High crude oil prices driving production in Bakken Shale

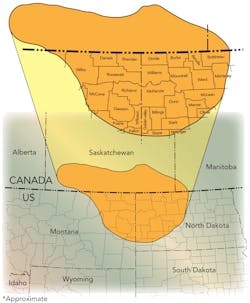

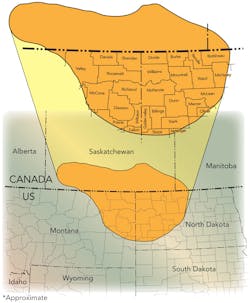

The Bakken shale play in North Dakota, Montana, and the Canadian provinces of Saskatchewan and Manitoba is one of the largest oil resources in North America. Some figures put estimated oil reserves at between 3.5 billion to 24.0 billion barrels of oil equivalent (boe). This is a wide range, but regardless it may be the largest oil find in US history outside the oil fields of Alaska.

Estimates of the Bakken's technically recoverable oil range from as low as 1% — because the Bakken shale has generally low porosity and low permeability, making the oil difficult to extract — to as much as 50% recoverable. Relatively high oil prices are driving exploration and production activity in the oily Bakken.

Production from the Bakken formation has been improving steadily with technological advances. This has prompted one of the major Bakken producers, Continental Resources, to increase its estimate of potentially recoverable reserves to 24 billion barrels of oil equivalent (boe). This estimate is substantially higher than the USGS's 2008 estimate of 4.3 billion barrels of undiscovered technical recoverable oil in the formation.

Continental says the difference between the estimates is that recovery on a per-well basis has increased dramatically since June of 2007, which was the approximate cut-off for wells in the USGS analysis.

In January, the North Dakota Industrial Commission announced that recoverable reserves from the Bakken-Three Forks reservoirs could reach 11 billion barrels in North Dakota alone – five times the commission's 2008 estimate.

What is occurring is that companies have been drilling vertical wells in the Upper Bakken since the 1950s, but they are now focused on the middle dolomite between the upper and lower Bakken shale. The heaviest drilling and production activity currently is in North Dakota.

Recent activity

Smart Sand and Canadian Pacific Railway Ltd. have partnered to supply and ship premium, Northern White frac sand to the unconventional oil and gas industry in key North America producing regions (including the Bakken and Eagle Ford formations, and the Utica and Marcellus shales). The partnership's first initiative: building a new frac sand transload facility, expected to be the region's largest, in Makoti, ND that will serve the Bakken formation in the Williston Basin beginning in early 2013.

Voyager Oil & Gas and Emerald Oil have entered into a securities purchase agreement whereby Voyager will acquire Emerald Oil to create a US-based oil and gas company that will focus on select oil and gas basins in the Rocky Mountain region. The transaction will combine the companies' oil-producing assets in the Williston Basin, specifically in the Bakken and Three Forks plays located in North Dakota and Montana, with Emerald Oil's acreage position focusing on the Niobrara shale in the Sandwash Basin located in Colorado and Wyoming.

North Dakota recently pulled in front of Alaska (onshore production) as the second largest oil-producing state on a daily basis. Texas, home of another prolific oily play – the Eagle Ford – is the only state producing more, noted Global Hunter Securities analysts in a June 15 note to investors. The analysts note that under an $80+ per barrel price scenario, exploration and production companies "should continue to increase the rig count."

In June Rangeland Energy's COLT facility went online. COLT is North Dakota's largest, open-access crude oil marketing terminal. Located in the heart of the Bakken and Three Forks shale oil producing areas, the COLT terminal provides refiners, marketers, and producers with outbound service by unit train and through the COLT Connector, a 21-mile, bi-directional pipeline that links the COLT terminal with multiple existing and planned pipelines at Rangeland's Dry Fork Terminal near Tioga, ND, including the Tesoro and Enbridge pipeline systems. The COLT Hub aggregates crude oil produced in the Bakken utilizing gathering pipelines and trucks.