DEEP WATER SAMBA

As part of the team planning and designing the evaluation and production development phases of one of the world's most outstanding exploration frontiers, José Formigli, executive manager of Petrobras E&P Pre-salt, considers himself fortunate. Petrobras will invest $30.9 billion in pre-salt up to 2014.

"Via radio and fax, when working offshore back in the 1980s", Formigli recalled, "we knew we were doing something special and we also could identify how difficult it might be for the decision makers at the time to tell us what the best move would be to make."

Brazil is the rising star of the Western Hemisphere for the oil & gas industry following the offshore finds in pre-salt. With a predicted production level of 2.7 million bpd and a domestic consumption level of 2.5 million bpd in 2010, the nation is only beginning to assert itself as a net exporter and has set a course to be the next big oil powerhouse.

Brazil's goal to rank fifth among the world's top oil powerhouses

Last June Petrobras CFO and investor relations director Almir Guilherme Barbassa announced the 2010-2014 Business Plan. Investments total $224 billion, representing an average of $44.8 billion per year.

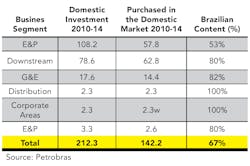

The plan foresees $212.3 billion (95%) will be invested in Brazil and $11.7 billion (5%) abroad and includes significant utilization of the domestic supplier market, with local content forming 67% of total investment. The E&P segment will invest $118.8 billion to target production of 3.9 million barrels of oil equivalent per day (boe) in 2014 and 5.4 million boe in 2020.

The lower production target for 2020, when compared to the previous 2009-2013 plan (of 5.7 million boe) is a consequence of reducing international production goals due to lower future investments. "Because of our opportunities in Brazil, reduced emphasis will be placed on Petrobras' international E&P activities," said Barbassa.

As a first step for establishing a new regulatory framework regarding the exploitation of crude oil under Brazil's pre-salt layer offshore, President Ignacio Lula da Silva signed a landmark bill last July governing the capitalization of Petrobras.

In a favorable context, Petrobras expects to have the largest availability of drilling rigs for deep-water than any other oil company, with a total of 26 rigs by 2014 and 53 by 2020 and 504 support vessels by 2020 (254 in 2009). Projected investments in refining, transportation, and marketing are budgeted for $73.6 billion.

The feedstock processed in Brazil is expected to reach 2.3 million bpd in 2014 and 3.2 million barrels in 2020. Thus, Petrobras will be prepared for the increasing demand for derivatives in the domestic market, projected to reach 2.4 million bpd in 2014 and 2.8 million bpd by 2020, Barbassa concluded.

The Brazilian content is expected to represent approximately $28.4 billion per year of Petrobras´ capex and will help to create a supply hub in Brazil.

Entering a new phase

Due to uncertainties in the market caused by changing rules and canceling bidding rounds and by reviewing the distribution of royalties, expectations for the acquisition of blocks in the pre-salt region did not materialize.

It's not really a question of what share of the market a company conquers, but rather a question of understanding what Petrobras's requirements are and where they would like to go in terms of developing a better understanding of the geology of their own blocks or preparing for blocks to be awarded by the ANP in a future round.

CGGVeritas' country manager in Brazil, Patrick Postal, identifies at least 3 major periods wherein independent or international operators came to explore the Brazilian market. The first was from 1997 to 2006 when the business model ran more or less as it was originally set up to run. During this period, a number of global companies entered Brazil and local companies entered the oil and gas business.

Unexpectedly, from 2006 to 2009, bidding rounds were cancelled and blocks taken out of bidding. "It was nothing serious but at the end of the day it cast a different light on a system that had succeeded in attracting a lot of interest," he said.

"Now we are in a third phase where we can see a form of a secondary market with companies leaving and selling assets while other players are looking to buy these assets," Postal explained.

Globally for the geophysics industry, it has been a rougher time than in 2007. "But it has been somewhat different in Brazil," Postal thinks. "Firstly, like many large National Oil Companies (NOCs) that manage their assets over the long term, Petrobras did not change its capital expenditure program in Brazil. Secondly, concession-holders were still in the process of building their oil and gas properties. People received their concessions and they had obligations to invest in seismic surveys in a set period of time."

He continues, "To stay one step ahead in the offshore acquisition segment, CGGVeritas presented its Sercel Nautilus steered Sentinel solid streamers."

Postal also affirmed that "wide-azimuth is a very effective advanced technology CGGVeritas operationally brought to the market, particularly as the pre-salt fields are developed as it provides information previously unavailable with older techniques and a much clearer image for a more accurate interpretation of the reservoirs in this complex salt environment."

Industry waiting new bidding rounds

In general, executives hope that with the changes in the market out of the way, a new ANP auction will be announced, either in the later months of this year or next year, and the offshore acquisition segment of the market will be able to sell data to many interested parties.

Another option is that there may be large oil and gas companies with strong offshore deepwater operation capabilities who would like to partner with Petrobras, if the new model is adopted the way it is being proposed to the Congress (regarding royalties).

"We need other options to develop in Brazil and be a bigger part of the business," noted Statoil's president Kjetil Hove.

"At present, Statoil's very attractive portfolio will carry the company over the coming 18 months. However, I think it's important both for Statoil and every other operator in Brazil that new opportunities are put on the market," he concludes.

"We must increase our portfolio to grow the company, and after such an aggressive exploratory campaign, it will be very hard for us to develop more fields if the ANP does not offer more blocks," concurs Paulo Mendonça, general director of OGX.

OGX, founded in 2007, has shaken up Brazil's oil industry with its huge success. Today OGX is the second largest oil company in Brazil after Petrobras with the amount of offshore acreage it owns.

OGX announced on August 12 that, through its subsidiary OGX Maranhão, it has identified gas in the onshore basin of Parnaiba. "This discovery opens a new exploratory frontier in an onshore basin, the first in two decades. It is important to note that this exploratory campaign was initiated in October 2009 and is conducted by Brazilian companies, obtaining important results in record time," commented Mendonça.

Room for smaller players

"If we look at the future, as I see Brazil looking much the same in the coming three years. Petrobras will have a better understanding of the pre-salt and there will be other pilot projects up and running. I hope that the license rounds will return in the non-pre-salt regions as well as clarification for the pre-salt itself," Kjetil Solbræke, NBH/Panoro's CEO forecasted.

He hopes, "I would like to see our company starting up production in the BS-3 area as well as discovering new potential in our round 9 licenses. I also expect to see consolidation in the market between independent operators as companies realize cooperation is the best approach to the Brazilian market and I think we will play a role in this. When you compare us to Petrobras — who is a giant — or OGX — who wants to be a giant — as well as the IOCs that are here, we are very different."

NBH/Panoro Energy ASA is an international independent oil & gas company with offices in Rio de Janeiro, London and Oslo. The Company holds a balanced portfolio of production, development and exploration assets in the Santos and Camamu-Almada basins offshore Brazil, as partner and operator.

The merger with Pan-Petroleum, a company with assets in Nigeria, Gabon and Congo, will create a strong E&P independent with a significant resource base of approximately 200 million boe, focusing on both sides of the South Atlantic.

Developing the supporting technologies

Javier Moro, Repsol Brazil president recalls, "We were the first partner of Petrobras which was an interesting experience both for them and for us."

"The Campos basin is receiving a lot of renewed attention due to the production figures Petrobras wants to reach. That being said, BM-S 9 with whom we are partnered with BG and Petrobras, is going to be our biggest asset in the next two to three years," "Santos basin is one of the key projects for Repsol internationally," he added.

"The government today is trying to define what the pre-salt region is but this is a country-making find. What government in this world would allow this discovery to be developed without having a say? Brazil had a goal of obtaining hydrocarbon resources and accessing them which they fulfilled. The problem today is in the secondary sector, with the development of supporting technologies and a workforce that can keep up with the growth. This is a big opportunity for companies all over the world to come to Brazil and be a part of developing what has already been found," observed Moro.

LOOKING PAST CARNIVAL AND SOCCER

Real opportunities ahead

Fernando Martins, responsible for all GE's Oil & Gas portfolio in Brazil, including VetcoGray, recalled that CEO Jeff Immelt announced early this year the decision to build GE's fifth Global Research Center (GRC) in Brazil.

"We are considering the hiring of more than 200 engineers to work in the R&D facility," he said. "GE Oil & Gas in Brazil started the year very well by securing some important orders such as a contract for Petrobras' new Comperj petrochemical complex. Serving the market both in the upstream and downstream in Brazil, GE is another player acknowledging a tremendous amount of growth in the market. Main clients are Petrobras and OGX. To provide technical support, GE has a field services unit in Macaé."

"So far, the eight drillships being ordered by Petrobras to the local market will require 32 turbines as well as 48 compressors. It's just the beginning of the 28 unit plan (drillships and vessels) that has been detailed to the industry."

"Just a few weeks ago GE delivered two complete compression modules for the P-56 platform. At a certain point, the building process required 600 employees. This was an initiative to increase our local content so we imported the skids but managed to make the modules with 65% local."

"GE Oil & Gas secured the largest contract with Petrobras for wellheads for $250 million worth of orders. Petrobras has strict technical requirements and they usually ask for customized systems. For instance, for the contract mentioned takes an estimated 200,000 engineering hours for the four custom systems."

"When it comes to Subsea Wellhead Systems we are very well positioned and we want to keep that way. On subsea production systems, subsea trees and manifolds, for example, we have a lot of opportunities to improve."

Critical success factor

John Oliver, senior vice-president of M-I Swaco South America said, "In the last 18 months, Brazil has been a critical factor for our success." Indeed, "In recent years M-I Swaco invested some $100 million in infrastructure in the Brazilian market and has facilities in all of the key operational areas."

All four of M-I Swaco segments are represented locally. The drilling and the environmental solutions segments; the wellbore productivity group, and the production technologies segment providing production chemicals.

A new addition is the Deeptec Brasil joint-venture, formed to provide expertise to Operators and the shipyards in rig, FPSO and supply vessel construction. "This is a departure from M-I Swaco normal four segments," noted Oliver, "but it is important to help build the shipbuilding industry here in Brazil using both foreign expertise and local content."

"All credit has to be given to our Brazilian staff who have believed in the market and maintained a relationship with Petrobras which represented much of the industry for many years," highlighted Oliver. "Our employees also seized the opportunity to pursue the IOCs market when it first opened up. They believed in the future and made the necessary investments to serve this segment."

"However, it's very competitive so while the top line growth is there it can be a struggle in terms of profitability. That being said, the activity levels here have been a significant help over a period when worldwide, the rest of the industry was really struggling," warned Oliver.

Oliver concluded, "The dream projects in Brazil are participating in the new rig builds because what we want to do is bring customization to the design process. This is why we've founded a Brazilian joint venture to establish Brazilian expertise."

The leading directional drilling company

"Today, we are the leading directional drilling company for Petrobras with 50% of the market share for the past three years. In order to maintain this position, we need to continue investing within the country, not only in infrastructure but also people. Therefore, we are engage in significant knowledge transfer to develop the local talent," explained Ney, Baker Hughes' president for Latin America.

The company's overall scope of operations includes from reservoir characterization to production. "Our artificial lift product line enjoys the highest market share in electrical submersible pumping (ESP) systems in Brazil and will continue to grow as more subsea and deepwater projects develop. Of course, drilling is a big focus in the market now, given the exploration and development of the newest offshore fields," he said.

"We have broken our own drilling records in the new discoveries. The faster and more efficiently you drill the more money you can save," said Ney. "We have also signed agreements with five different universities for technical cooperation, personnel development and sourcing."

Recently, Baker Hughes signed a technology cooperation agreement with Petrobras as they seek to lower the cost of production in new fields in order to make it feasible at oil price levels of $45 per barrel. "They feel the best way to do this is to develop the technology locally," noted Ney.

Baker Hughes has five geo-markets in Latin America and the growth has not come from every one of them. "We have seen considerable growth in Mexico, Brazil and the Andean countries - including Colombia, Ecuador and Peru. Two geo-markets have been relatively flat in recent years, Venezuela and the South Cone, mainly driven by Argentina."

Minds are changing

"The people here are open and cognizant of the fact that we cannot live without foreign capital. The challenge to explore the pre-salt region is enormous and it's impossible to think that Brazil alone can face it, regardless of what the politicians say. Starting in the early 1990s we began to redesign Brazil so the country today is very different to that of yesterday," Eduardo Gouvêa Vieira, president of the Federation of Rio de Janeiro's Industries (Firjan), explained.

For him, the combination of these factors makes Brazil an attractive nation for outside companies to invest in as they know they are protected by the environment established here. "The changes are evident, for example the Brazilian National Development Bank BNDES used to be exclusively for domestic companies yet today is open for all," explained Firjan's president.

"We (Firjan) work to develop local companies as well as bring business to the city. To do this we need to make sure the community has the necessary qualifications for business and provide economic studies on the region. On top of these responsibilities we seek to aid those employed to receive appropriate healthcare in order to create a better life for them and the companies. Firjan is completely apolitical but we work alongside municipal, state and federal governments in order to fulfill our responsibilities," he concluded.

Exporting the experience

"Although it's not the easiest market to work in, Brazil is booming at the moment. Many companies invested in locations like Europe when maybe they should have invested in Brazil and this is especially true in segments like shipbuilding," said Trico Marine's director Per Thuestad.

Trico Marine Group derives from the 2008 addition of Deep Ocean and CTC to Trico Offshore, which coincidentally occurred just after Trico arrived in Brazil to establish operations and just before the start-up of the group's first contract with Petrobras.

"The offshore operations are important to the group as they allow us to bring in vessels to Brazil which supports the rest of our operations as a local subsea company. As a whole, the group is changing its strategy from a towing and supply focused company into a more subsea-centered business. Today, this means we are selling older vessels, keeping the new ones and transferring some into our subsea services segment," he explained.

"A good example of how our know-how can be taken from the Brazilian market to be applied elsewhere would be our plans to offer our subsea services in West Africa based on our experiences here. As a result of this initiative, the Trico Marine Group VP Americas and West Africa is actually relocating to Brazil. These locations have similar aspects when it comes to deepwater possibilities and we want to take advantage of that," complimented Trico Marine's marketing and sales manager for Brazil, Matheus Vilela.

WHERE THE PARTY IS !

The fast success of Lupatech, which only recently decided to create a new company called Lupatech Oilfield Services, reflects booming opportunities in Brazil.

"As a result of our efforts we've recently been able to capture a five year, $779 million contract with Petrobras to provide offshore services. We're offering a technical solution at or above the level of others in the market and we're doing it at the best price so this was not a decision of national or international but rather a technical one. That being said, we're a young player in the oil and gas arena and at the beginning of our history as an upstream services provider. Looking at the market today, the conditions to grow are there," anticipates Nestor Perini, Lupatech's president.

No bad weather for deeper tow-depths

In 2008 Petroleum Geo Services' (PGS) with Petrobras signed a $250 million high-density 4D contract. At the time, Jon Erik Reinhardsen, CEO of PGS, commented that this was a big breakthrough for the company because it was not only industry-leading technology but also industry-leading design meeting one of the biggest markets in the world right now.

PGS strategy is to refocus on marine acquisition and the deployment of its Ramform technology, meaning that PGS sees a market for its new technology in Brazil. Later this year PGS will bring in a 3D vessel to shoot a 3D GeoStreamer program.

PGS has been working with the GeoStreamer technology for many years. According to Alex Vartan, managing director of PGS Brazil, "if you look historically at streamer acquisition, the technology of the streamer itself has not really changed in 30 years or more. PGS, however, has been able to co-locate a hydrophone and a geophone in the same cable, which means that it can deploy this cable at deeper tow-depths."

"In effect, oil companies can benefit from a better bandwidth of data with more penetration, which is great for the pre-salt here in Brazil, while the company gains from greater efficiency because the streamer is deployed at a greater tow-depth meaning GPS is not shut down for weather nearly as often."

Weather is an enormous issue, Vartan warns. Typically on a survey, as an industry we are shut down for maybe 40% of the working time out on the ocean.

Brazil's Onshore Bet: Other data acquisition technology

The onshore business right now is not as big as the offshore, but when you compare the investment in seismic acquisitions onshore with offshore, they are pretty much the same size. One quick look at the offshore business reveals that the majority of the investments are for drilling, development and production, not seismic.

The combination of PGS Onshore and Geokinetics in Latin America strengthened the company's position. Now the industry has the biggest company involved in onshore and ocean-bottom cable (OBC) data acquisition available. "Through this acquisition we doubled our asset capacity and we put our faith in markets where we did not yet have a presence," said Darci Matos, Latin America vice-president at Geokinetics Brazil.

"As OBC involves offshore up to 300 meters of water, we are not in the deepwater business in Brazil. Since a couple of years ago ANP started investing heavily in the onshore basins with plans to invest around $100 million per year in seismic in so called new frontiers basins. Currently ANP is conducting a bid process for two projects in Amazon and Acre basins. Last year three other projects were bid: Parecis, São Francisco and Paraná basins."

Geokinetics has two crews in operation in Brazil; one is working for Petrobras in a four years contract. The other one was working for ANP, finished the São Francisco 2D project and is mobilizing for other client in Potiguar Basin. Furthermore, there are 5 bids outstanding in the market which award should come within the second half of the year. Petrobras has plans to bid at least three more projects till the year ends.

Scope of operations in today's market

C&C entered Brazil with its autonomous underwater vehicles (AUV) offerings nearly a decade ago. Now it provides services that involve measurement of water properties to seabed topography, and to seabed soil characterization

"Due to the structure of the Brazilian market, the majority of our resources are absorbed by the main oil & gas operator in Brazil," said Donizeti Carneiro, C&C's South America general director.

"We use vessels as platforms to launch equipments, covering the depth range from ultra shallow till our current technological capability of 4500 meters and our clients use these parameters to assist their underwater infrastructure construction. This is slightly broader than what C&C offers in the US, where the focus is seafloor mapping, surface and acoustic positioning. In Brazil the company has enlarged its scope of services on demand by clients after the success of our seafloor mapping," explained Carneiro.

He added that the company was asked to help in oceanography and environmental monitoring, which today makes up a good part of their revenues in the local market. "Headquarters has seen the positive response to these operations and are now considering implementation of similar services in the US," said Carneiro.

"With offshore positions you need to multiply your crew needs by four times due to both 24-hour operations and crew rotation. After the first two years, a vessel must operate in Brazil with 66% local content. One of the issues we have to tackle is that the know-how to operate our AUV technology rests in the hands of a few members. We have to disseminate this knowledge to the local workforce and incorporate more local talent," concluded Carneiro.

Petrobras to invest $10 billion annually in ultra-deepwater

For a niche player in ultra-deepwater the Brazilian market is a pretty obvious choice. Petrobras alone is looking to invest up to $10 billion annually in this field.

Pacific Drilling's first step was to put the operations vice-president Cees van Diemen in Brazil, which is a sizable move. Pacific Drilling has also adjusted the specifications of their rigs to meet Petrobras' own technical requirements which are fairly unique.

Van Diemen conjectures that Brazil is seen as a base by which to expand operations elsewhere due to the amount of wells being drilled here and the challenge presented in drilling each one creates a good learning curve for a company.

"It's also important to emphasize that there are many talented, well educated people here in Brazil." However, van Diemen warns, "There are really two challenges to face. First, you have to bring the rig into the country and there's only one way to do this and that's 100% by the rules of the country: don't think that you can bend the rules. This requires the appropriate preparations by engaging companies in Brazil to help in tasks such as making the inventory of the rig and filing the paperwork for importation."

Opportunity & competition

"It's a very exciting moment for Astromarítima Navegação, very important due to several events on the horizon. Firstly, we have to renew 10 of 14 contracts with Petrobras in a difficult period of high competition. It's a challenge but we're very happy with the success," said Renato Cabral, director president.

"This business started successfully in 2009 when we operated two to three vessels at any given time. By contrast, by the end of 2010 we expect to run more than 20 vessels," Cabral added.

The executive warns that local content is a very important factor and in particular, the legislative protection that comes for vessels built in Brazil. The government is interested in developing the industry including shipyards, supply vessel groups and oil companies so they've been making a big push in this regard. Moreover, the economic situation of Brazil has improved a lot over the years making it more appealing financially to construct here.

The challenge is to maintain these businesses and keep the vessels running.

Presently, the local operations represent a significant part of the group's revenues. This is explained by two simultaneous factors: the fast growth of the local operation, concurrently with the slowdown in the Gulf of Mexico.

Cabral believes there is a space for everybody in the Brazilian market because Petrobras wants to double its production from now through 2020, which is obviously a big move and Astromarítima Navegação wants to be part of it.

Van Diemen's dream project is to have multiple rigs in the market run by Brazilian people who can also supply other regions of the world where the company operate. "I would like to take what Pacific Drilling learns from here, drilling in the pre-salt, and apply to other areas."

SHIPPING - offshore and marine construction and conversion

Early July, President Luiz Inácio Lula da Silva launched to sea the first vessel under the Transpetro Fleet Modernization and Expansion Program (Promef), at the Atlântico Sul Shipyard (EAS), in the Northeastern state of Pernambuco.

Brazil was once the second largest naval constructor in the world during the 1970s but lost its position over the course of the 1980s and 1990s. Promef was launched in 2004 to revitalize the shipbuilding industry on globally competitive bases, based on the placement of orders for 49 vessels.

"Once Luiz Inácio Lula da Silva obtained the presidency in 2002 with Dilma Rousseff as his Chief of Staff, they began to look at the shipbuilding industry as one that could play a key role in Brazil," explained Ariovaldo Rocha, president of the Ships building and Repair Association (Sinaval).

In 2003, Petrobras incorporated into its five year plan the idea to build two platforms in the international market. "Through Sinaval's discussions with the government, we managed to convince Petrobras to place these orders in the domestic shipyards," explained Rocha.

"Currently there are 26 shipyards fiercely competing with one another and there are 17 more being built so we perceive Brazil as a competitive market which is healthy. If you look at who is here today, you'll see the South Koreans, present through STX who has its own shipyard, and Samsung, who is partnered with Atlântico Sul. Hyundai has also joined the market recently through a partnership with OSX to build a large yard in Santa Catarina. Singaporeans are also here with Keppelfels' yard in the south of Rio de Janeiro state and Jurong building their own yard in Espírito Santo which is already building the hull of a platform and they have the intent to do the integration locally. The American company Edison Chouest is here with its own yard, Navship, from where they build vessels for both the Brazilian and US market. In fact, they use Brazilian financing through the MMF because anyone who builds in Brazil is automatically eligible for these incentives," analyzed Rocha.

With the Promef, Transpetro, the nation's largest oil and gas transportation company, which currently has 52 vessels on its fleet, will modernize and grow, topping out at more than 100 ships in 2014. This figure is expected to increase with the third phase of the program, slated to be launched later this year.

The first two phases of the Promef were conceived before the new discoveries were made in the pre-salt layer in the Santos and Espírito Santo basins, which points to the creation of new phases for the program already this year.

The newly launched Suezmax-type vessel is a historical milestone for the Brazilian naval and ship building industry. "This ship represents the first in a series of many others that will be built here. It is the beginning of a virtuous cycle for the sector," said Petrobras' CEO, José Sergio Gabrielli.

An early mover into the country, dating back from 1980s when it undertook various vessel repair jobs from Petrobras, the establishment of Keppel FELS Brasil in Rio de Janeiro and its BrasFELS yard in Angra dos Reis in year 2000 played a critical role in the revival of the local offshore and marine industry.

Through a sustained transfer of expertise, technology and systems from Keppel's Singaporean yards, BrasFELS has become the most comprehensive offshore and marine facility in Latin America. At full capacity, the yard is estimated to be able to complete an average of eight vessels a year.

Integrated steelwork to meet demand

Companhia Brasileira de Offshore (CBO) has been a player in the Brazilian market for over three decades. Founded in the late 1970s as an offshore service provider, today CBO belongs to the Fisher Group and has 17 vessels in operation: two for Statoil, one for Devon and the others for Petrobras.

"Currently, we have eight vessels under construction for Petrobras, four of which will be delivered through 2011, while the other four will be ready by 2012. These have been a result of Petrobras's development program and we are currently bidding on several other vessels for them too, which means we're in a position to renew and increase our fleet. It's clear to us that we have to grow and follow the progression of the market and with so many new players it's important to keep our market share," explained CBO director Ronaldo Lima of Aliança Shipyard.

"Today we can deliver up to three vessels per year but the demand is clearly booming so we need to increase the shipyard's capacity for the next years. In this line we are in the process of expanding our facilities, by integrating into our operations a steel work company that will be located 15 kilometers from our yard in São Gonçalo (Rio de Janeiro state)," added Lima.

"Today, the Brazilian companies combined don't have a fleet large enough to block foreign vessels to come in. There are approximately 250 vessels operating on the Brazilian coast for Petrobras and other oil companies, half of which have Brazilian flag. In 2008 President Lula da Silva announced the 146 vessel program looking to replace the foreign vessels in the market," advised Lima.

FEITO EM BRAZIL

The challenge of local content

The local content initiative has been bolstered through a combination of higher tax rates on imported equipment that can otherwise be found locally and discounted borrowing rates from the National Development Bank of Brazil (BNDES) of 0.5%. The latter of which comes through the Merchant Marine Fund (MMF) who can help finance up to 90% of a newly built project given that those companies looking to receive its attractive support meet its local content demands: the higher content, the bigger benefit. Many have taken advantage of MMF program, including CBO who secured a 750 USD million loan, approved in June by BNDES, to fund 19 new PSVs that meet local content demands.

Of course, these initiatives for more Brazilian goods extend directly to suppliers. Flutrol, a Brazilian distributor and service provider for high pressure solutions, is a prime example of a local company developing with the market. Now approaching its 18th birthday, Flutrol has extended its offerings overtime from and instrumentation component provider to pump distributor to solution assembler. Director Manuel Fernandes explains, "Initially we began distributing instrumentation components, valves and fittings. Later, we moved into pump distribution which is when we also began assembling solutions. Today we service practically every industrial segment in Brazil including automotive, petrochemical and oil and gas."

"Basically, we are importing components for integration. We add the frames, motors, instrumentation locally as well as the engineering, assembly and testing. The big question of the future is how do we deal with Brazil's costs? It can be difficult to compete with international companies, located outside of Brazil particularly at a time like today where there isn't so much business in Europe or the US market."

"These competitors are also working to make 5% profit margins which we cannot compete with," explained Fernandes.

Clarifying the tax exemption regime

Nevertheless many complex and specialized pieces of equipment are still necessary to import and as an answer, the government has developed the REPETRO program which is a tax relief system to bring in goods that could otherwise not be found locally.

Antonio Ferreira, president of the Brazilian Association of Oil & Gas Service Companies (ABESPetro) organization commented: "Regarding the tax exemption regime, we need to be clear: this system only benefits (and the law was written for that) imports of products which Brazil does not produce locally. However, nowadays in Brazil, you cannot manufacture, for example, all the parts of a sixth generation rig, a cementing unit or a seismic vessel. While there is a push to increase local content, it will take time until the industry has the capacity to manufacture such specialized equipment, which makes the tax relief system extremely necessary. In summary, this is not a mechanism for foreign companies to obtain a tax break, but rather it's a mechanism to make the industry viable."

More Oil & Gas Financial Journal Current Issue Articles

More Oil & Gas Financial Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com

| This sponsored supplement was produced by Focus Reports. Project Director: Carolina Oddone. Editorial Coordinator: Alexander Tapper. Edited by: Peter Howard Wertheim and Dayse Abrantes. For exclusive interviews and more info, log onto www. energy.focusreports.net or write to [email protected] |