AFRICA SOUTH: SPRINGBOARD TO THE NEXT FRONTIER

Offshore rig sunset.

This sponsored supplement was produced by Focus Reports. Project Director: Koen Liekens. Project Coordinator: Mathilde Paquet. Contributor: Chiraz Bensemmane, Herbert Mosmuller, Isabella Romeo Gomez. Project Publishers: Crystelle Coury & Ines Nandin. For exclusive interviews and more info, please log onto energy.focusreports.net or write to [email protected] |

When South Africa entered the prestigious club of BRICS countries in 2011, the country designated the oil and gas industry as a priority sector for economic growth. "I think we have overcome the hurdle of recognizing the importance of the sector, and are now going into the details of the investments that need to take place, as well as the support programs that we need to put in place," said Rob Davies, minister of trade and industry.

These announcements followed the new plans for South Africa's future energy mix, outlined by the government a year earlier. "In 2005, we faced the challenge of security of supply of liquid fuel products, while we additionally faced challenges of electricity supply in 2008. Those events spurred us into action and as a result we now have the 20-year Integrated Resource Plan (IRP) in place. This is an energy mix plan where we look at the total energy base as well as the different resources available. This is an important tool in planning for the future," added South Africa's minister of energy, Dipuo Peters.

Dipuo Peters, minister of energy

Nosizwe Nokwe, group chief executive officer, PetroSA

In line with President Zuma's declaration of 2012 being the "Year of Infrastructure," the political urge to enhance the country's energy security has spurred South Africa to ramp up its investments in downstream infrastructure. The country has just completed an investment of more than USD 2 billion in a new pipeline and is now studying the possibility of constructing a mega-refinery. South Africa's six existing refineries, in turn, are looking into renewing their own refining infrastructure.

One of the NMPP pumpstations

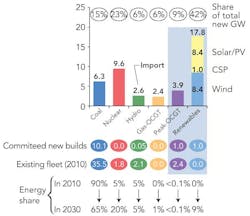

Policy-adjusted IRP from December 2010, outlining the proposed generation new build fleet for South Africa for the period 2010 to 2030. Source - Standard Bank

PetroSA, the country's National Oil Company (NOC), is also investing at the other end of the value chain in upstream production of offshore gas from a new field on the country's South coast. In addition to serving its purpose of extending the life of the company's gas-to-liquids (GTL) refinery, it was a move that additionally boosted seismic activities along the South African coast. This has added to the industry's excitement concerning onshore fracking opportunities, which exist in spite of a government-imposed moratorium on fracking.

Charl Möller, chief executive, Transnet Pipelines

The growing realization that infrastructure is one of the country's key bottlenecks has also reached South Africa's Western Cape province, which aims to position itself as an upstream oil and gas service hub to the broader region. Blessed by its unique geographic positioning, advanced infrastructure and a sophisticated engineering and manufacturing base, South Africa's Western Cape –a province the size of Louisiana- is showing a strong determination to revamp its infrastructure to better service the exploration and production (E&P) boom in Sub-Saharan Africa.

SOUTH AFRICA'S FIRST BEE COMPANY GETS BOOST FROM NMPPDespite a national empowerment drive, South Africa's black economic empowered (BEE) companies found themselves in a tough battle to penetrate an oil major-dominated downstream industry. The smaller to medium-sized BEE companies have traditionally had limited to no control over most of the country's downstream infrastructure, which largely remains owned and controlled by majors in the likes of Shell, BP and Sasol. In 2007, South Africa gazetted its Broad-Based Black Economic Empowerment (B-BBEE) legislation. Aimed to deracialize South Africa's economy and fast track the entry of Historically Disadvantaged Individuals (HDIs) into the business arena, the act is the accepted framework for economic empowerment in South Africa. In addition to the act, for 7 years now, the oil and gas industry in South Africa follows the Petroleum and Liquid Fuels Charter, aimed at empowering small and medium BEE companies by stating that 25 percent of the industry's procurement should come from them. Now, key infrastructure developments in South Africa's downstream landscape are providing the necessary additional push for these smaller players to take on a greater role in the capital-intensive and highly competitive market. South Africa's first BEE company in the sector was the independent distributor of petroleum products Afric Oil. Today, the company prides itself on being the first independent black-owned company to have received capacity allocation on Transnet's new pipeline, which it perceived to be a major boost in its competitiveness vis-à-vis the traditional oil majors. "As far as pricing is concerned, we are very competitive as Transnet is managing the infrastructure on our behalf, as well as on behalf of the other players. Without this leasing opportunity, we would have to build and manage our own depots," commented Tseke Nkadimeng, Afric Oil's chief executive officer. "We are now a serious competitor to the oil majors," he concluded. |

2012 saw the completion of one of South Africa's most significant infrastructure projects: a ZAR 23.4 billion (approximately USD 2.24 billion) state-of-the-art pipeline from Durban to Heidelberg, in Gauteng. Durban, the country's third largest city, is South Africa's most important port of entry for the downstream sector and handles 80 percent of South African fuel imports through its single buoy mooring (SBM). Gauteng, in turn, is South Africa's wealthiest and most energy-hungry province, home to the country's administrative capital Pretoria as well as its largest city: Johannesburg.

"The big 24 inch pipe we have put in the ground is our way of pre-investing in transportation infrastructure and later on we can add more capacity," said Charl Möller, chief executive of Transnet Pipelines. A state-owned entity, Transnet is the company behind South Africa's national transport businesses including its pipelines, rail, ports and terminals. Its pipeline division, Transnet Pipelines, holds the mandate over South Africa's strategic pipeline assets and now acts as the custodian of the 347 mile long New Multi-Product Pipeline (NMPP).

"At the moment," Möller continued, "we are in the first phase of a 5-phased expansion plan. With present projections of demand, we aim to complete the final expansion by 2035." A major new infrastructure asset for the country, the NMPP is expected to reach an extensive economic life span: "If we adhere to our strict operating and maintenance programs, experts have estimated its economic life to 75 years," Möller pointed out.

With the NMPP, a brand new competitive facility for transportation of refined products in South Africa has become reality. Buffered by two terminals on each side of the pipe, disruptions in the supply chain can now be accommodated for up to five days.

SOUTH AFRICA'S REFINING FUTURE: Diverging Decisions

Whereas the New Multi-Product Pipeline (NMPP) lessened the immediate urgency of raising South Africa's fuel capacity, the plans on where to invest next vary considerably.

PetroSA has recently intensified its plans to build a world-class crude refinery in the Coega Industrial Development Zone in the Eastern Cape province, an initiative called Project Mthombo. If built, the facility would become Africa's biggest crude refinery with a capacity of 360,000 barrels a day.

Gerard Derbesy, CEO, BP Southern Africa

Rob MacKenzie, managing director, Endress+Hauser

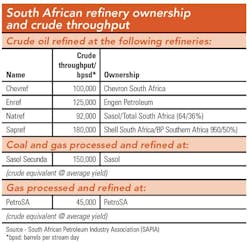

South Africa's existing refiners, however, have questioned the economic logic of such major investment and believe that the country may be better served through an investment in the existing refining base. Last year's data from the South African Petroleum Industry Association (SAPIA) indicate a combined national capacity of about 692,000 barrels a day, which is already significant within the African continent. Apart from synthetic fuel operations run by Sasol and PetroSA, production comes from BP and Shell's SAPREF, Engen's Enref in Durban, Chevron's Cape Town refinery and Total and Sasol's inland Natref refineries.

The downside is that these refineries are old and outdated, and currently in a condition described by Energy Minister Peters as "decaying." Durban-based SAPREF –a joint-venture between Shell SA Refining and BP Southern Africa- is Southern Africa's largest crude oil refinery accounting for 35 percent of South Africa's refining capacity alone. Gerard Derbesy, CEO of BP Southern Africa, assessed the situation: "Today, like the rest of the industry, the refinery runs on around 75 percent capacity, while the rest of the world stands at around 85 percent."

Having labeled the country's refining capacity as just "adequate," Derbesy recognized the need to boost its reliability. Last year, the South African government set 2017 as the deadline to upgrade the country's existing refineries with the purpose of implementing cleaner fuel standards in line with the EURO 5 fuel specifications. The required upgrades were expected to come with a price tag of ZAR 25 billion (roughly USD 3 billion).

Rob MacKenzie, managing director of the Swiss-based flow measurement & management expert firm Endress+Hauser, points to the complex nature of plant maintenance as one of the biggest problems for the industry in South Africa. "A part of the reason for this is that skills required for the people onsite are also more and more difficult to find," he said.

"What we need to do as a service provider is to support the technical expertise of customers. For example, we have now also entered into contracts in South Africa with some of the group's global customers, where we offer onsite maintenance services in addition. In this way, we have people permanently positioned at our customers' sites to avoid problems, rather than wait for them to happen," MacKenzie explained.

"One of the most important elements for organizations such as ours however is to have the right support and service levels in different countries around the world. Around 25 percent of the staff that we now employ in South Africa are part of the service department, which gives us a strong competitive advantage," added MacKenzie. To ramp up its service capacity, Endress+Hauser has invested in new infrastructure in South Africa: "We are currently constructing a new head office in South Africa and are upgrading our existing offices to turn them into a logistics and service center. The move to the new building is planned to be completed in September 2012," he elaborated.

Commenting on South Africa's inability to meet local demand through its own refineries, Minister of Energy Dipuo Peters further announced in June 2012 that –as a net importer- the country's dependency on imported petrol, diesel and other liquid fuels is on the increase, adding that the country continues to rely on foreign refineries to meet local demand.

As a result of South Africa's strong reliance on its single buoy mooring (SBM),the Port of Durban is still expected to remain a bottleneck in times of need. "Under a crisis scenario where a refinery such as SAPREF, Engen or Natref has an unplanned shutdown," said Derbesy on behalf of BP, "the infrastructure will become very constrained to take on all the additional cargo." And although their financiers have not yet been identified, additional import terminals in Durban will have to be the way forward in facilitating clean fuel imports and extra capacity.

INVESTMENTS FOR THE LONG TERM-INALS

In line with the rapid increase in consumption of petroleum products, independent storage providers are taking on a growing role in South Africa. To address the rapidly expanding market in the country, storage providers are now looking into different ways to invest in new infrastructure too.

With terminals in 81 different locations around the world, Netherlands-based Vopak chose the South African city of Durban for its first –and still only– terminal on the African continent. Historically used for chemical storage, the terminal is due for expansion to address the company's rapidly developing petroleum business.

INVESTMENTS IN ENERGY SECURITY - USD 3 BILLION FOR GREEN INDUSTRIES

South Africa's strong coal dependency is the country's most significant climate change challenge. "Coal accounts for more than 70 percent of our primary energy consumption in South Africa. It reflects our lack of oil and gas reserves as much as it highlights, in contrast, our vast reserves of coal," acknowledged Sasol's chief executive officer, David Constable.

In an attempt to reduce its carbon footprint, create jobs and bring economic benefits to rural areas, South Africa has identified green industries as a key focus area within its New Growth Path – President Zuma's plan to create five million jobs by 2020 to counter soaring unemployment rates. Its state-owned finance institution Industrial Development Corporation (IDC), commercial banks and other development institutions will play a critical role in developing and investing in these industries by providing funding to this fledgling sector.

Abel Malinga, division executive mining & manufacturing, IDC

The IDC alone has set aside ZAR 25 billion (approximately USD 3 billion) to invest in the green industries value chain over the next five years, including the manufacturing of green components and services related to green industries. "We are investing significantly in the green economy but are still sourcing many parts from abroad. Instead, one would like to see that a certain number of components can be manufactured in South Africa," highlighted Abel Malinga, IDC's divisional executive mining & manufacturing.

Set to cover the next five years, the investment plan focuses around five key green areas: renewable energy, energy efficiency, emission and pollution mitigation, and fuel-based power such as waste-to-energy and co-generation, as well as biofuels. In this respect, the IDC and the German Development Bank (Kfw) already announced a ZAR 500 million (approximately USD 60 million) Green Energy Efficiency Fund earlier this year, aimed at promoting investments in both energy efficiency and renewable energy.

"This is why we are studying the opportunity to build more tanks in Durban, to eventually achieve a 50/50 balance between chemicals and petroleum products," said Vopak's managing director in Durban, Marcel van de Kar.

"For Vopak we see a demand from out of the market to expand our terminal in Durban and the establishment of new storage capacity in south-east of Johannesburg. Furthermore we get requests for independent storage capacity in Richards Bay (roughly 110 miles east of Durban) for chemicals that we now store in Durban as well as petroleum products and LPG," van de Kar expanded.

"We see the need for an open and independent distribution facility, as well as a buffer and strategic storage facility. It will assist in preventing a shutdown of the economy in case of hiccups in the system. Beyond operational issues and mechanical defects that can occur, strategic storage is also important from a political perspective. We believe that a new terminal in Gauteng can contribute to all these different aspects," he detailed.

In addition to the New Multi-Product Pipeline, future expansion of South Africa's inland terminals is not only essential to serve the country's growing energy thirst; it also creates an additional buffer to enhance energy security within southern Africa as a whole. Neighboring countries such as Botswana, for instance, are still highly dependent on South Africa for their supplies and are the first to feel the heat when supply chain disruptions occur.

LOCAL BRANDS IN SOUTH AFRICA: NOT TO BE UNDERESTIMATED

Effective as from January 1, 1999, leading South African compressor, generator and auxillary equipment rental company Rand-Air has been part of the Swedish multinational Atlas Copco group. While some may have expected the international group to push through its well-known brand name into the South African market, the Rand-Air brand is a prime example of the strength of local brands. In response to the question why the company preferred to stick with its own name rather than leveraging on the Atlas Copco brand, Rand-Air's general manager Louwrens Erasmus pointed to an exceptional track record in the local market.

Sapref refinery in Durban, copyright Michael Sand

"From a rental perspective, Rand-Air has been in existence since 1972, which now gives us a track record of 40 years in the industry. We have had an established name with high values and a strong customer focus within the industry. From this point of view, we have historically been regarded as 'the rental company'," Erasmus boasted. On the sale of equipment, however, Atlas Copco remains the established market leader in South Africa.

In the oil and gas industry, the company has been extensively supplying South African refineries. "For the last 20 or 30 years, Rand-Air has been a supplier to Sasol, both in Secunda and in Sasolburg. We have dealt with them significantly and have acquired significant operational knowledge from them. We have also been involved with Chevron in Cape Town, as well as Engen and Sapref in Durban in the past," Erasmus noted.

Transnet Pipelines, for instance, currently services this market through its flagship terminal in Tarlton, Johannesburg. Following the company's own major investment in the New Multi-Product Pipeline (NMPP), it is now looking at the private industry to expand the roughly 1 million cubic feet facility in Tarlton. This, in turn, is creating new opportunities for independent storage providers as well as South Africa's local Black Economic Empowered (BEE) companies.

SOUTH AFRICA'S BACKYARD E&P PLANS

In 2002, South Africa introduced its Mineral and Petroleum Resources Development Act aimed at providing the necessary legislative and legal building environment to attract E&P players. As the Act gained traction over the years, exploration has picked up accordingly, "most of the exploration rights that were granted 3 to 4 years ago have been asked to be extended, which shows the confidence of the sector," testified Mthozami Xiphu, chief executive officer of the Petroleum Agency SA (PASA)– the government's body promoting exploration for onshore and offshore oil and gas resources and their optimal development.

Raoul Jacquand, Sub-Saharan Africa geomarket director, CGGVeritas

"The offshore map of PASA that we have in our office here gets updated quickly," concurred Raoul Jacquand, geomarket director Sub-Saharan Africa for the Paris Headquartered geophysical services company CGGVeritas. "This means that," Jacquand continued, "while South Africa is not yet a big oil and gas-producing country, the government realizes that action is needed due to the depletion of current fields.

The list of applicants is growing, and permits for feasibility studies are being converted into exploration rights licenses. Last year PetroSA organized tenders for its seismic offshore activities. CGGVeritas took it as a good sign because it showed that this flagship player is ready to explore again; as we all know, finding is impossible without exploration!

The international community needs to overcome its reticence about South Africa and the continent as a whole. Hopes that an iconic country like South Africa will blossom and grow are strong," Jacquand concluded.

Since the Minister of Mineral Resources granted its exploration right for the Orange Basin Deep Water area off South Africa's north-west coast in February 2012, it also became the first time in 108 years for Shell to have an upstream business in South Africa. Describing offshore as the company's bread and butter, chairman and country GM Bonang Mohale is ready to start increasing E&P investments.

WHAT THE FRACK?

In April 2011, the South African government placed an indefinite moratorium on oil and gas exploration in the Karoo region, where the controversial shale extraction technique of hydraulic fracturing (fracking) might be deployed. A semi-desert natural region of South Africa, the Karoo occupies about 153,000 square miles i.e. roughly one-third of the total area of South Africa.

A vast and ecologically sensitive region, sheep farming currently still is the economic backbone of the arid Karoo region. The area, however, is also thought to hold vast deposits of natural gas in shale rock deep underground. Many of the local farmers and conservationists are concerned about the possible environmental impact of extracting these deposits.

The counter-lobbying content of mainly local farming communities through non-profit organizations such as Treasure Karoo Action Group (TKAG) comes down to a clear no against fracking. In their view, gas production would mainly be driven by short-term gains for foreign oil companies and the South African government, while putting at stake the water supply and health of the people of the Karoo.

Rob Jeffrey, managing director and senior economist, Econometrix

Promising estimates, however, have motivated the South African government to study extraction possibilities in the area. An independent report by Econometrix assessed the economic benefits of the shale gas potential in the Karoo region where the late Tony Twine -highly respected in the industry- was the lead economist. Rather than attempting to assess any environmental impact, the report set a benchmark for the potential of the Karoo shale gas deposits.

Map of the Karoo region in South Africa, as delineated by the World Wide Fund for Nature. Source - NASA

"When it comes to the economic benefits and by looking at the numbers in the Karoo," elucidated Econometrix' managing director Rob Jeffrey, "the estimates shows a range of USD 11 to 30 billion per annum as a potential contribution to GDP. This may not be particularly significant in international terms, but in South Africa this represents between 3 and 7 percent of the GDP."

At present, the South African government made one thing clear: fracking in the Karoo should not come at any cost. Until further notice, the moratorium will therefore stay in place.

"South Africa still faces energy poverty, where 10 million of the 50 million South Africans have zero access to any form of energy. They are the people that bring down our forests and trees just to cook, heat and be able to provide some general energy. In a country that is relatively advanced in terms of being endowed with natural resources, clearly this situation cannot be. If oil or gas is found, it could reduce South Africa's dependence on imported energy supplies and help meet growing energy demand.

The biggest single contribution Shell can make to social and economic development is by helping to meet growing energy demand while respecting the people and the environments where we work," Mohale pointed out.

Bonang Mohale, chairman & country GM - commercial, Shell

Whereas he recognizes the country's moratorium on hydraulic fracturing (fracking) as useful, necessary and critical, Mohale also defends Shell's efforts to look at unconventional gas as a supplement for electricity generation. "Gas makes a strong case. It is a cleaner source compared to coal-fired power stations at around one tenth of the cost… It is worth pointing out that gas has 50 to 70 percent less CO2 emissions than coal-fired power stations," he added.

INTERVIEW WITH JOHN LANGHUS, COMMERCIAL DIRECTOR OF FOREST EXPLORATION INTERNATIONAL

Mr. Langhus, you first came here in January 2009 with the task to secure production and exploration rights for Forest in South Africa. How has the journey been in these first 3 years?

John Langhus, managing director - international, Forest Oil Corporation

The challenge for South Africa on the West Coast is the lack of an existing market for gas. We have therefore been working diligently to develop such a market, knowing that the name of the game here is 'gas to power.' We need a very significant initial customer to justify the large infrastructure investment.

Do you feel that a perception change has taken place with regard to the role that natural gas can play within South Africa's energy mix?

South Africa has been slow to get there and certainly lags behind in the understanding of the importance and value of gas compared to the rest of the world. However, they have certainly come around more recently, triggered by the major gas finds offshore Mozambique and the debate about the possibilities of shale gas in the Karoo. Our goal is for more people to realize that we do not have to wait for these sources, because we already have an excellent source of gas off the West Coast of South Africa.

South Africa's investment climate, does it play a role in the way you manage the strategy for Forest here?

The fiscal regime for oil and gas in South Africa is quite positive and is an area of public policy that is very encouraging for investors. The National Treasury has done an excellent job in crafting policy to be more conducive to investment in the oil and gas industry. They have provided tax incentives for for exploration and development expenses, have made easier the temporary importation of expensive exploration and drilling equipment, and so forth.

This is an extract. To consult the full interview, please visit www.energy.focusreports.net

Mohale further points to South Africa as a market where oil and gas companies can make a significant difference, because every dollar invested almost directly shows the causal effect in the quality of lives for the majority of people. For him, and perhaps for many others to come, this makes South Africa the most exciting market to be in the world today.

PROJECT IKHWEZI: EXTENDING THE LIFE OF PETROSA'S GTL REFINERY

Although South Africa is far from a known destination for oil and gas, exploration interest in its acreage has recently followed suit after the Sub-Saharan E&P boom. One of the biggest confidence boosters in this respect is the fact that the country's NOC, PetroSA, is actively exploring South African shores, as part of Project Ikhwezi.

Since its board approval in March 2011, Project Ikhwezi has been described as one of the most strategically important initiatives in the company's history and is set to play an instrumental role in sustaining the life of its gas-to-liquids (GTL) refinery in Mossel Bay, a harbor town located 250 miles east of Cape Town.

The project involves tapping into gas reserves in PetroSA's F-O field, located 25 miles southeast of its F-A production platform off the south coast of South Africa. Nosizwe Nokwe, the NOC's group chief executive officer sees a crucial role for PetroSA as "the gas company" in enhancing the growth strategy of South Africa.

"There is an energy deficit in South Africa that is hampering our growth," noted Nokwe. "In partnership with the other State-Owned Entities (SOEs)," she continued, "our role is to use some of our technical knowledge to assist with overcoming some of the barriers that may persist. Our energy is coal-fired, which is not environmentally sustainable.

We have a role to play in helping to find other sources of energy, together with Eskom (the electricity public utility)… We are already a pioneer in Gas-To-Liquids (GTL) technology, have a wealth of experience and knowledge in this field, and are using our position to further grow in the gas value chain."

COORDINATION CENTER TO TAP INTO THE NEW FRONTIER

South Africa is gearing up to tap into a boom of E&P activity in Sub-Saharan Africa. Whether in Cape Town or Johannesburg, the country now hosts a myriad of regional headquarters for the upstream sector, labeling itself as the springboard to tap into the rest of Africa. Tullow Oil, Baker Hughes and DHL are three examples of international companies that took the leap.

In addition to Dublin and the London headquarters, global oil and gas E&P company Tullow Oil has embraced Cape Town as its third key office location. Coming forth out of a 2004 acquisition of Energy Africa, the team of Cape Town has been a key asset in Tullow's remarkable exploration success in Africa.

"What put Tullow on the map was probably a combination of the oil finds in Uganda and the discovery of oil in Ghana. Together with the Dublin office, we were jointly responsible for this discovery," says Bill Torr, Tullow's Africa finance manager and general manager in Cape Town.

"Including Ghana, Uganda and now Kenya, this office has been responsible for opening up 3 new basins in Africa in the last 5 years. We have also opened up a new basin off the coast of South America. Note that opening up just 1 basin would already be an honor in a geologist's life," he adds. Tullow's success rate has indeed been exceptional: a record 44 out of 46 wells were successful in Uganda in just six years.

Chris McCarty, sales director Sub-Sahara Africa, Baker Hughes

Amongst the world's oilfield services companies, Houston-based Baker Hughes is one of the largest. At present, the company has operations in roughly 12 countries in Sub-Saharan Africa. "When we speak about Sub-Sahara, we typically speak of a number of core nations, including Nigeria, Angola, Equatorial Guinea, Congo and Gabon," said Baker Hughes' sales director for Sub-Sahara Africa.

More recently, however, new "frontier" areas have also come into play. "Today, we have a lot of up-and-coming countries, such as Ghana and Ivory Coast on the West Coast. Others that we see as countries on the rise are: Mozambique, Tanzania and Uganda on the East Coast," added McCarty.

To oversee its operations in this entire region, Baker Hughes has chosen Cape Town as its base which has —in recent years— taken on increasing responsibilities, following a company-wide global reorganization in 2009. "Formerly, a lot of the support and management decisions were coming out of Europe and Aberdeen, in particular.

The reorganization shifted the decision-making, the control and the technical expertise to Africa. This did not happen overnight. We continue to move more and more people into the African countries. We are also hiring, recruiting and developing a lot of people within Africa. While more of the decision making now takes place here, the shift also brought our technology a lot closer to the field, whether it is here in South Africa or Angola, Uganda, Ghana, Equatorial Guinea, Congo, Gabon, etc." McCarty noted.

German-headquartered global logistics firm DHL makes a third prime example of the springboard proposition. Whereas the German multinational has particularly been known for its Express Division, DHL also provides an extensive range of services in heavier freight operations and capital projects to the oil and gas industry. Overseeing roughly USD 1.25 billion global revenues from energy, the company's global president for its energy sector, Steve Harley, runs the show from his new offices in Cape Town.

Steve Harley, president, DHL Energy Sector

"South Africa plays an important role for us in a number of ways, both in terms of being a center where management sits as well as a financial and training center. We also bring in people for coordination meetings and the country is also a hub for the Express operations in the Southern African region," Harley concurred. "Moreover," added Harley, "there is a lot of interest in creating locations such as Saldanha Bay to become a logistics hub for both East and West Africa. This again emphasizes the importance of South Africa within the developing of logistics solutions for the whole of Africa. We are very interested in participating in such developments as a company."

CAPE TOWN'S A-BERTH FACILITY TO BOOST OIL & GAS HUB STATUS

Completely redeveloped with the sector in mind, the newly constructed A-Berth facility has perhaps been the most significant upstream oil & gas servicing infrastructure recently coming on stream in the Port of Cape Town. Dedicated to the repair and maintenance of rigs, specialized upstream vessels and associated equipment, A-Berth is now the home turf to flagship South Africa-headquartered DCD Marine. DCD Marine provides turnkey ship repair solutions to the marine and oil & gas sectors across Africa. Established in 1903, DCD Marine's main facility is situated in the port of Cape Town and is the largest ship repair yard in Africa. "We have always seen a very big opportunity along the West Coast of Africa, and more recently along the East Coast as well, to have a service and repair facility," said its general manager Gerry Klos.

Passed with distinction

Ranking among the best in the world, the World Economic Forum's Global Competitiveness Indices have regularly praised South Africa's financial system for being sophisticated, robust and well regulated. The recent global financial crisis was an excellent moment to put these statements to the test. "The first part of the crisis did not really affect us badly at all," said Cas Coovadia, managing director of the Banking Association of South Africa. "Once the crisis led to a downturn in the real economy, our economy contracted by roughly 6.7 percent. As a result of that, we also saw contraction in the business of the banks. Nonetheless, we managed to maintain a profitable situation and had absolutely no capital or liquidity problems," he continued.

Cas Coovadia, managing director, The Banking Association of South Africa

Brian Kennedy, group managing executive, Nedbank Capital

It thus showed that in circumstances of severe economic downturn, the South African banking sector was still able to maintain a strong liquidity and capital position, while remaining profitable albeit at a lower level. This emphasized the robustness of the sector," Coovadia illustrated.

Brian Kennedy, group managing executive of one of the top 4 South African banks, Nedbank Capital, even sees South Africa as one of the best places to be a banker today. "The fact that we sit on the African continent and that there is so much to be done here, is a key driver of motivation. One should not underestimate the role that bankers – who understand how these things work - have to make a difference. There are going to be big projects in Africa for the next 50 years. The oil and gas sector alone is already lifting the economy and creating additional jobs," explained Kennedy.

"This was our vision when we started building our facilities in 2005. To put it in another perspective, we have taken the work -that would have traditionally gone elsewhere- to Cape Town," initiated Klos. While DCD Marine also operates in the South African ports of Coega and Saldanha Bay, for instance, the company seems to have a particular keenness to remain strongly rooted around Cape Town.

Gerry Klos, general manager, DCD Marine

Some of the highlights of the upgrades were announced at A-Berth's opening ceremony in November 2011: a new laydown area of roughly 460,000 square feet, a warehouse facility of around 30,000 square feet, office space of approximately 11,000 square feet and a medical facility were all included during the renovations.

"Our preference lies in Cape Town because we can offer the most cost-effective solutions for the customer there, thanks to our state-of-the-art facilities," justified Klos. "These facilities have all the necessary communication tools, project offices, 3G connections, safety systems, a clinic, workshops, equipments, and so on. There is no yard that has better facilities in the world for the size on which we operate," he added.

DCD Marine's workshops in Cape Town

Whereas Klos' Marine division may account for only 10 percent of DCD's multidimensional group today, its revenues increased tenfold between 2005 and 2011, and are set to soar further following this year's acquisition of South Africa's second largest ship repairer Elgin Brown and Hamer.

Apart from increasing the company's operational flexibility, the acquisition places a sizeable foot in the door 1,000 miles north of Cape Town, in the neighboring Namibian Port of Walvis Bay,. At the end of the day however, Cape Town will remain the prime coordination center too. "Even if we were to start taking on oil and gas work in Walvis Bay such operations would be led from Cape Town," concluded Klos.

TURNING THE WESTERN CAPE INTO THE NEXT SINGAPORE

"Around our coast, we see significant movement of rigs, with 132 oil rigs passing by South Africa in the last year alone. Of those 132, very few were able to be serviced in the South African ports, because we are still building the necessary capacity. This is where we see a huge opportunity because of our proximity to the industry versus other hubs such as Rotterdam or Singapore.

This is why many companies have started taking us in serious consideration, and have increasingly begun to open their regional head offices here," stated Alan Winde, minister of finance, economic development & tourism of the Western Cape government.

Many South Africans –particularly those in the Western Cape- are looking at Singapore as a role model for their own future role in the sector. "I have been in Singapore to talk to the industry players there. We also had a lot of discussions with the Singaporean government and have had the opportunity to learn from their experiences," added Winde.

The Province's premier, Helen Zille, supports the notion that both Singapore and Rotterdam can be important role models in a certain way. Her real ambition, however, is to be a modern version of these hubs. In five years time, Zille alludes to becoming the preferred port of maintenance and shipbuilding and –repair, not only for the West Coast's gas deposits, but internationally. "We would rival Singapore," she boasted.

Alan Winde, Minister of Finance, Economic Development & Tourism, Western Cape Government

"The problem with Cape Town is that there is no great space to further develop the port area… Going forward, we almost need a dual hub in the Western Cape," stated Warwick Blyth, CEO and executive director of the South African Oil and Gas Alliance (SAOGA), a non-profit organization dedicated to promoting the development of South African-based industry supplying products and services to the upstream oil & gas sector.

Asking Blyth which location could best complement Cape Town, he looked at Saldanha Bay, a natural deepwater port on the southwest coast of South Africa, north of Cape Town. "It is only about one hour from Cape Town and is thus a very attractive future proposition," Blyth replied. Ongoing delays in physical oil and gas related infrastructure investments over recent years, however, support the notion that the dual hub proposition is not an overnight story.

SOUTH AFRICA PUSHING FOR GREATER INVOLVEMENT OF PRIVATE OPERATORS IN PORT INFRASTRUCTURE DEVELOPMENTS

A key determinant with respect to the future of South Africa's port infrastructure is the Transnet National Ports Authority (TNPA). A division of the state-owned company Transnet, the TNPA acts as the 'port landlord' in South Africa, providing port infrastructure and marine services at the country's eight commercial seaports. This year, the South African government allocated ZAR300 billion (roughly USD 36 billion) to spend on capital projects over the coming 7-year period, roughly one sixth of which will trickle down to the TNPA.

Tau Morwe, chief executive, Transnet National Ports Authority (TNPA)

"The big projects include the expansion of the iron ore terminal in Saldanha Bay, which effectively increased capacity from around 50 to 83 million tonnes," said Tau Morwe, TNPA's Chief Executive. "Additionally, we will be moving both the manganese terminal and the liquid tank farms from Port Elizabeth to the Port of Coega. Also, we will deepen the berths of the Durban container terminal while additionally expanding the Cape Town terminal," he added.

According to Morwe, further implementation of the National Ports Act will also enhance industry participation in future oil and gas port infrastructure. This may be a welcome move for the private sector, which has been known to publicly criticize the TNPA for favoring its cash cow container business over additional oil and gas and ship repair infrastructure.

Cadets of SMIT Amandla Marine in the Port of Cape Town

"Compared to the past, we now have the National Ports Act which basically tells us to launch a publicly transparent terminal process for any new terminal coming on stream. You will therefore see the private sector becoming more and more involved in terminal operations in the port. As Transnet we therefore do not necessarily need to fund the building of terminals. The private sector can now build, operate, own and transfer such facilities," he said.

CAPTURING RIG BUSINESS BY REACHING OU TO THE INTERNATIONAL SCENE

Dormac, one of South Africa's flagship local players in ship- & rig repair, is convinced that a dual hub in the Western Cape would enhance its focus on the sector and potentially mirror the success of common user facilities such as the Australian Marine Complex South of Perth in Australia.

Chris Sparg, managing director, Dormac

In an attempt to progress faster however, the company has also been looking at international partnerships as the way forward. "In many instances, in South Africa, we tend to give a lot more importance to international players before appreciating the local competence that exists" explained Dormac's managing director Chris Sparg. "The local confidence may still be lacking, which is why we hope that an international alliance will help elevate the profile in order for the government to engage with us directly," his divisional director offshore Salvo Cuttino added.

To better reach out to the international community and increase their chances of winning rigorous tendering processes, South Africa's ship and rig service yards have also deployed what one may call "a multiport model." As a result, companies akin to DCD Marine and Dormac can now be found in multiple ports in the Southern African region. Apart from greater flexibility, this wider geographic coverage effectively puts these yards in a better position to tap into work coming from both the West and East Coasts of Sub-Saharan Africa.

And just in case the mountain will not come to Muhammed, these flagship players will also not hesitate to reach out further beyond Southern African territory. "In the coming 5 years," Sparg explained, "you will see a new division being started under the oil and gas division to support the riding squads or repair teams along East and West Africa. As opposed to bringing rigs into a port in West Africa, our intention is to put large teams in those areas to conduct complete projects to assist our clients."

SOUTH AFRICA'S UPSTREAM SERVICE PROVIDERS TO EXPAND INTO SOUTHERN AFRICA

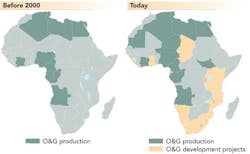

"There is a range of countries where we would have never thought to find oil or gas, most particularly in the East of Africa with countries such as Kenya and Uganda for oil and Tanzania and Mozambique in terms of gas," stated Elias Pungong, oil and gas sector leader Africa for Ernst & Young. Standard Bank's adjacent figure visualizes this geographical shift, where the light brown –indicating development rather than production– areas are perhaps even the most remarkable.

In Mozambique alone, Anadarko recently estimated its total recoverable natural gas resources to be between 30 and 60 trillion cubic feet (Tcf), enough to meet an entire year's gas consumption by France, Germany, Britain and Italy.

19th Africa Oil Week – 29 October to 2 November 2012, V&A Waterfront, Cape Town

Johan de Villiers, general manager, The Pavillion Conference Centre

Becoming a preferred oil and gas hub requires more than oil and gas infrastructure alone. Aspects such as financial stability, legal framework, hotels, road infrastructure, etc. most definitely count. In line with this, the country has invested significantly in state-of-the-art conference venues. General manager of The Pavilion Conference Centre in Cape Town, Johan de Villiers sees his four star venue playing a key role in uniting the international oil and gas community. "Today, South Africa is being regarded as the ideal host for bringing every one together due to our iconic strategic location. We create the opportunity for all the Sub-Saharan players to gather in one place," de Villiers stated. "We have positioned ourselves as one of the most iconic buildings in Cape Town's renowned Waterfront area. We do not only offer conference facilities, but in terms of hotel capacities we remain linked to the various venues in the area," he added. This August, The Pavilion opens a second conference centre inside the V&A Waterfront: " this will give us access to over 4,000 square meters –roughly 43,000 square feet– of flexible conference space within walking distance of 1,500 hotel rooms, making it possible to host major local or international delegations without having to face any logistical concerns," added de Villiers. The 19th Africa Oil Week –one of Africa's premier international oil and gas events– will take place at the Pavilion Conference Centre from 29 October to 2 November 2012.

The exciting news was perhaps first heard by the neighboring South Africans, where the upstream service providers have been responding enthusiastically by broadening their focus within Southern Africa. "Companies such as Anadarko, ENI, Shell and Sasol have all invested in exploratory offshore oil and gas activities in that market," said Paul Maclons, managing director of the Southern African specialist marine services company SMIT Amandla Marine – subsidiary of 170 year old Netherlands headquartered SMIT.

Paul Maclons, managing director, SMIT Amandla Marine

Dave Murray, business unit manager - transport, SMIT Amandla Marine

Growth in this market has been identified as offshore oil & gas support, which is not just limited to our traditional services of vessel chartering and offshore support, but also LNG terminal activities," Maclons added. "In my opinion at the moment, Mozambique on its current growth trajectory is probably set to outgrow South Africa from a resource exploitation point of view. China, India and Brazil have all made plans to substantially invest in Mozambique," concluded Maclons.

"Significant developments are also taking place in Namibia from an offshore concession perspective," added SMIT Amandla Marine's business unit manager transport Dave Murray. "There is a lot of excitement, but developments are slow. There still remain some questions around licensing, logistics and partnerships. Namibia today is perhaps where Mozambique was 3 to 4 years ago," observed Murray.

Bruce Xiste, vice president Southern Africa of the French inspection and certification company Bureau Veritas, sees a massive growth potential for the region. "We have mainly invested in Namibia, South Africa and Mozambique, while we are in the process of opening up in Zambia at the end of 2012. Botswana and Zimbabwe, in turn, remain coordinated out of South Africa," he said.

Based on regional growth opportunities, Xiste expects Bureau Veritas' current capacity of 1,200 people in South Africa alone to soar in the coming years. "By the end of 2015, we need to have around 2,500 people in Southern Africa. This implies that we will be recruiting new people, expanding in our markets, enlarging our service offering, broadening our customer base, etc. In oil and gas, we will mainly target Mozambique," concluded Xiste.

AN ABC TO MITIGATING RISK IN EAST AFRICA – A SOUTH AFRICAN PERSPECTIVE

Dimmie de Milander, group commercial director, Starlite Group

Despite the growth hype, East Africa is not for the faint-hearted. What makes the region worth moving into? Focus Reports therefore asked the following question to a number of South Africa-based service and equipment providers:

"What advice would you give to industry players entering East Africa?"

Dimmie de Milander, group commercial director, Starlite Group: "In Africa, everything revolves around respect. Africans are really perceptive of this principle. In essence, a contract is of lesser value than a handshake in Africa. This is the key difference to doing business anywhere else in the world. We can enter in multimillion dollar contracts on a handshake whereas the actual paperwork may only follow weeks later.

We are now working for a Sudanese company in South Sudan, which is about the toughest political environment you can face in Africa. Yet, we still get paid and things do work. We have known these people for 10 years, have never let each other down and have always been open and honest with one another. It is all about trust and being good, rather than trying to look good."

Starlite, a homegrown South African offshore helicopter service supplier, bets highly on the up and coming East Coast – particularly Kenya, Tanzania and Mozambique as well as a number of new frontiers on the West Coast. In fact, "South Africans tend to work well under unstable African conditions with long supply lines. Our staff is more used to rougher conditions than some of the European and Western companies are," de Milander added.

Mark Tapson, general manager Southern & Sub-Saharan Africa, Emerson Process Management: "Localization is a key part of the strategy. For many of the projects, for example in Mozambique, supplies cannot just be obtained down the road. It can be an entire logistical nightmare. The closer you can be to the end-user or project site, the lower the risk. Wherever we can drive localization, we therefore should definitely do so. The local people – as well as the host country as a whole – need to be involved."

Anton Botes, leader oil & gas industry, Deloitte South Africa: "At Deloitte South Africa, our strategy is to offer insight into these different countries' political thinking. We have an oil and gas center of expertise that these companies can tap into. We actually have a set of solutions to those issues that any organization will typically face when entering, which vary according to the life cycle of the organization." Botes further added that most of his clients seeking to understand the potential of the East Coast of Africa, face 4 groupings of issues that need to be resolved first: "understanding the country (political stability, outlook, short-term VS. long-term, opinions on beneficiation, etc.), ease of doing business (setting up an office, paying taxes, using local workforce, etc.), upstream-specific challenges (availability of service & maintenance facilities, sourcing of spare parts, etc.) and sustainability over time," he observed.

TRAINING AFRICA'S TALENT OF TOMORROW: BOOT CAMP SOUTH AFRICA?

Africa's E&P boom is generating a stark increase in demand for qualified labor, a trend that is being felt by the South Africans. Organizations such as SAOGA see the opportunity for the country to train more African talent on its territory. The infrastructure for training in South Africa is great. Moreover, a lot of crew changing goes through either Cape Town (offshore) or Johannesburg (for international stopovers)," said its CEO and executive director Warwick Blyth.

"There is a lot of opportunity to do a lot more upstream training in South Africa. We now have 2 facilities that offer offshore survival courses in Cape Town and yet, too many people are still flying to Europe for such training," Blyth added. "We work very closely with SAOGA to promote and ensure the availability of local resources," testified Alan Stothard, managing director of IQS International, a South African gem when it comes to inspection and quality services to the sector.

A Q&A with Stanley Subramoney, deputy CEO of PricewaterhouseCoopers in South Africa

Stanley Subramoney, deputy CEO, PricewaterhouseCoopers

What are some of the factors that still make investors hesitate about Africa?

One of the key factors is infrastructure and logistics. In many parts, moving goods and services across the continent is still slow and expensive. As we speak, there are a number of large scale cross-border infrastructure projects taking place, which will help the African countries to become more competitive.

Would you say that the governments of Africa's new E&P frontier countries –for instance on the East Coast- are now tackling foreign investment differently to ensure the creation of a sustainable local economy?

Historically, the problem in Africa has been the fact that wealth has been exported while poverty has been imported. We have used our mineral wealth and created infrastructure that all led to our ports, in order to export our goods. I believe that the African governments and their models have become smarter. These models now have a much stronger focus on local development, local empowerment and local procurement. There has also been a major shift with respect to what companies are now doing to protect, sustain and grow the local environment. Global companies are becoming more responsible and have become more sympathetic. I hope that the model of the future is one of partnership. Instead of only exporting wealth, I hope to see Africa importing opportunities, job creation and growth.

South Africa's PetroSA has shown strong ambitions to expand its footprint across Africa. How do you see the role of these African NOCs, going forward?

The NOCs play a critical role across the continent. They align with government policies and have access to government's resources. The NOCs will start to play beyond their borders and drive resources as so-called government-to-government contacts. As these companies start to move outside of their respective countries, they will pass on their value systems, grow the wealth of the country, grow partnerships, and support local procurement.

This is an extract. To consult the full interview, please visit www.energy.focusreports.net

"In this way," Stothard continued "we have been involved in different training initiatives to get the skills of various inspection personnel up to levels of international acceptance. We have done this quite well and have trained over 200 individuals in various disciplines of welding inspection and non-destructive testing in the past two years. IQS developed a training matrix and a resource development plan, in line with what the industry requires. Our focus is oriented towards the international acceptance of the qualification, which helps overcome certain stumbling blocks we may face, for example in the power industry. We try to target training in a way that is acceptable to everyone while - at the same time - we try to find people work."

REVAMPING SOUTH AFRICA'S MARITIME SECTOR

On July 4, 2012, the South African Maritime Safety Authority (SAMSA) took control over South Africa's polar research vessel from the Department of Environmental Affairs (DEA). Starting its voyage with 32 cadets in Cape Town, the vessel set course for Durban to collect another 15. In the coming months, the SA Agulhas –now converted into a training vessel– will be sailing to Namibia, Angola, Ghana, Liberia and Nigeria to collect further cadets to join the South Africans for on board training.

Commander Tsietsi Mokhele, chief executive officer, South African Maritime Safety Authority (SAMSA)

A historic milestone, the investment is part of SAMSA's mandate by the Government to develop a maritime strategy to grow and develop the country's maritime economy. "At present, we are investing heavily in taking young people to sea," said Tsietsi Mokhele, CEO of SAMSA. Crowned a champion of transformation, Mokhele has been praised for his efforts on skills development in the sector. "SAMSA for example also launched a national cadetship program last year, of which hundreds have already gone to sea," he added. "We are increasing the number of intakes at our maritime universities and will soon launch the National Maritime University of South Africa. On the policy side, we are also finalizing our shipping policy and are adjusting the taxation policy accordingly. We are recreating South Africa as a center of excellence when it comes to shipping," Mokhele boasted.

People-intensive businesses such as classification societies and inspection companies in particular, see no other way than training most of their experts on their own turf. Peter Hamer is the director of operations Sub-Saharan Africa for the Norway headquartered classification society DNV, and reflects on how –from his offices in Durban- he coordinates African talent development to grow his business across the continent. "I started working with our first African DNV colleague in 1999. We sent him out for two years to develop skills and competences in the UK and Norway. As a result, he has been leading our Ghanaian operations since 2002, and the group became a team of 5 and is still growing," he commented.

Peter Hamer, director of operations, DNV Sub Sahara Africa

Whereas DNV's success in the Sub-Saharan region largely came down to the selection of the right people, local skills development has also been a key factor to reassure the company's less confident international clients in these riskier African markets. "The clients see that DNV Africa has a pro-active way of working and a strong focus on building long-term relationships. As soon as they feel that we have control over what we do here in Africa, they see their risk profile decrease… One of our roles is to act as an example, to show that companies can operate safely."

The SA Agulhas in the Port of Cape Town