan, Singapore's country manager for London-headquartered leading provider of quality and safety solutions, Intertek adds that "with strategic laboratory and office locations, Intertek serves clients in the entire Jurong Island complex".

Photo courtesy of PSA Corporation Ltd

Gas-powered bunkering In 2009, the qualities of Singapore as one of the world's top bunkering ports have once again manifested itself in record deliveries of 36.4 million tonnes and an increase in bunker sales of 4.2 percent. Consequently, local bunker operators have recognized the need to increase the capacity of their vessels and upgrade their fleet accordingly. Established in 1981, homegrown Hong Lam Marine has been gradually developing newer and better tankers resulting in a notable fleet of 35 tankers with a total tonnage of 300,048 DWT today. First to deploy the largest double hull tanker in Asia in 2005 and first to launch and operate the world's largest purpose built bunker tanker in 2009, Hong Lam Marine has positioned itself at the forefront of the innovation spectrum. Part of this success is attributable to the company's visionary co-founder and present chief executive Mr. Lim Teck Cheng, who has been lobbying for the use of diesel-electric engines since 2005 and will soon see his plans taking shape with delivery of 3 diesel-electric powered vessels in 2011. Next on the agenda is the company's ambition to be the first Singapore operator to offer gas bunker tankers, anticipating an increasingly gas-powered future maritime industry. This move will not go without its challenges and will inevitably require substantial amounts of capital, special crew training and, naturally, the support of the government to ensure the right safety features and latest technology are implemented. With these elements in place, gas bunkering tankers could soon become the way forward. |

Diversifying energy sources

Looking ahead, the Island's landscape is deemed to change as it will see the expected completion of Asia's first open-access multi-user liquefied natural gas (LNG) terminal by 2013. "LNG is expected to contribute about 17 percent of global gas supply in 2020, a significant increase from a mere 7 percent in 2003", comments Mr. S. Iswaran, Senior Minister of State for Trade & Industry and Education, during his speech at the groundbreaking ceremony of the terminal in March 2010. With 80 percent the country's electricity generated by gas of which, in turn, 80 percent is sourced from neighboring Indonesia, Singapore's diversification strategy had led it into pursuing LNG. Moreover, the terminal may turn Singapore into a center for LNG trading in Asia. The CEO of Gas Supply Pte Ltd (GSPL), Tan Chin Tung, maintains a similar perspective stressing the fact that "even more than for oil, Singapore is ideally located on the crossroads of the producers in the Middle East, Papua New Guinea and Australia and the large consumers such as India, China, Japan, Korea, Taiwan and so on. Notwithstanding the different economics in the value chain of LNG, I foresee developments towards the use of Singapore as a physical and commercial trading hub", Tung finds. His chairman, John Lim Kok Min, agrees and is preparing the company accordingly, adding that "the emergence of LNG in Singapore is of course something GSPL has been anticipating for a while now and, as Singapore's largest piped natural gas importer at the moment, we must of course prepare ourselves for the advent of LNG".

Eelceo Hoekstra,President Vopak Asia

Manohar Khiatani,CEO of JTC Corporation

The terminal, in turn, may also create opportunities for the storage operators on Jurong Island. "What is crucial is what the customers ultimately decide on their desired location to store gas. Whenever an opportunity occurs in Asia with a growing LPG and LNG market, Vopak will consider taking advantage of this potential", states the company's Asia president, Mr. Eelco Hoekstra. The numerous spin-off effects the LNG developments will bring are reminiscent for the nation's business climate and only make up a snapshot of Singapore's pro-active drive towards increasing efficiency and productivity, while further tapping into new markets and opportunities. With a promising future ahead and a strong pro-business mindset in place, there is no doubt that the Lion City will continue to roar and outperform many, if not all, of the region's emerging oil and gas hubs.

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com